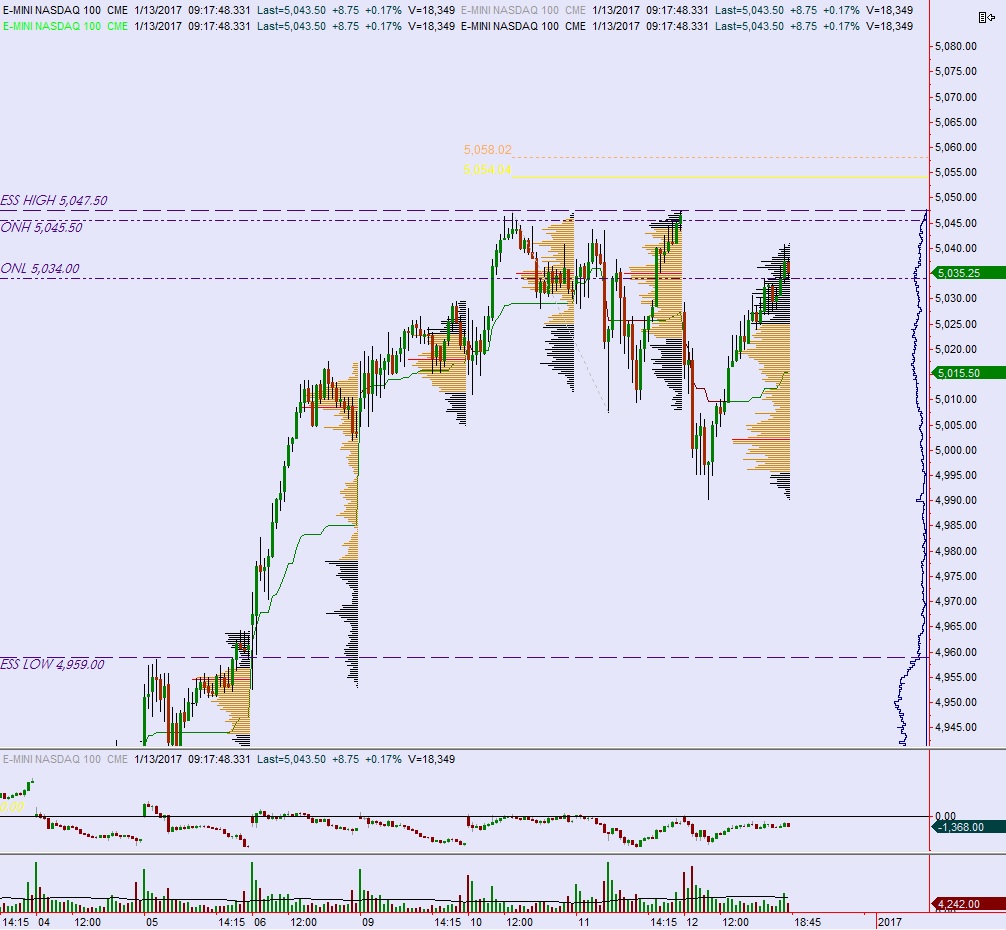

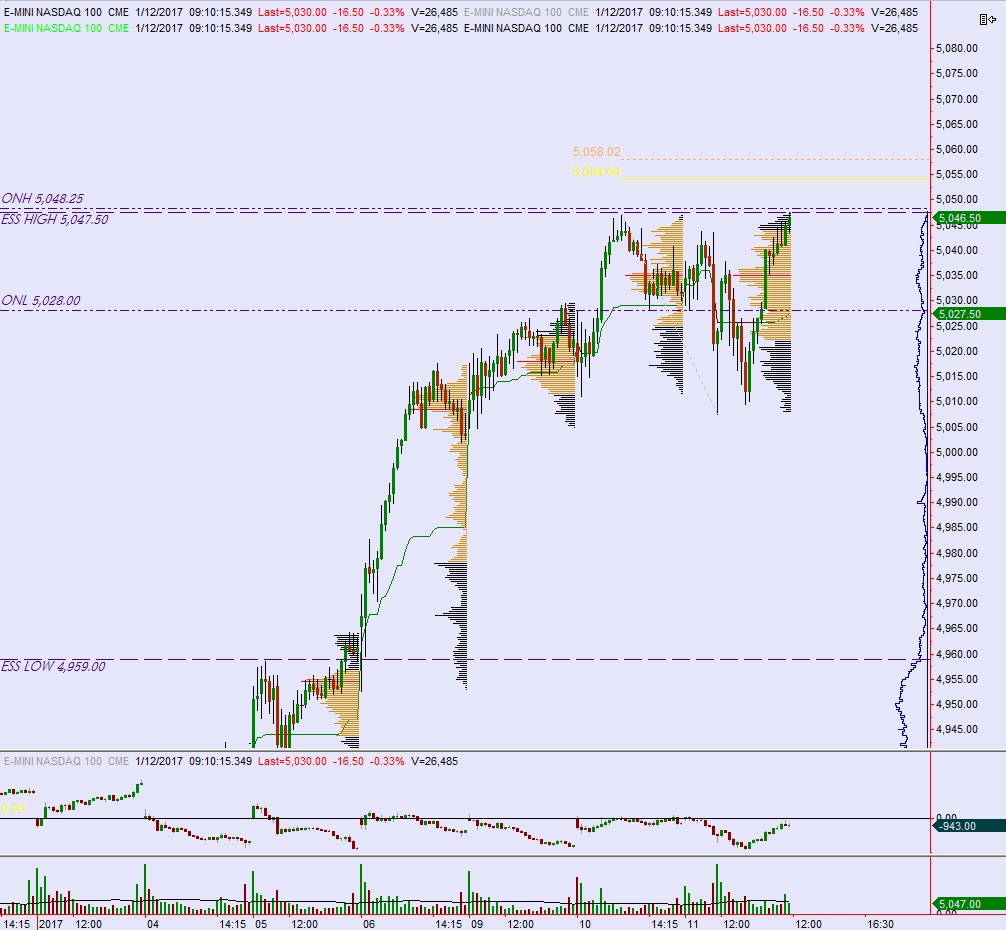

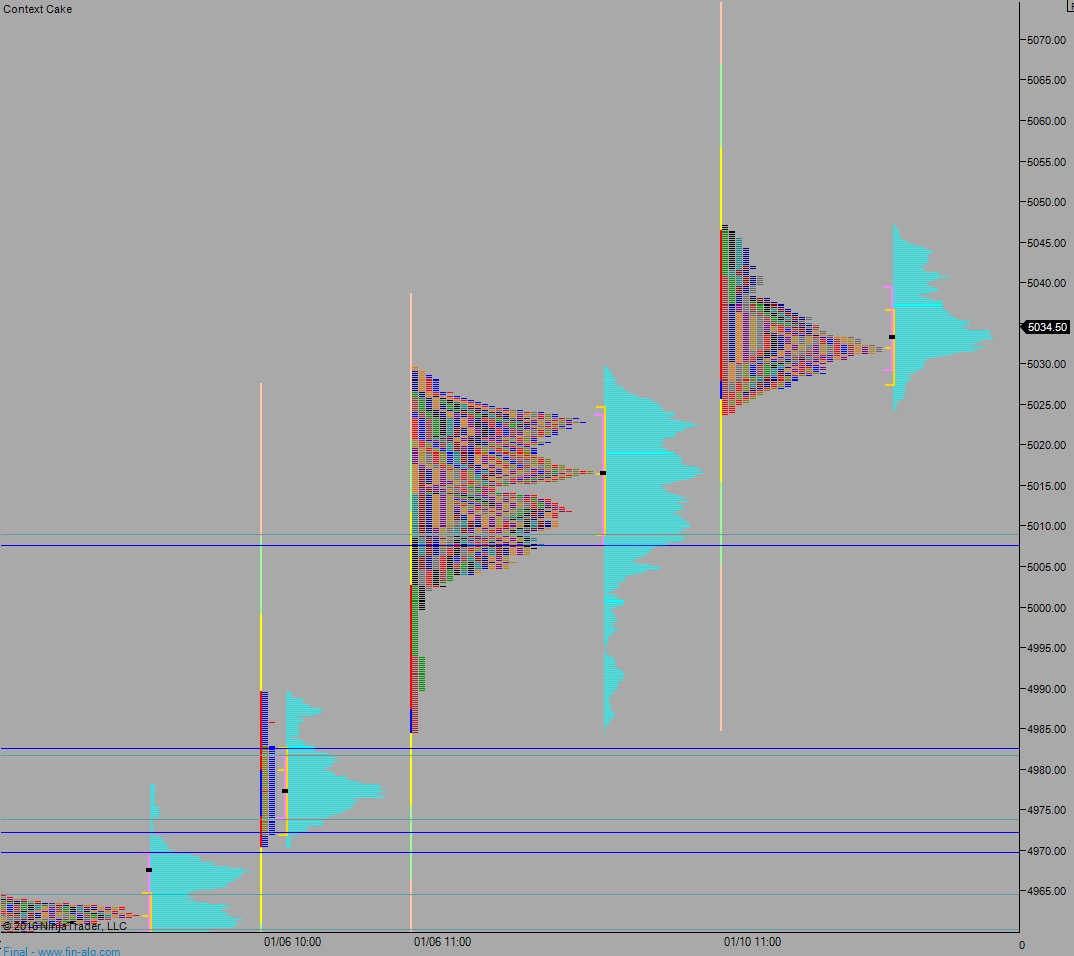

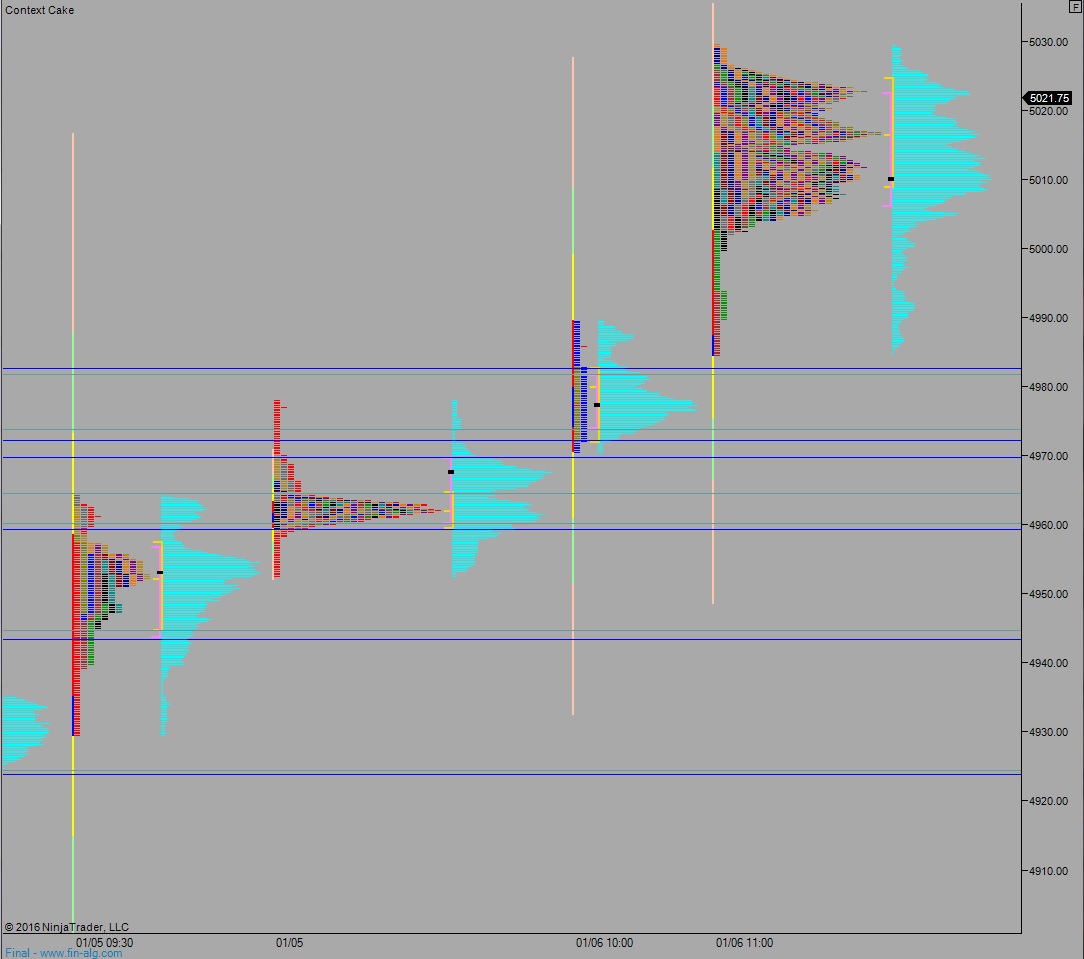

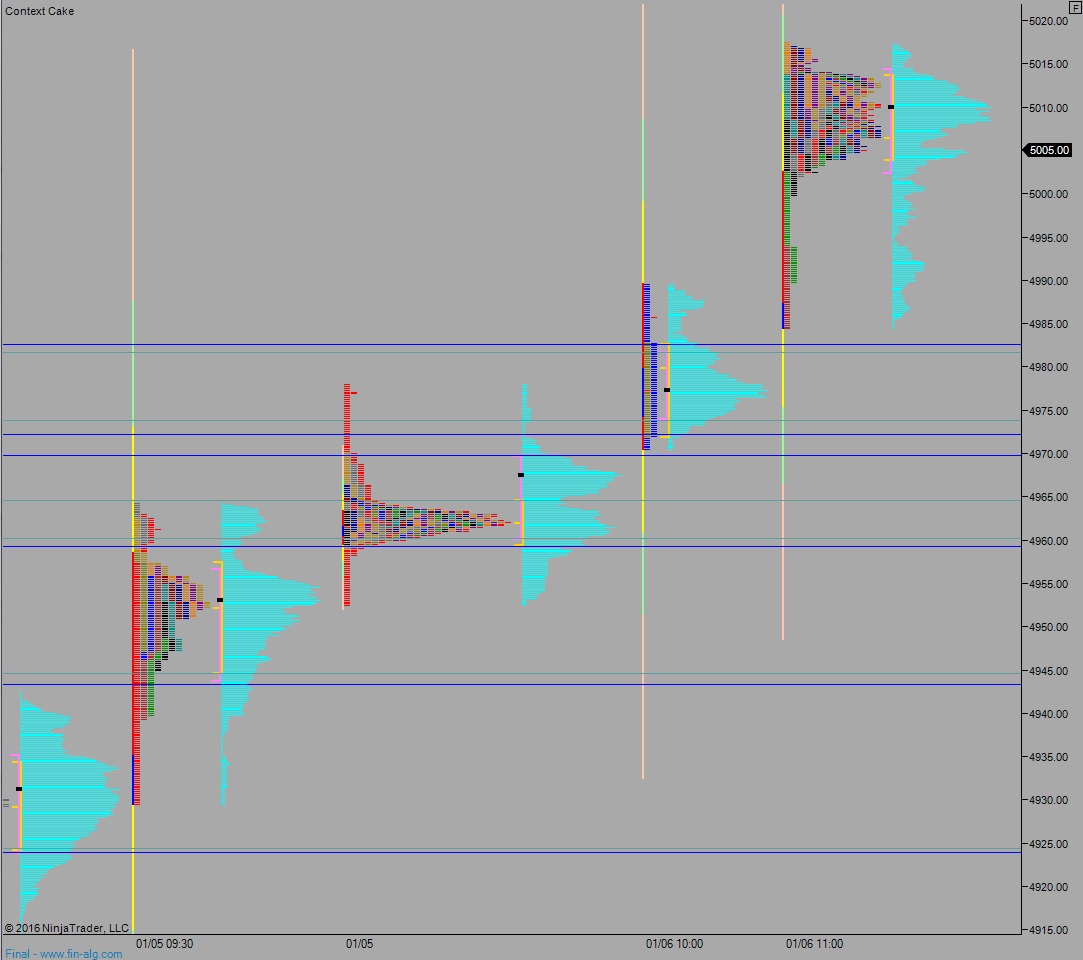

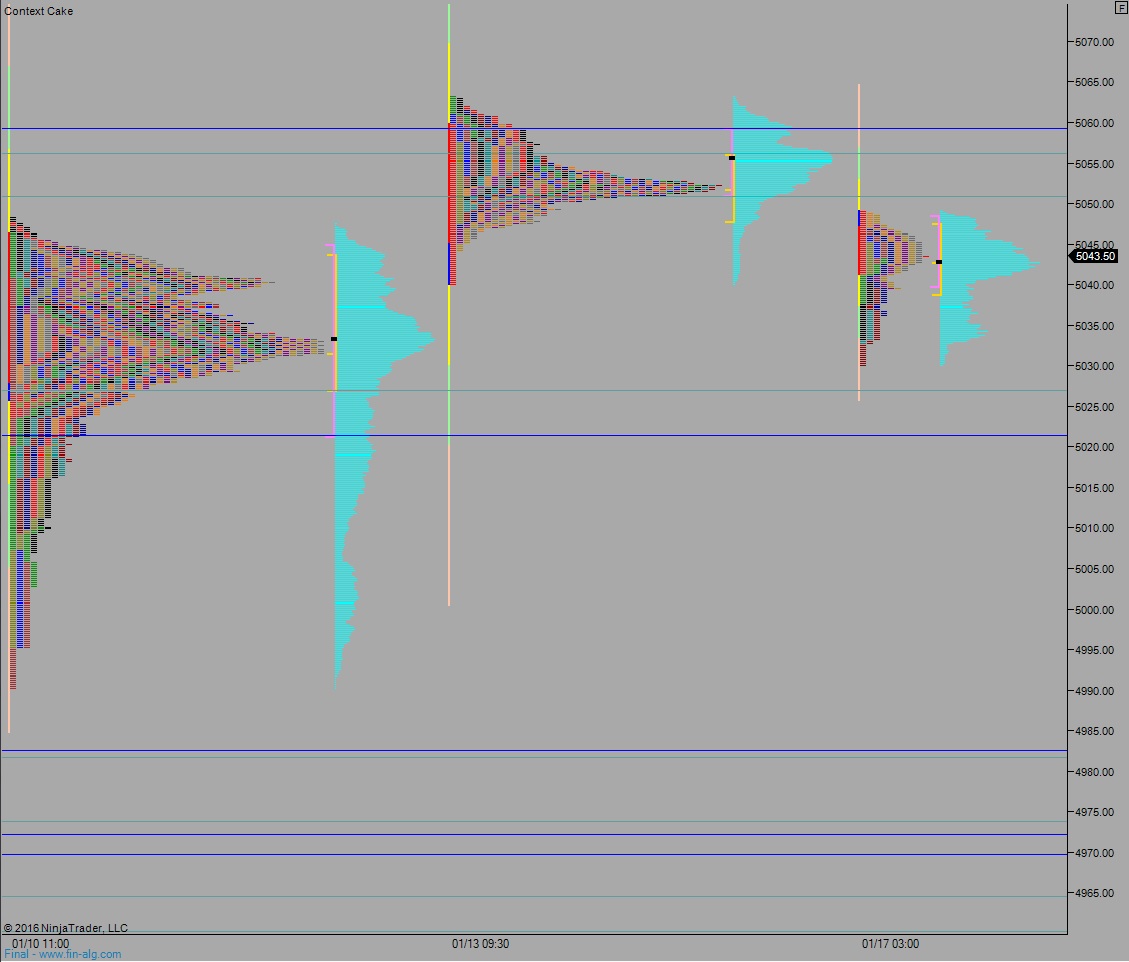

NASDAQ futures are heading into Tuesday gap down after an overnight session featuring normal range on elevated volume. Price worked lower, pressing down into the upper-quad of last Thursday’s range before balancing out.

The economic calendar is light today, but be aware there are multiple T-bill auctions at 11:30am.

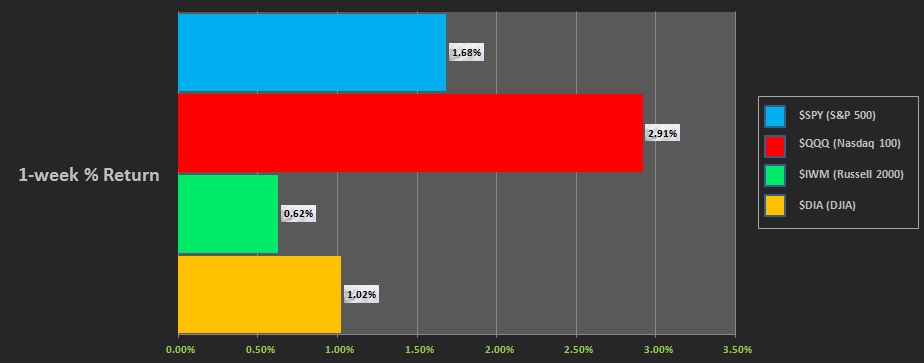

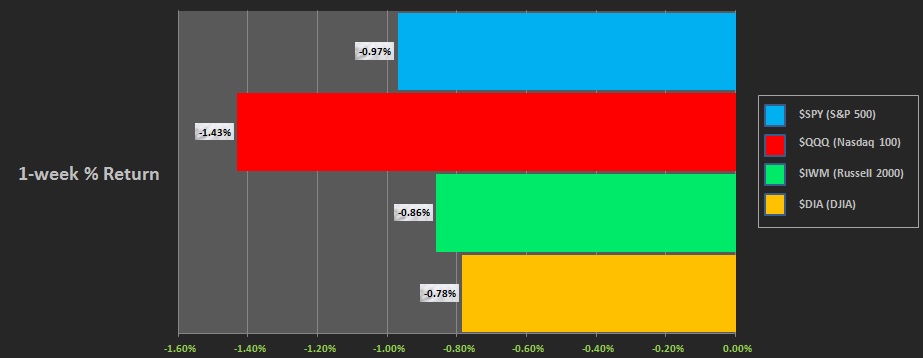

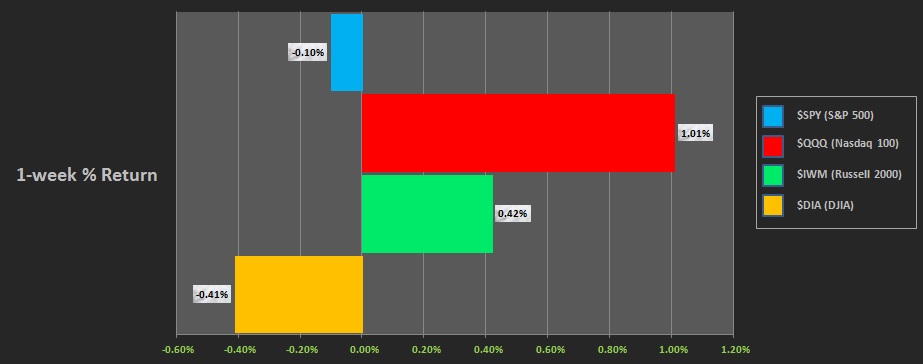

Last week was dominated by the NASDAQ while the other major U.S. indices marked time. The performance of each major index can be seen below:

On Friday The NASDAQ printed a normal variation up. Price drove higher Friday morning after opening gap up then churned sideways before a late-day thrust higher.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5056. Some struggle here before we continue higher to close the gap up to 5061.50 and two way trade ensues.

Hypo 2 sellers show up ahead of 5050.75 and work lower, down through overnight low 5030 setting up a move to target 5027 before two way trade ensues.

Hypo 3 stronger selling down to 5021.25 before two way trade.

Hypo 4 buyers sustain trade above 5059 setting up a fresh leg higher. Stretch target is 5106.

Levels:

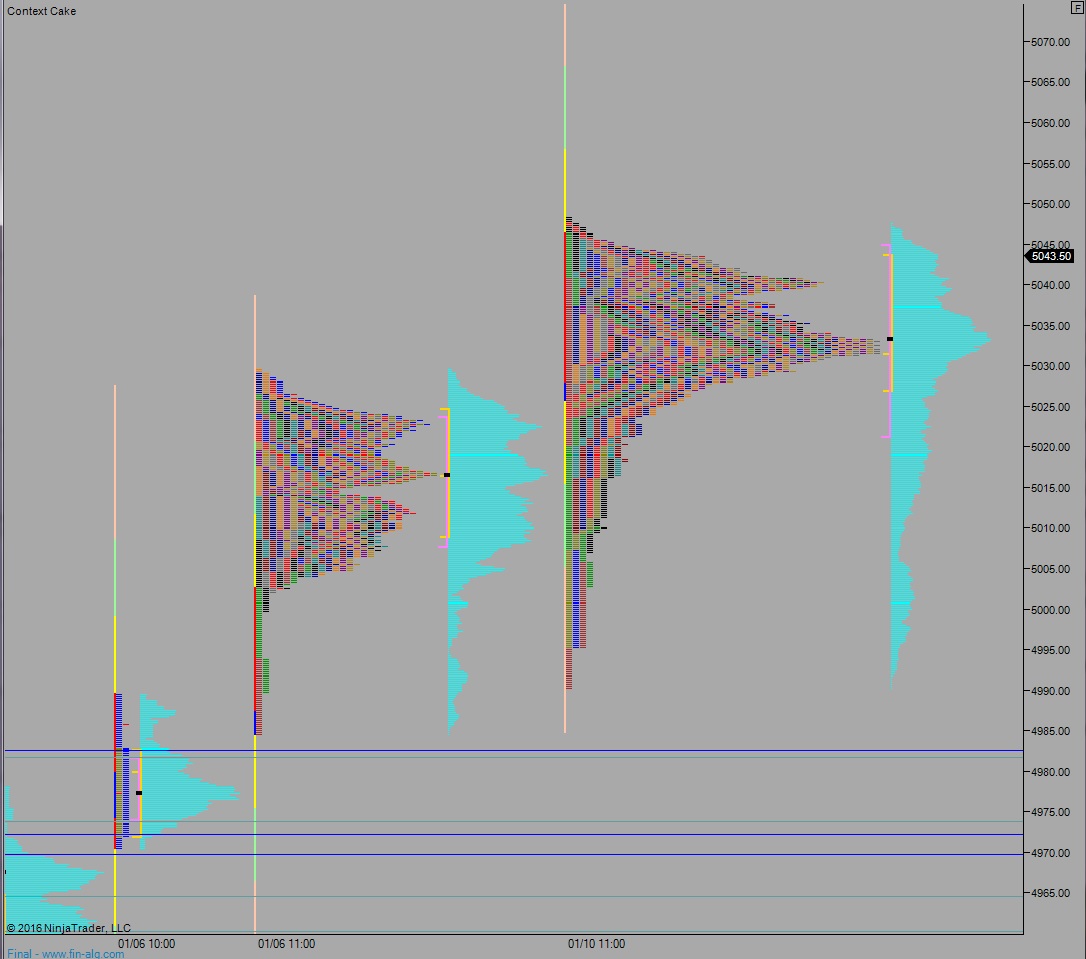

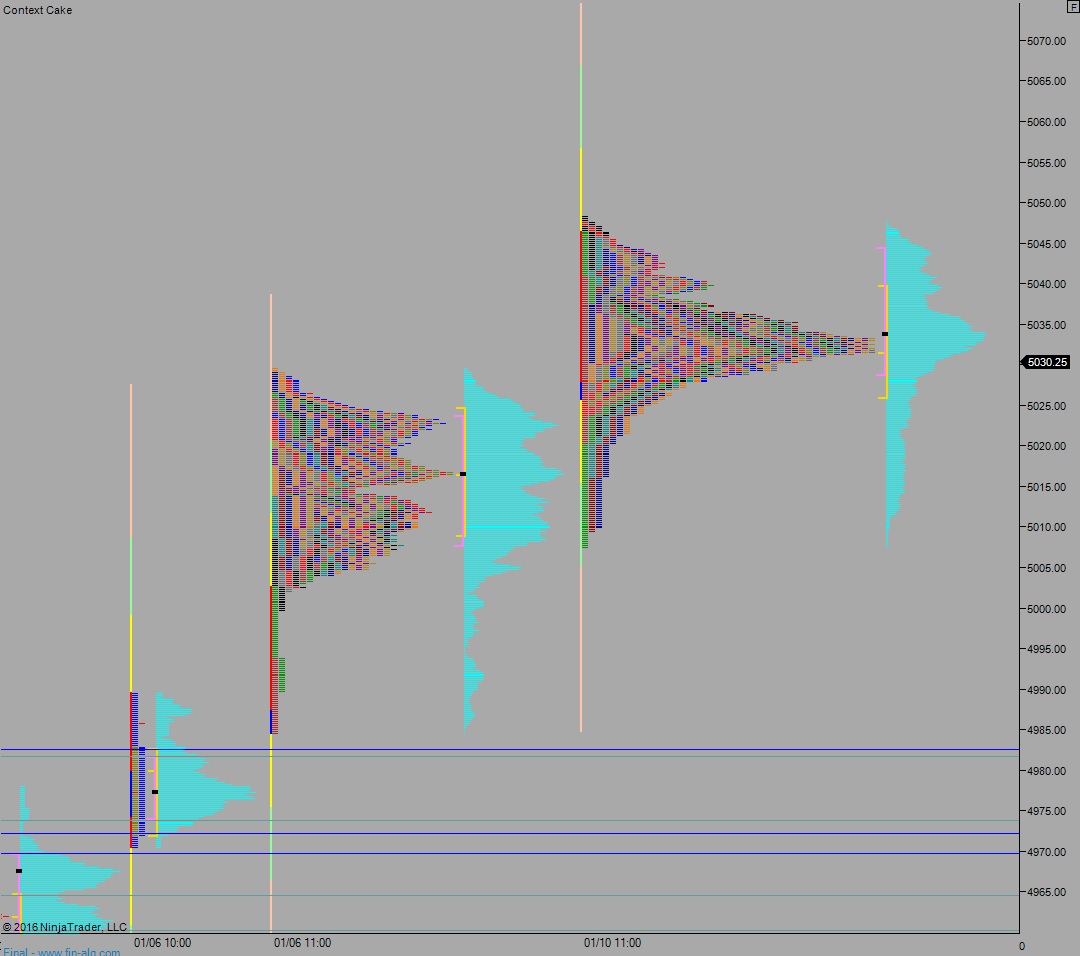

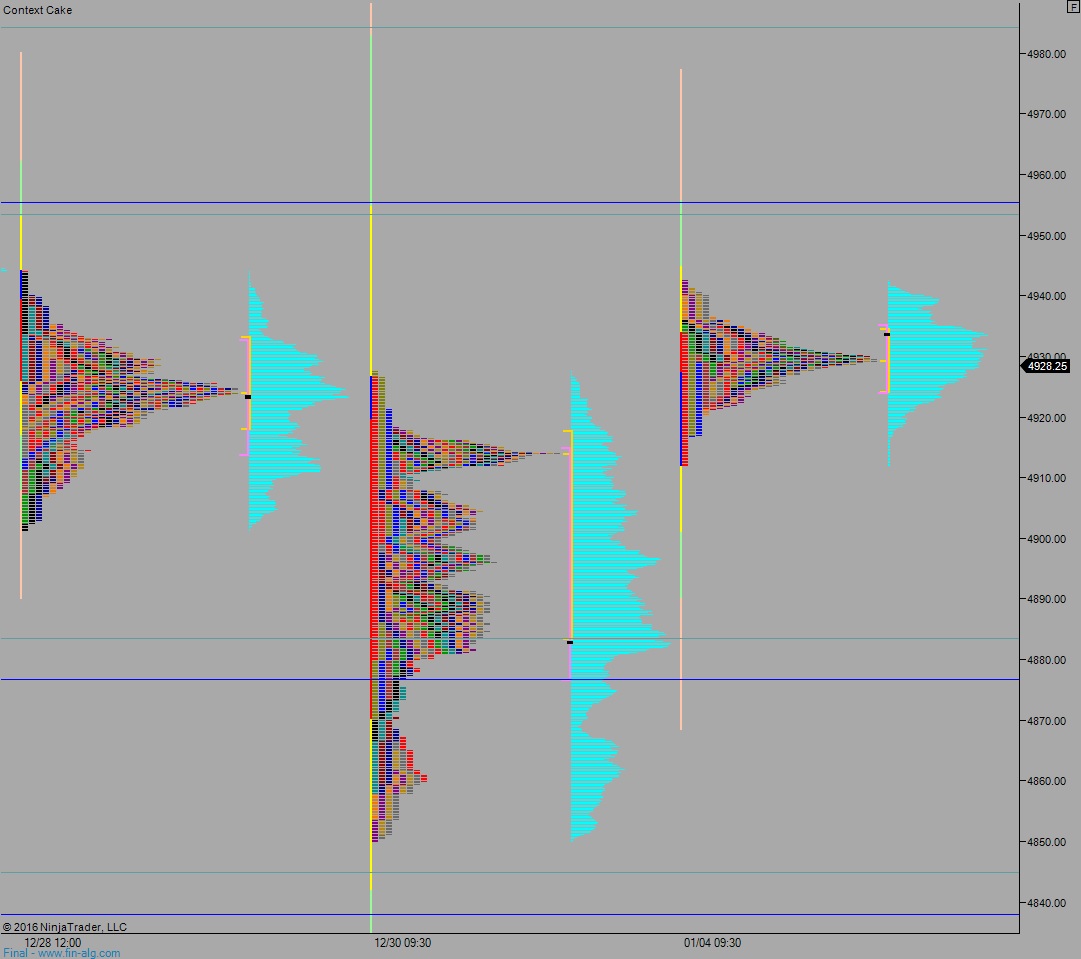

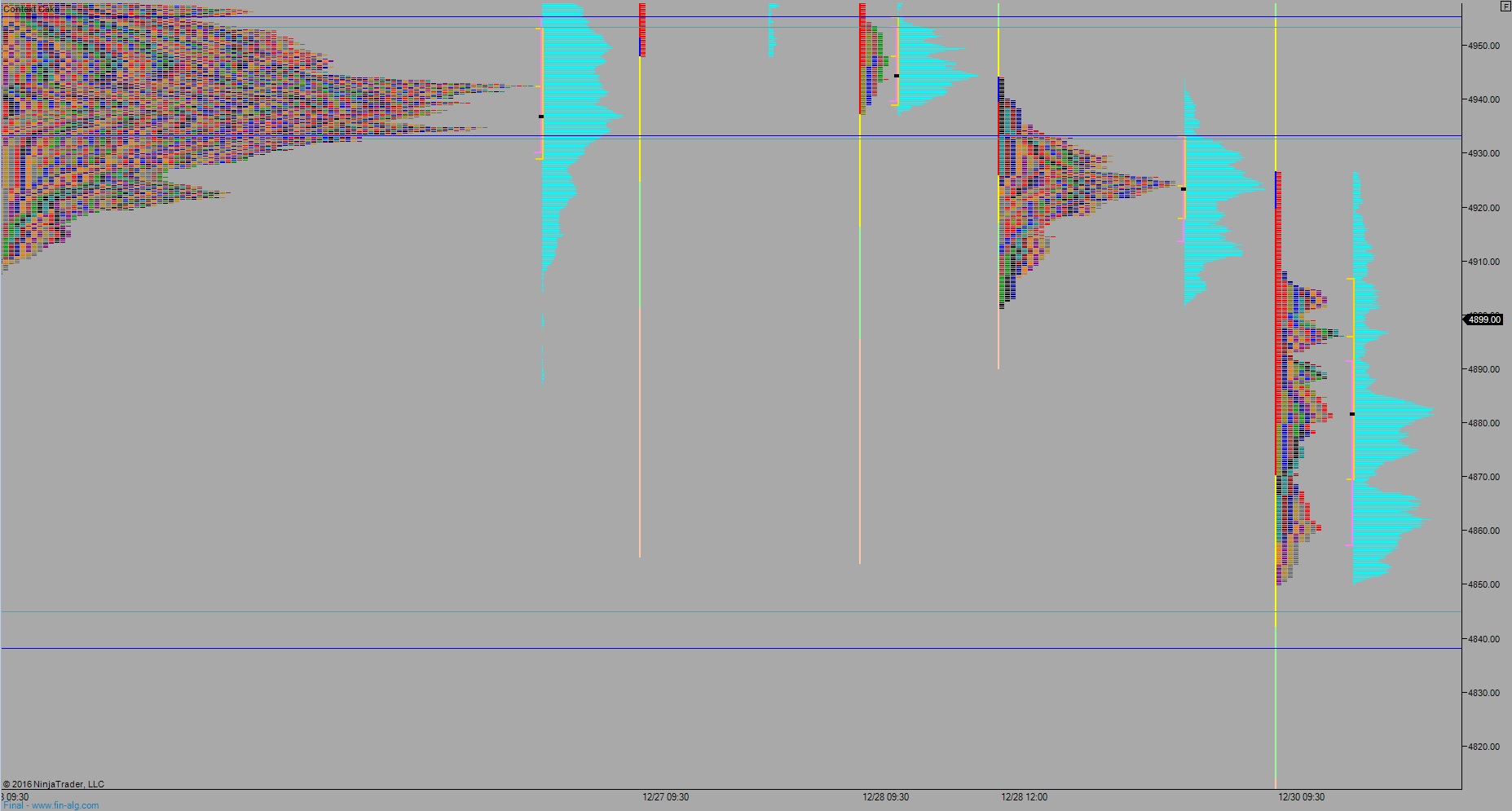

Volume profiles, gaps, and measured moves: