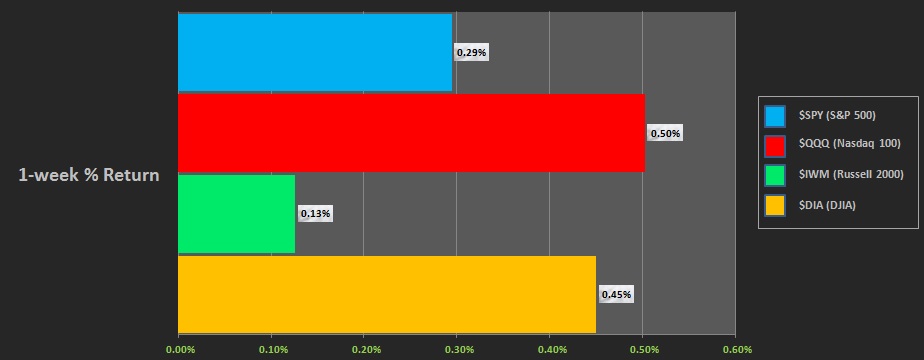

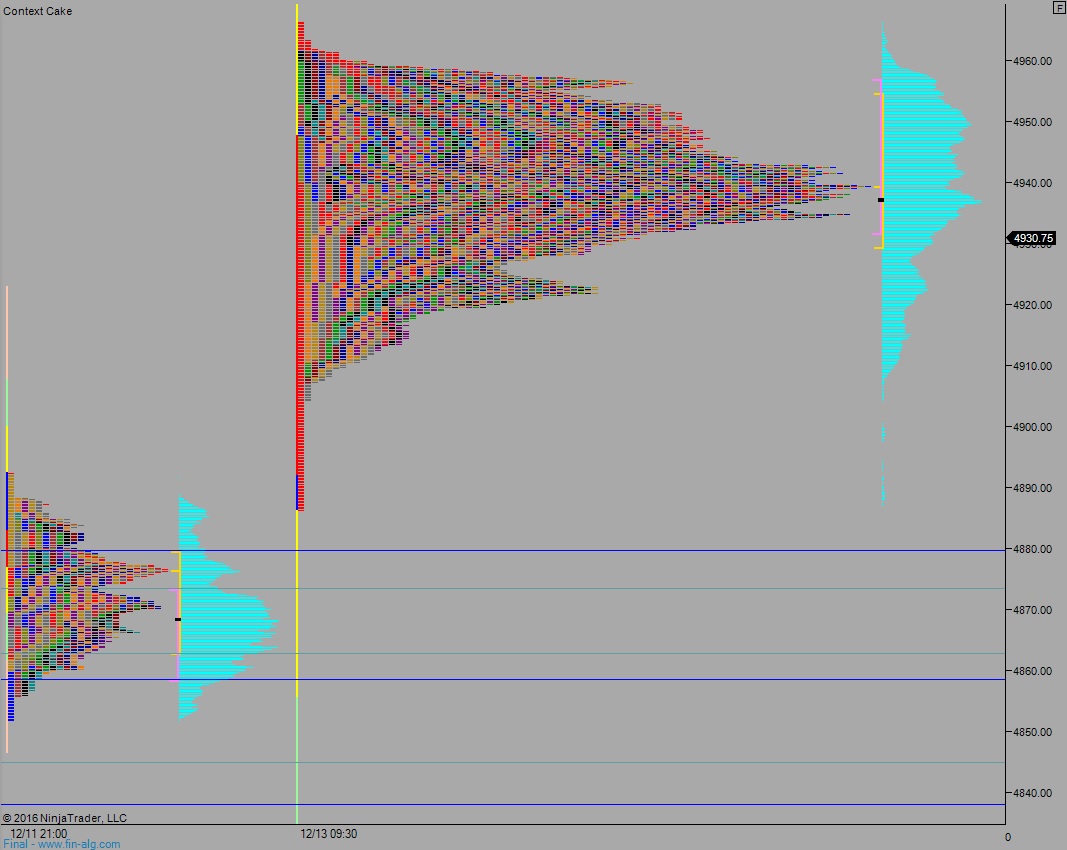

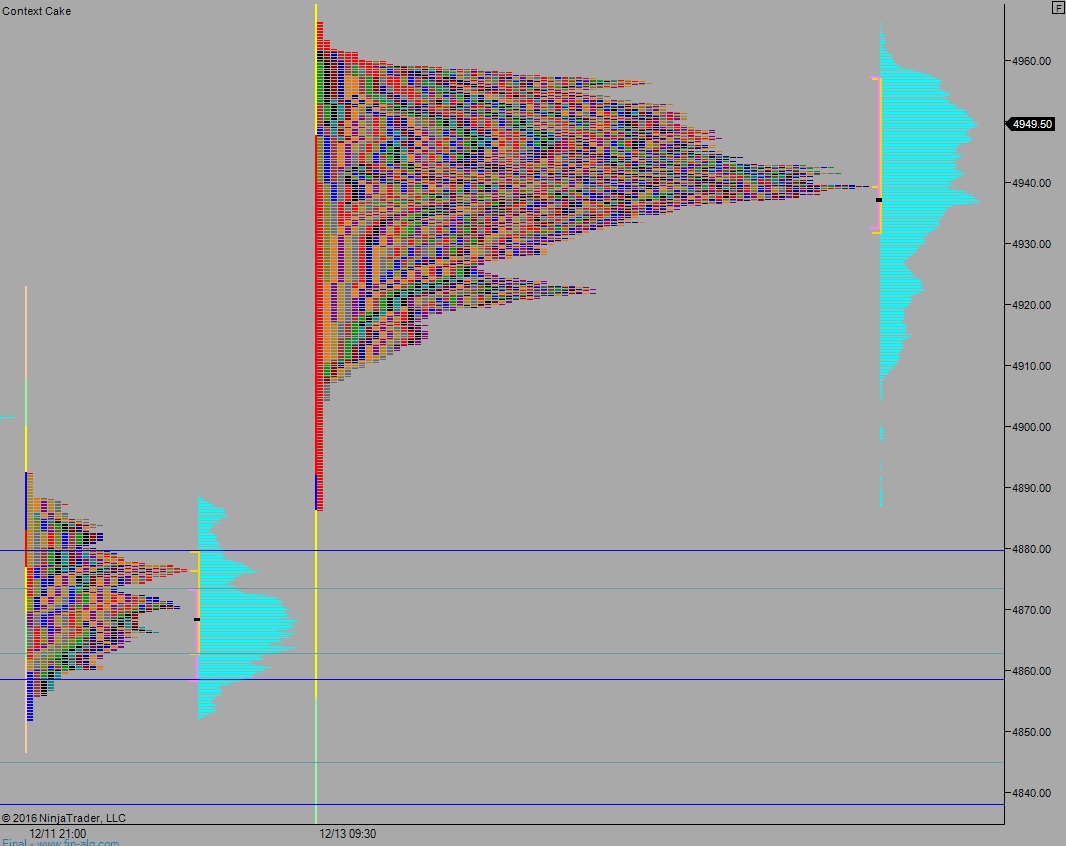

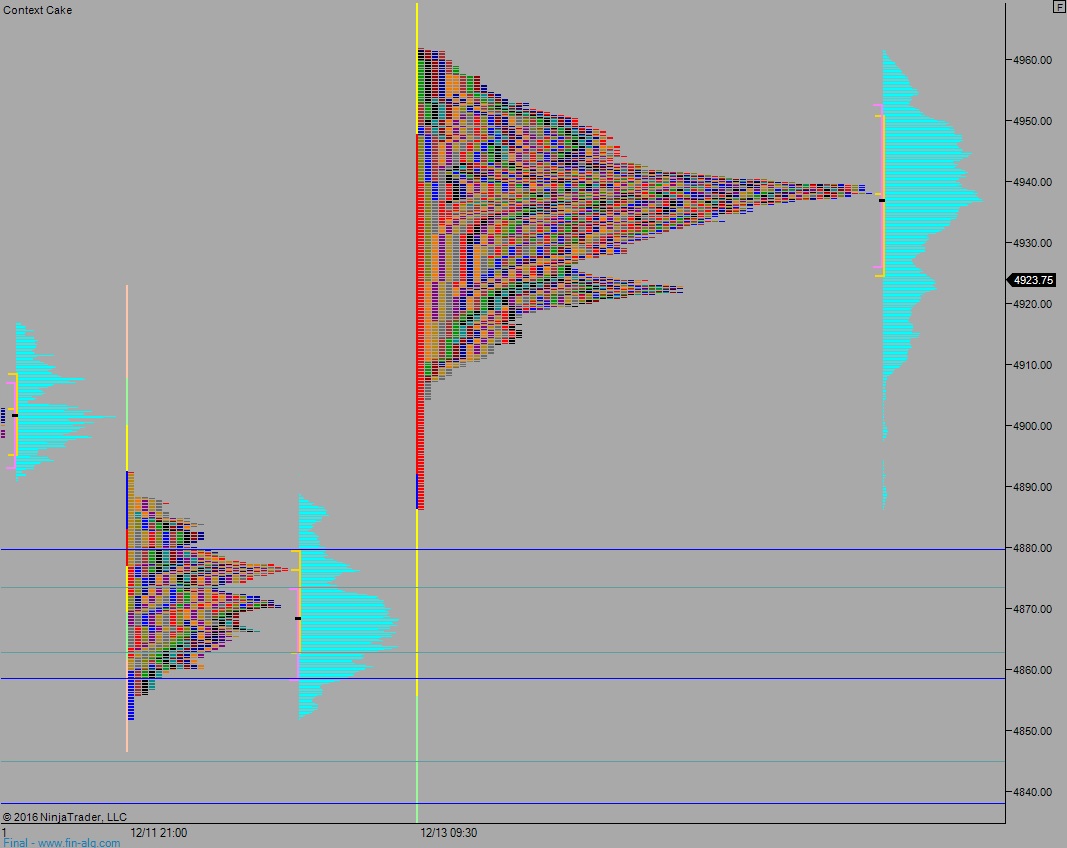

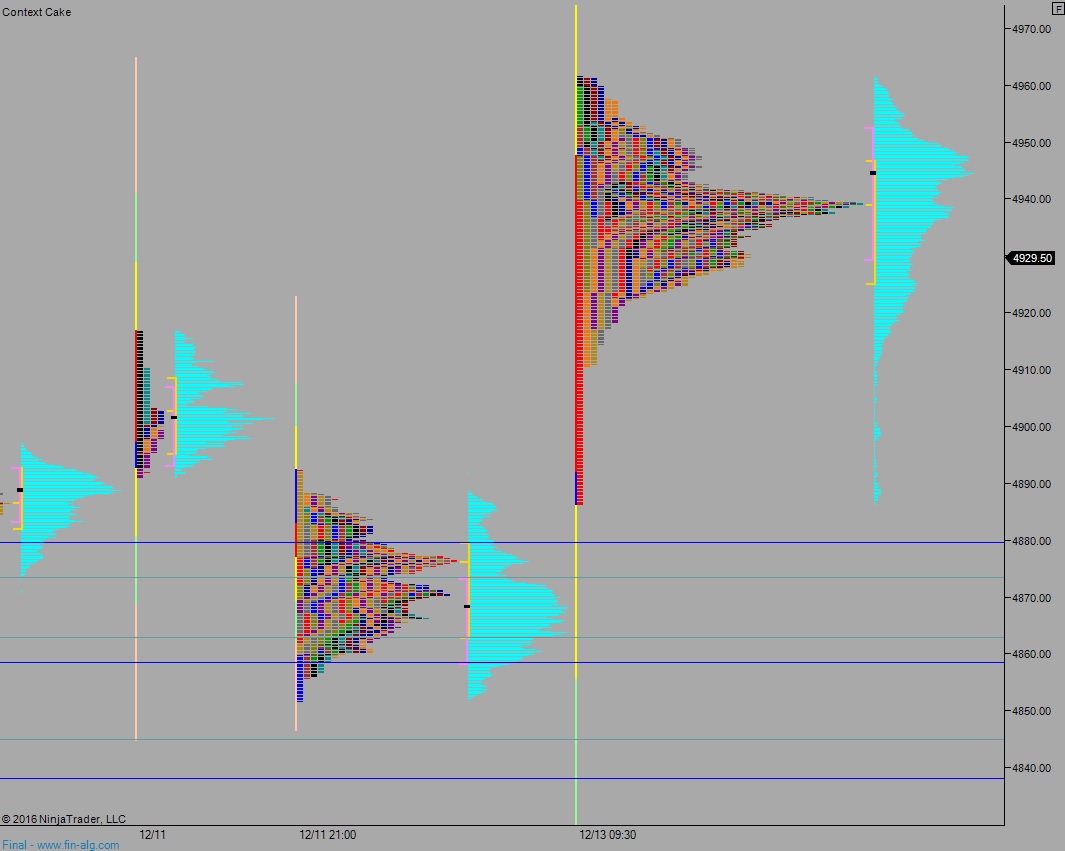

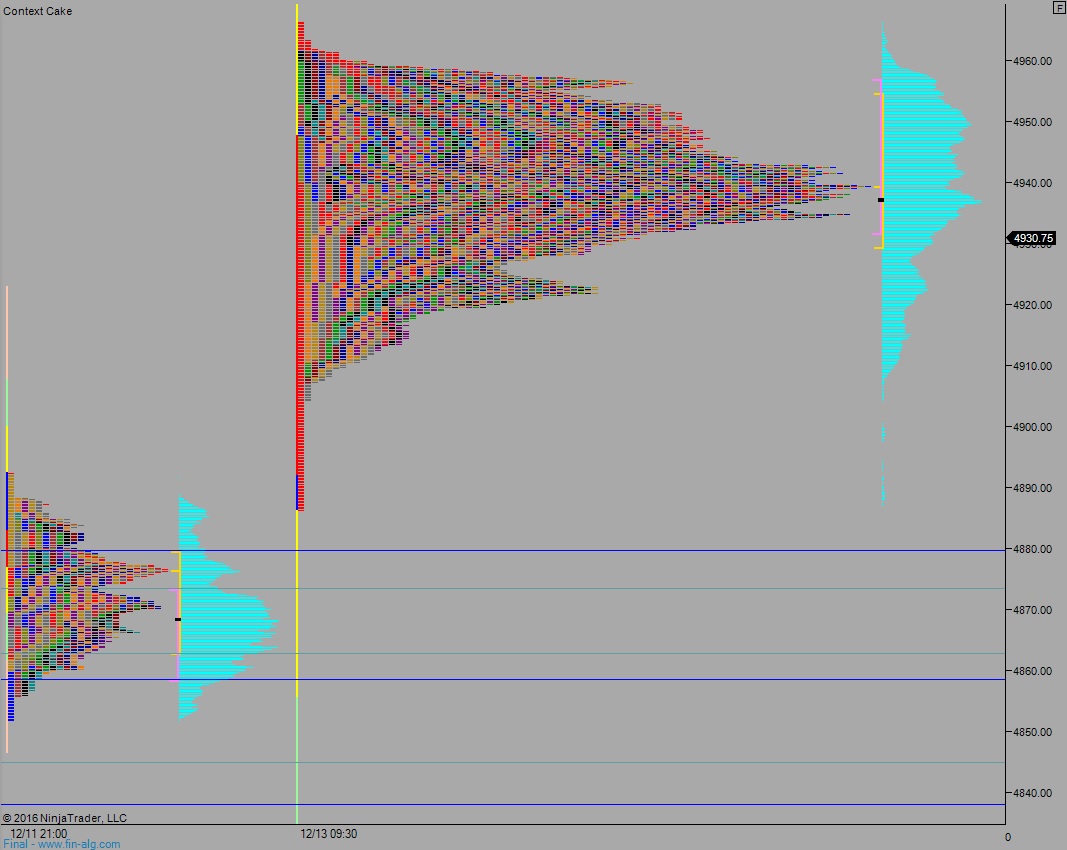

NASDAQ futures are coming into Friday flat-ish, down a touch, after an overnight session featuring abnormally low volume on normal range. Price held Thursday’s range in balanced trade along the low-end of value.

On the economic calendar today we have New Home Sales and the final December reading of U. of Michigan Confidence at 10am, then at 1pm the Baker Hughes rig count.

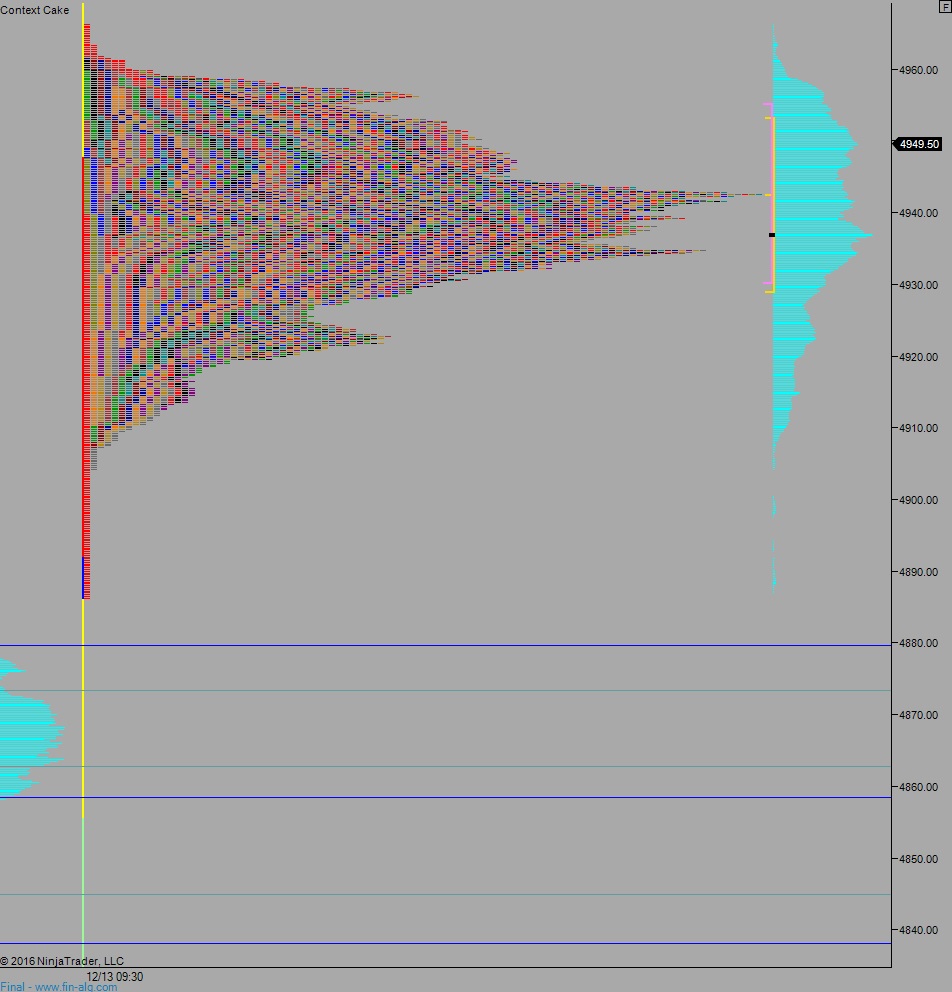

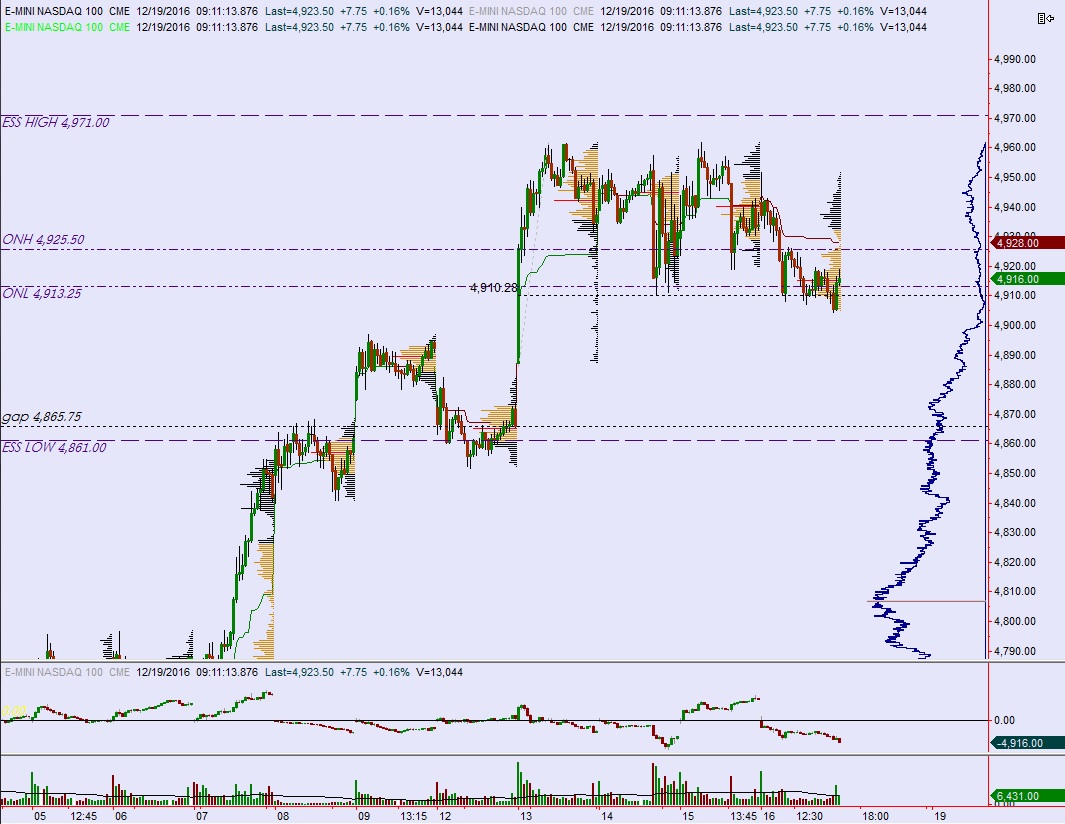

Yesterday we printed a normal variation down. There was a morning drive lower followed by a second, initiative wave of selling. Then, on the low-end of value a responsive bidder stepped in.

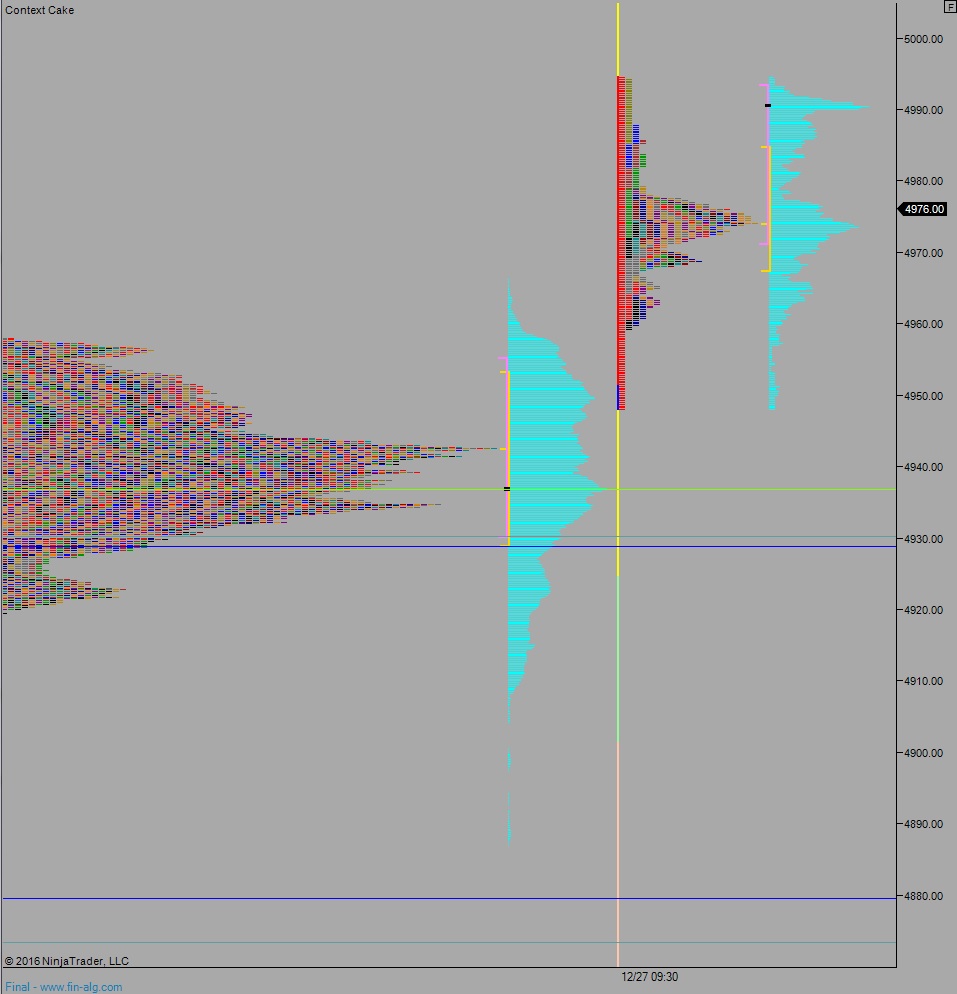

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4936.25. From there we continue higher, up beyond overnight high 4938.25 before settling into trade around the MCVPOC at 4937.25.

According to the CME, we close at the regular time today, and NASDAQ futures will remain closed through Monday in observance of Christmas. Note: I will be updating the IndexModel ahead of closing bell (inside Exodus, grab your free trial now if you haven’t already) to determine whether or not to hold my position short via $QID through the holiday.

Hypo 2 work down through overnight low 4827.25 and test the Thursday low 4917, finding buyers just below it and settling into two-way trade.

Hypo 3 full-on liquidation triggers by first sustaining trade below 4917 then thrusting down to 4900. If 4900 does not hold then liquidation down to 4879.75.

Hypo 4 strong buyers press to new highs, up beyond 4956.75 and sustaining trade above it to trigger a move up to 4971.

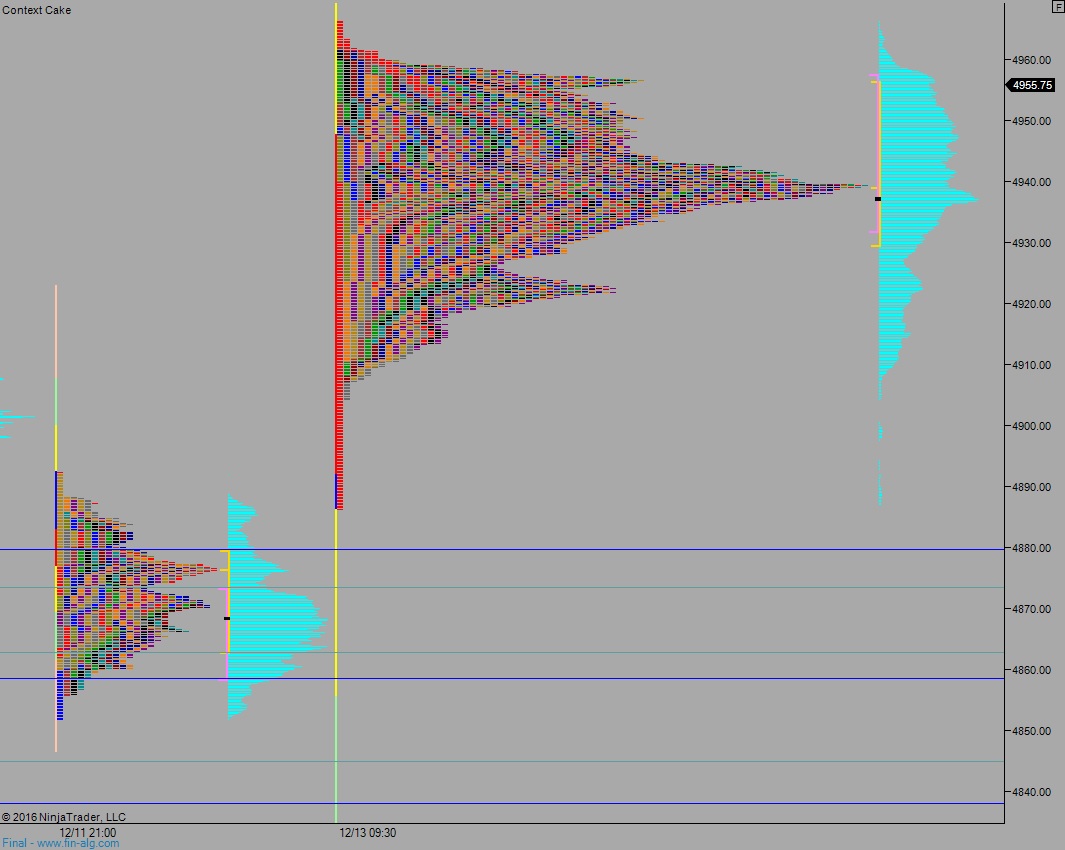

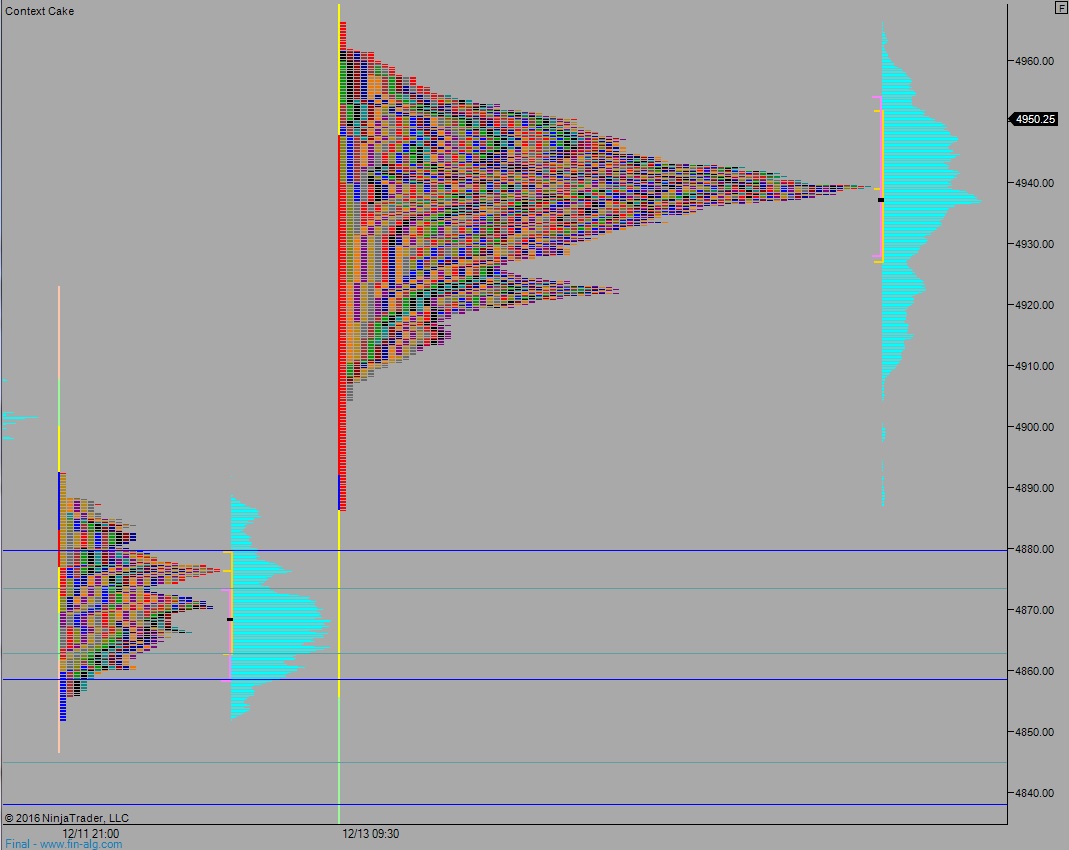

Levels:

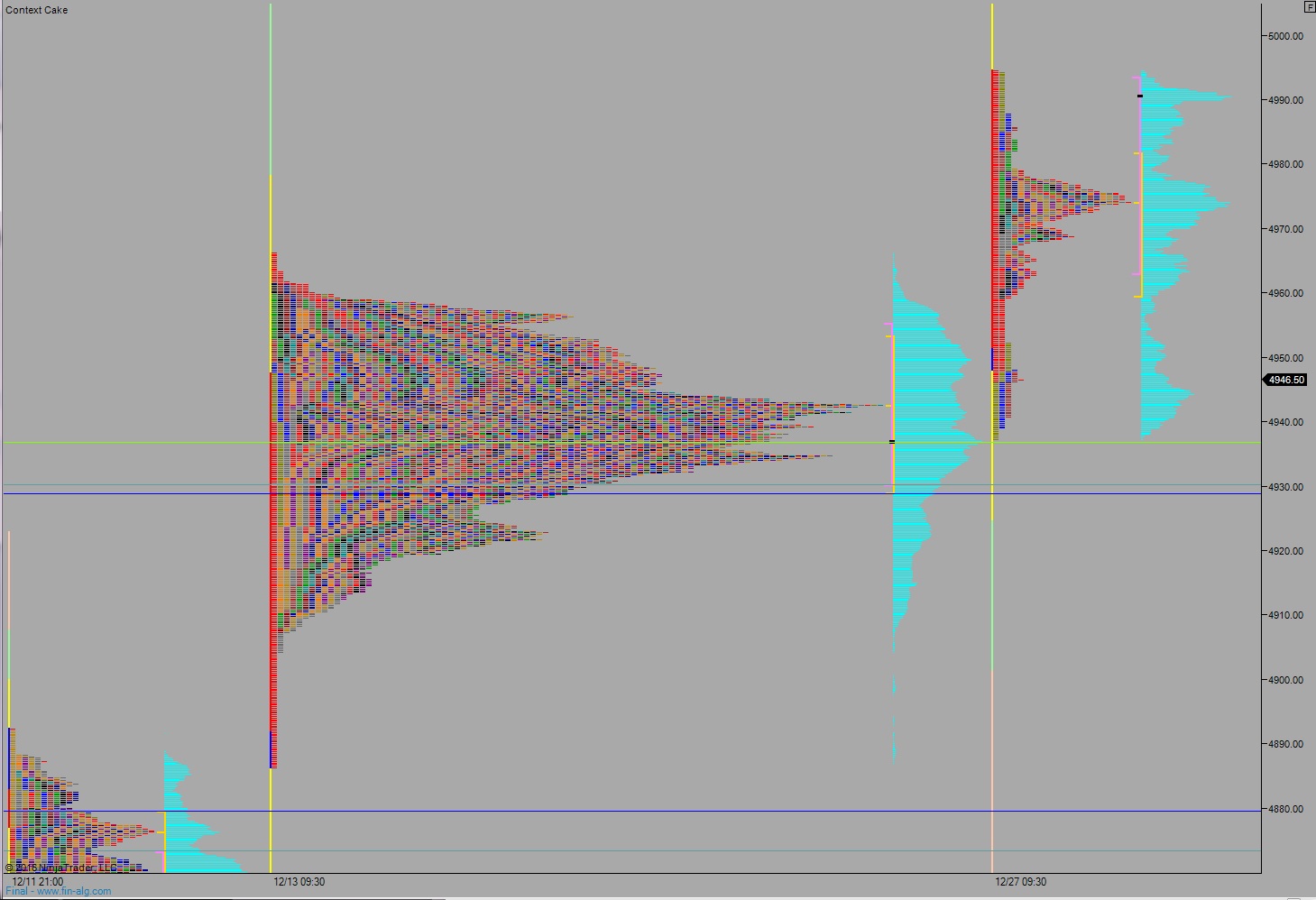

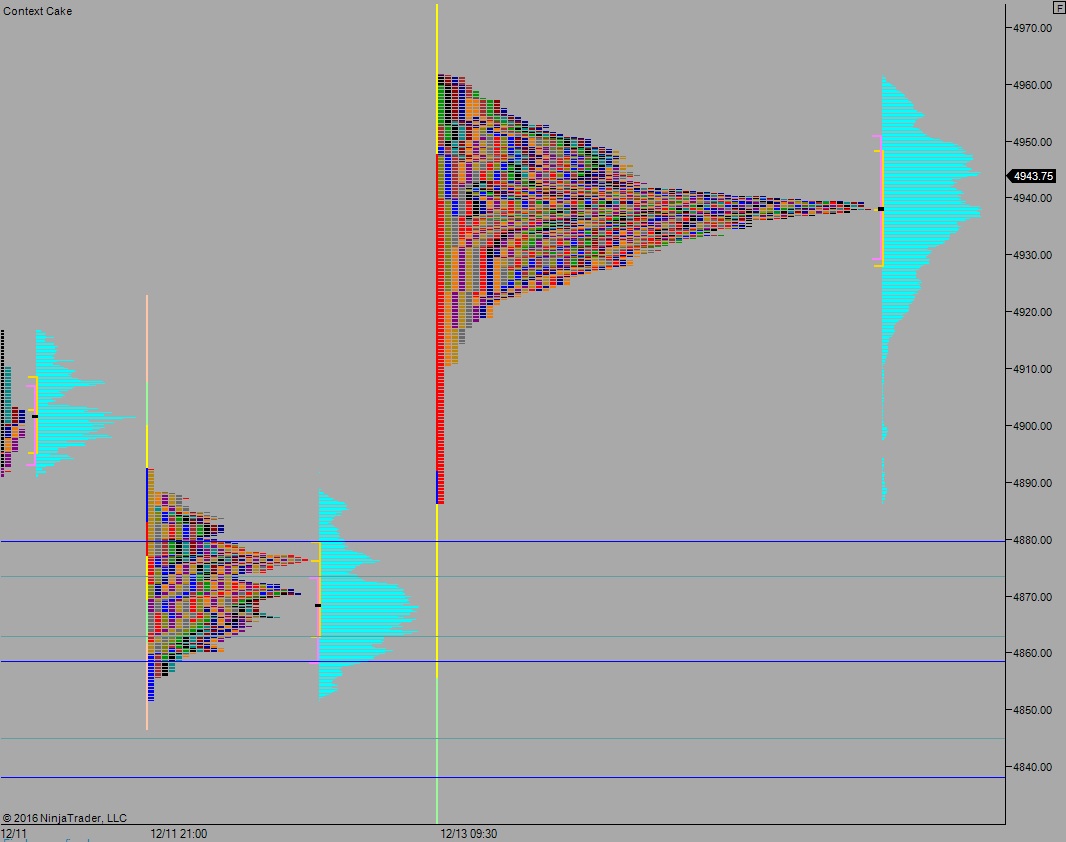

Volume profiles, gaps, and measured moves:

Comments »