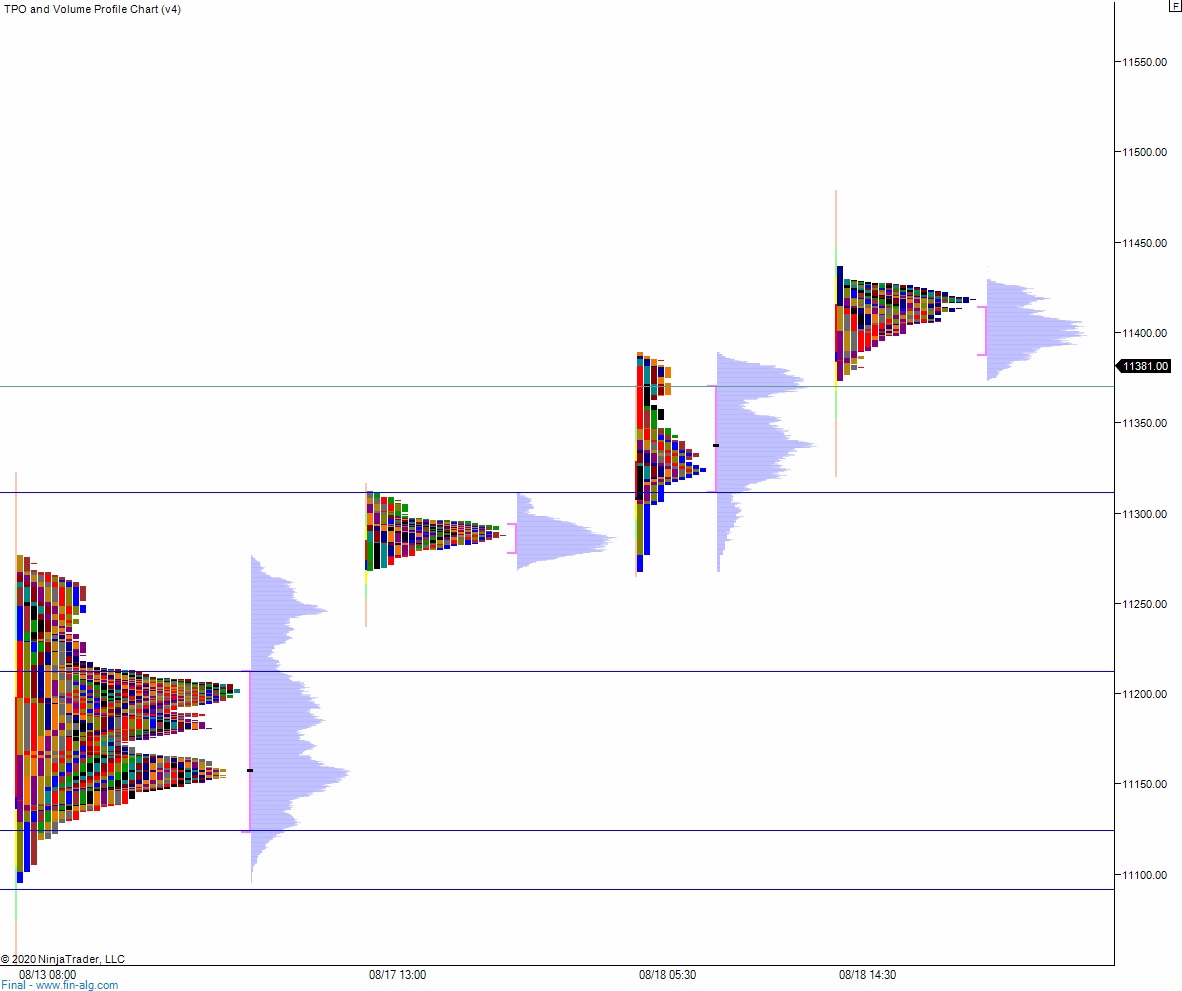

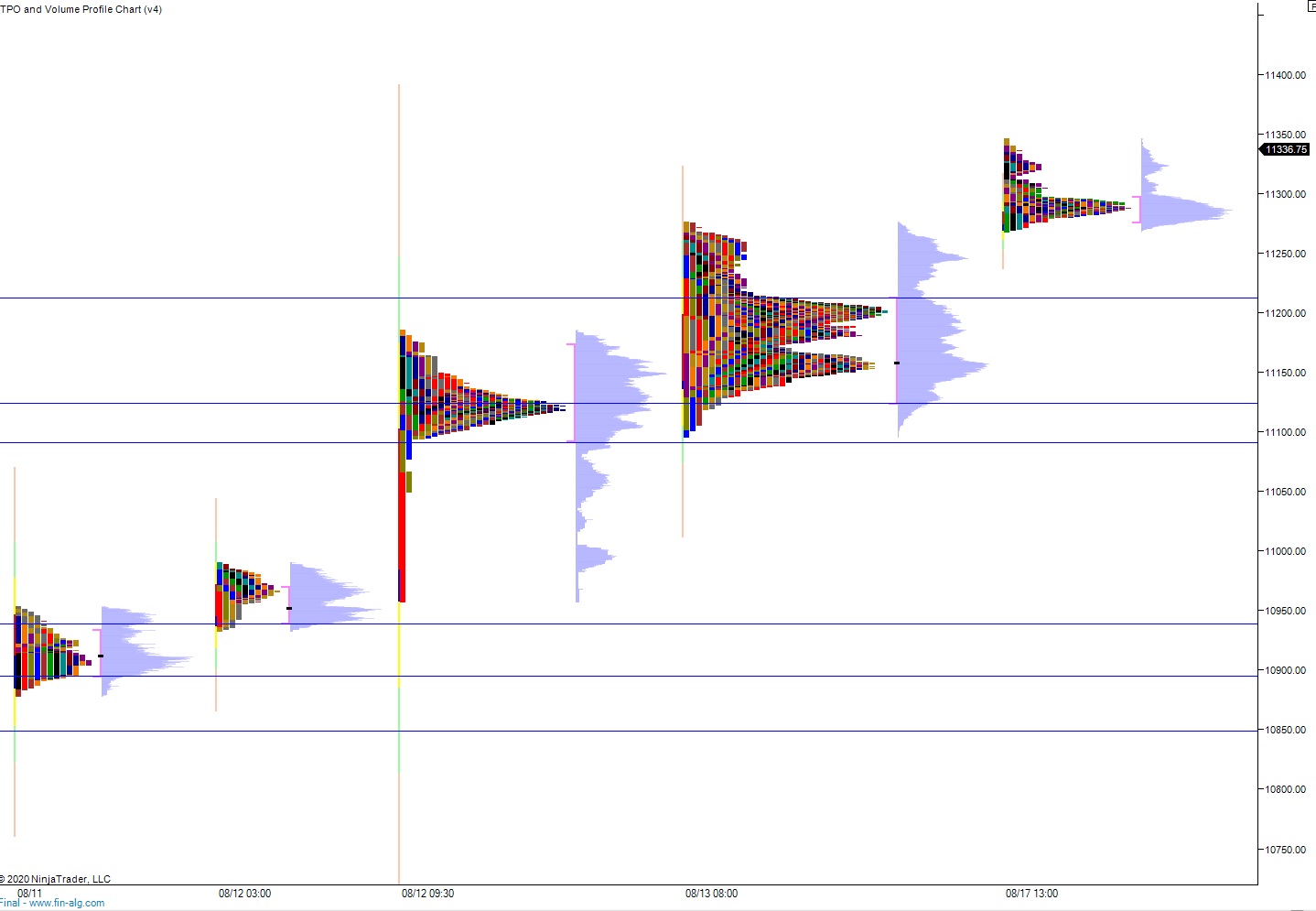

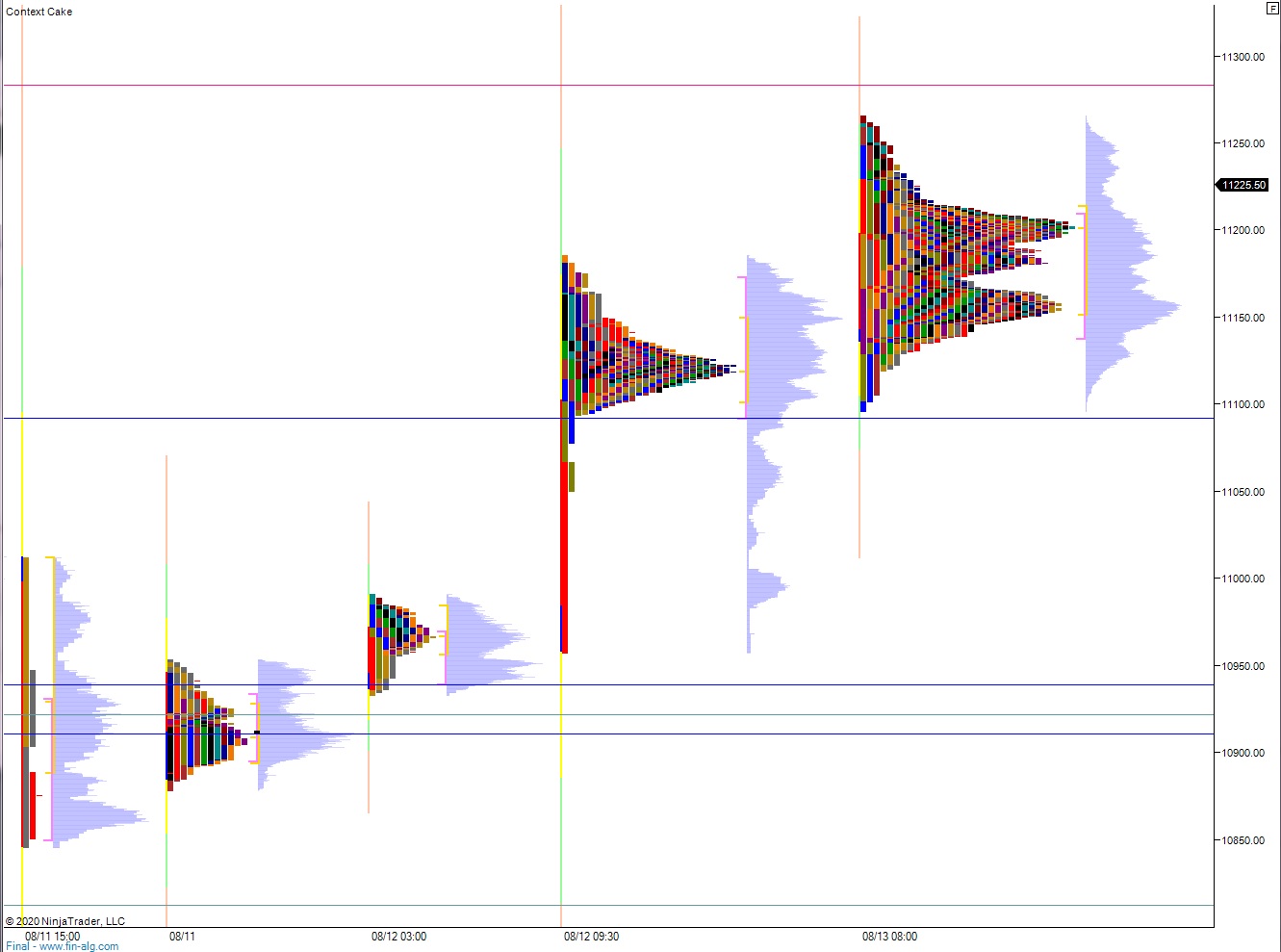

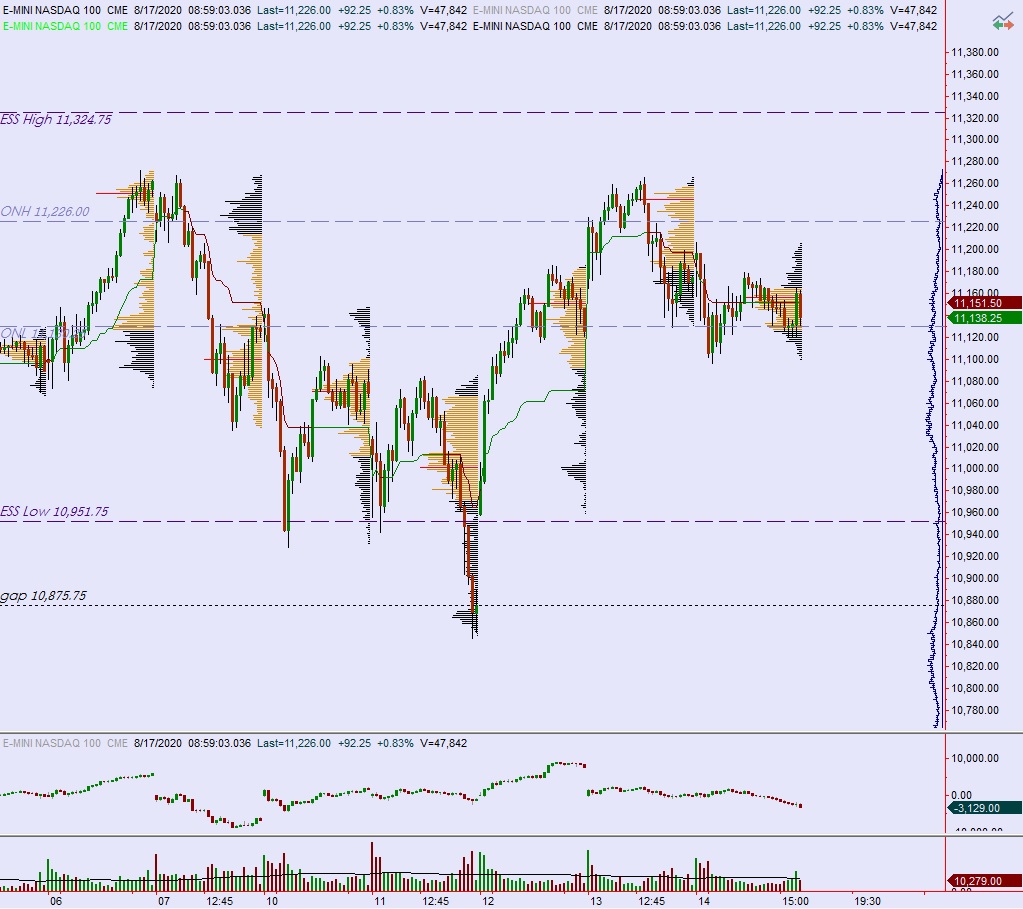

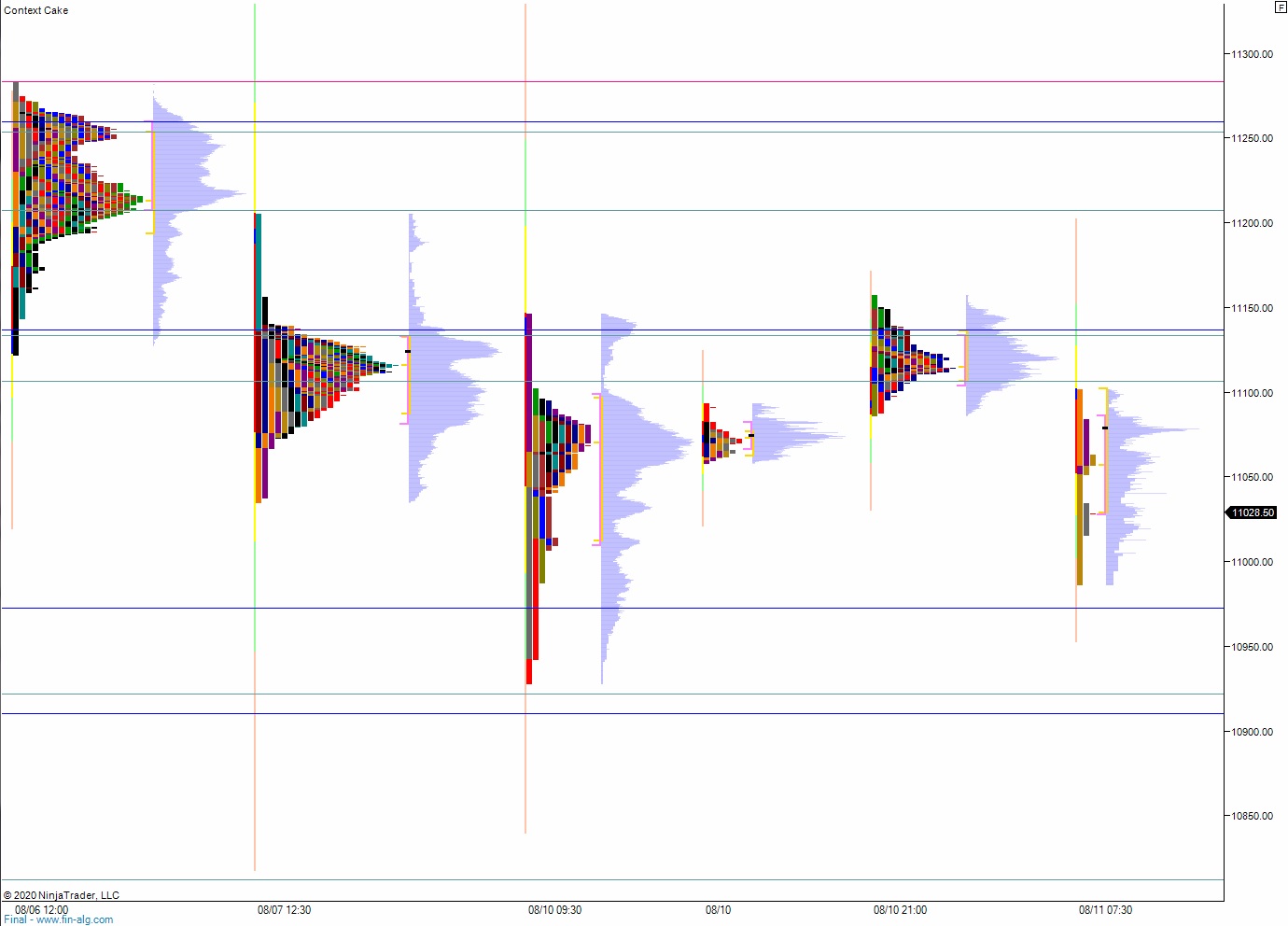

NASDAQ futures are coming into Friday with a slight gap down after an overnight session featuring extreme range on elevated volume. Price briefly set a new all-time-high overnight before peaking out around 9:30pm New York. From then onward we steadily rotated lower, trading back down into Wednesday’s range. As we approach cash open, price is hovering above Wednesday’s high, up in the upper quadrant of Thursday’s range.

On the economic calendar today we have Flash PMI at 9:45am followed by existing home sales at 10am.

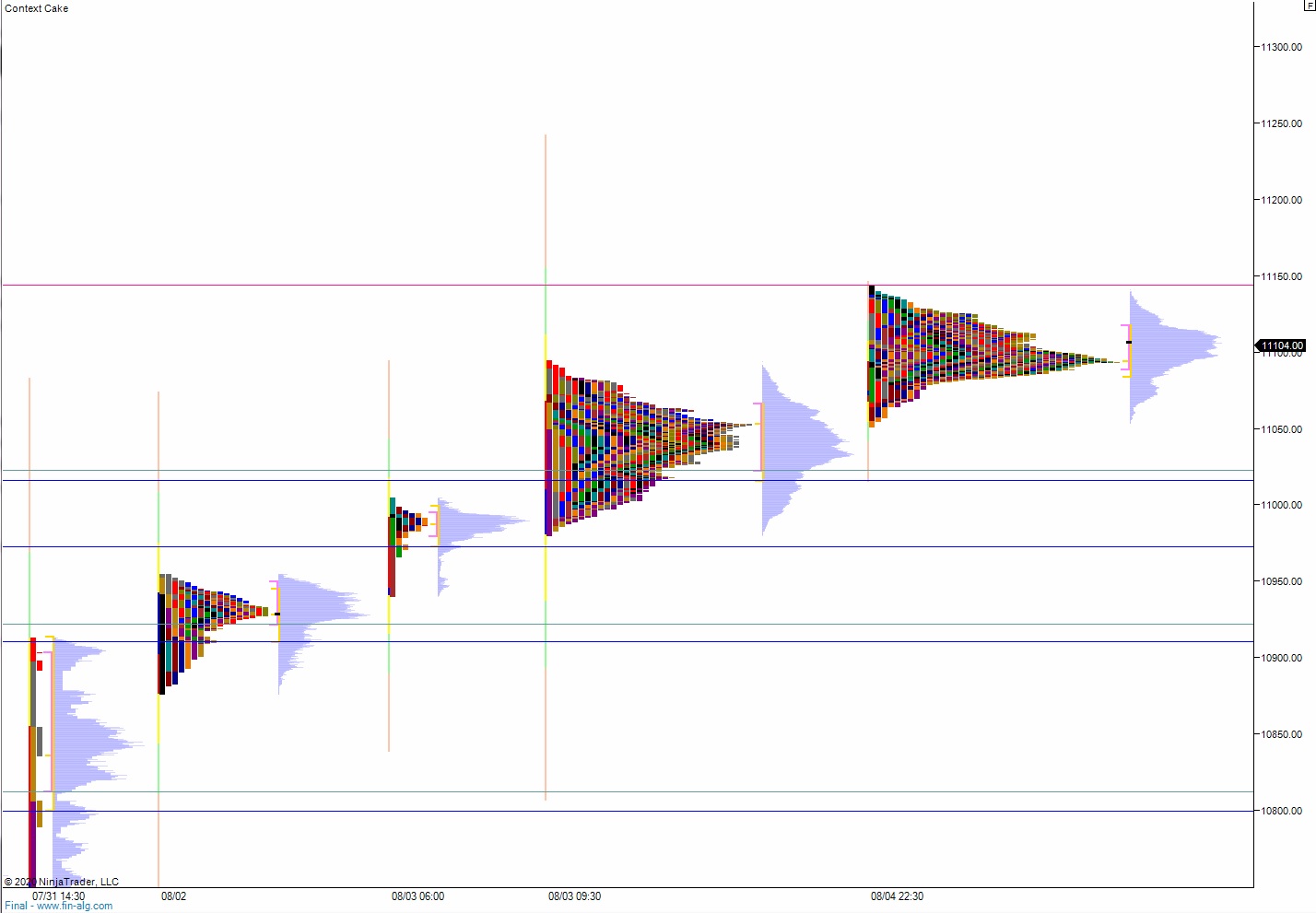

Yesterday we printed a trend up. The day began with a gap down below prior day range. After a brief open two way auction buyers stepped in and drove higher, closing the overnight gap and continuing into the Wednesday range, tagging the Wednesday midpoint early on and pausing briefly before continuing to campaign higher. Price flagged for about an hour just below prior all-time high before continuing the campaign up to new record highs and rallying right into closing bell.

Trend up.

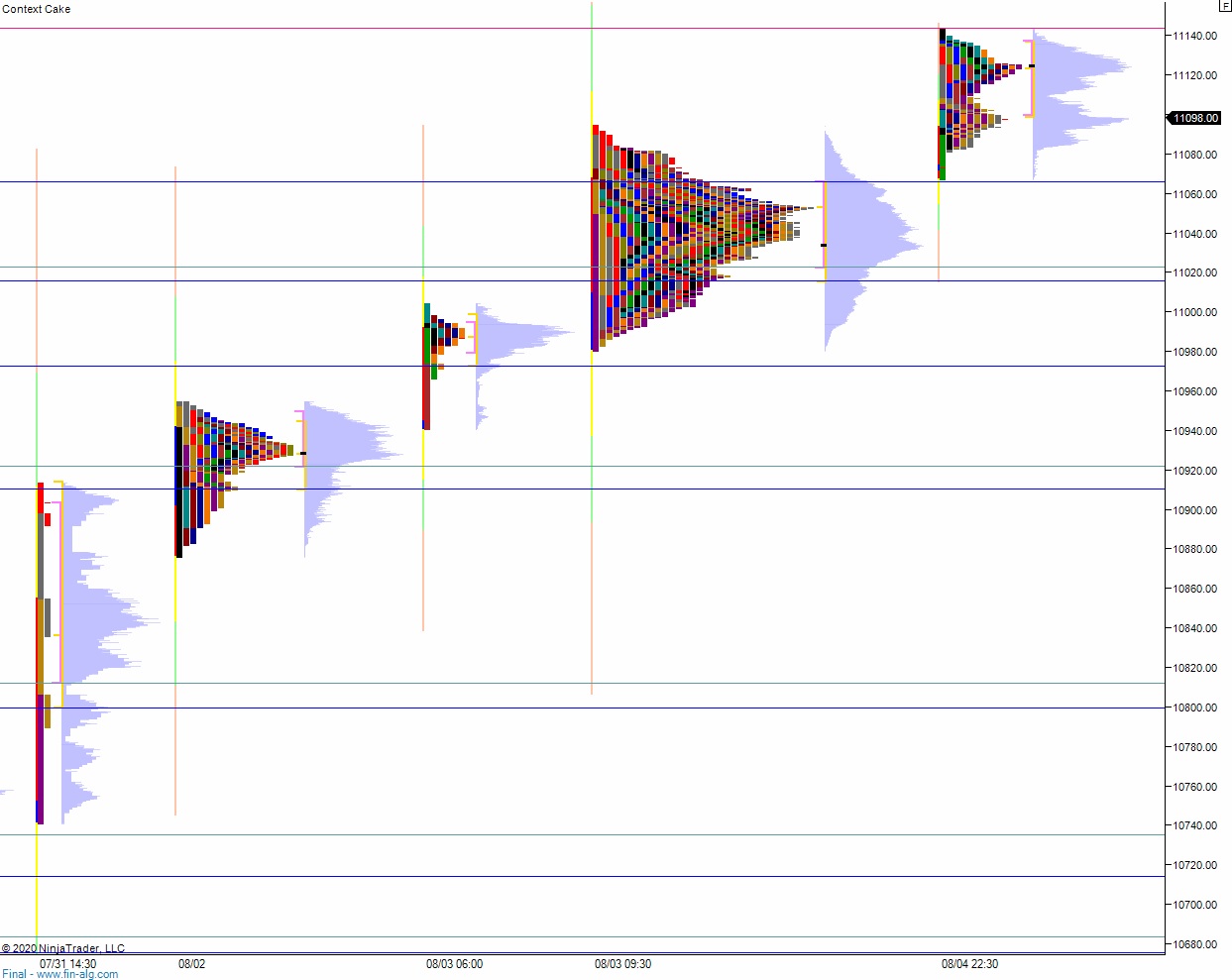

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 11,478.75. From here buyers continue higher, tagging 11,500 before two way trade ensues.

Hypo 2 stronger buyers take out overnight high (ATH) 11,524 on their way to tagging 11,550.

Hypo 3 sellers press down through overnight low 11,407 and tag the low volume node at 11,383 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: