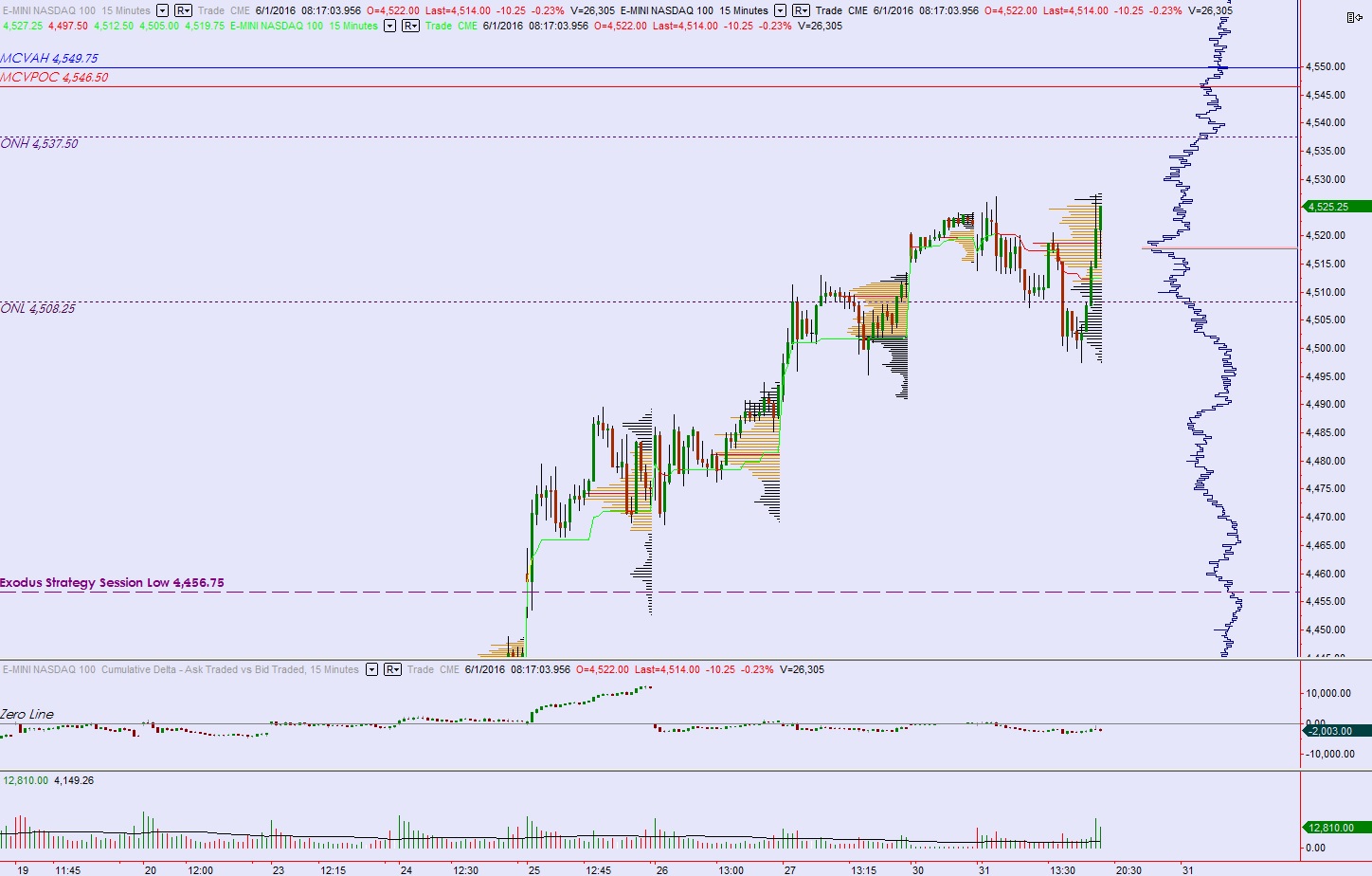

NASDAQ futures are set to start the month of June out gap down after an overnight session featuring normal range and volume. Price managed to trade up above yesterday’s high before settling into balanced trade. At 7am MBA Mortgage Applications came out below expectations.

Also on the economic calendar today we have ISM Manufacturing and Construction Spending at 10am, a 4-week T-Bill auction at 11:30am, and the Fed Beige Book at 2pm.

Yesterday we printed a neutral extreme up. After price briefly went range extension up late in the morning sellers stepped in and traversed the entire range. Responsive buyers defended ahead of last Friday’s low and a strong ramp took hold, higher, near the end of the day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4525.25. From here look for buyers to continue higher to take out overnight high 4537.50. Look for responsive sellers up at 4546.50 and two way trade to ensue.

Hypo 2 sellers work lower early on, take out overnight low 4508.25. Look for a move down to 4497.75 before two way trade ensues.

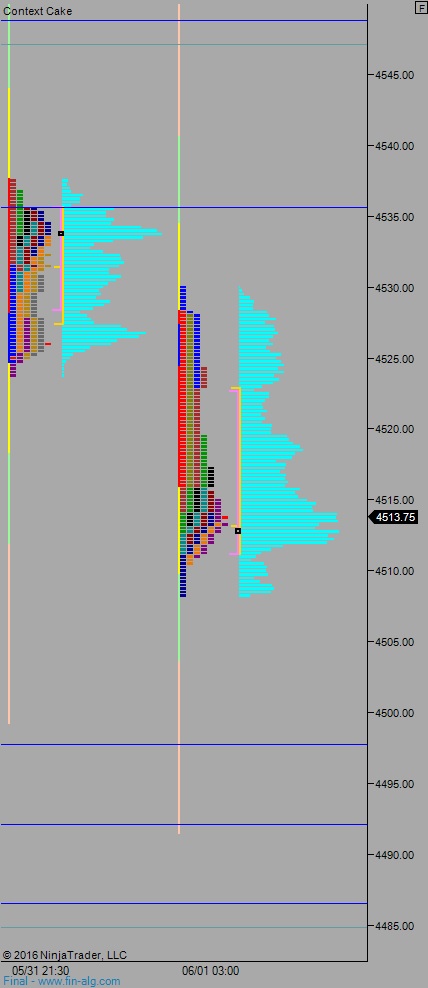

Levels:

Volume profiles, gaps, and measured moves: