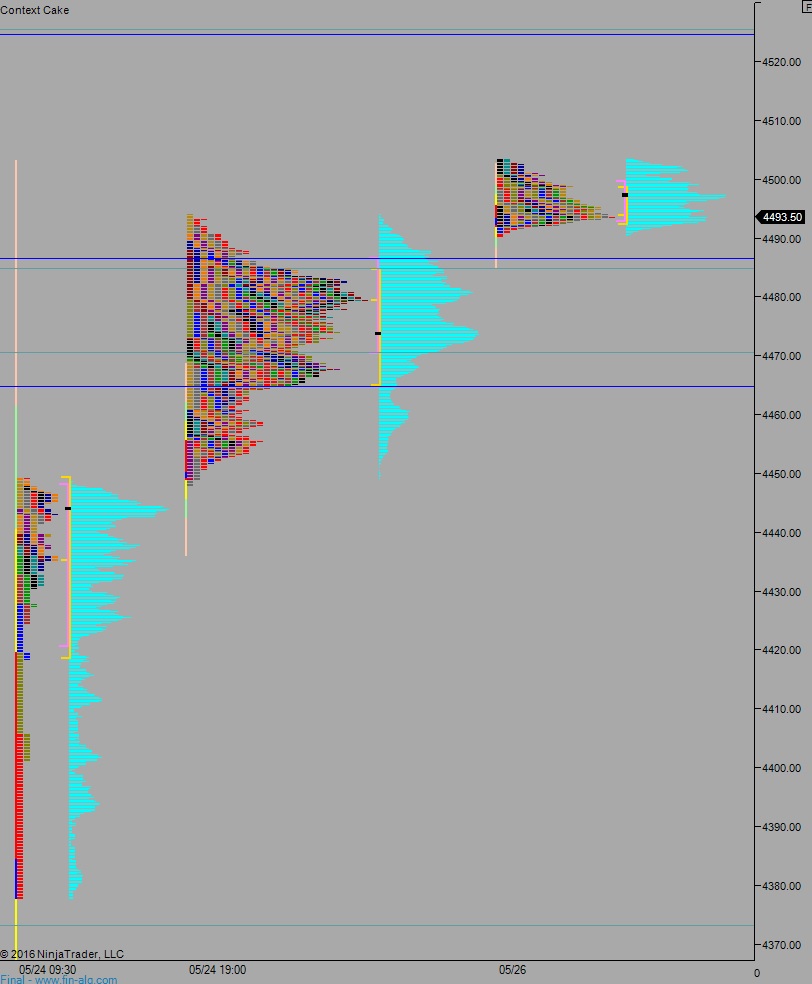

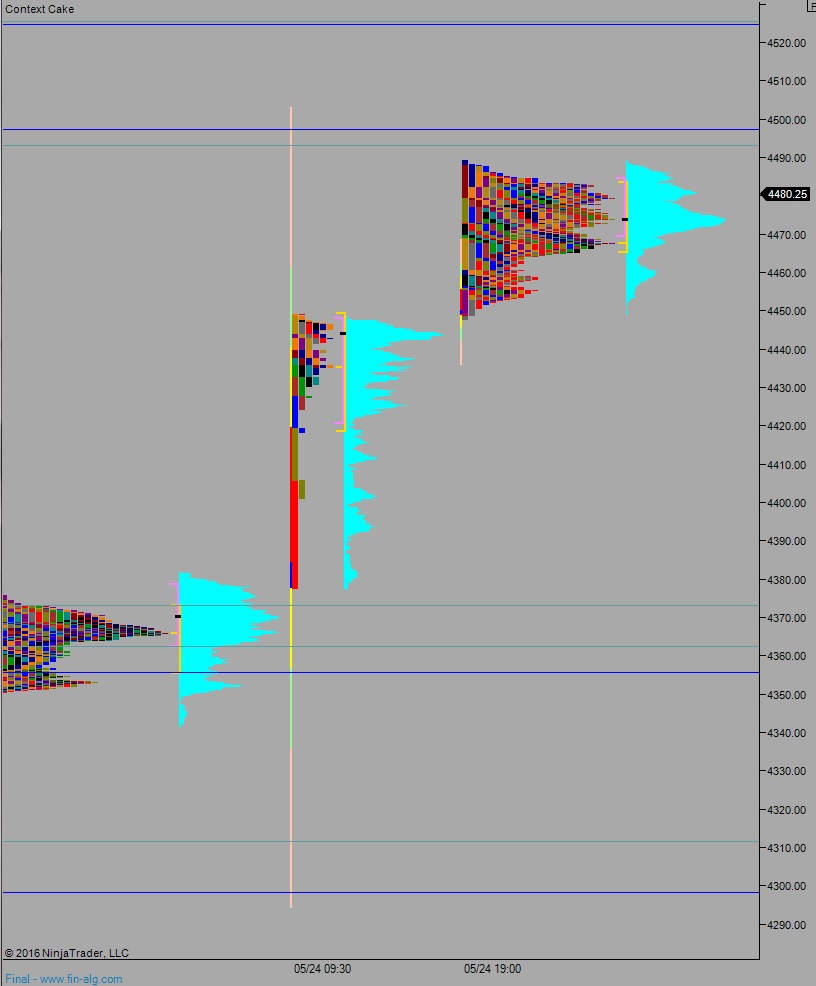

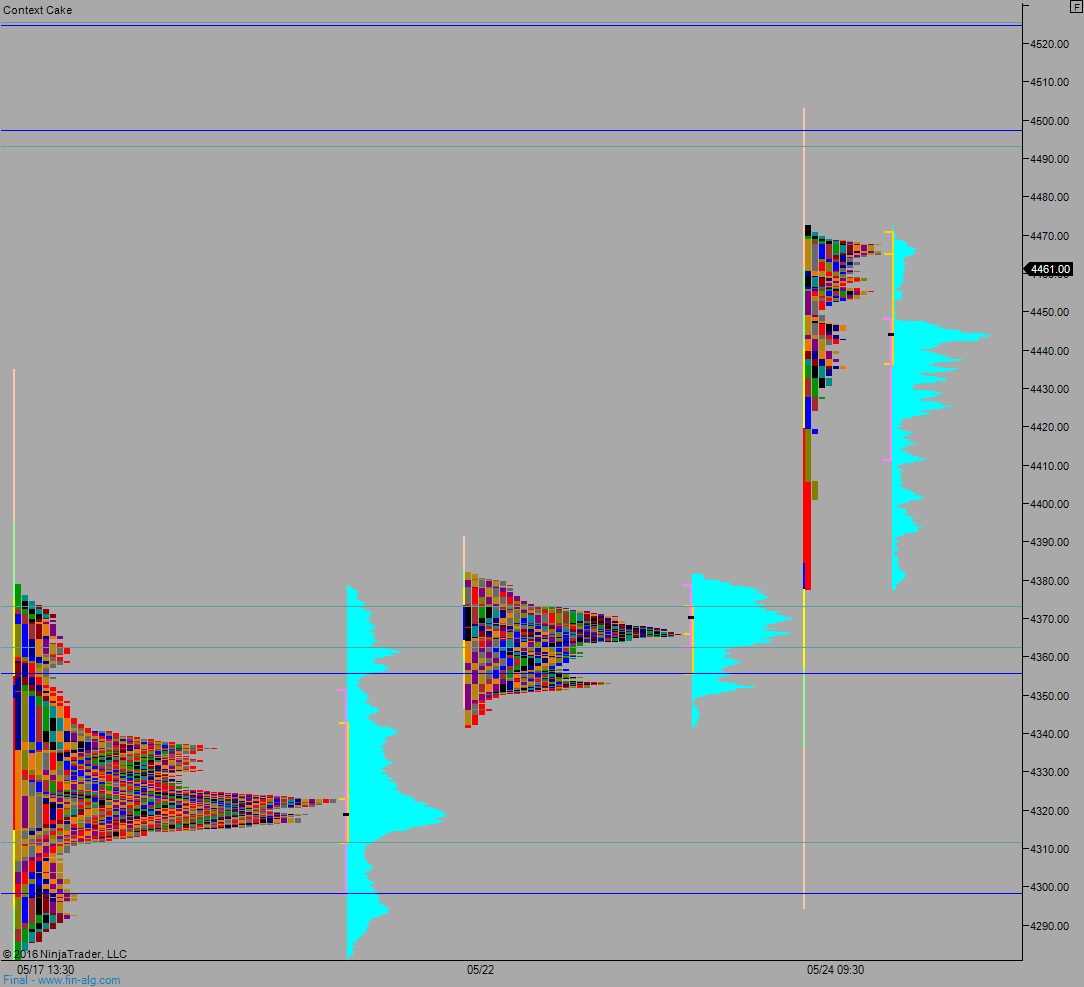

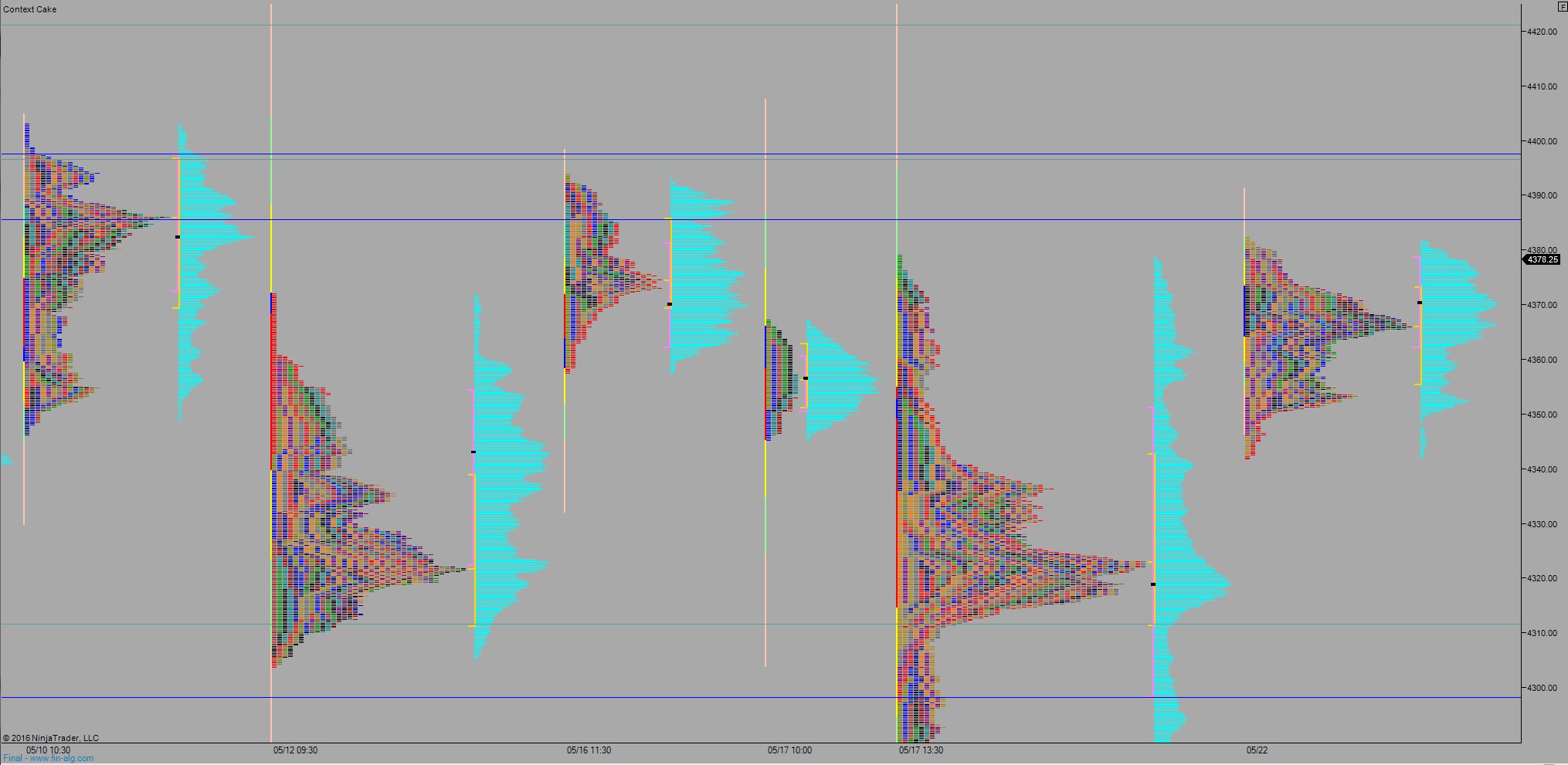

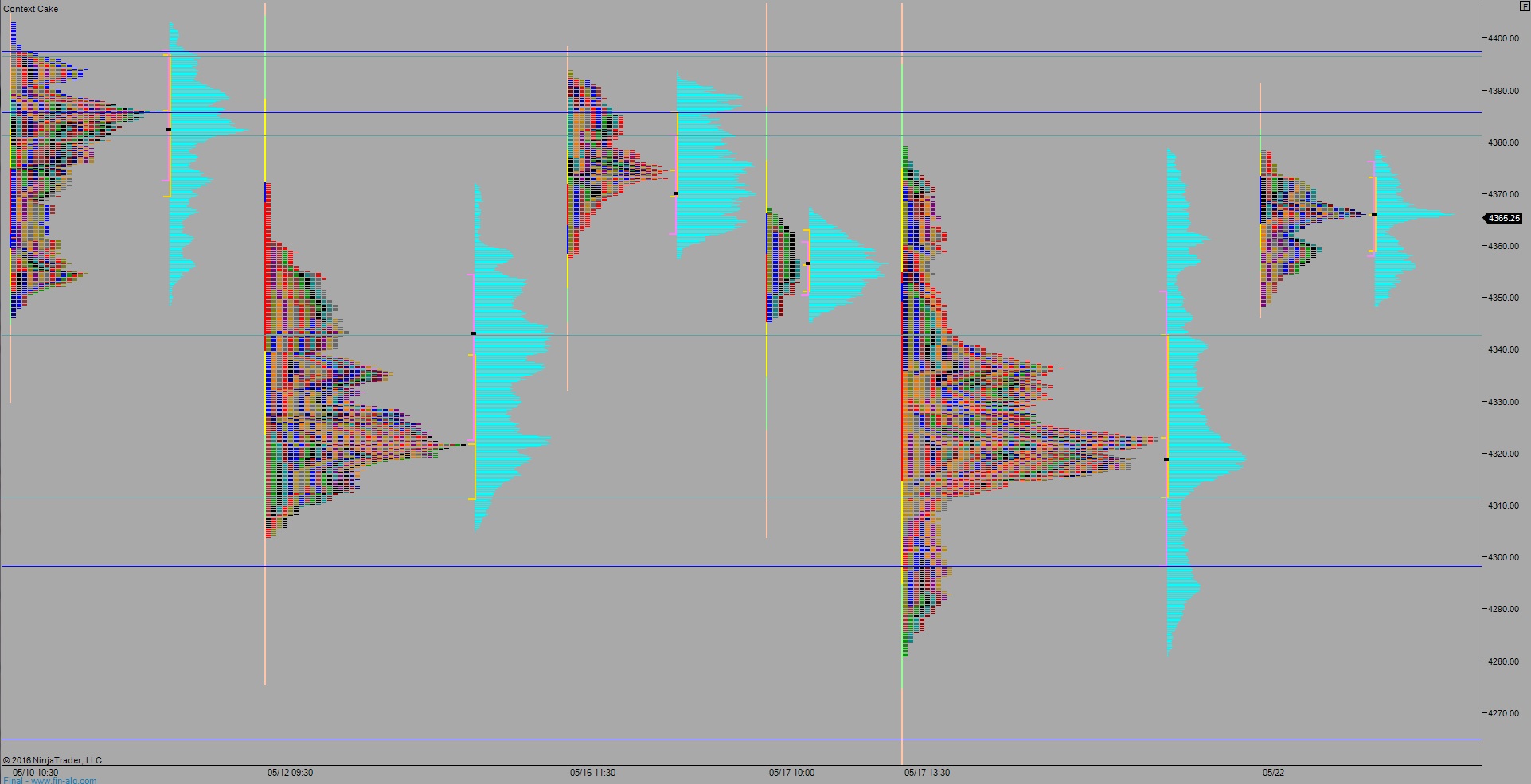

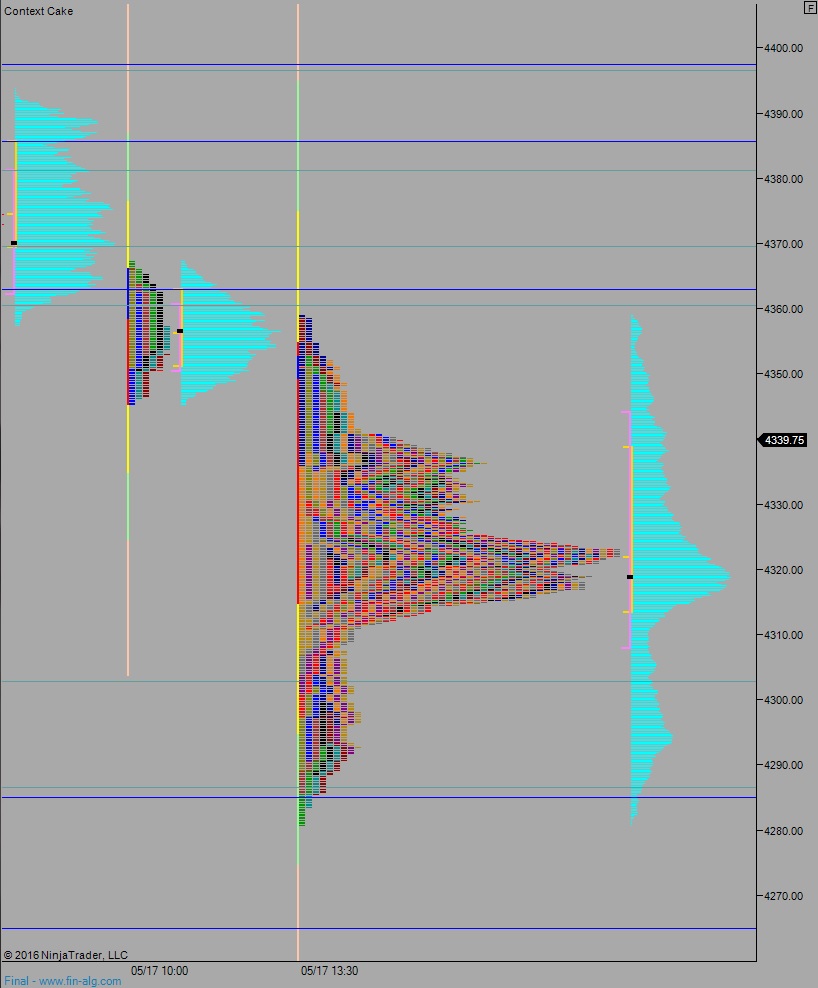

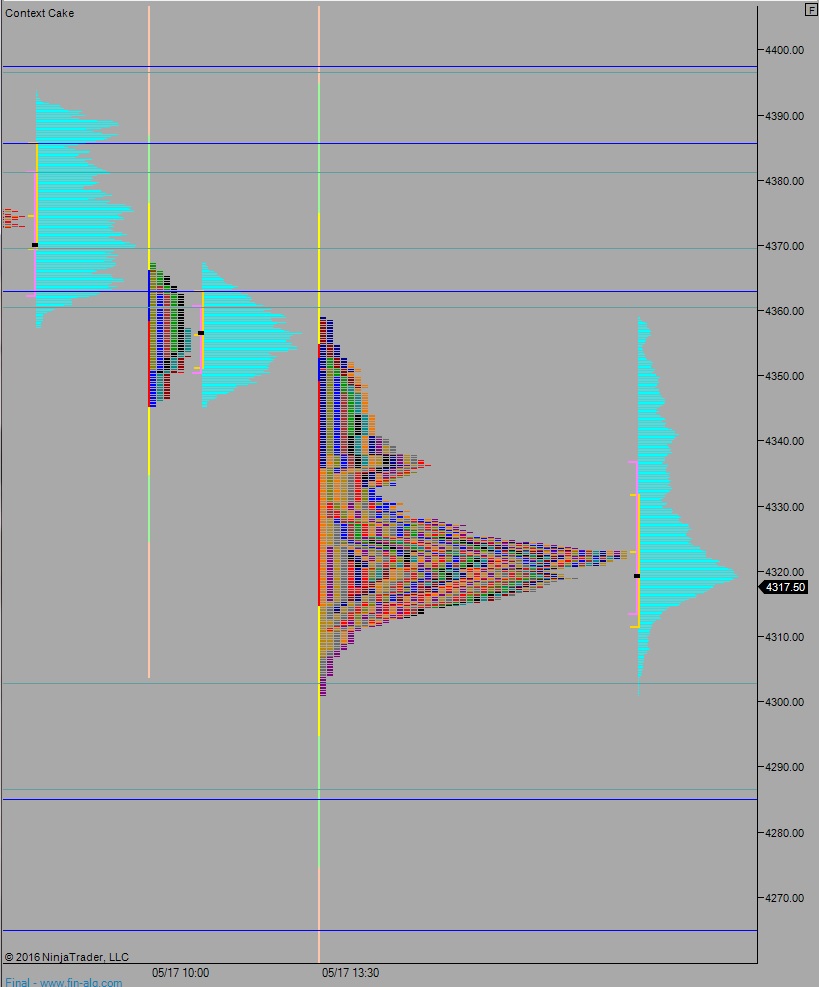

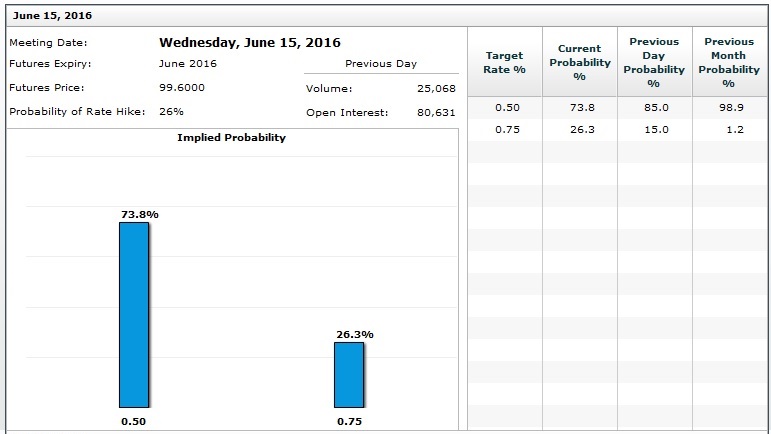

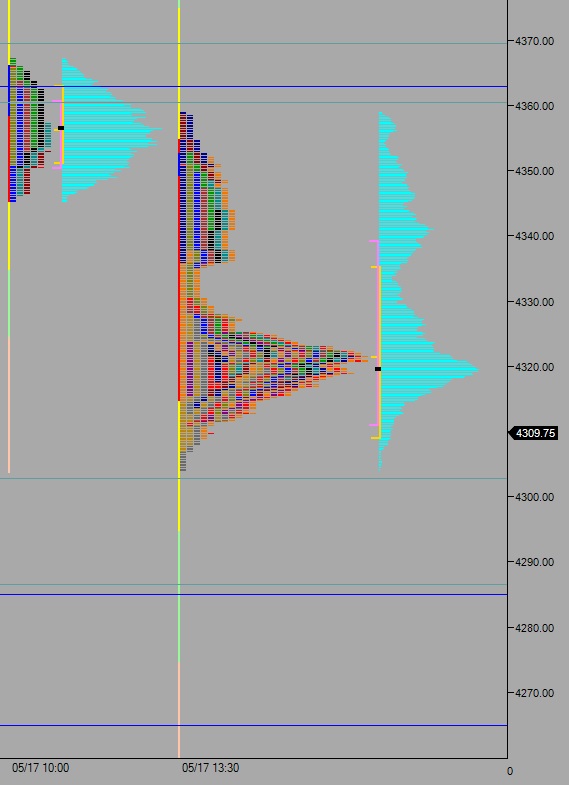

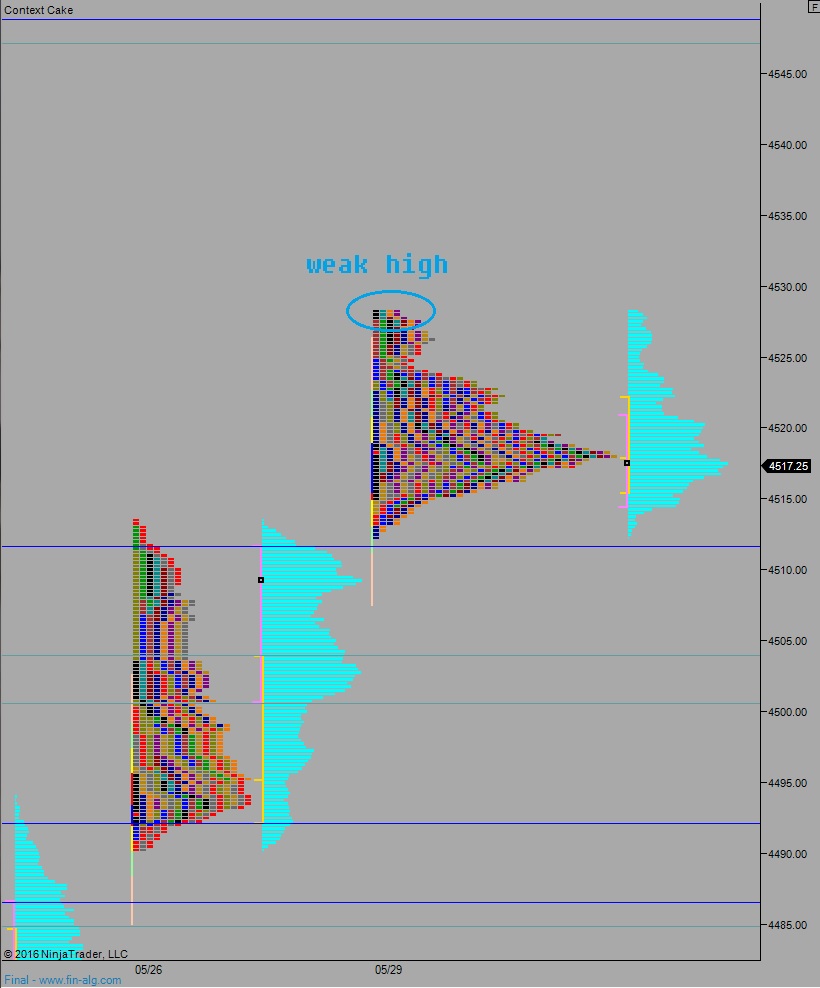

NASDAQ futures are set to come into the holiday-shortened week gap up after an overnight session featuring normal range and volume. Price managed to extend on last week’s rally before finding sellers at the value area low from the mid-April balance [see volume profile chart]. Price lingered on the high for several hours resulting in a weak high print on the market profile chart. At 8:30am Personal Consumption data came out as follows:

The U.S. Bureau of Economic Analysis reported that personal income rose 0.4 percent in April the same as March and spending rose 1 percent versus a 0.1 percent rise in March.

Also on the economic calendar today we have Consumer Confidence at 10am and 3- & 6-month T-Bill auctions at 11:30am.

Last week the market trended higher. The upward move continued into the weekend when we printed a neutral extreme up on Friday.

Heading into today my primary expectation is for buyers to push up and take out overnight high 4528.25. Look for price to stall out just above, around 4530 and two way trade to ensue.

Hypo 2 sellers work into overnight inventory and close the gap down to 4511.50, taking out overnight low 4512.25 along the way. Look for responsive buyers down at 4511.75 and two way trade to ensue.

Hypo 3 strong buyers push up through overnight high 4528.25 and sustain trade above it setting up a move to target the MCVPOC at 4546.50 before two way trade ensues.

Hypo 4 strong selling takes out overnight low 4512.25, closes overnight gap 4511.50 then sustains trade below 4511 setting up a move to target 4504 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Comments »