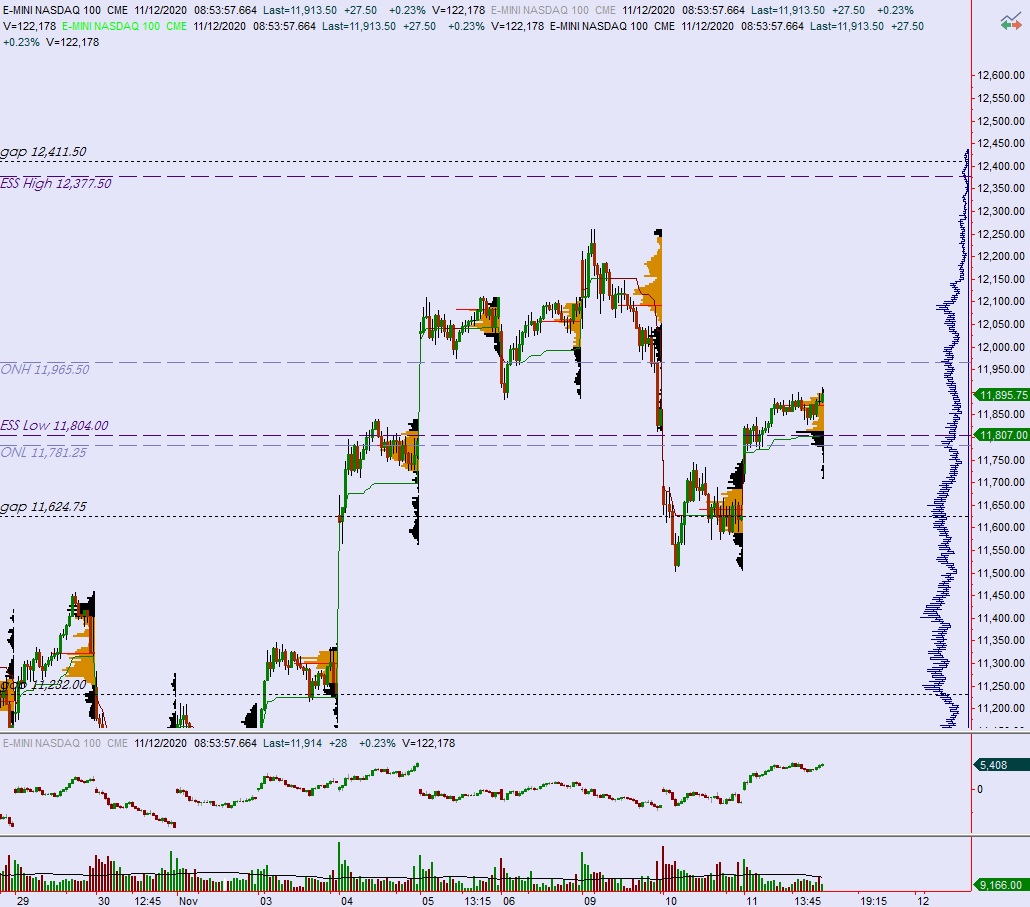

NASDAQ futures are headed into the fourth day of a new President-elect with a slight gap up after an overnight session featuring extreme volume on elevated range. Price was balanced overnight, chopping along the top-side of Wednesday’s midpoint until about 4am when buyers worked price up through the Wednesday high. Since then buyers rejected an attempt back into Wednesday range. At 8:30am CPI data came out softer than expected and jobless claims data slightly better than expectations. As we approach cash open price is hovering just above the Wednesday high.

Also on the economic calendar today we have 4- and 8-week t-bill auctions at 10am then a speech from Fed Chairman Powell at 11:45am. There is also a 30-year bond auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap up and after buyers held the bid above 11,700 during an open-two way auction buyers stepped in and drove higher, right up to 11,800. Chop ensued for several hours, chopping above the midpoint before a second rotation higher began around 12:15pm New York. We flagged along the highs for the rest of the session, eventually ending near session high.

Heading into today my primary expectation is for sellers to reclaim the Wednesday high 11,910.75 early on and close the gap down to 11,895.75. Sellers continue lower, down through overnight low 11,781.25 before two way trade ensues.

Hypo 2 buyers reject a move back into Wednesday high 11,910.75 setting up a run through overnight high 11,965.50. Look for sellers at 12,00 and for two way trade to ensue.

Hypo 3 stronger buyers rally up to 12,070.25 before two way trade ensues.

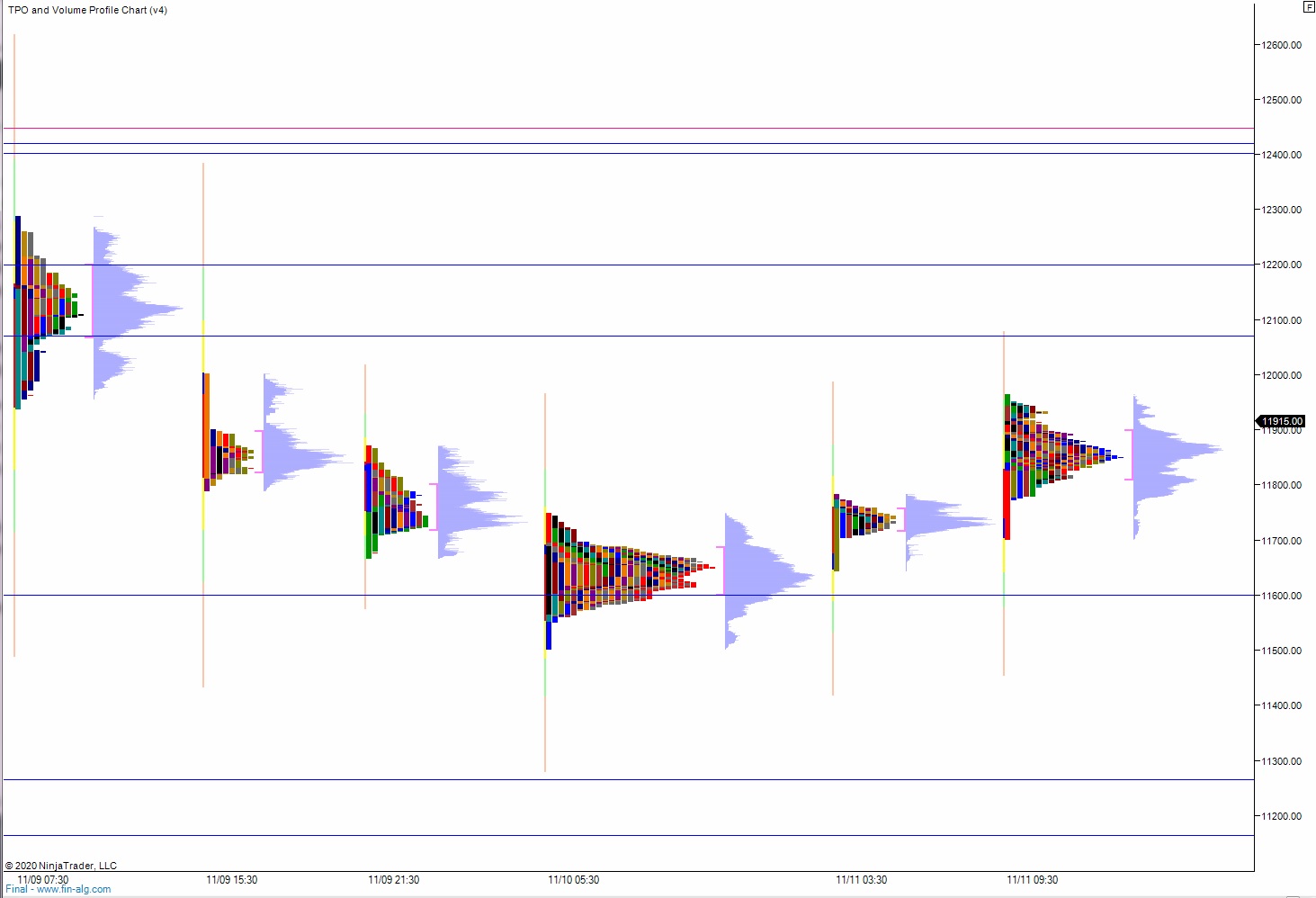

Levels:

Volume profiles, gaps and measured moves: