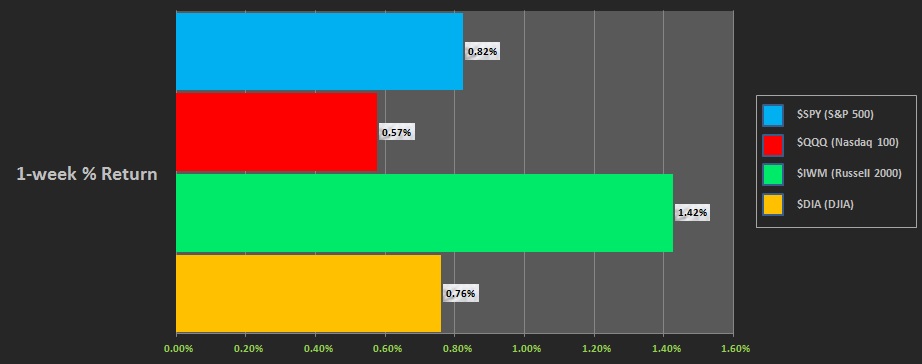

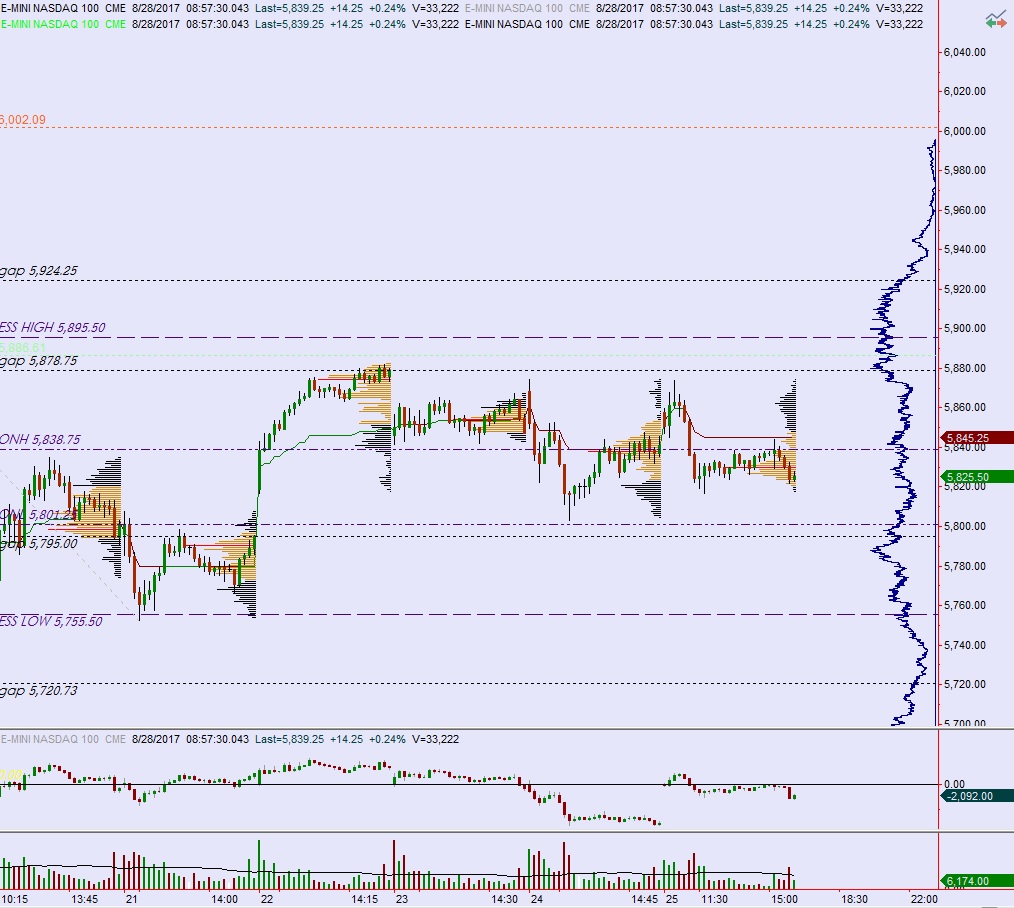

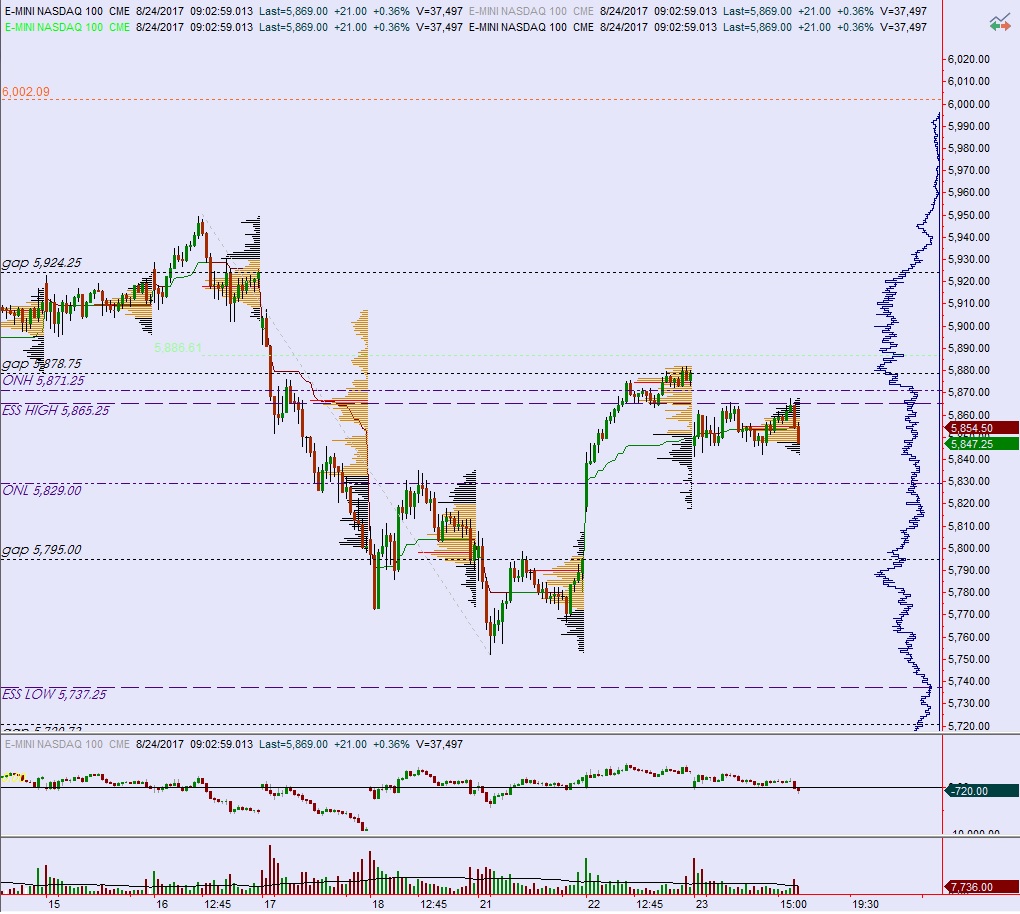

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated volume on normal range. Price worked higher overnight, attaining record highs before settling into two-way trade. At 8:30am non-farm payroll data came out below expectations.

Also on the economic calendar today we have a 10am data dump: ISM Manufacturing/Employment and University of Michigan confidence.

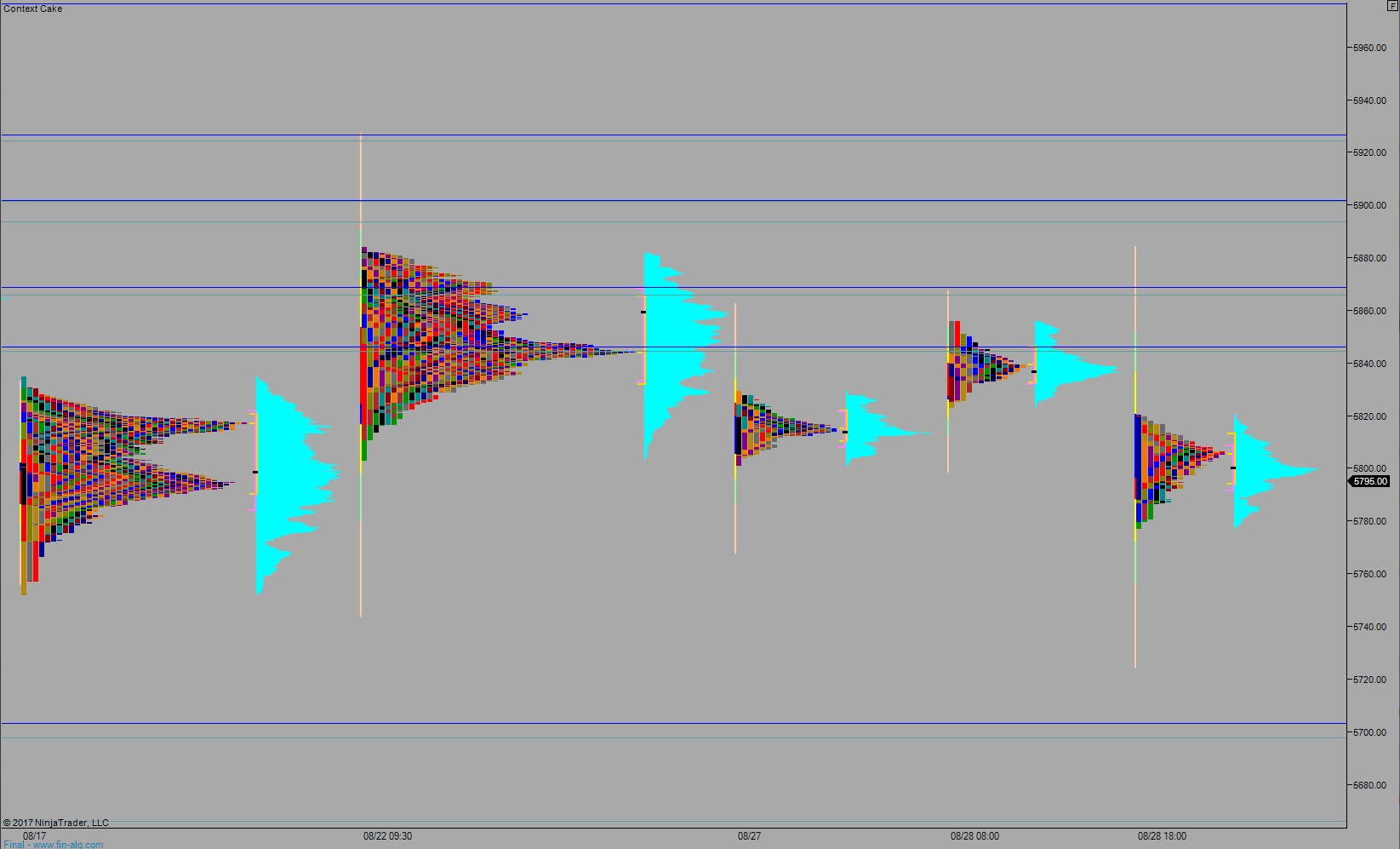

Yesterday we printed a double distribution trend up. It was the third consecutive trend day. Quite bullish.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 5992.25. Buyers step in here and we work up through overnight high 6019.75 before two way trade ensues.

Hypo 2 buyers gap and go, take out overnight high 6019.75 and continue higher, up to 6038 before two way trade ensues.

Hypo 3 stronger sellers press down through overnight low 5990.25 and continue lower, down to 5985 before two way trade ensues.

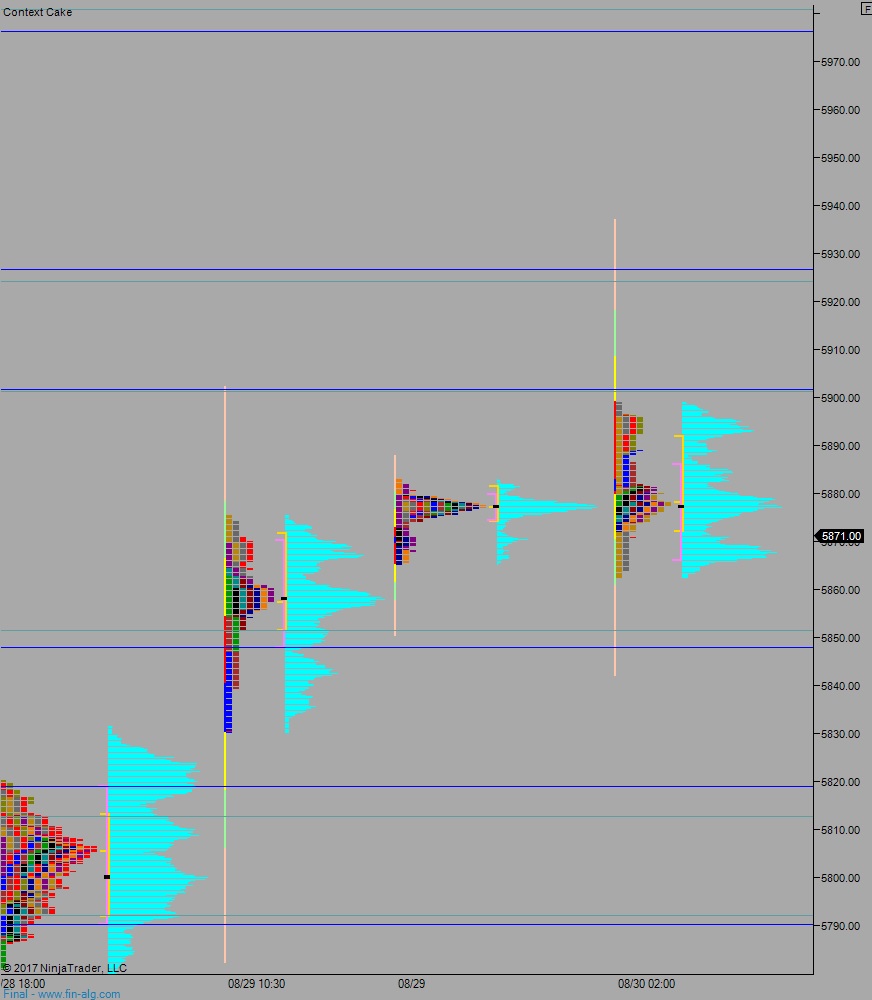

Levels:

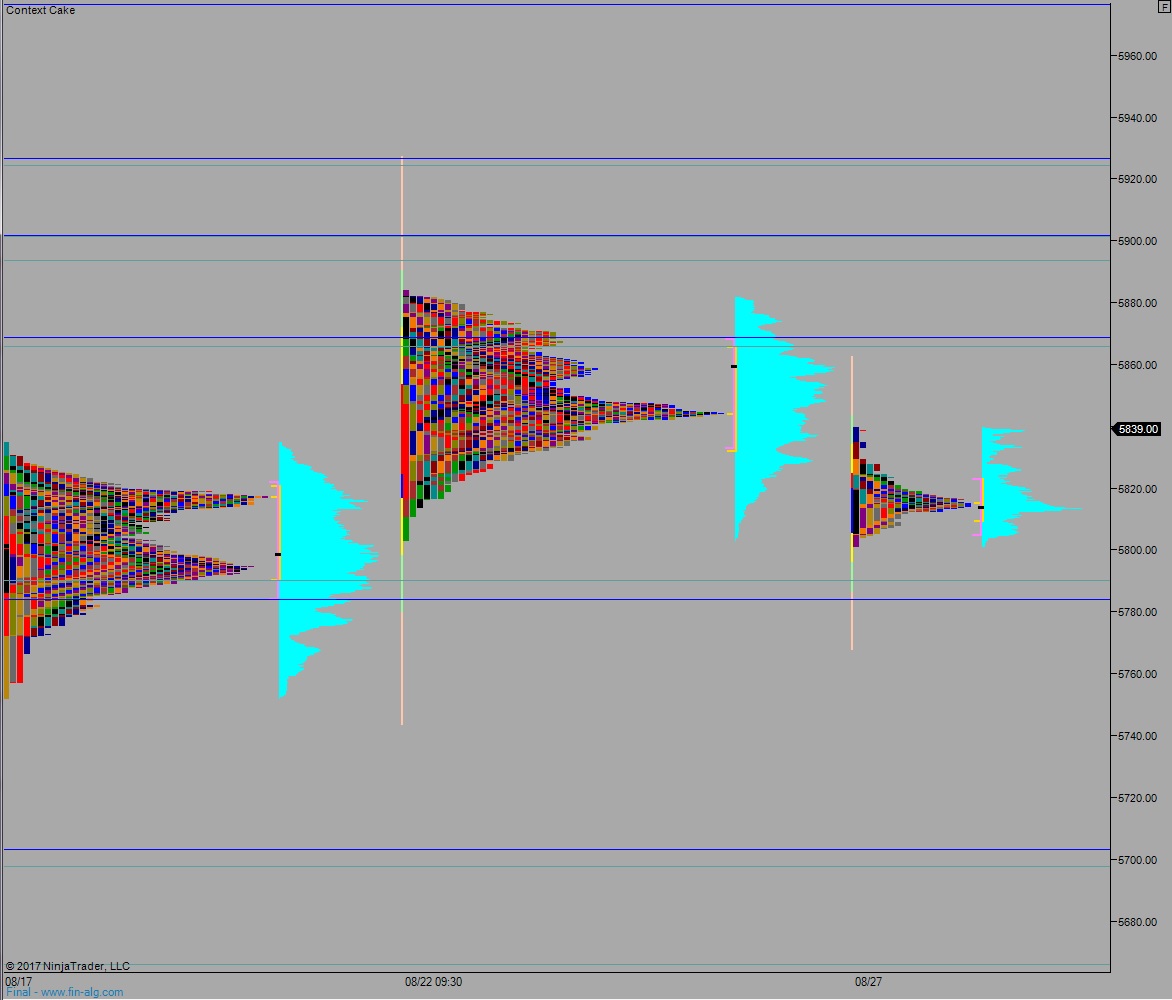

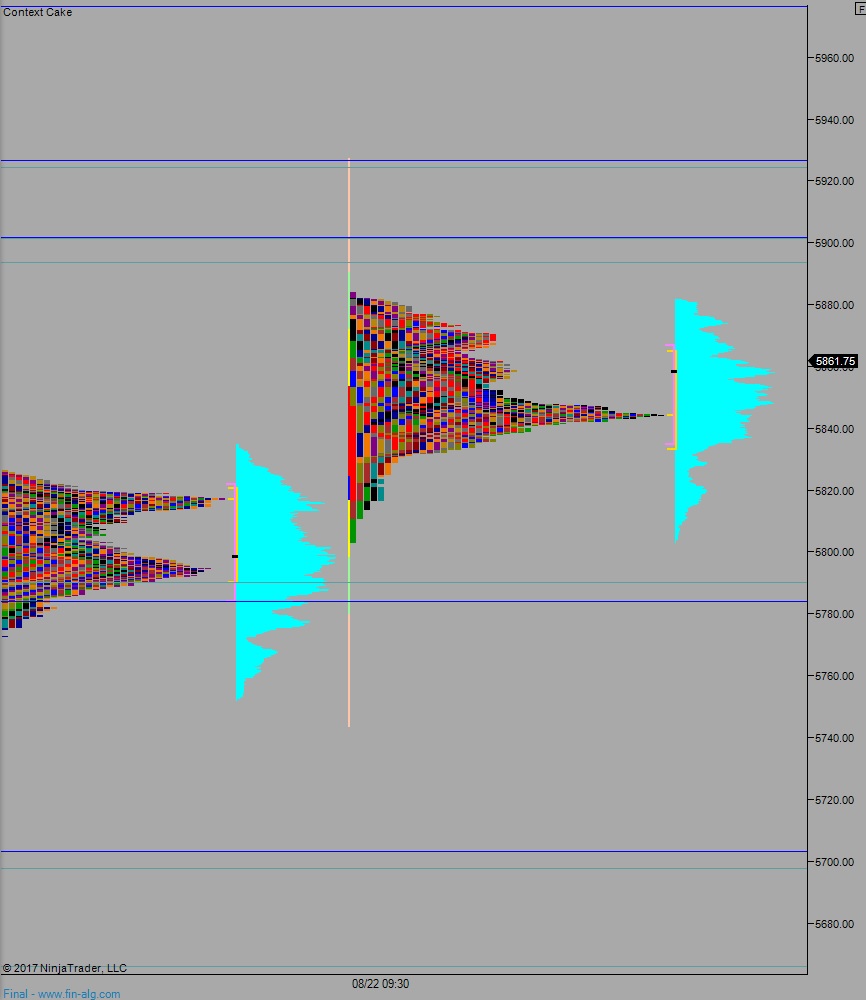

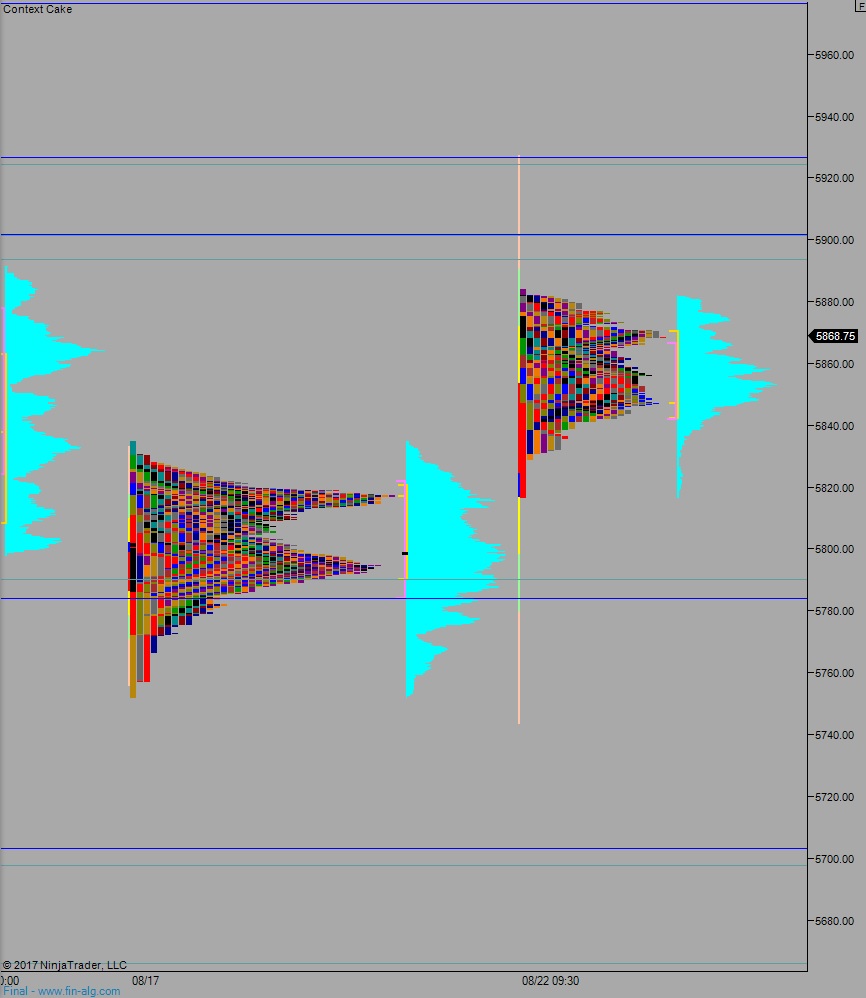

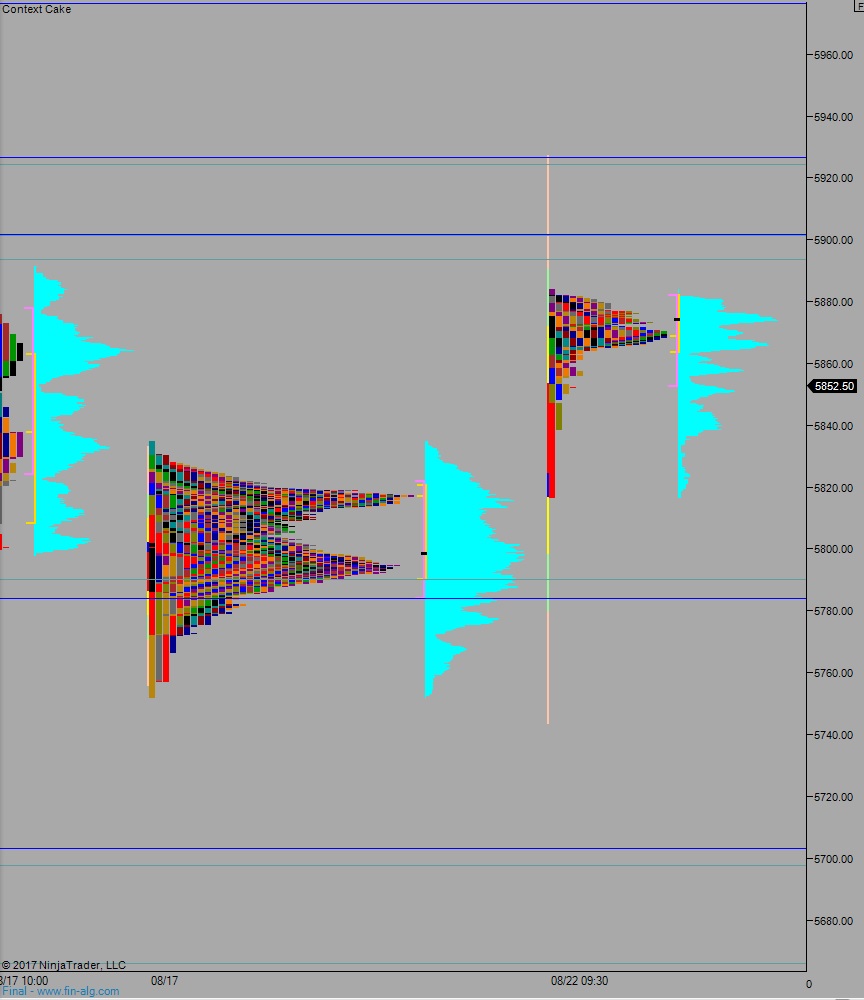

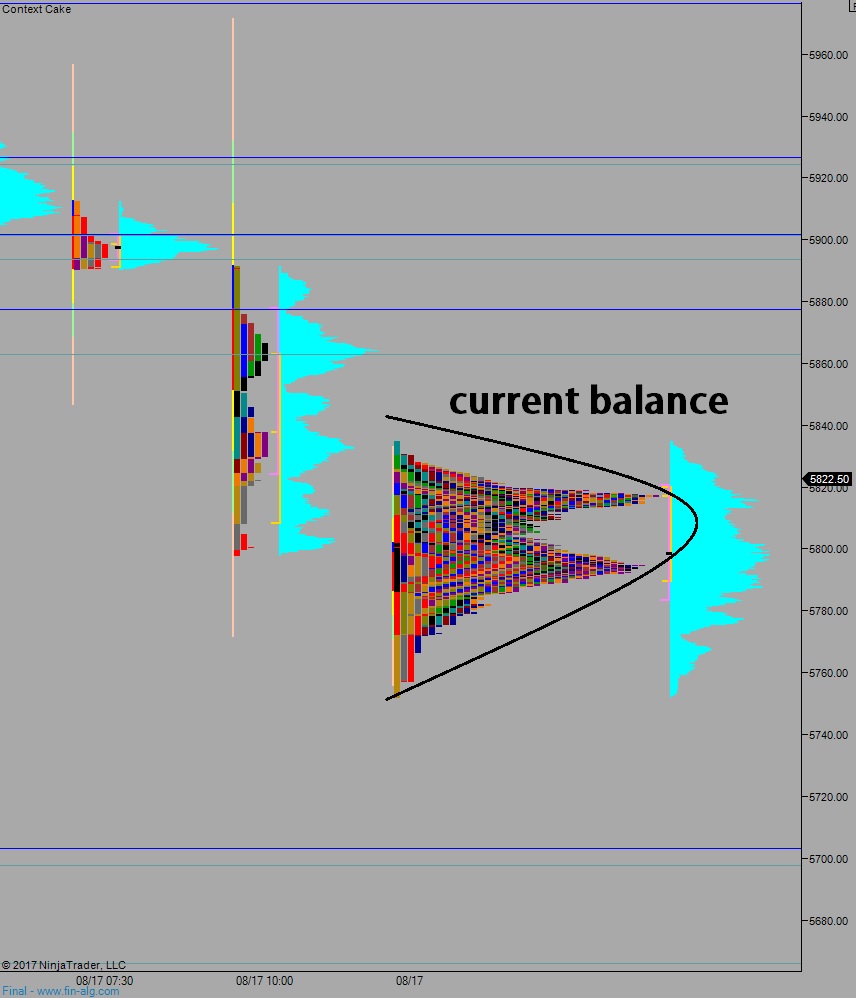

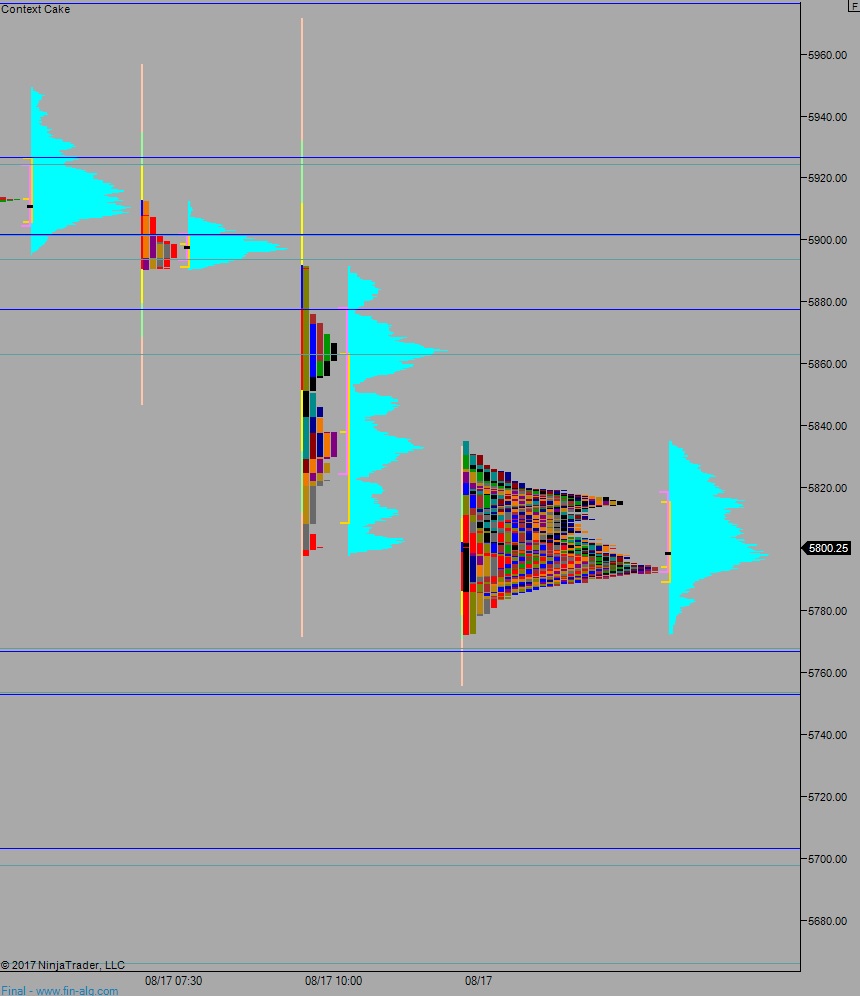

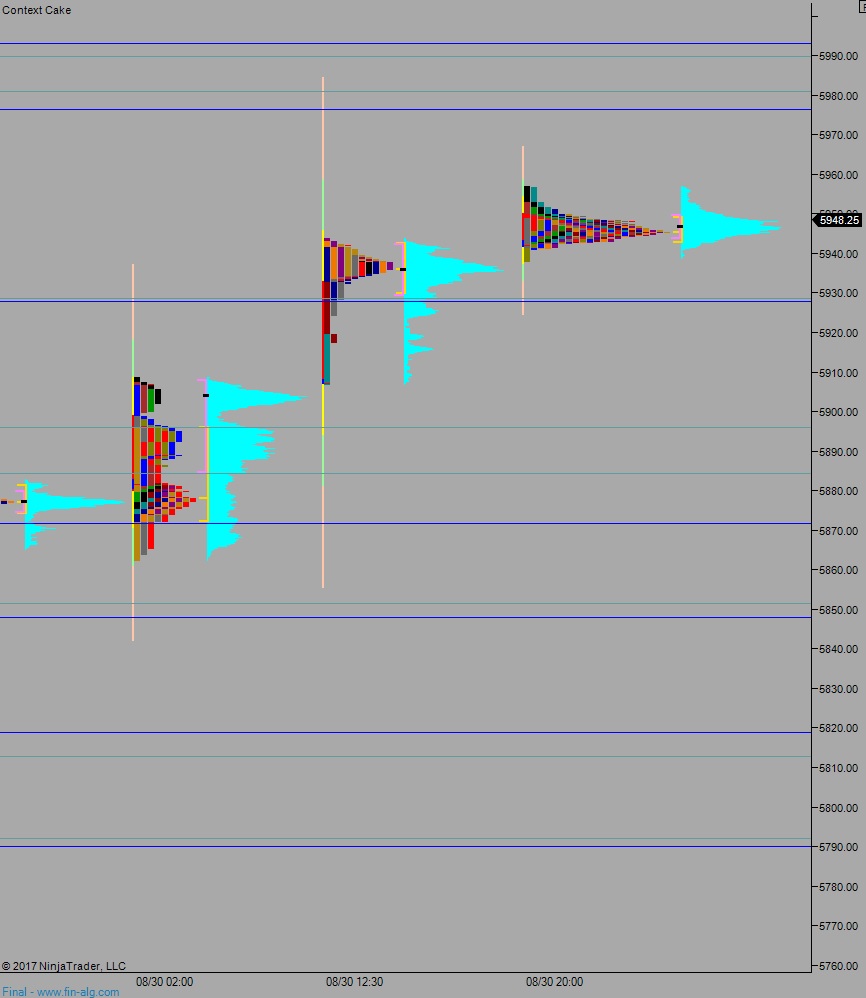

Volume profiles, gaps, and measured moves: