NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price held range during Globex on balanced trade, suggesting little has changed since yesterday morning. At 8:15ma ADP Employment data came out slightly worse than expected and at 8:30am Initial/Continuing Jobless claims data was mixed.

Neither of these employments statistics managed to move the market which appears to be waiting to hear tomorrow morning’s Non-farm payroll lead before breaking the current balance.

Also on the economic docket today we have crude oil inventory at 11am.

Yesterday we printed a normal variation up. The market drove higher early on then buyers held session mid through the closing bell.

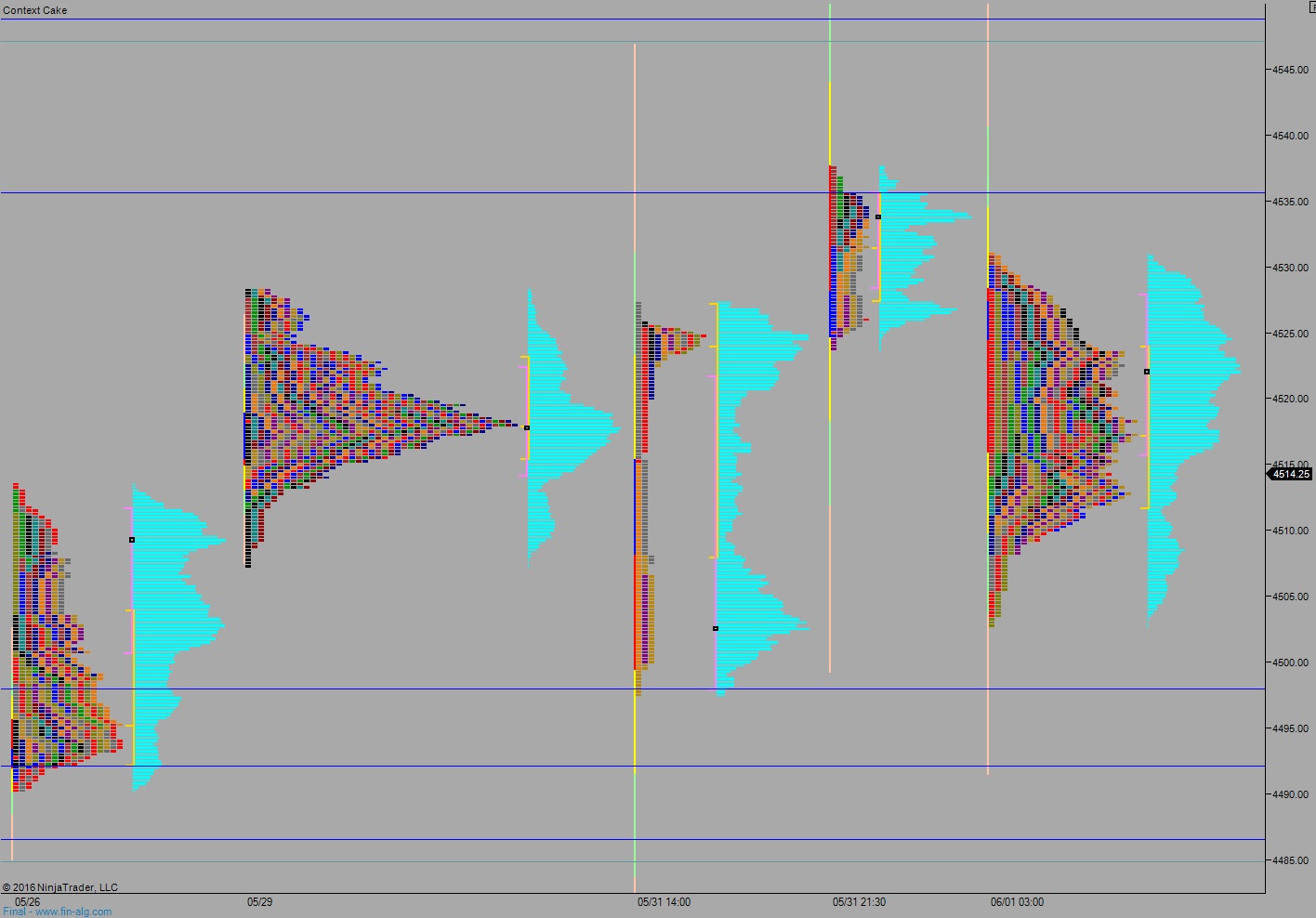

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4521.50. Buyers then continue higher and take out overnight high 4526.75 setting up a move to test above the Wednesday high 4531. Look for responsive sellers at 4535.50 and two way trade to ensue.

Hypo 2 sellers take out overnight low 4508.25. Responsive buyers step in ahead of 4500 and two way trade ensues.

Hypo 3 strong buyers close gap up to 4521.50, take out overnight high 4526.75 then sustain trade above 4535.50 setting up a move to target 4546.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

had my eye around 4490’s, chickened out with the speed of the initial push. Pattern wise, looks like a potential fake breakdown out of the hourly triangle. Trading just a hair back inside of it now.