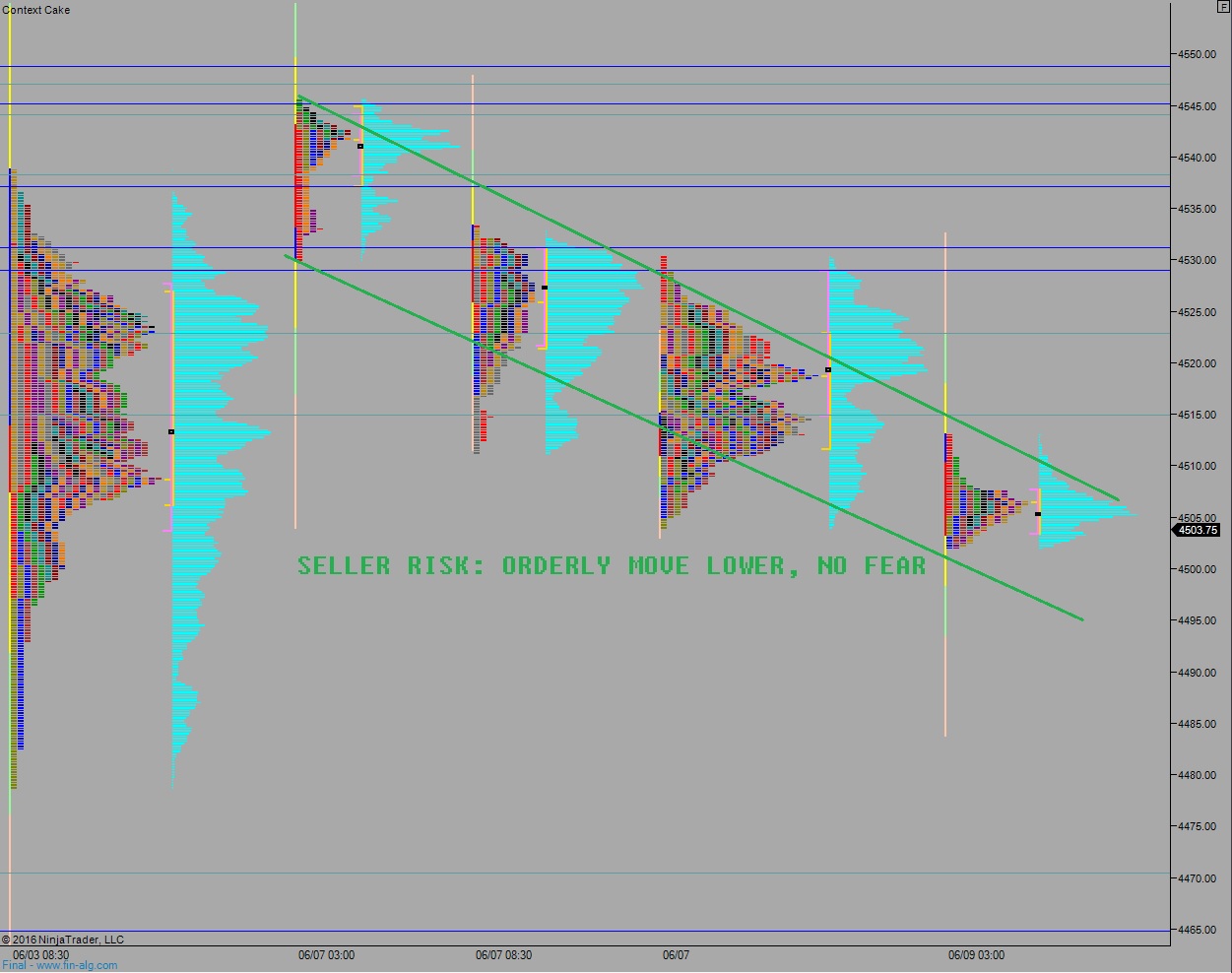

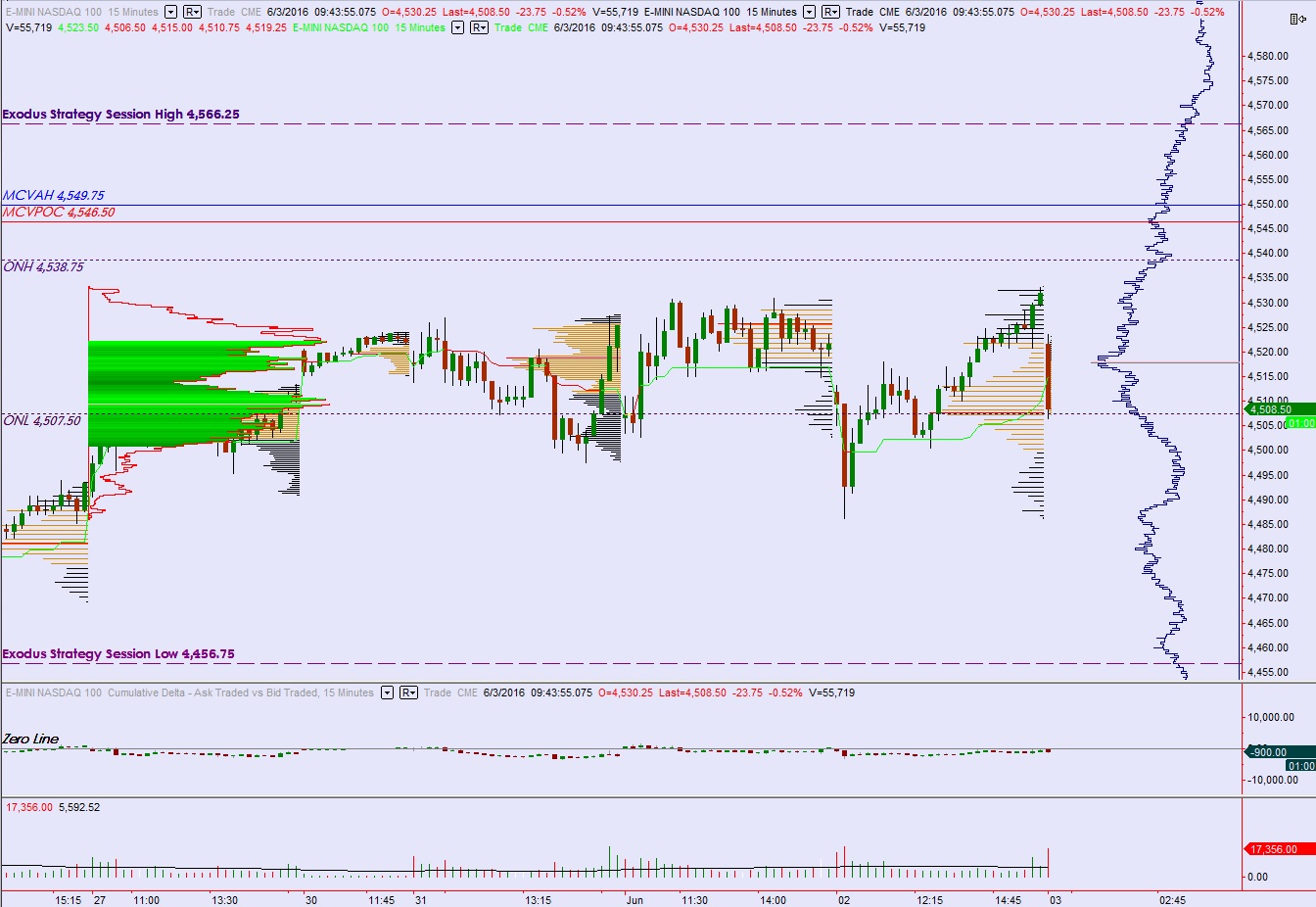

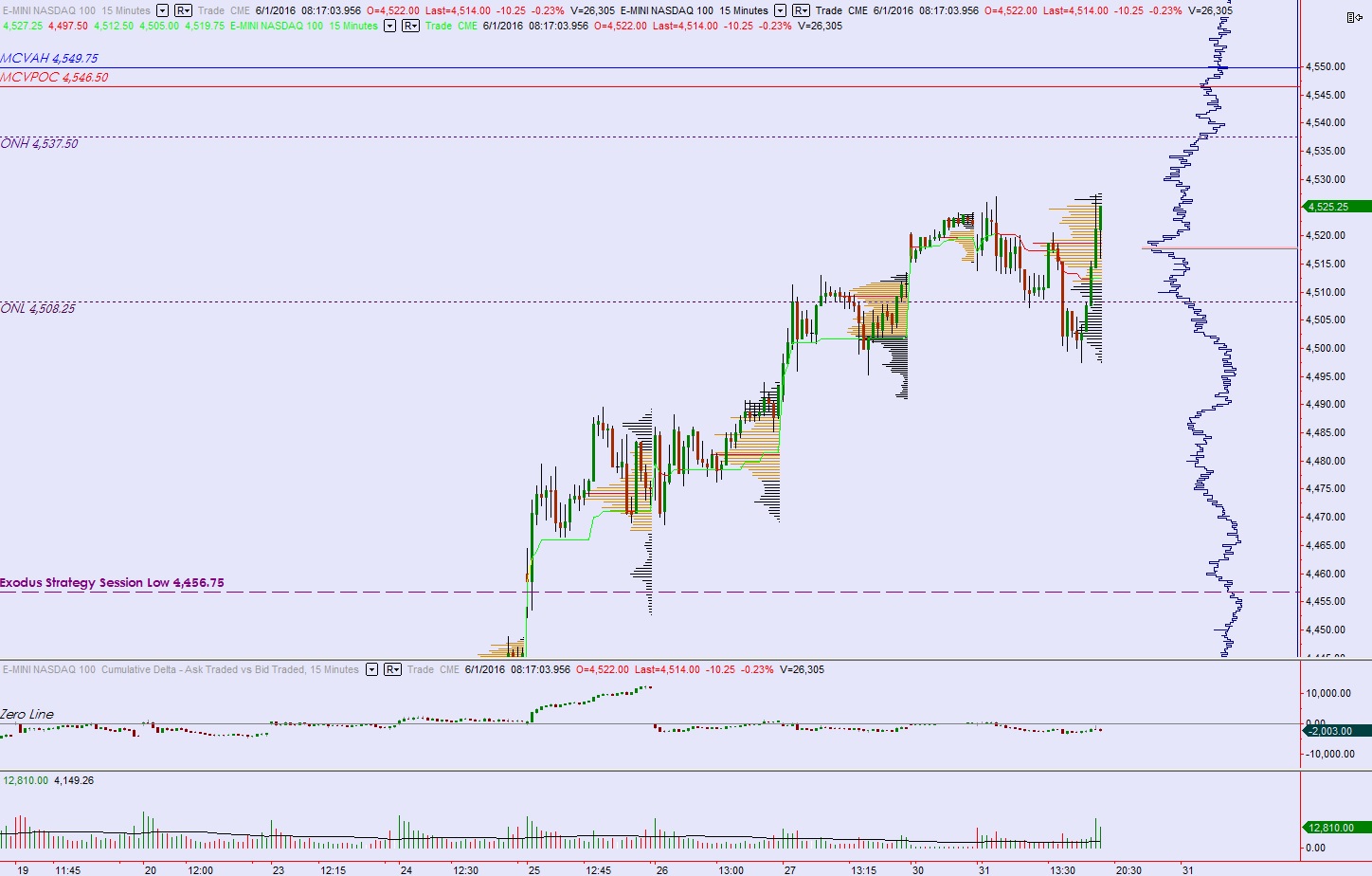

NASDAQ futures are coming into Friday gap down after an overnight session featuring normal volume on slightly elevated range. Price was balanced until about 3am when a half-hour’s worth of selling came into the market.

On the economic calendar today we have University of Michigan’s preliminary June reading of Confidence. At 1pm Baker Hughes will report how many rigs they’ve counted, and at 2pm they will release a Monthly Budget Statement.

Yesterday we printed a normal variation down. Price opened gap down, below Wednesday’s range, and worked higher off the open. Then just before lunch sellers came in and pushed the market range extension down. Just below 4500 a responsive bid stepped in and two way trade ensued (see hypo 2).

Heading into today my primary expectation is for buyers to make a hard push into the overnight inventory and close the gap up to 4511.75. Look for responsive sellers right around here and two way trade to ensue.

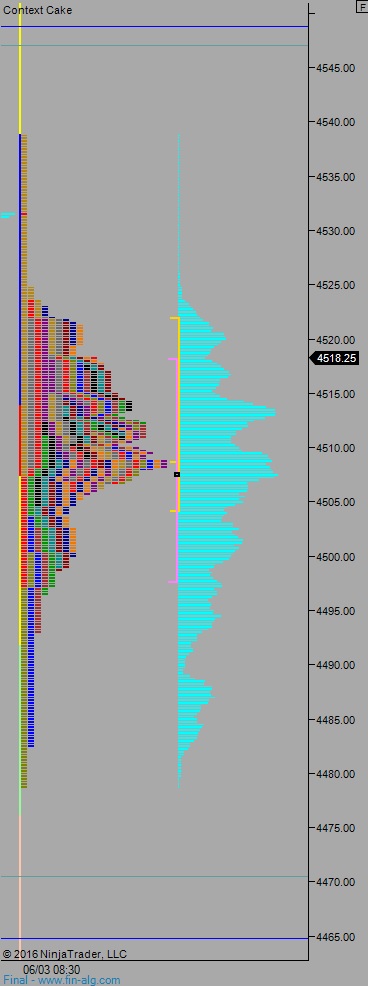

Hypo 2 buyers push a half gap, stalling out just below the 4500 century mark. Sellers then work lower to take out overnight low 4476.25 and find responsive buyers around 4470.75.

Hypo 3 sellers gap-and-go down, take out 4470.75 early on then find a responsive bid around 4465 before two way trade ensues.

Hypo 4 full-on liquidation. Hard push down off the open then sustained trade below 4465 setting up a push down to 4420.75.

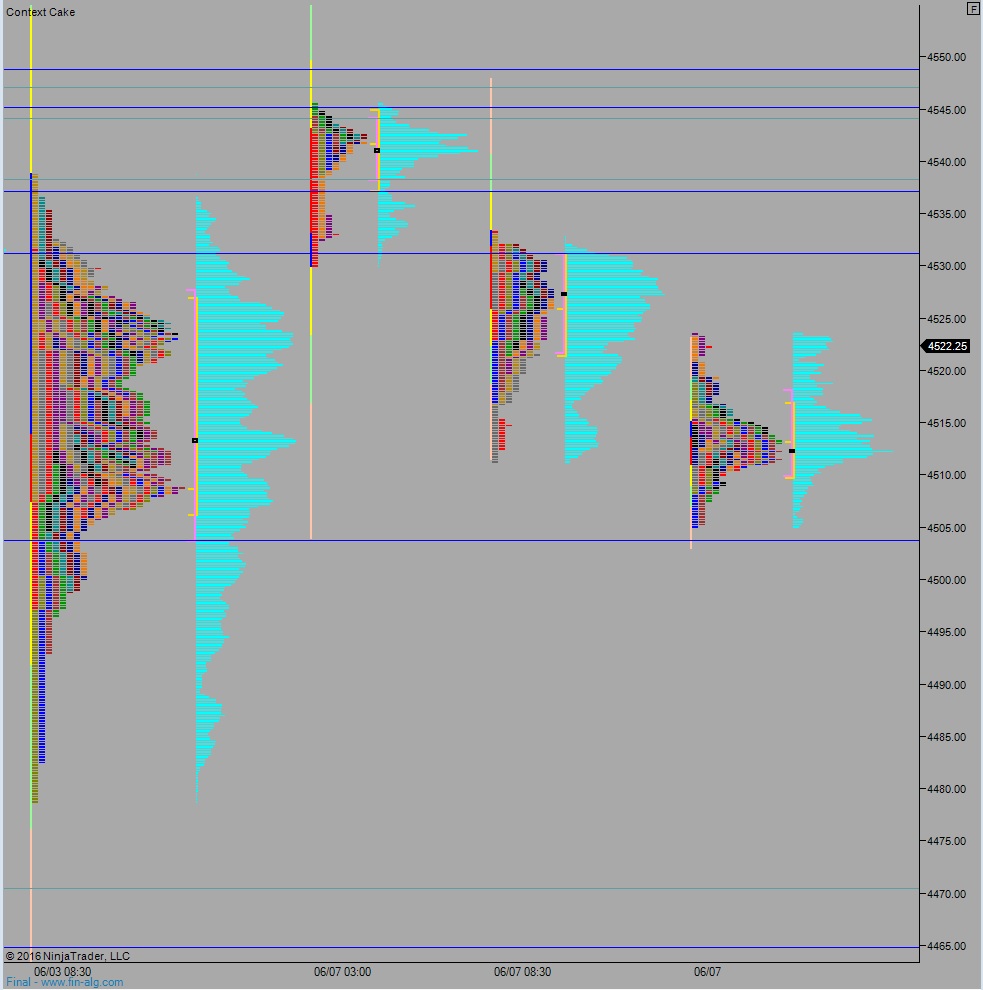

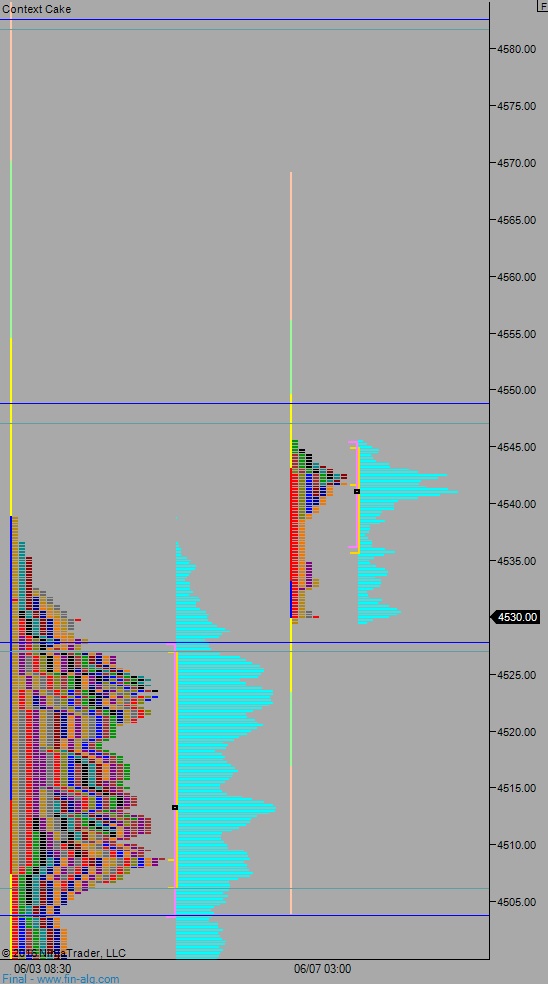

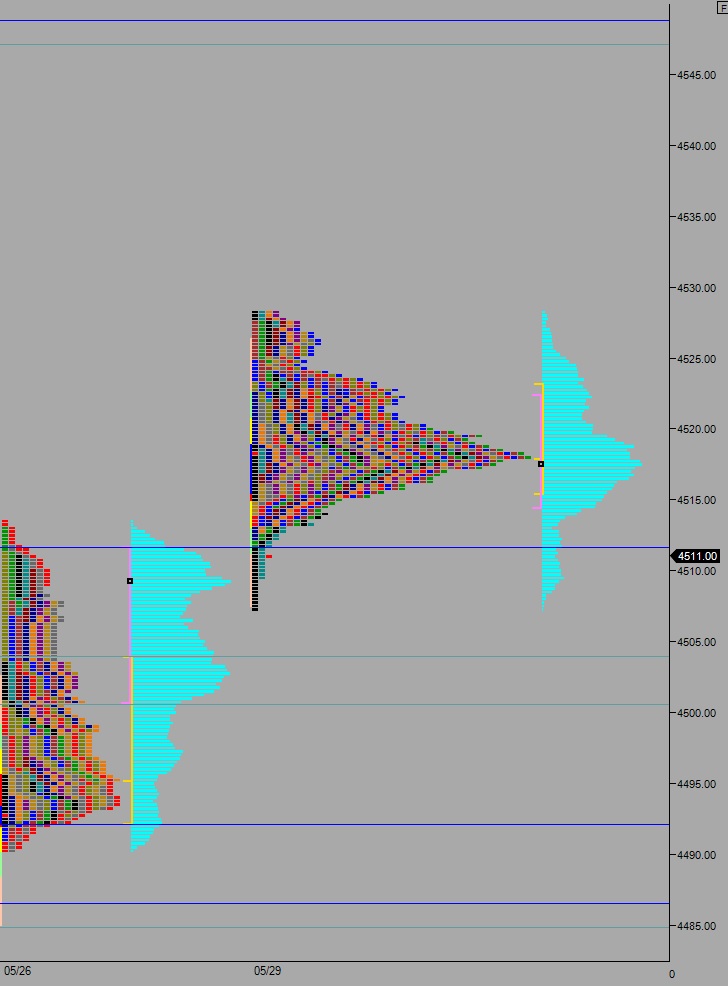

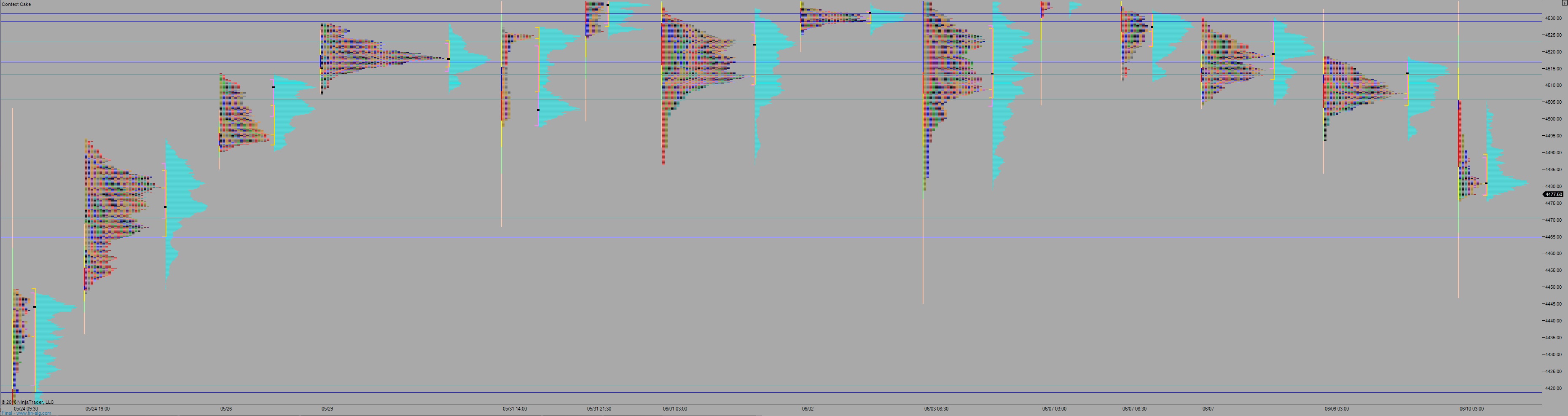

NOTE: All levels quoted above and shown below on Market Profile are for the June’16 contract despite most activity rolling forward to the September contract.

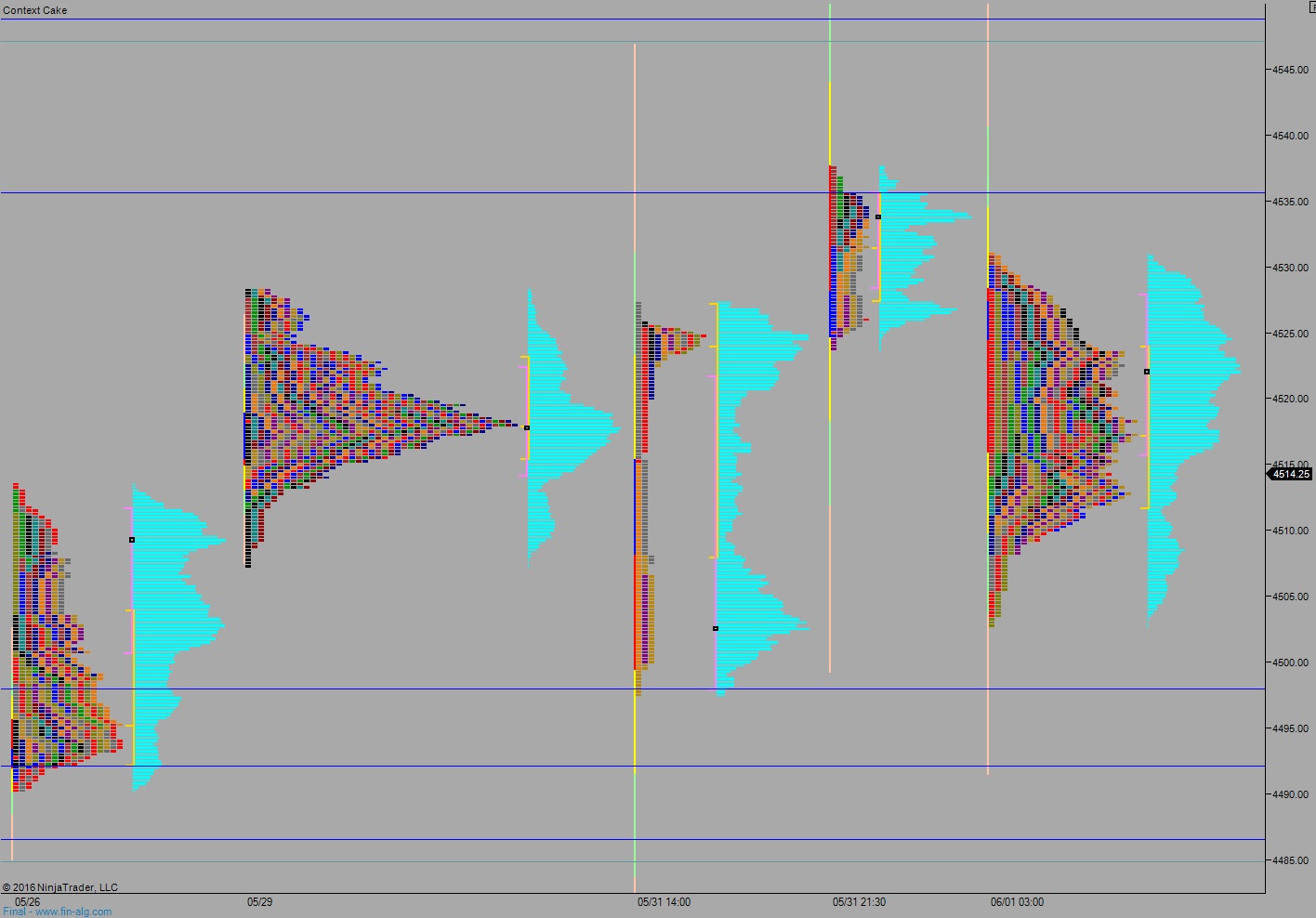

Levels:

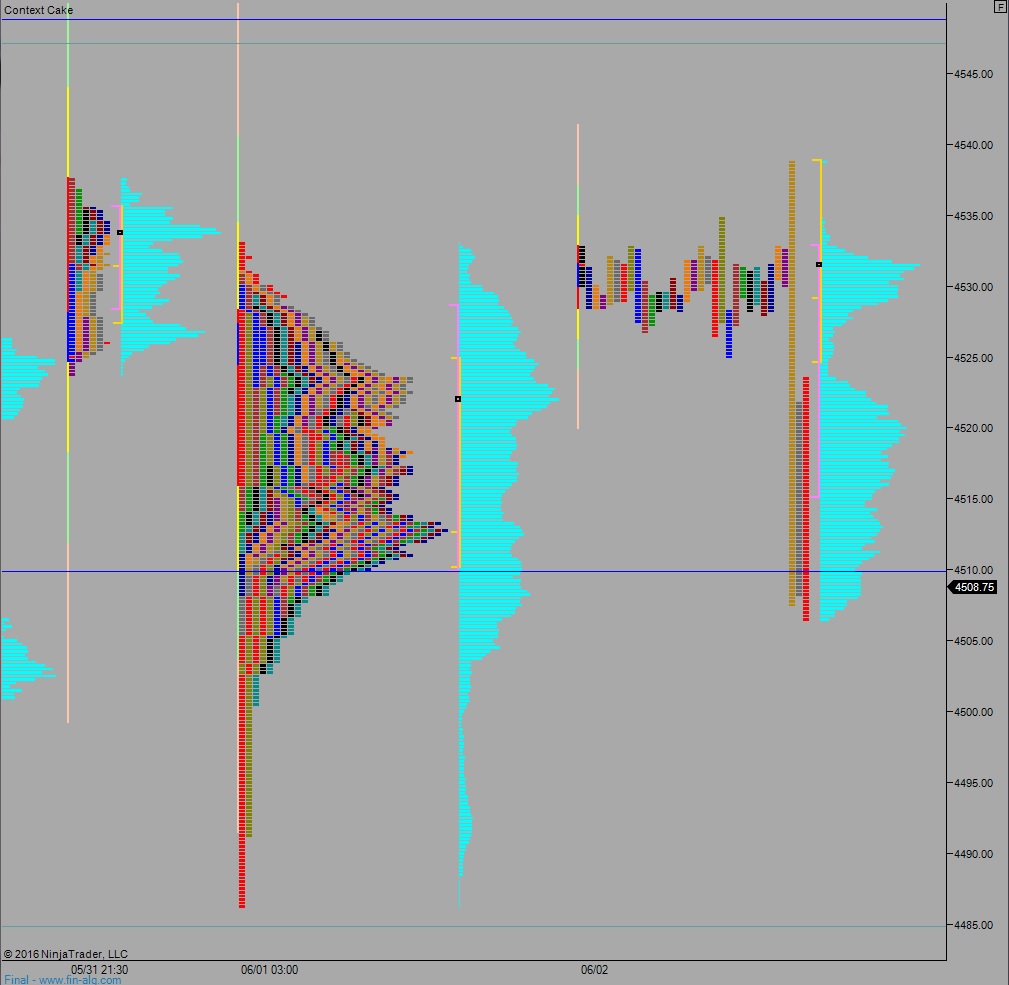

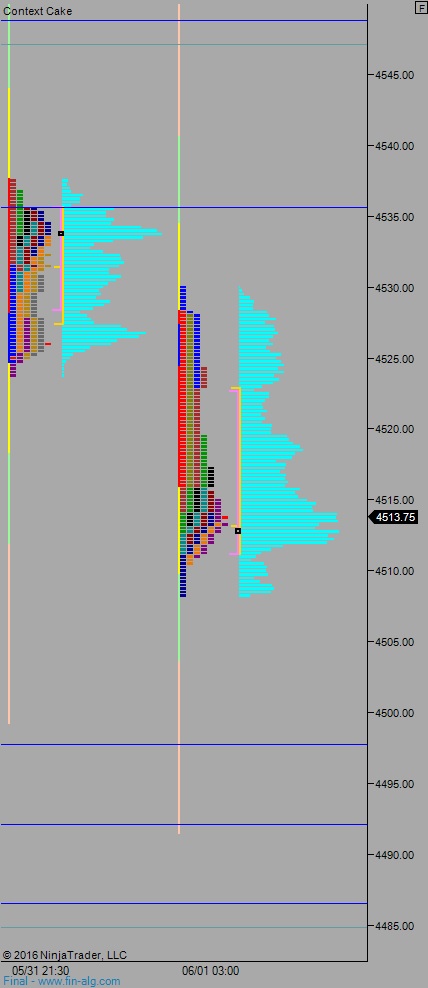

Levels (zoomed in):

Volume profiles, gaps, and measured moves: