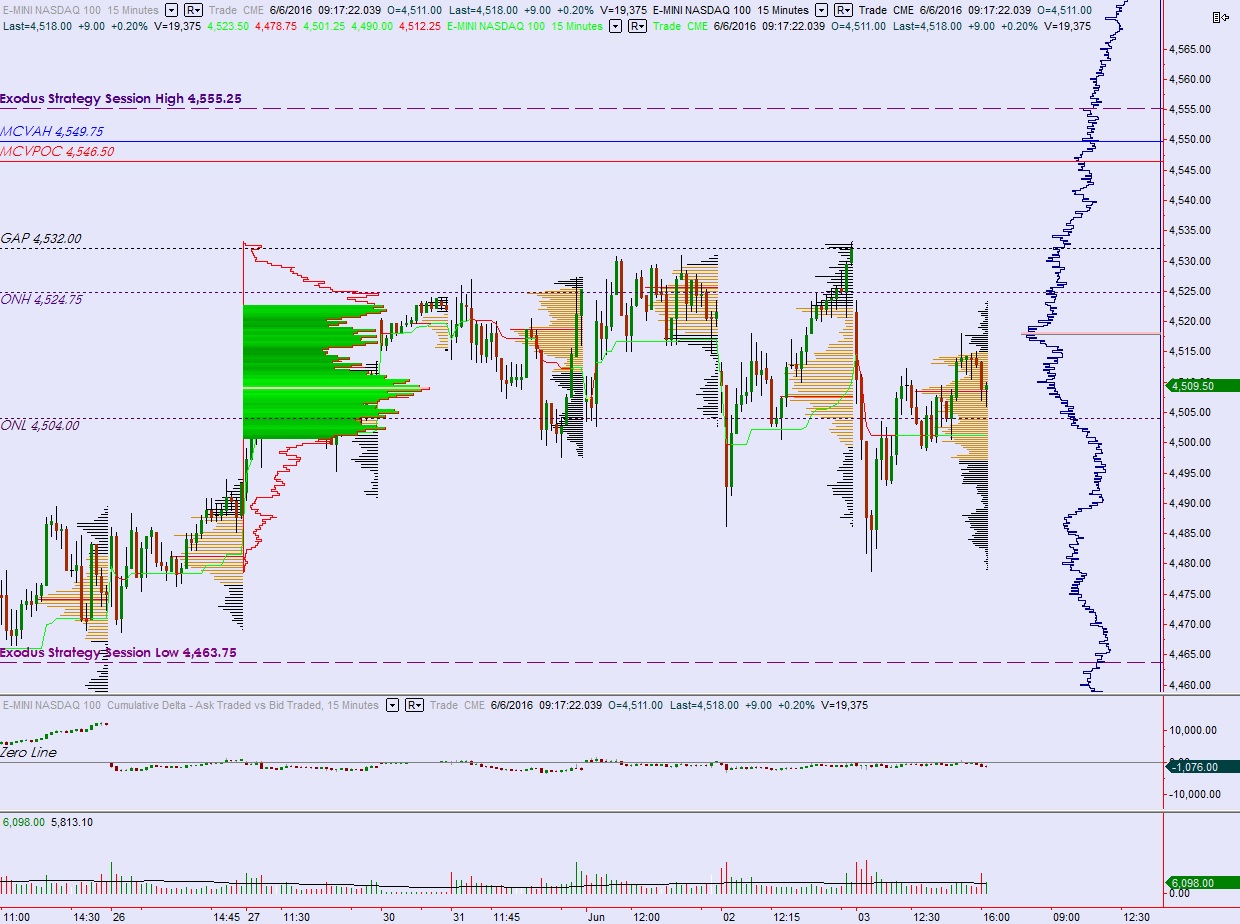

NASDAQ futures are coming into the second week of June gap up after an overnight session featuring normal range and volume. Price managed to exceed last Friday’s high briefly before settling into two-way, balanced trade.

Today is arguably the most important day of the week for economic events. Kicking it off, we have a 3- and 6-month T-bill auction at 11:30am. Then, during NYC lunch, at 12:30pm Fed Chair Yellen is set to speak in Philadelphia.

Last week price traded sideways with a slight upward drift. The action seemed choppy at times but overall was methodical and balanced. On Friday we printed a normal day, which is anything but normal, occurring less than 20% of the time and often at-or-near inflection points.

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 4509.50. Look for responsive buyers ahead of overnight low 4504 then a move up to take out overnight high 4524.75. Buyers target the open gap up at 4532 before two way trade ensues.

Hypo 2 sellers work the gap fill down to 4509.50 then take out overnight low 4504. Look for responsive buyers down at 4497.75 then two way trade to ensue.

Hypo 3 buyers gap-and-go, take out overnight high 4524.75 early on then close the open gap up at 4532. Buyers sustain price up here, outside of balance, setting up a move to target the MCVPOC up at 4546.50 before two way trade ensues.

Hypo 4 strong selling down through 4497.75 sets up a test of Friday’s low 4478.75. Look for responsive buyers down at 4470.75 then two way trade to ensue.

Levels:

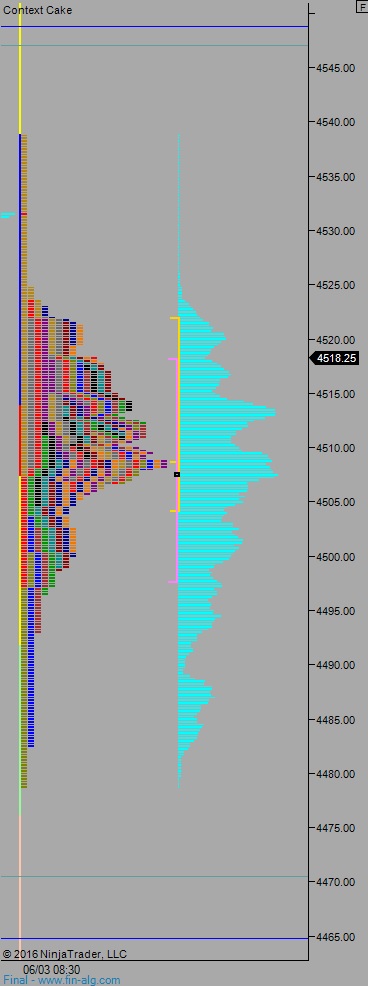

Volume profiles, gaps, and measured moves: