NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing below Wednesday’s low for much of the Globex session before about 8:30am. At 8:30am jobless claims came out in-line with analyst consensus. Still, it sent price lower and as we approach cash open, price is trading right along the Monday low.

Also on the economic calendar today we have new home sales at 10am along with Fed Chairman Powell speak. At 11:30am there are 4- and 8-week T-bill auctions at there is a bunch of Fed speak due out from less important bankers from 12-1pm.

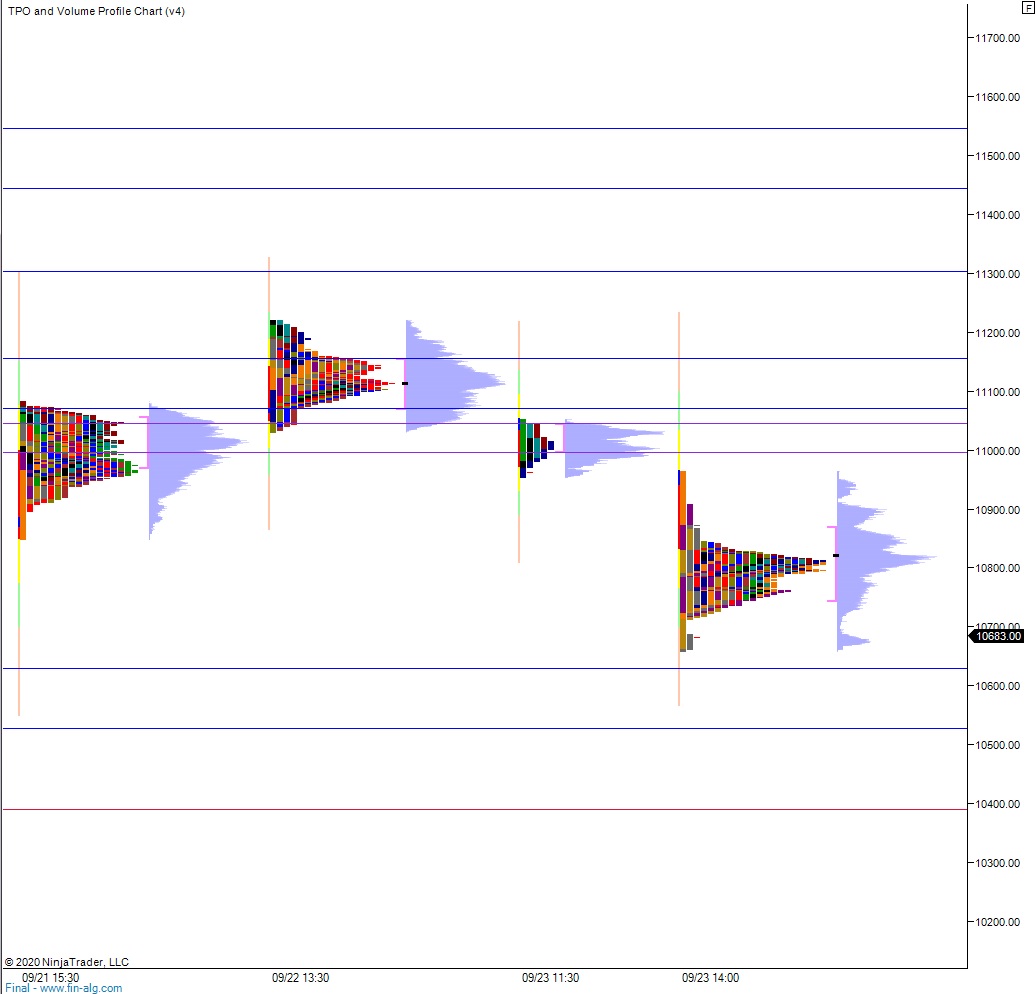

Yesterday we printed a trend down. The day began with a very slight gap up that was resolved during an open two-way auction. That would be the extent of the control buyers would have on the day. Price quickly drove down below the Tuesday midpoint and the daily midpoint wall until about 11:30am when sellers became initiative and drove lower, taking out the Tuesday low by about 2:30pm and eventually tagging the Monday naked VPOC. We ended the day near the low.

Trend down.

Heading into today my primary expectation is for a choppy battle. Buyers are seen defending ahead of 10,600 and we chop in this 10,600-10,700 range.

Hypo 2 stronger sellers gap-and-go lower, taking out 10,600 and sustaining trade below it to set up a run to 10,553.75. Look for buyers down at 10,527.50 and for two way trade ensue.

Hypo 3 buyers press into the overnight inventory and close the gap up to 10,830. Buyers continue higher, taking out overnight high 10,847 on their way to tagging 10,900.

Levels:

Volume profiles, gaps and measured moves: