NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring elevated range and volume. Price worked lower overnight, trading down near but not exceeding last Friday’s low. Since around 4am New York buyers have reversed much of the overnight selling. At 8:30am jobless claims data came out worse than expected. So far no reaction, and as we approach cash open price is overnight a few points below the Wednesday close.

Also on the economic calendar today we have existing home sales at 10am followed by 4- and 8-week T-bill auctions at 11:30am.

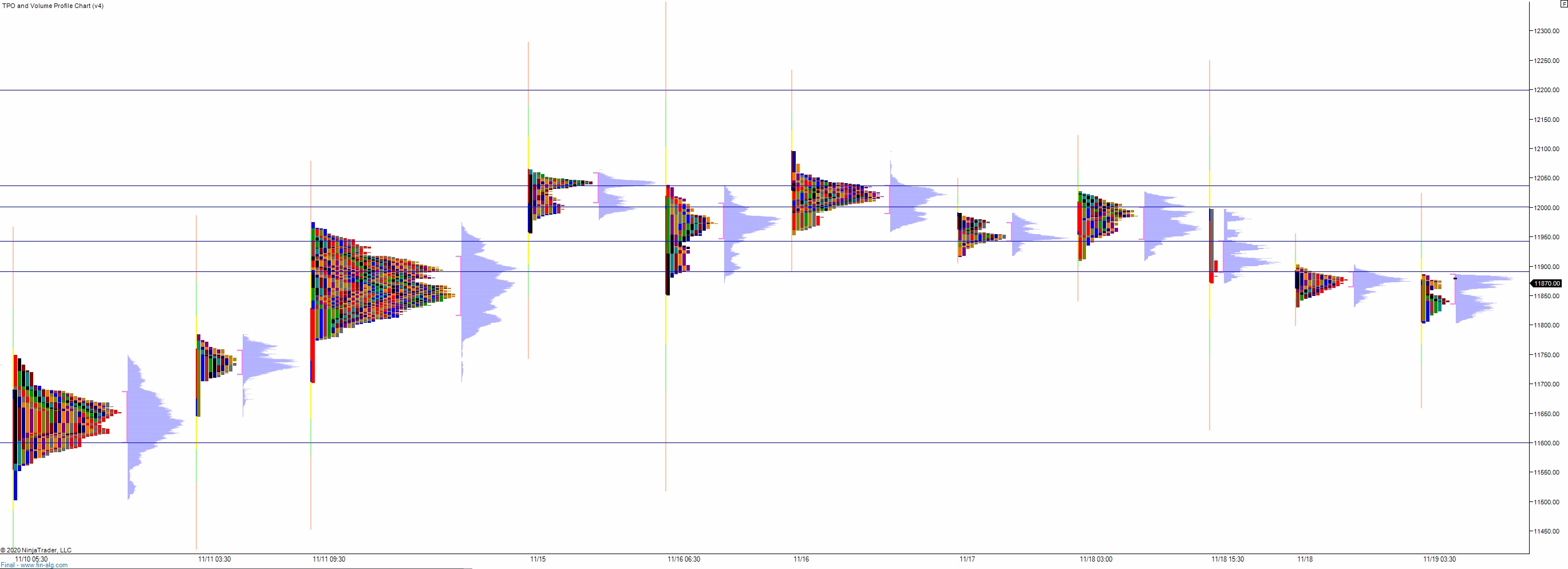

Yesterday we printed a neutral extreme down. The day began with a slight gap down that buyers quickly resolved during an open two-way auction. Shortly after the open sellers spiked price down through the Tuesday low but the move had no follow thru. Instead the morning low was set before 10am and we spent the rest of the morning auctioning higher. Buyers worked price up into the top quadrant of Tuesday’s range but could not take out the high. Instead price fell back down into the midpoint around 2pm and after buyers defended the mid once, they failed during a more rapid bit of selling late in the afternoon. The closing selling pressed us into a neutral print and closed out the session on the lows.

Neutral extreme down.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 11,883.50. From here buyers continue higher, up through overnight high 11,903 before two way trade ensues.

Hypo 2 buyers buyers trade up to 11,941.50 before two way trade ensues.

Hypo 3 sellers press down through overnight low 11,804.50. Look for buyers just below at 11,800 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: