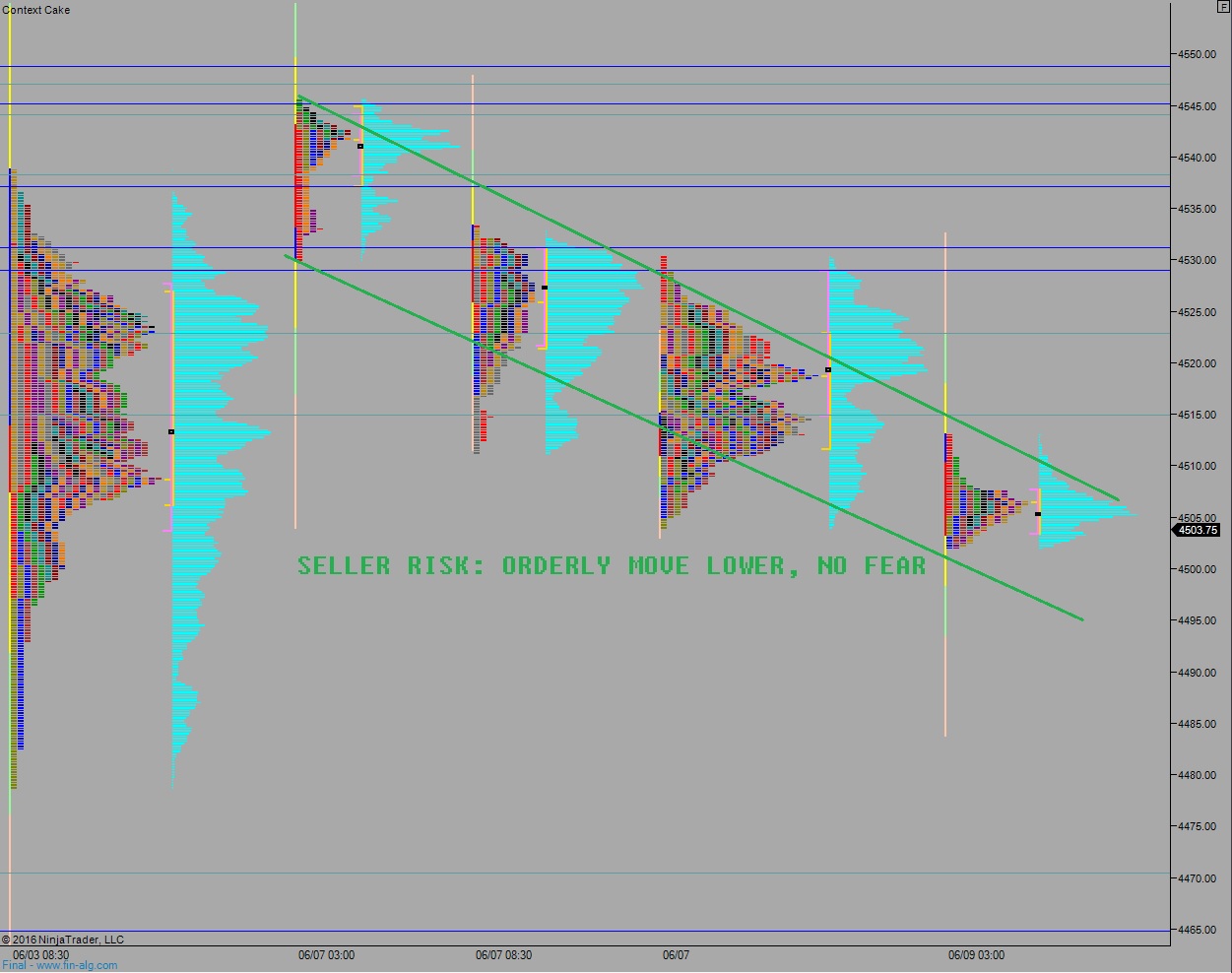

NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price slowly worked lower overnight, pushing the market down just below the lower bounds of value. At 8:30am Initial/Continuing Jobless claims data came out better than expected.

Also on the economic docket today we have Household Change in Net Worth at 12pm and a 30-Year Bond Reopening auction at 1pm.

Yesterday we printed a normal day. A bid sell push early in the session gave us a wide initial balance that would mark the day’s range through the close.

Heading into today my primary expectation is for a flush off the open. Sellers are aggressive in pushing the market lower, trading down to 4470.25 before two way trade ensues.

Hypo 2 buyers push into the soft-handed overnight inventory but stall ahead of the open gap, finding sellers up at 4515. From there the market works lower to take out overnight low 4502, finding responsive buyers just below the 4500 century mark and settling into two-way trade.

Hypo 3 buyers push a full gap fill up to 4518.75 then take out overnight high 4522.50. Look for a move up to 4529 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

so hypo 2 looks in play – frustrate everyone