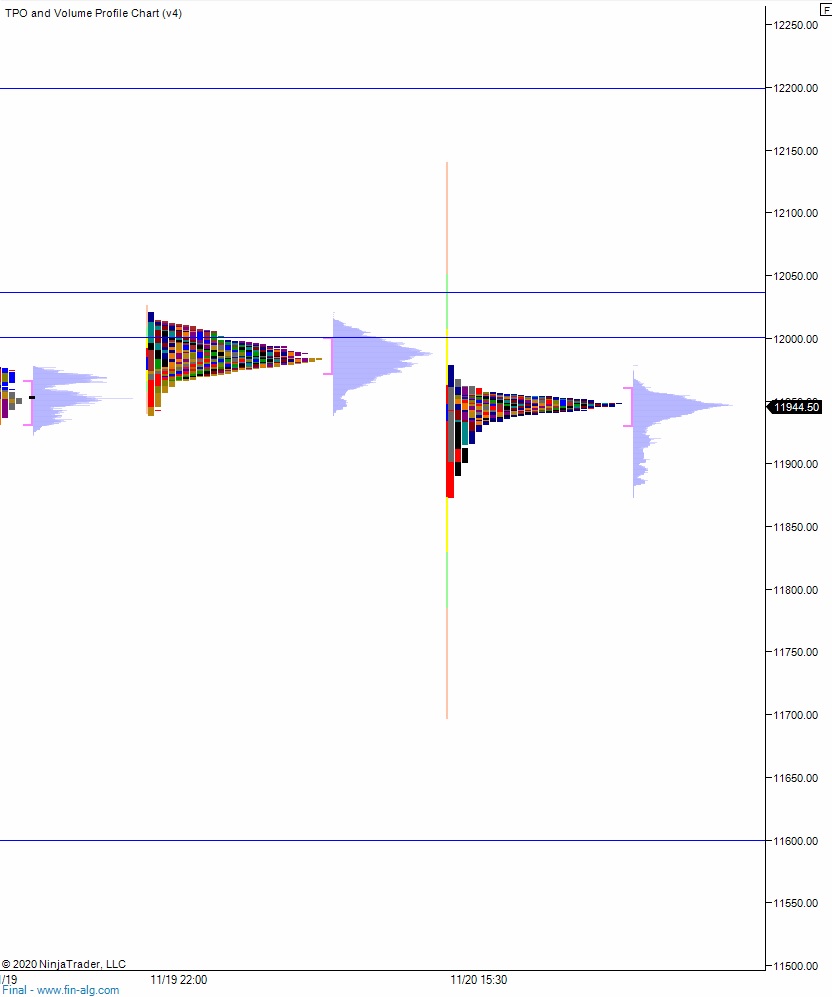

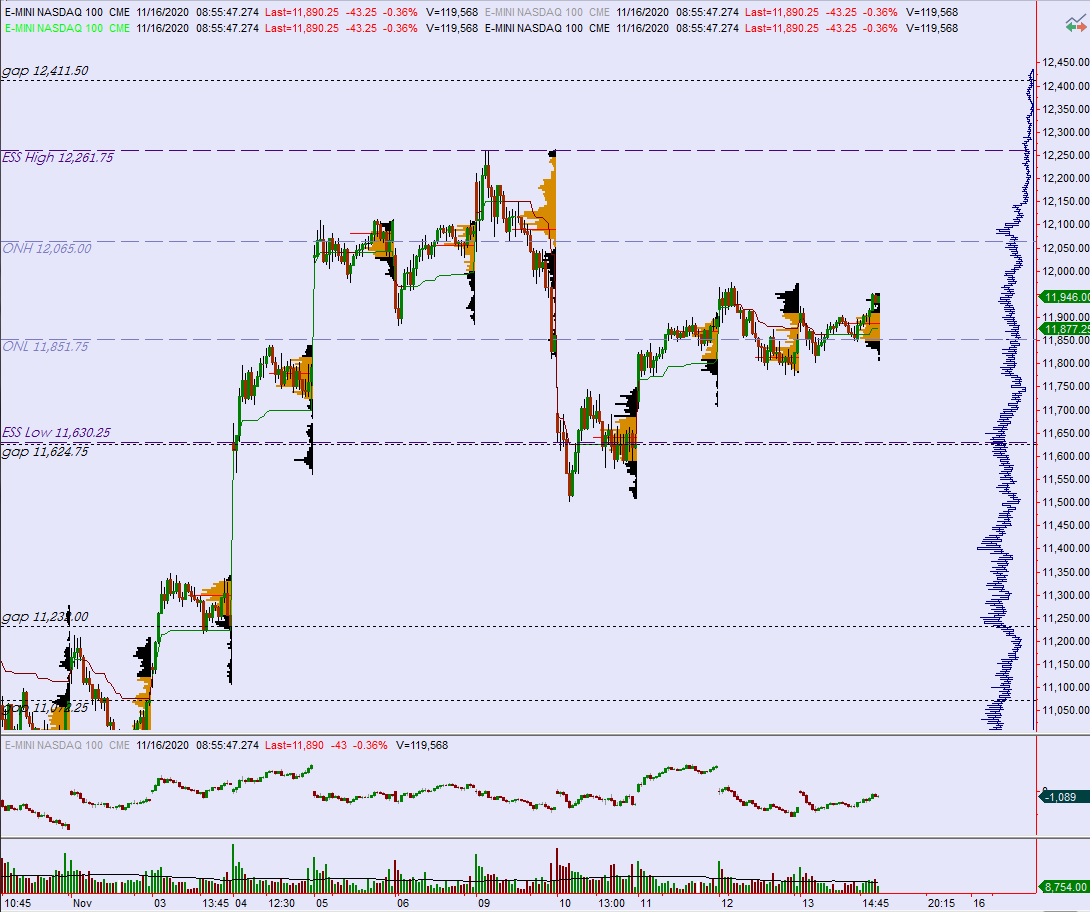

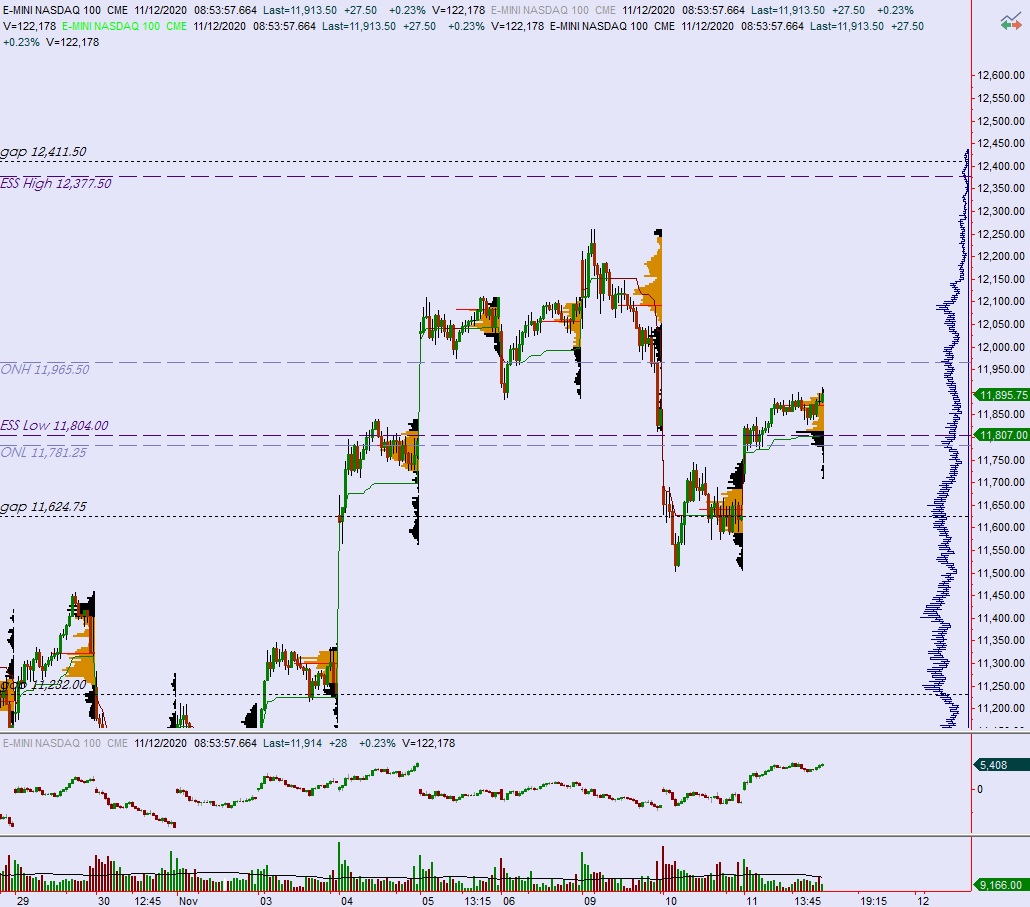

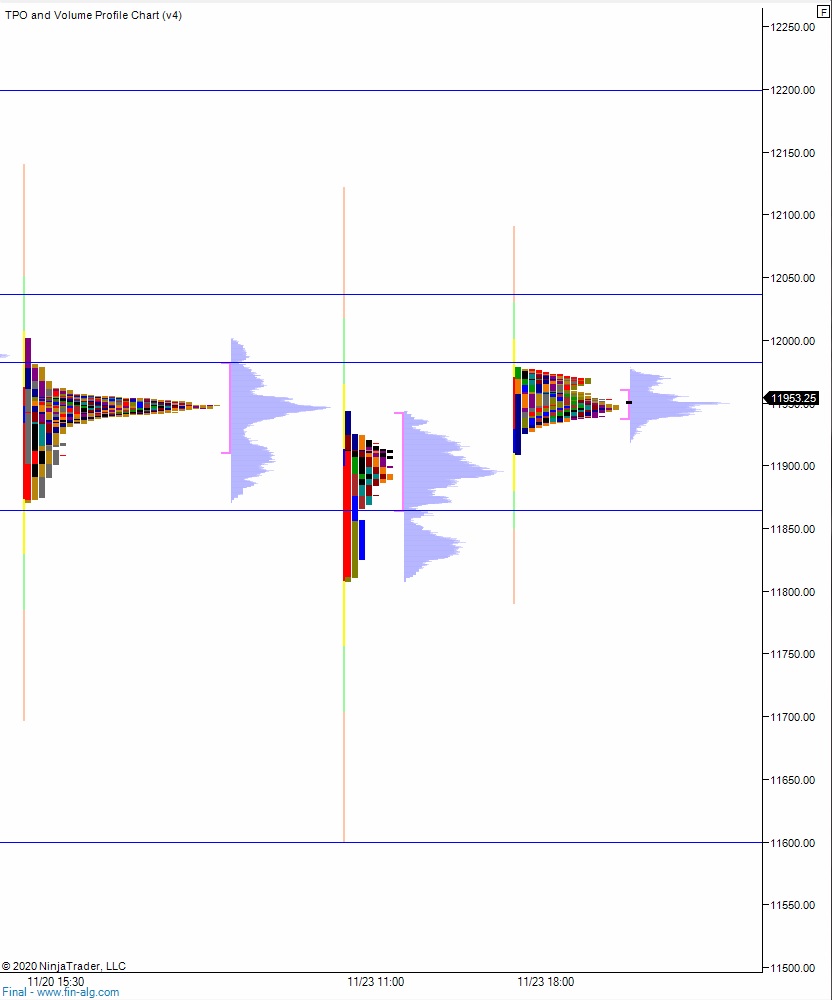

NASDAQ futures are coming into the Tuesday before Thanksgiving with a slight gap up after an overnight session featuring elevated range and volume. Price worked higher overnight, without any seller confrontation until price neared the upper quadrant of Monday’s range around 3:30am New York. Price fell off the Globex high and eventually found balance, and as we approach cash open price is hovering above the Monday midpoint.

On the economic calendar today we have consumer confidence at 10am followed by 2- and 7-year note auctions at 1pm.

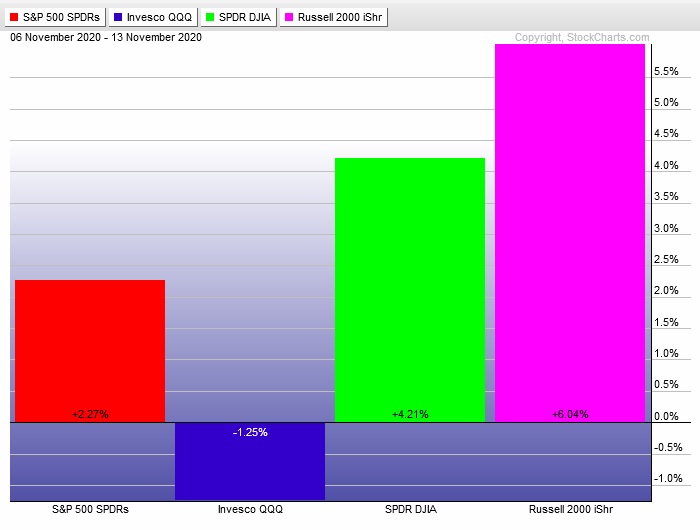

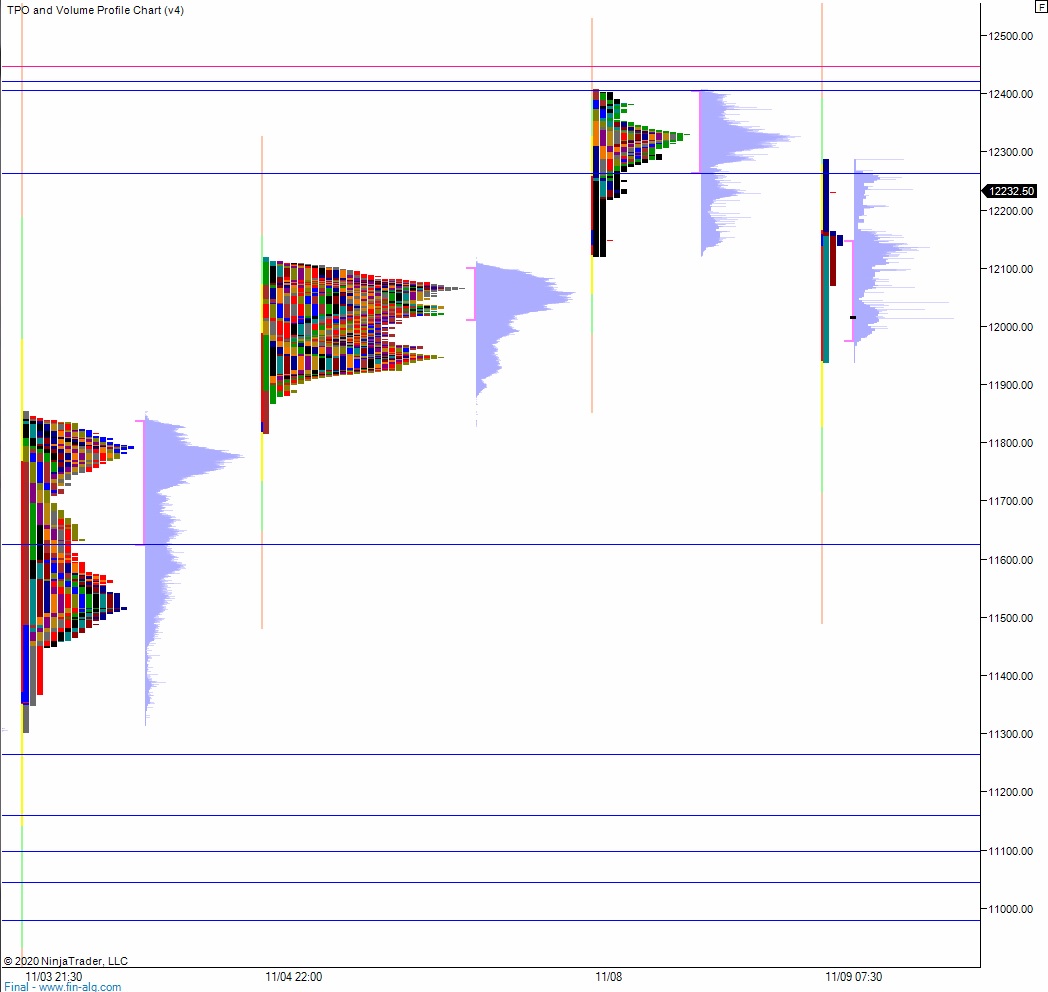

Yesterday we printed a normal variation down. The day began with a decent gap up inside last Friday’s range. Buyers engaged the tape on the open and spiked price up to the 12k century mark, which aligned nicely with the Friday naked VPOC. It was all sellers from here on. Price moved sharply lower until catching a bid around 11:15am, just a bit below last week’s low print. Buyers slowly rotated price back up to the daily midpoint. Sellers defended a first attempt through the mid, but the slow drift eventually reclaimed the mid and we ended the session right on it.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 11,905. From here sellers continue lower, tagging 11,900 before two way trade ensues.

Hypo 2 buyers gap-and-go up through overnight high 11,979.25 and stall out just above at 11,982.25 before two way trade ensues.

Hypo 3 stronger buyers rally up to 12,036.50 before two way trade ensues.

Levels:

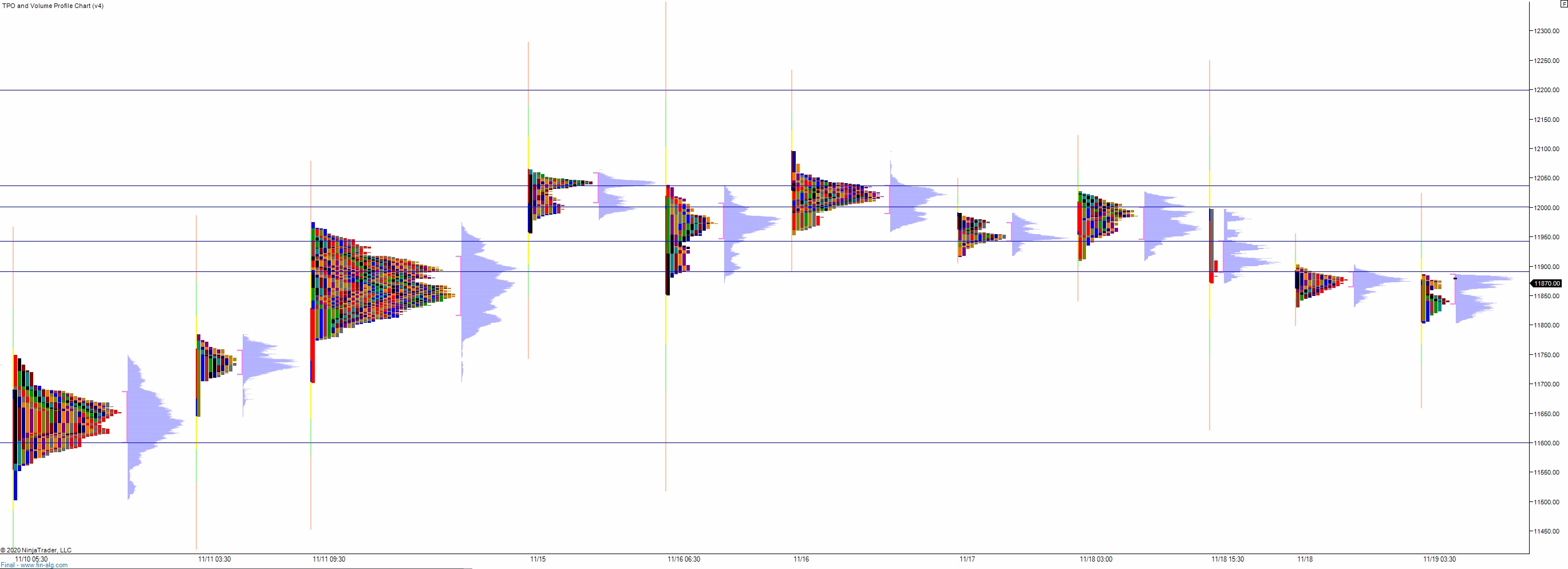

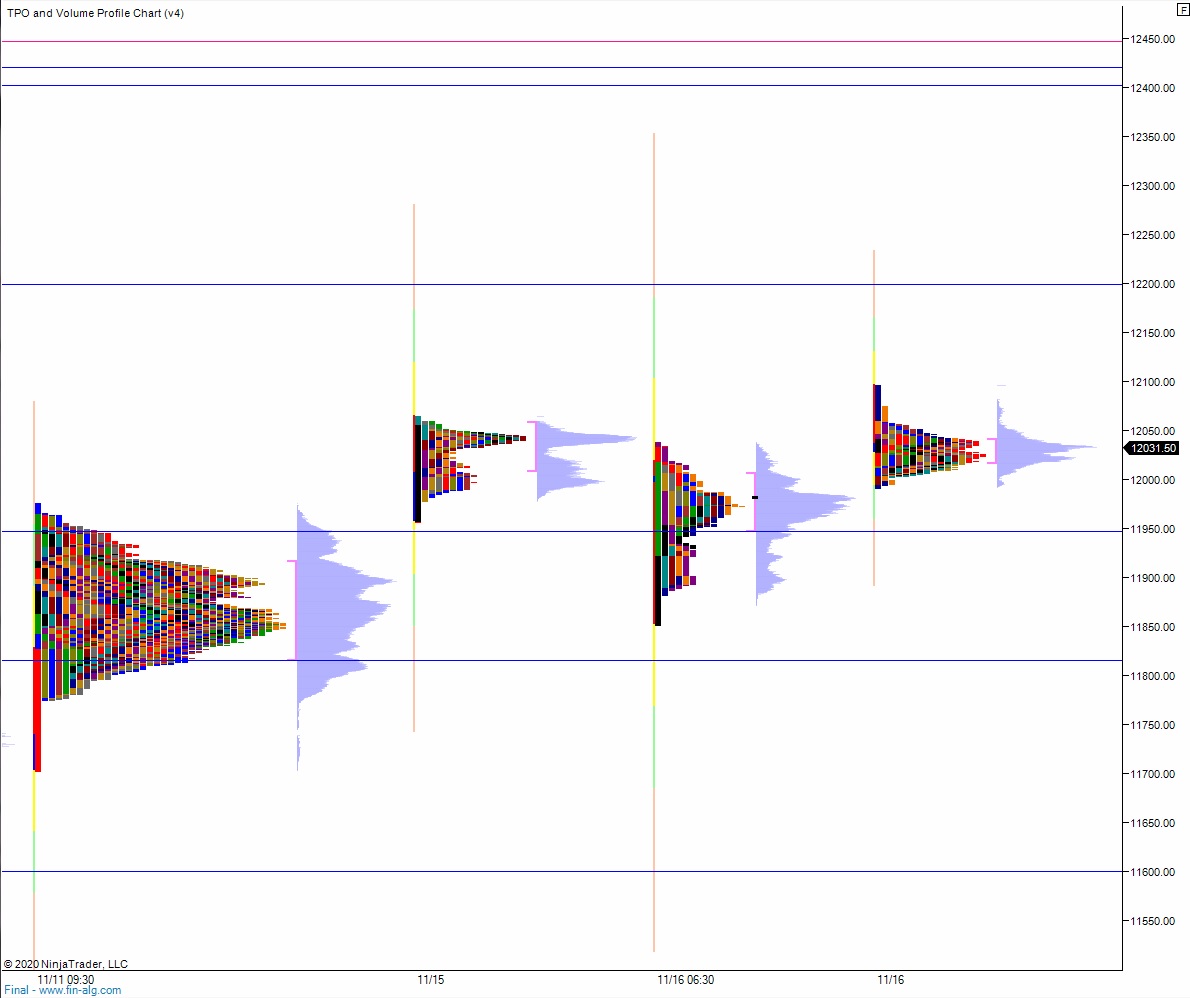

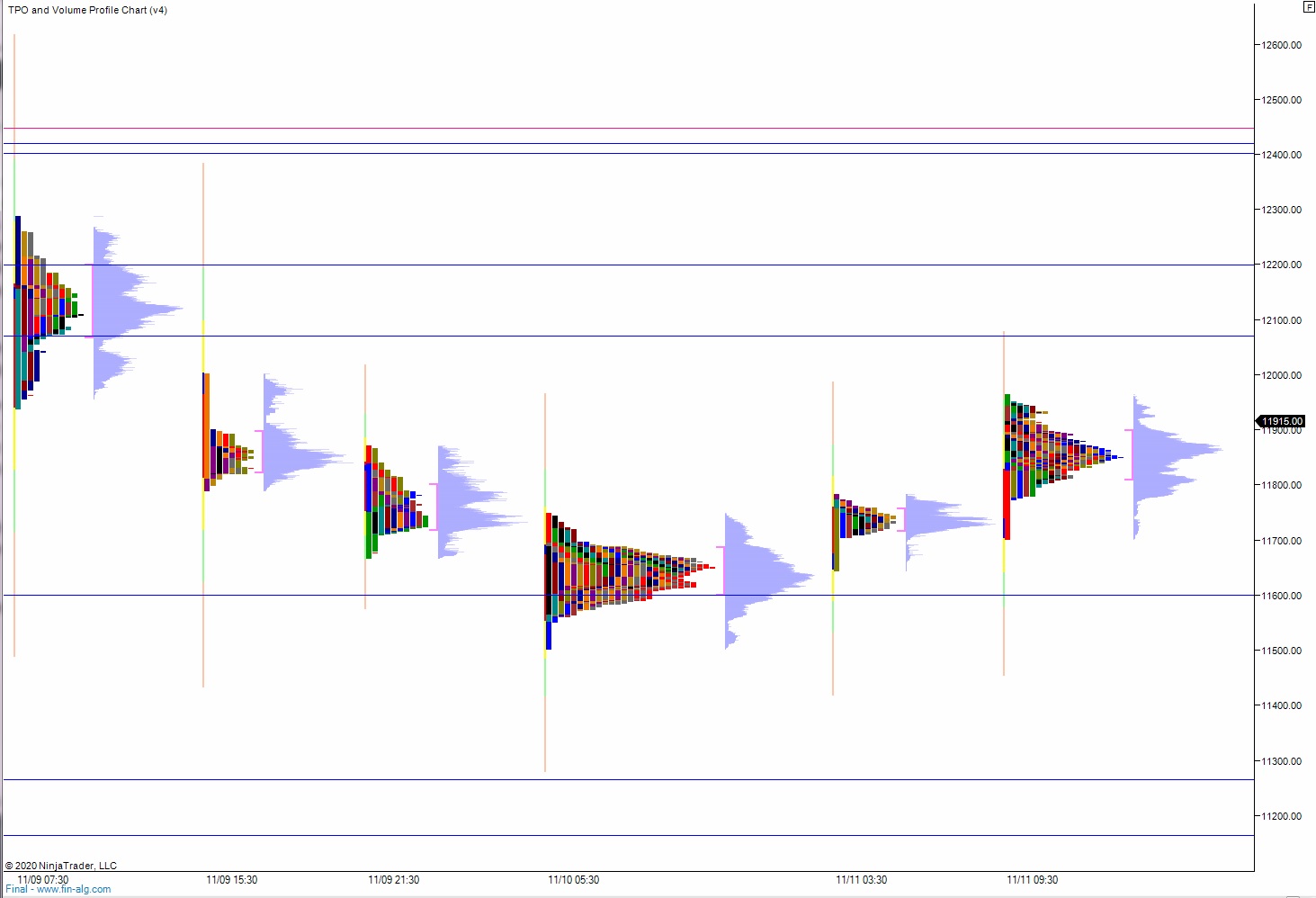

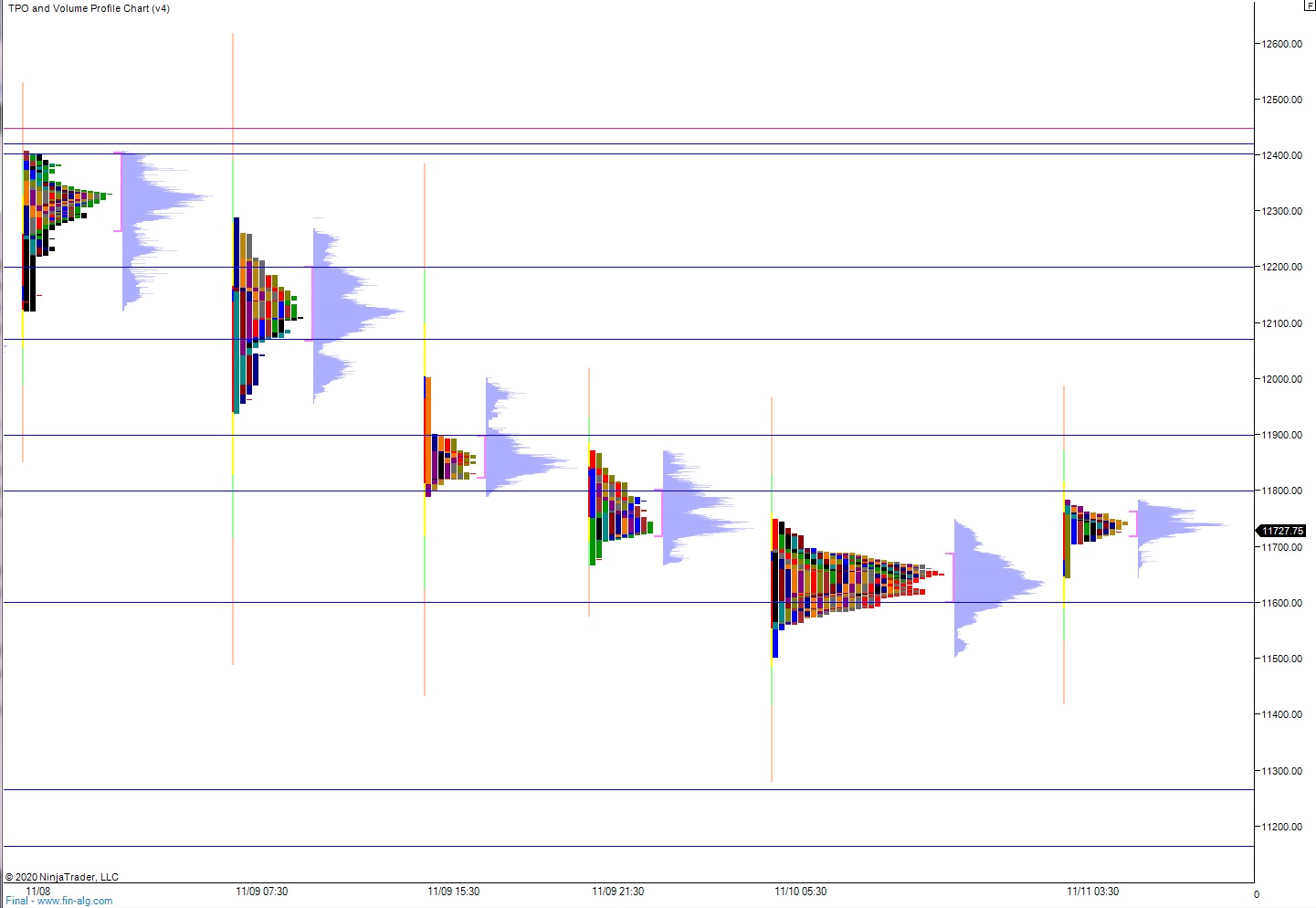

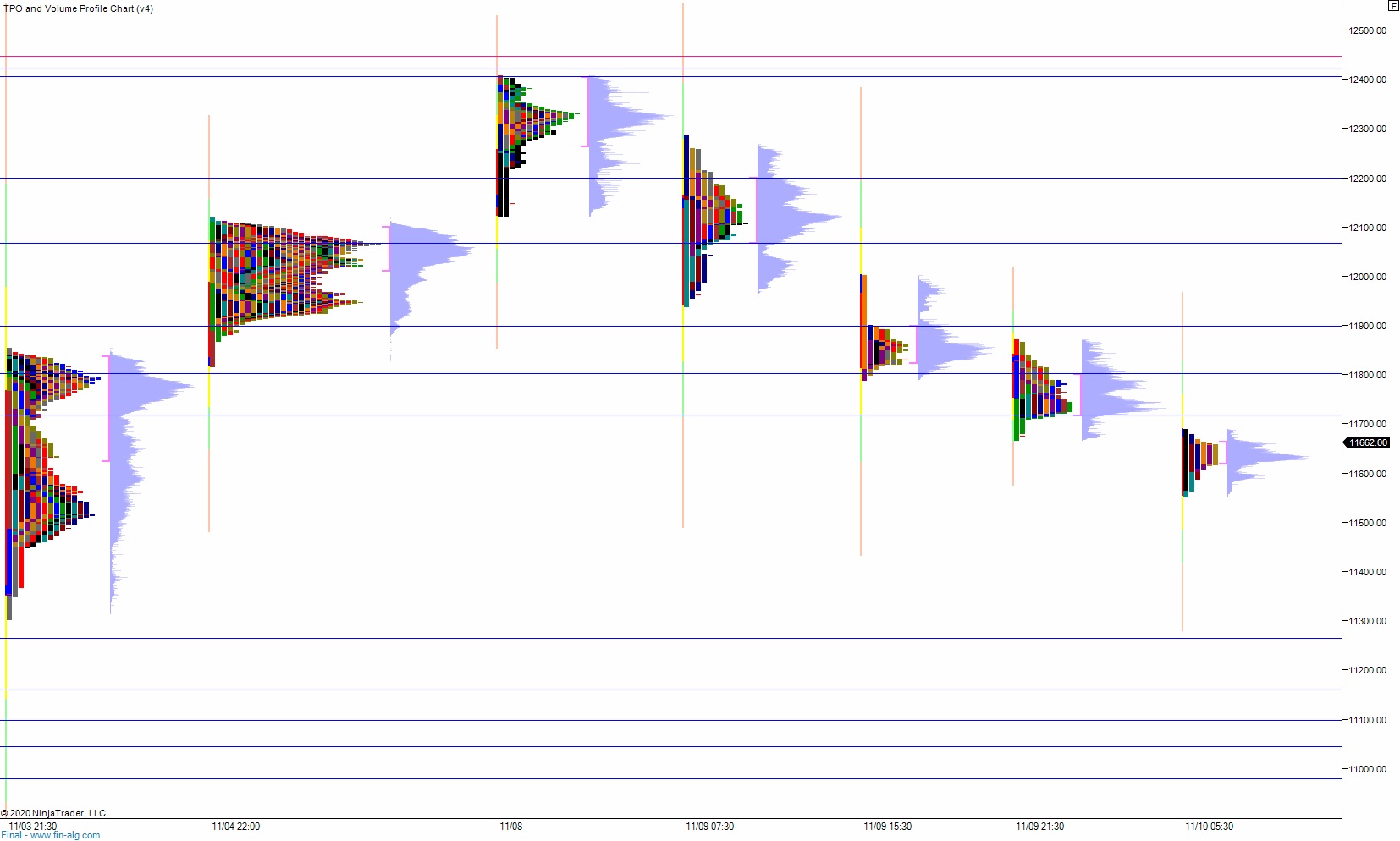

Volume profiles, gaps and measured moves: