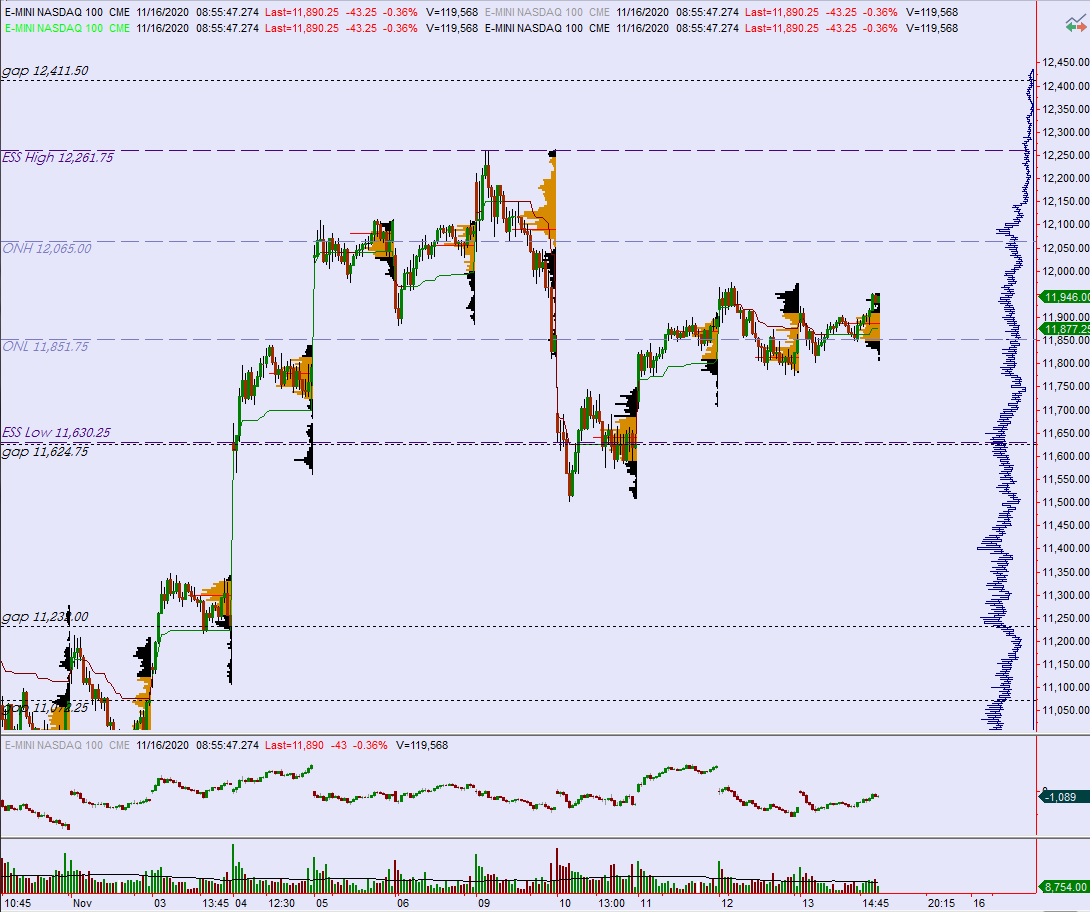

NASDAQ futures are coming into Monday with a slight gap down after an overnight session featuring extreme range and volume. Price spiked Sunday evening when Globex trade opening, sending price up near last Monday’s VPOC before stalling. Price held the highs until about 7am when sellers began actively campaigning price lower. As we approach cash open, price is back inside last Friday’s range, hovering about ten points above the Friday midpoint.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am. Also be aware major U.S. employer and retailer Walmart is set to report earnings Tuesday before the bell.

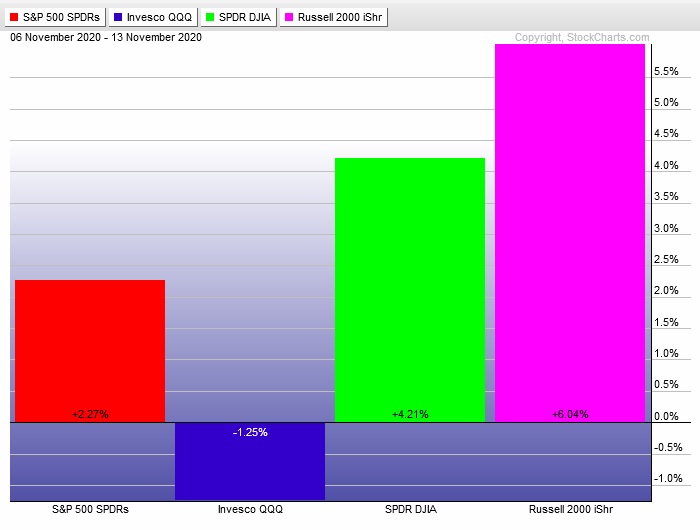

Last week kicked off with a bit of a morning spike, then we faded lower through Tuesday morning. By late Tuesday morning a responsive bid had stepped in and put a floor in the markets. We gradually rallied higher for the rest of the week, never taking out the high prints set Monday. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap up in ranger that sellers quickly resolved after an open-two way auction. Said sellers continued worki lower, tagging the Thursday naked VPOC before discovering a responsive bid. The morning selling lasted long enough to press the market range extension down, but the rest of the session was controlled by buyers, who reclaimed the midpoint by noon New York and defended a check back around 2:15pm. Then we ramped higher into the close, not exceeding the Thursday high but pressing into a neutral print and closing on the day’s high.

Neutral extreme up.

Heading into today my primary expectation is for sellers to gap-and-go lower. Sellers are active ahead of 11,900 setting up a move down through overnight low 11,851.75. Look for buyers down at 11,815.75 and for two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and close the gap up to 11,946. Buyers tag 12,000 then look for sellers up at 12,056.75 and for two way trade to ensue.

Hypo 3 stronger buyers pres up through overnight high 12,065 and tag the Monday naked VPOC at 12,087.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: