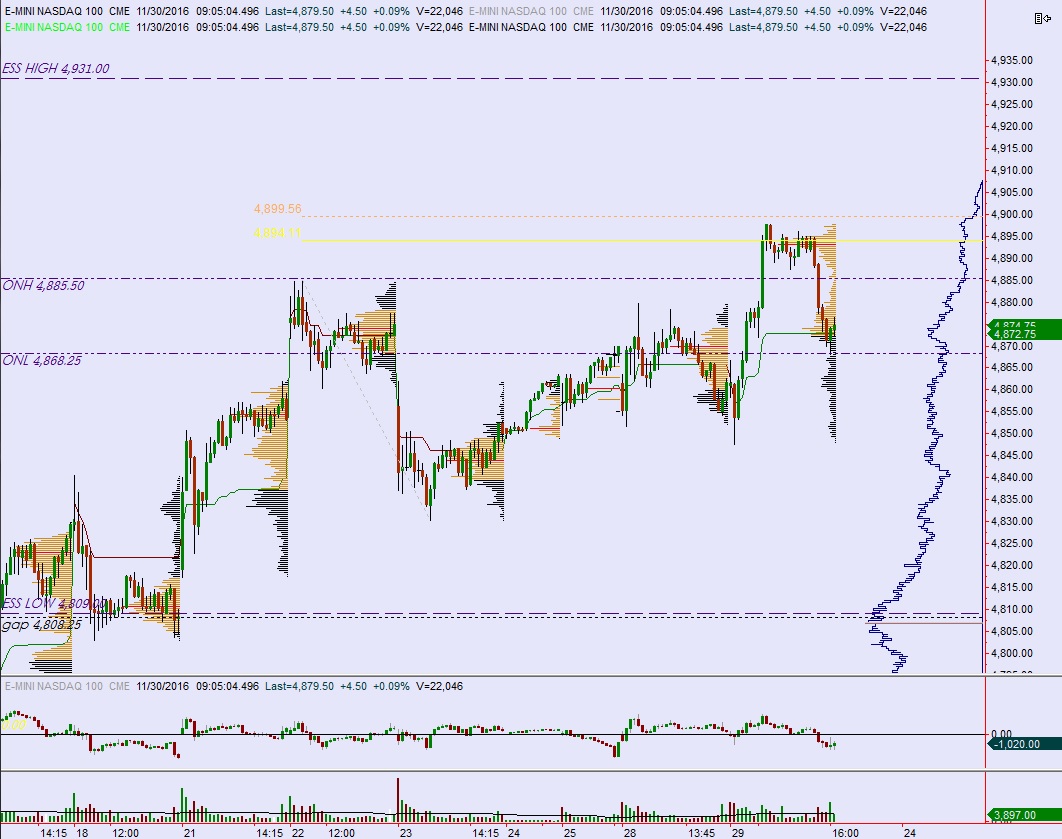

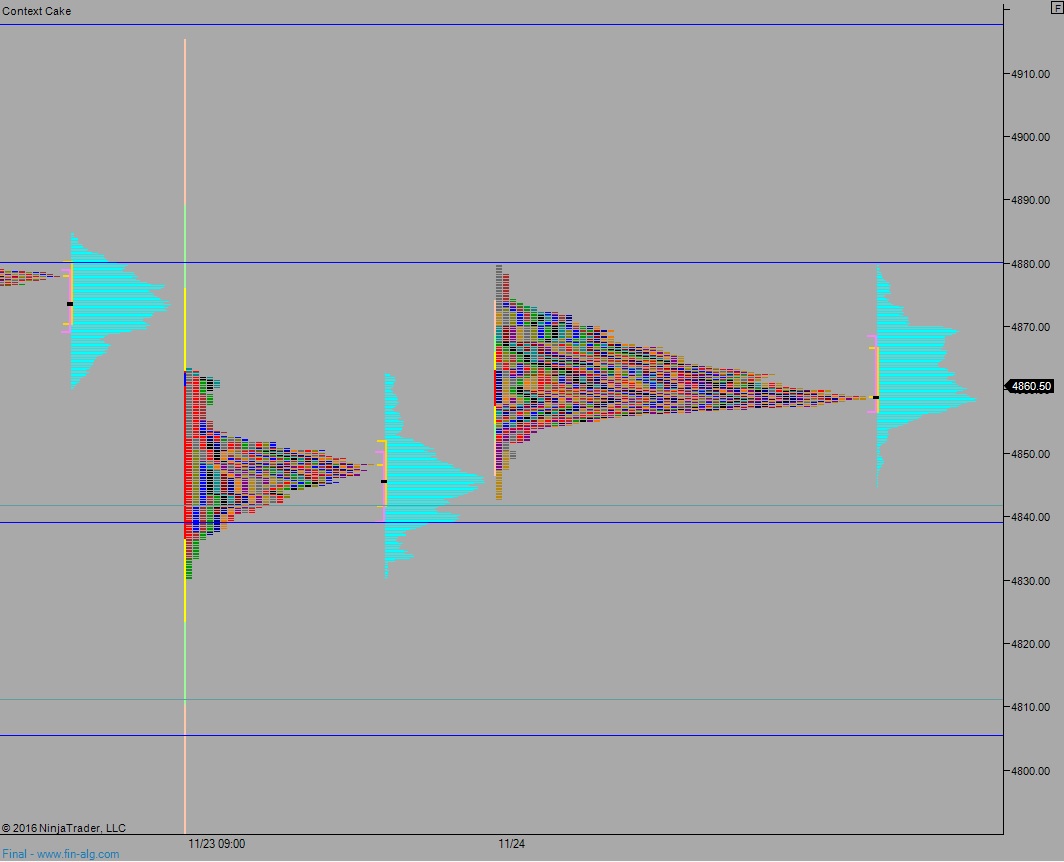

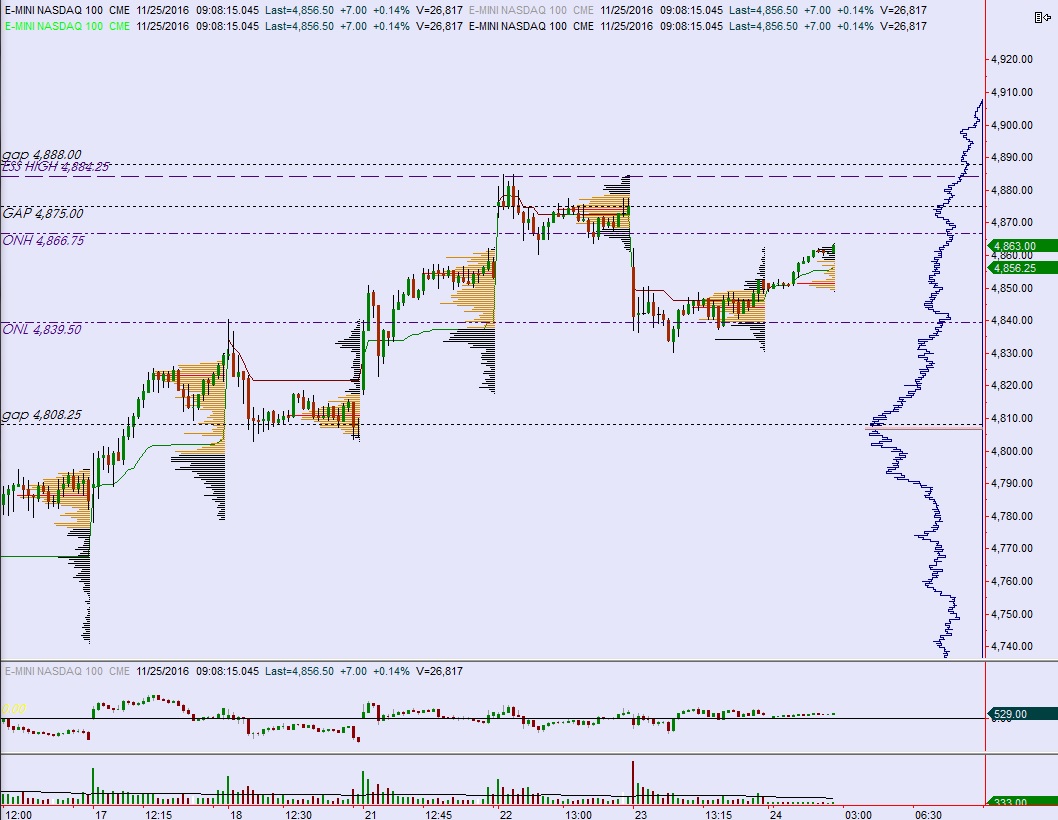

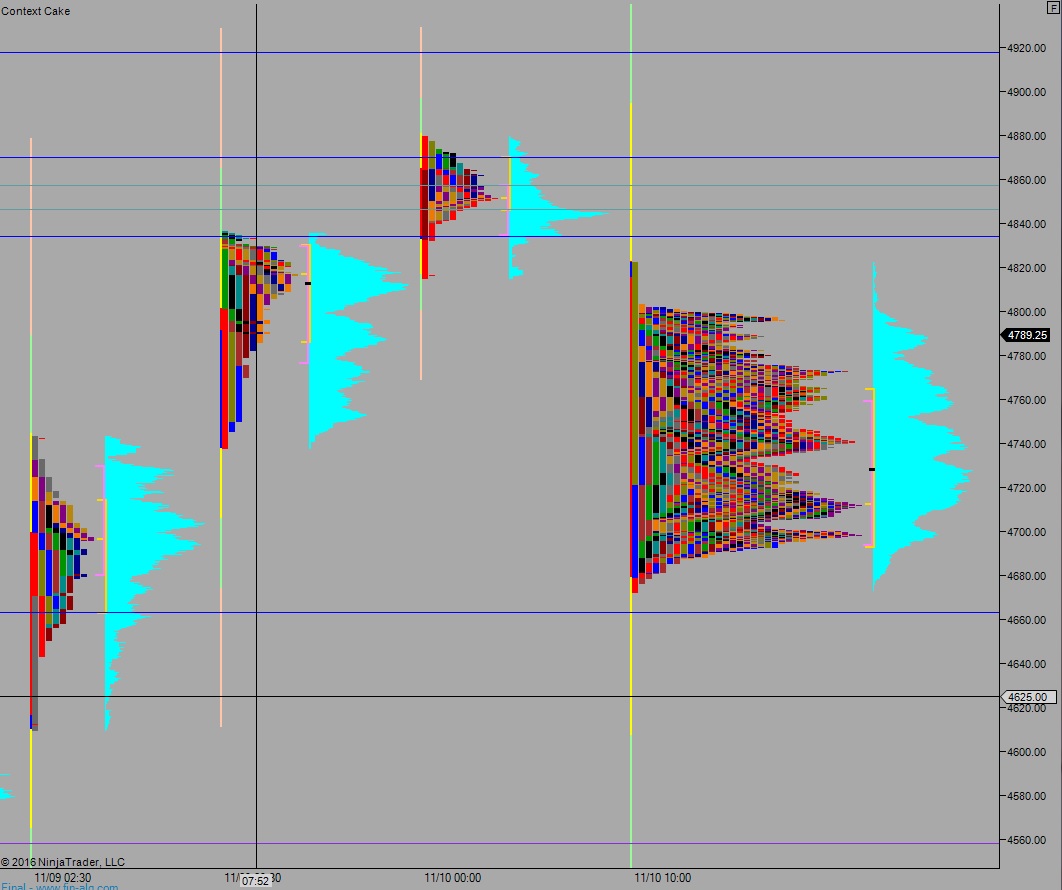

There was a hard sell two days after Trump won President but it was a knee-jerk, algorithmic type move. Otherwise we’ve rallied.

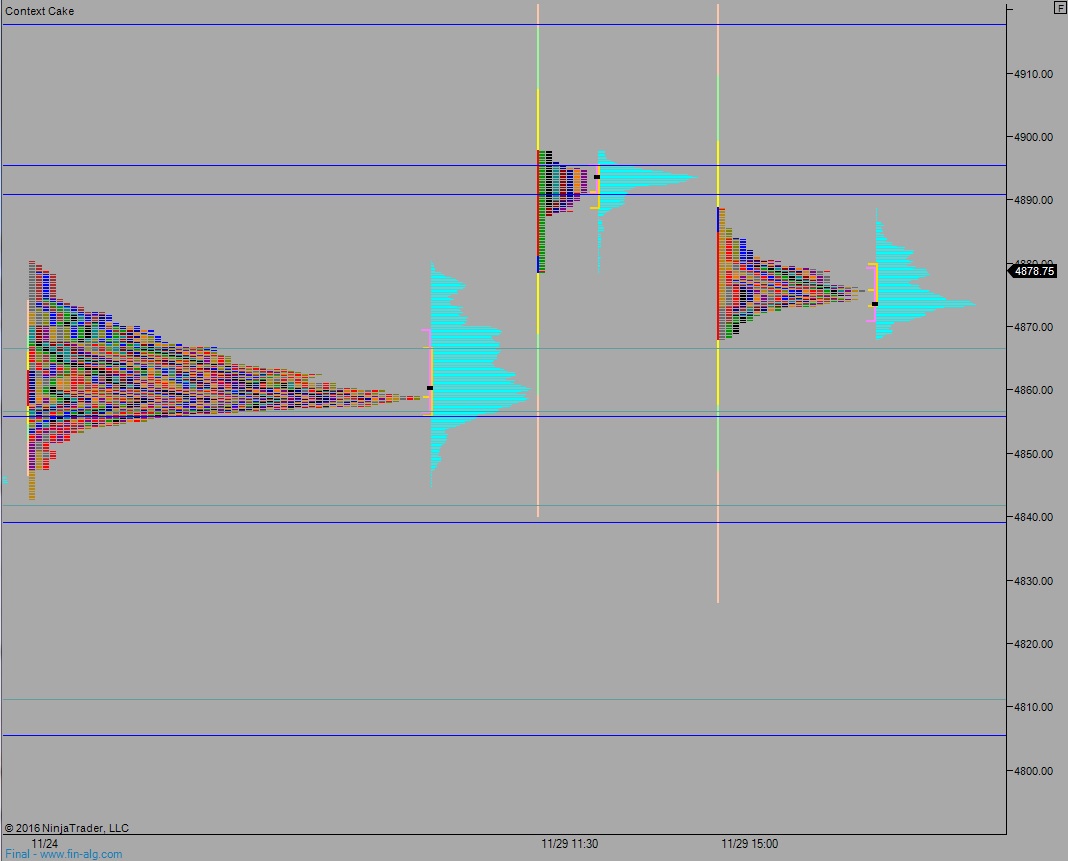

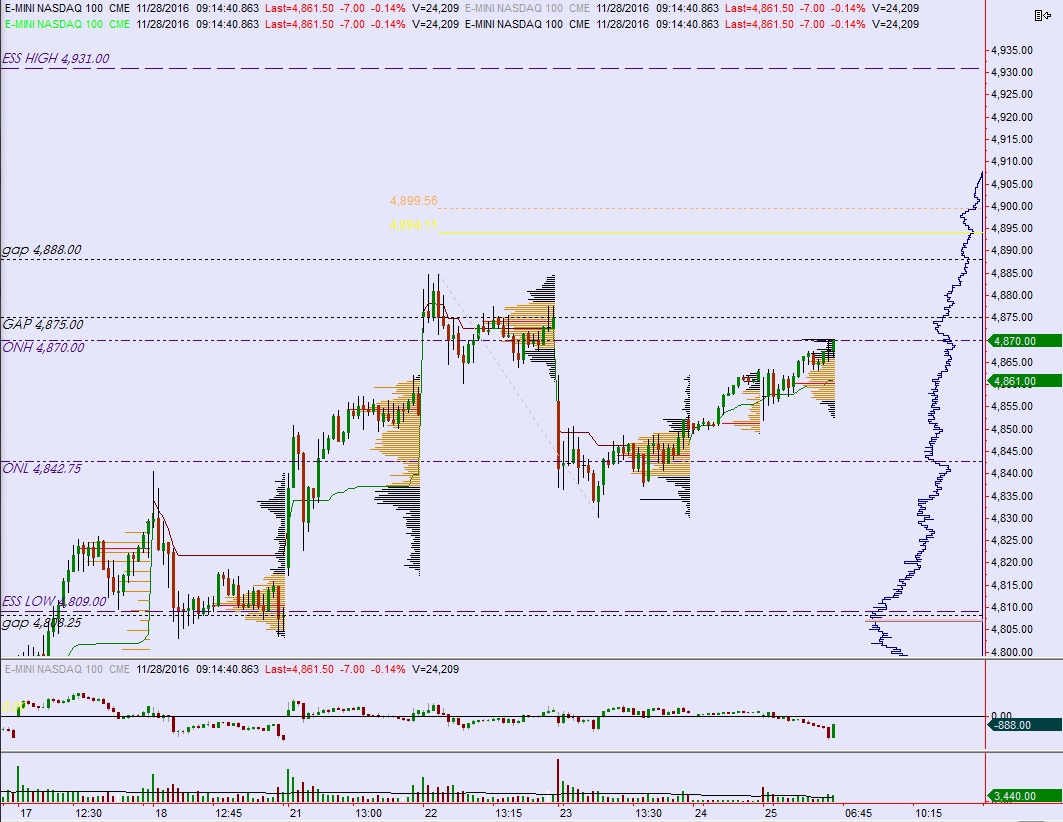

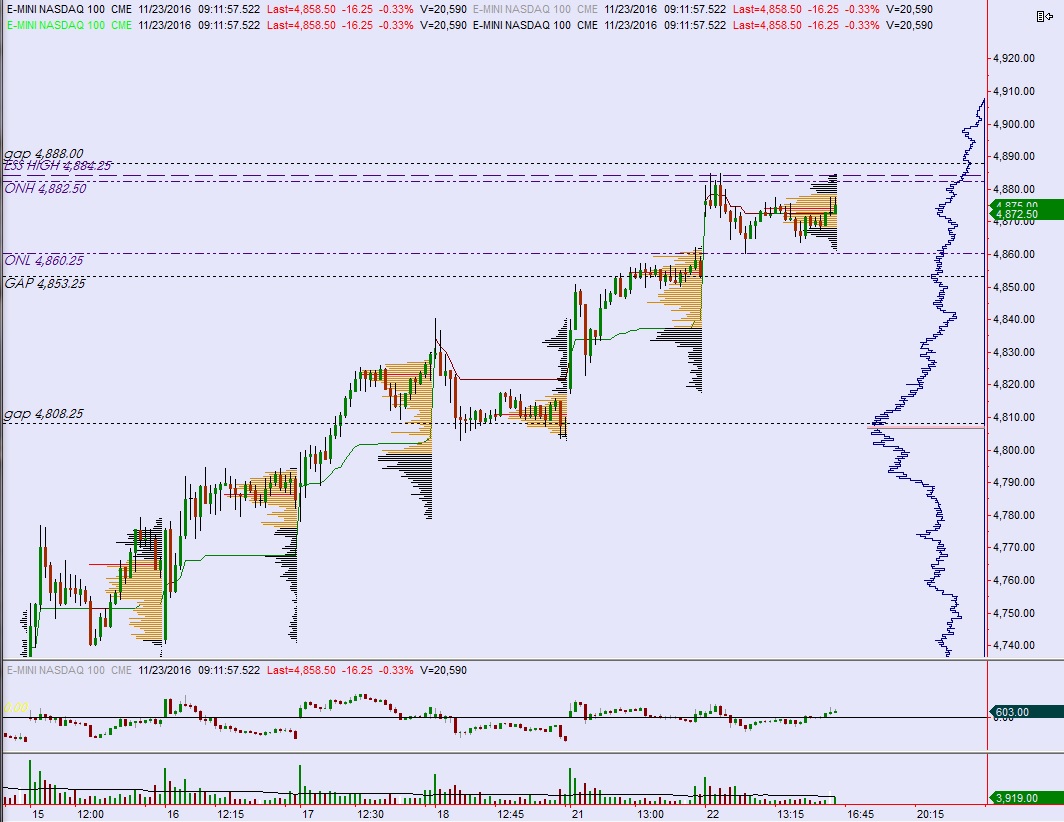

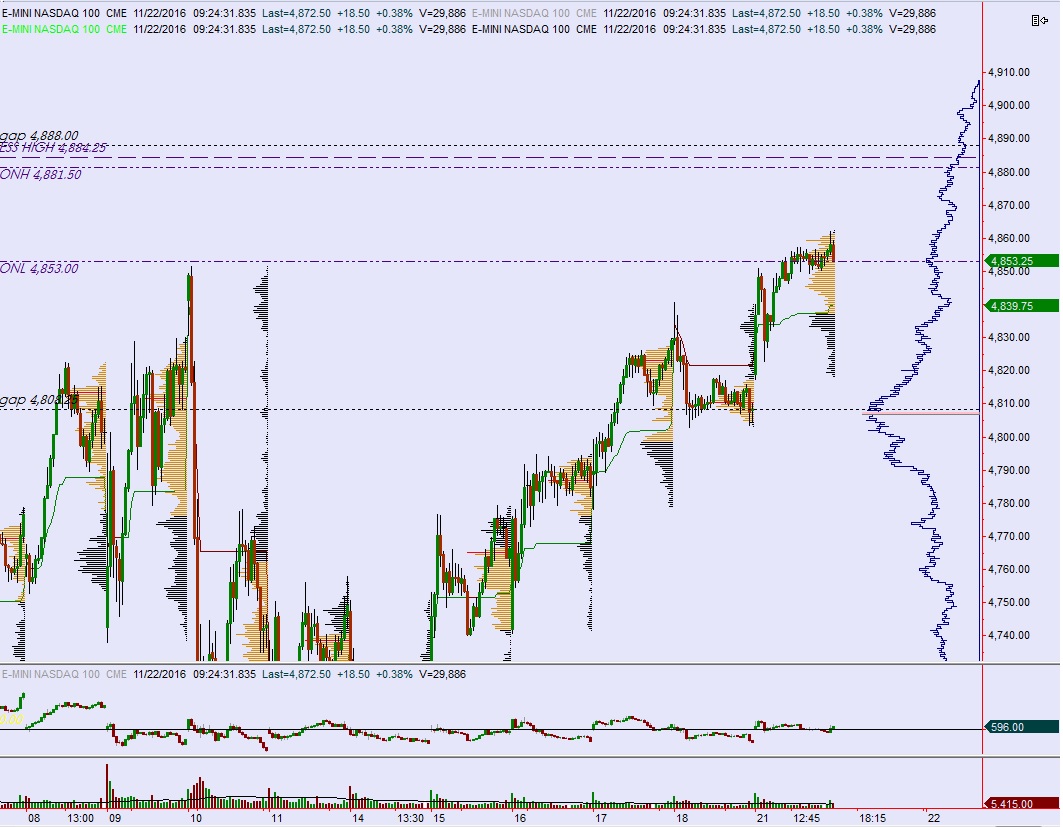

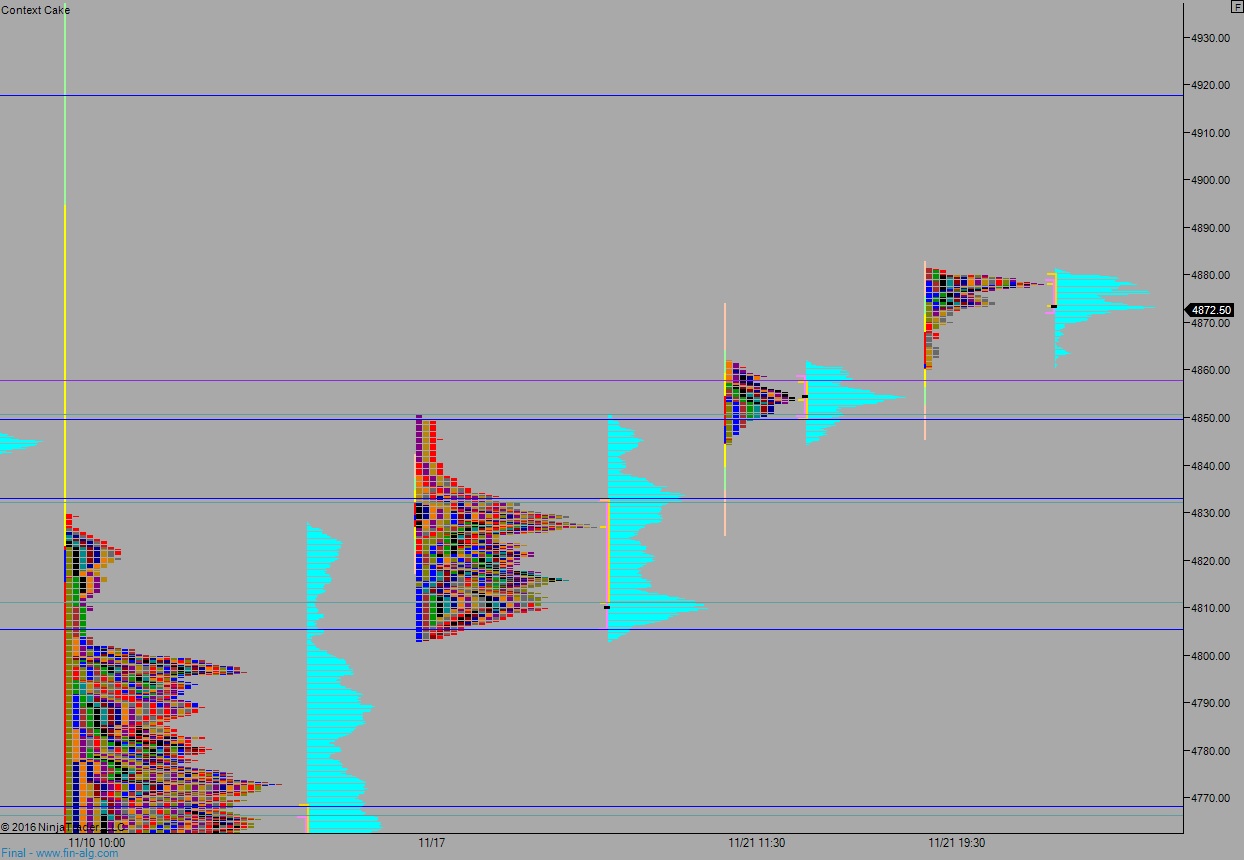

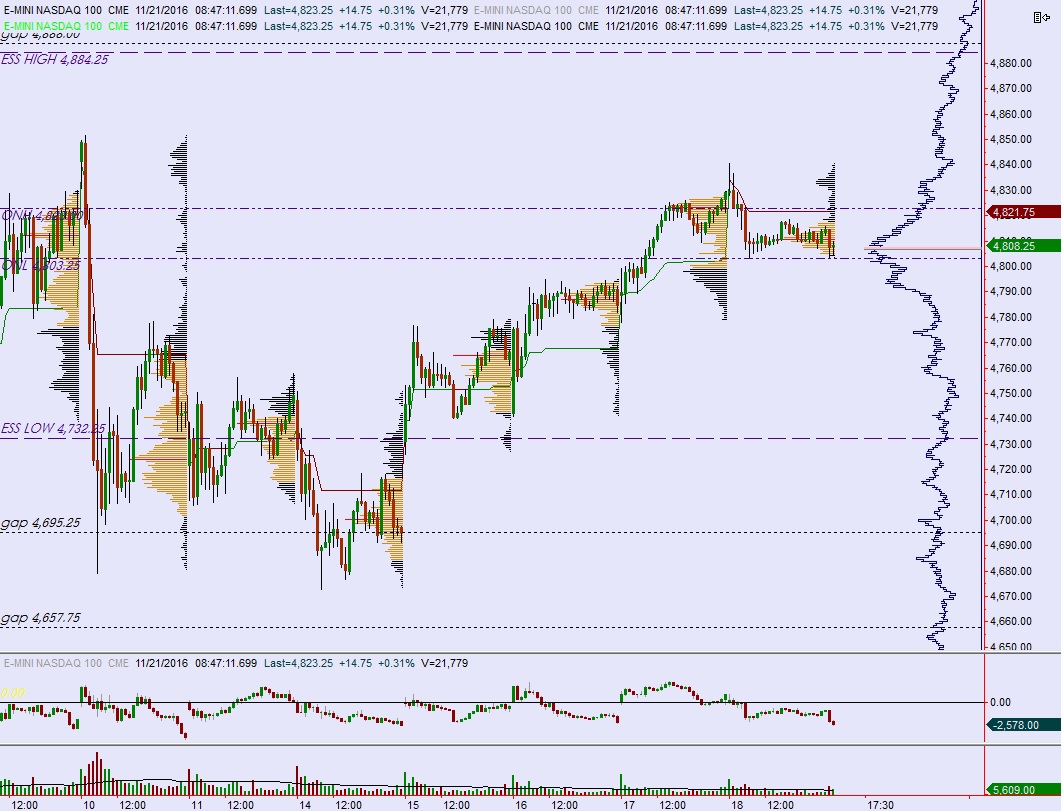

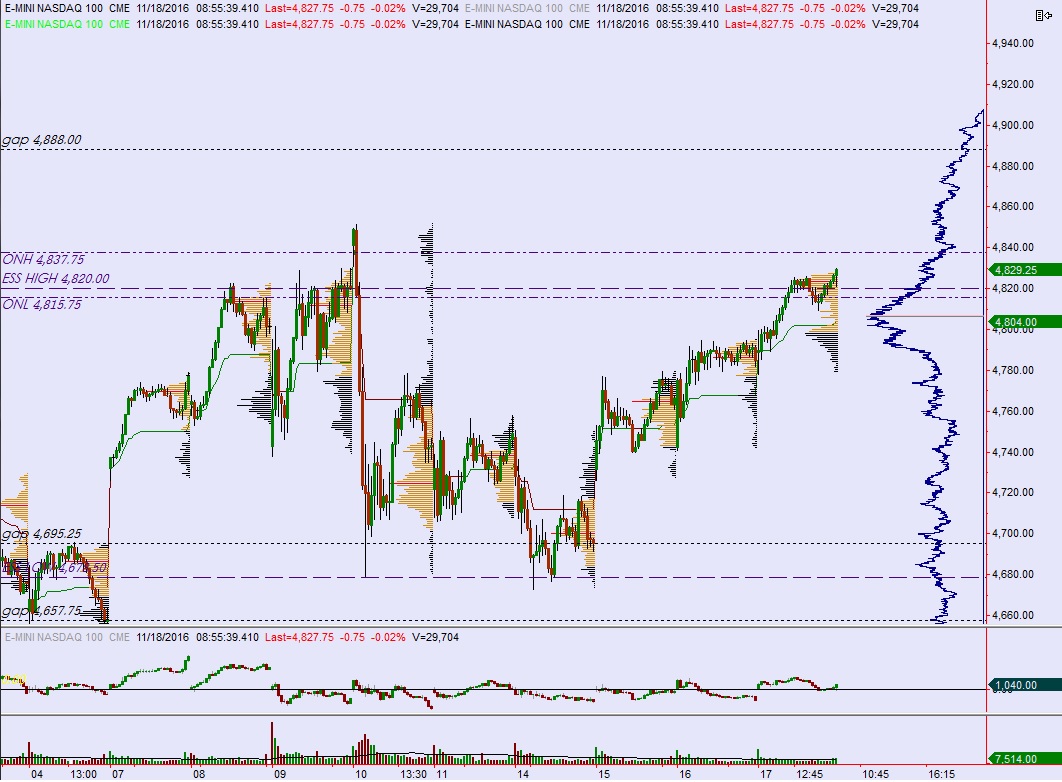

However, in what has become a popular pastime in American market lore, exceeding the most recent swing high introduced a strong seller. This is the case again Wednesday on the NASDAQ exchange.

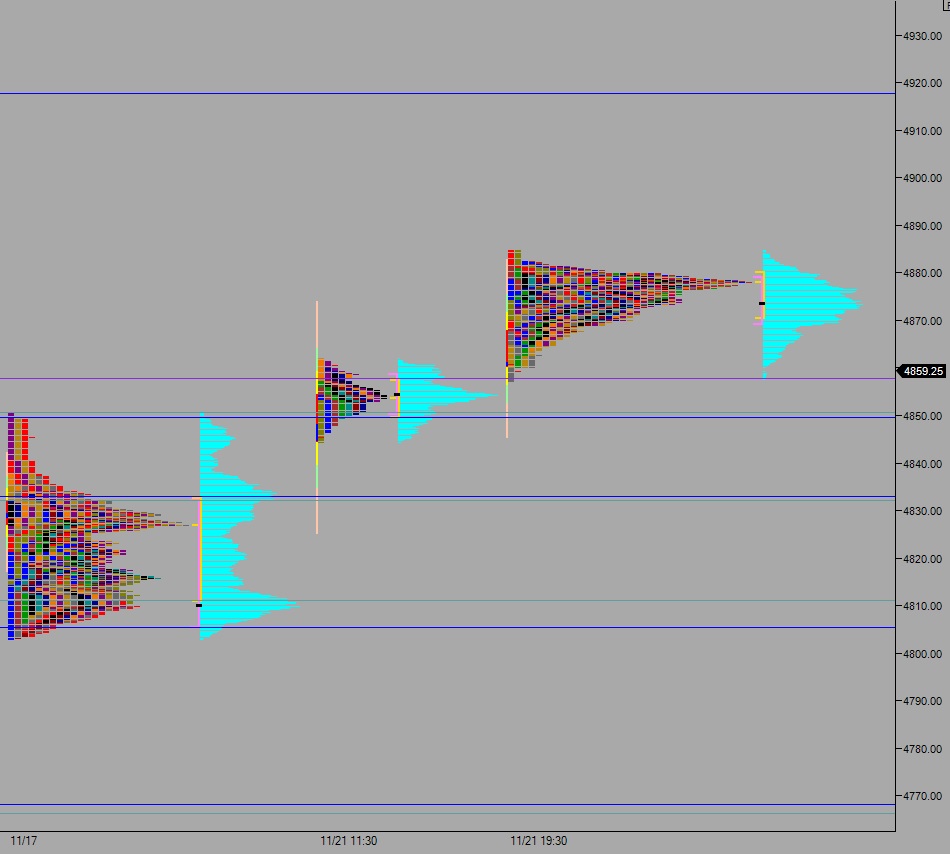

It happened inside my two favorite Fibonacci extensions, which I use to gauge whether a breakout is real or just a stop hunter:

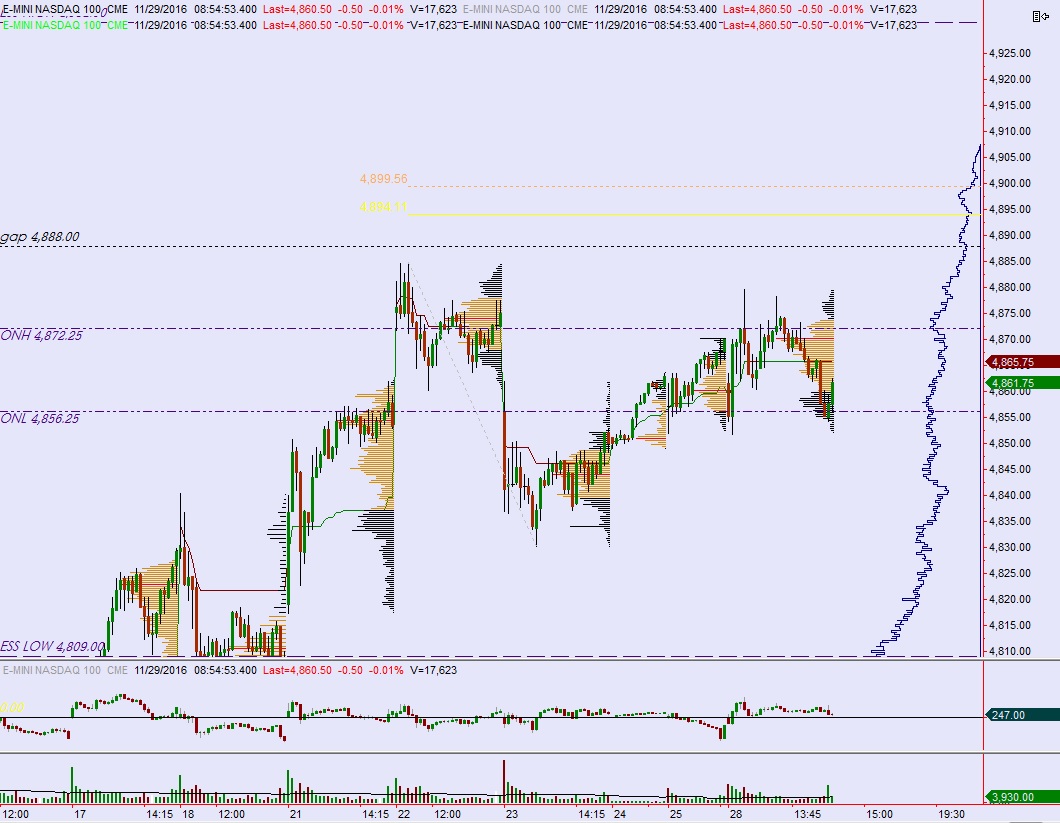

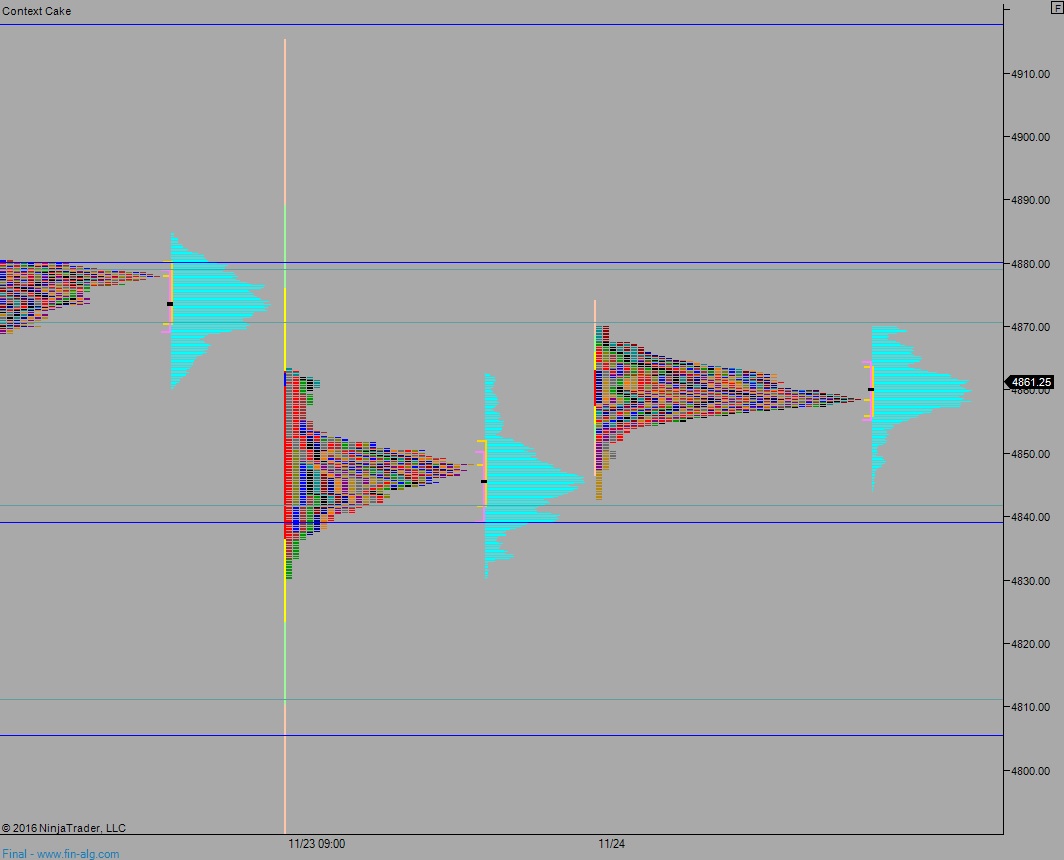

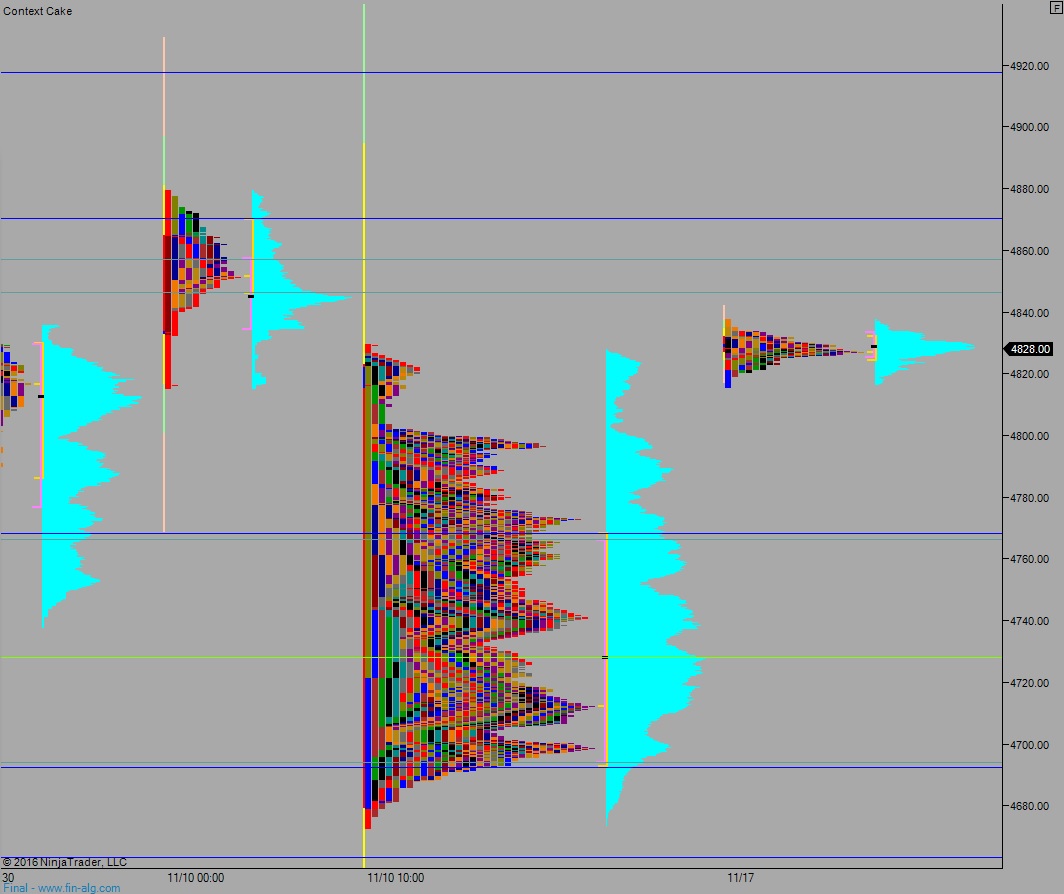

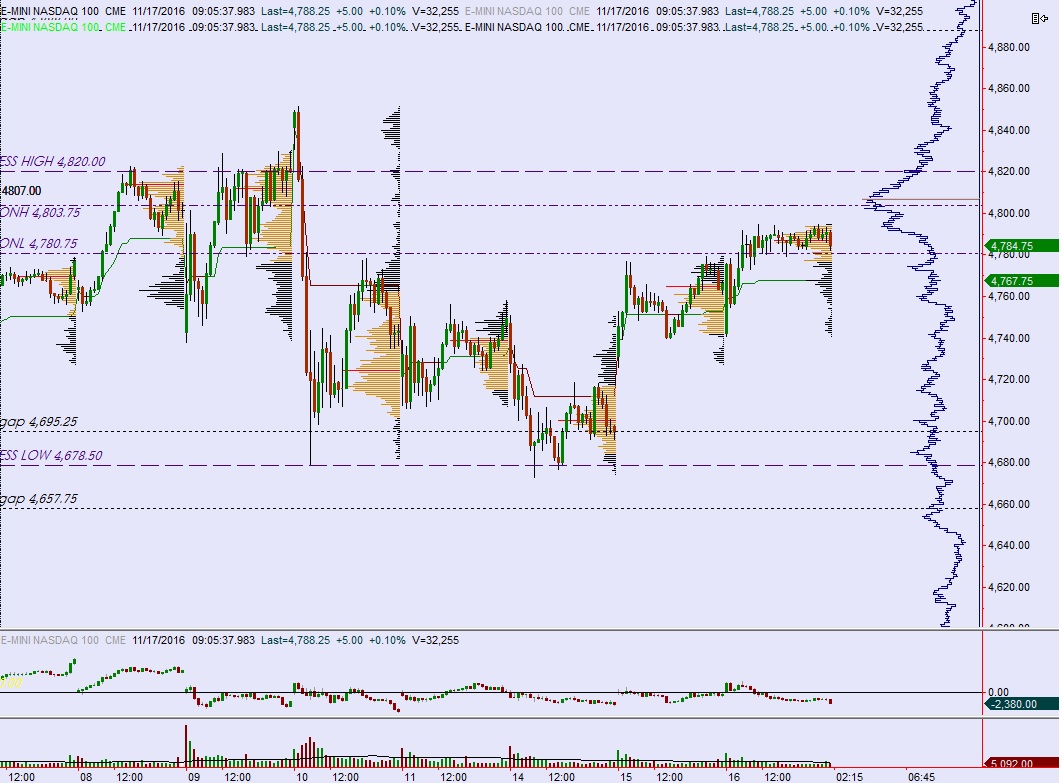

The selling that came in today was methodical, resting then cutting through local levels*. It was initiative in nature, meaning the higher time frame continued to engage the NASDAQ throughout the day via their sell orders.

*market profile levels on any morning report are examples of local levels

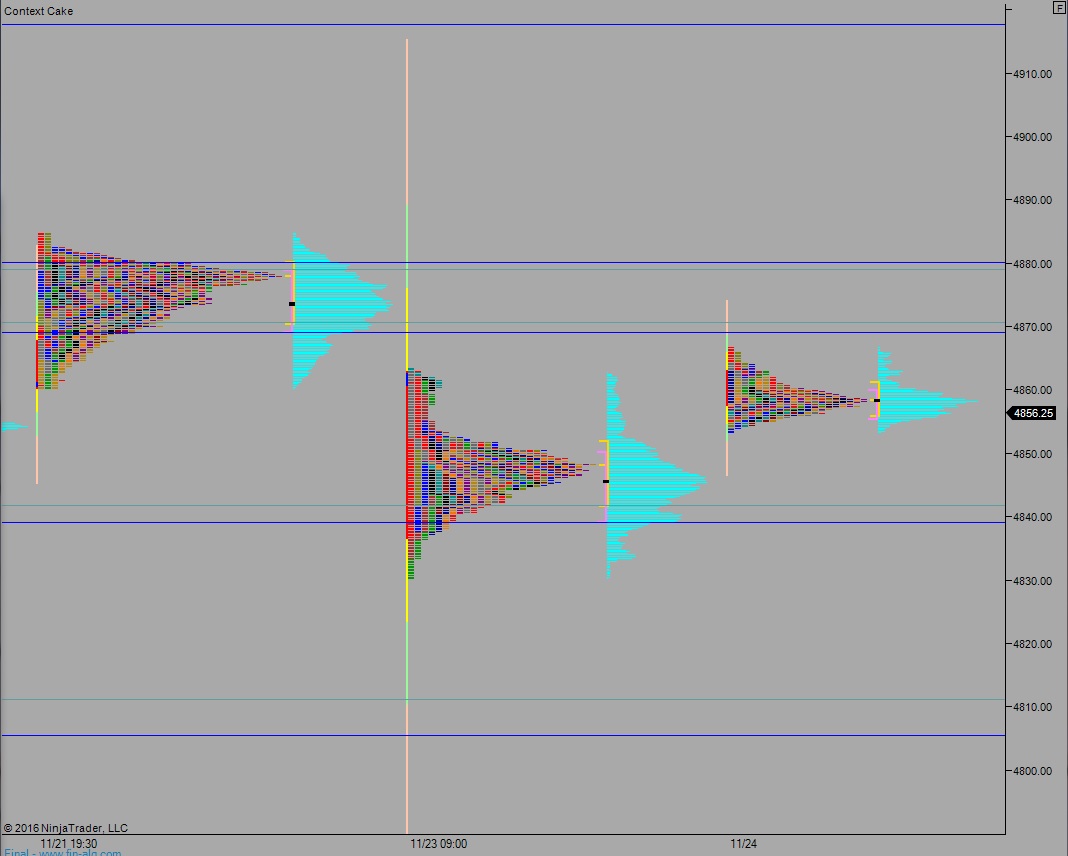

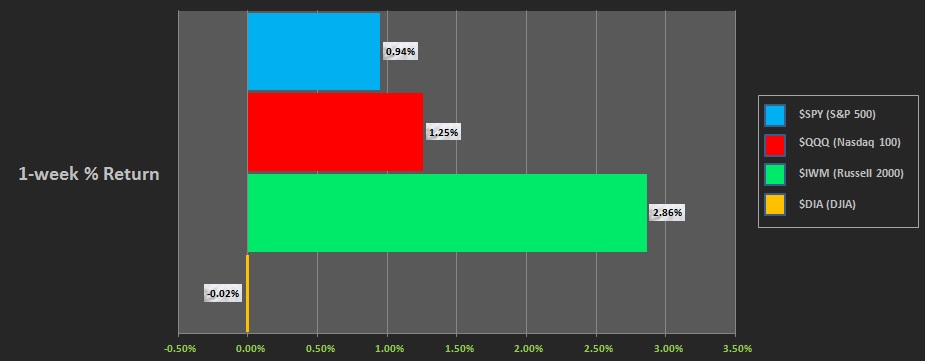

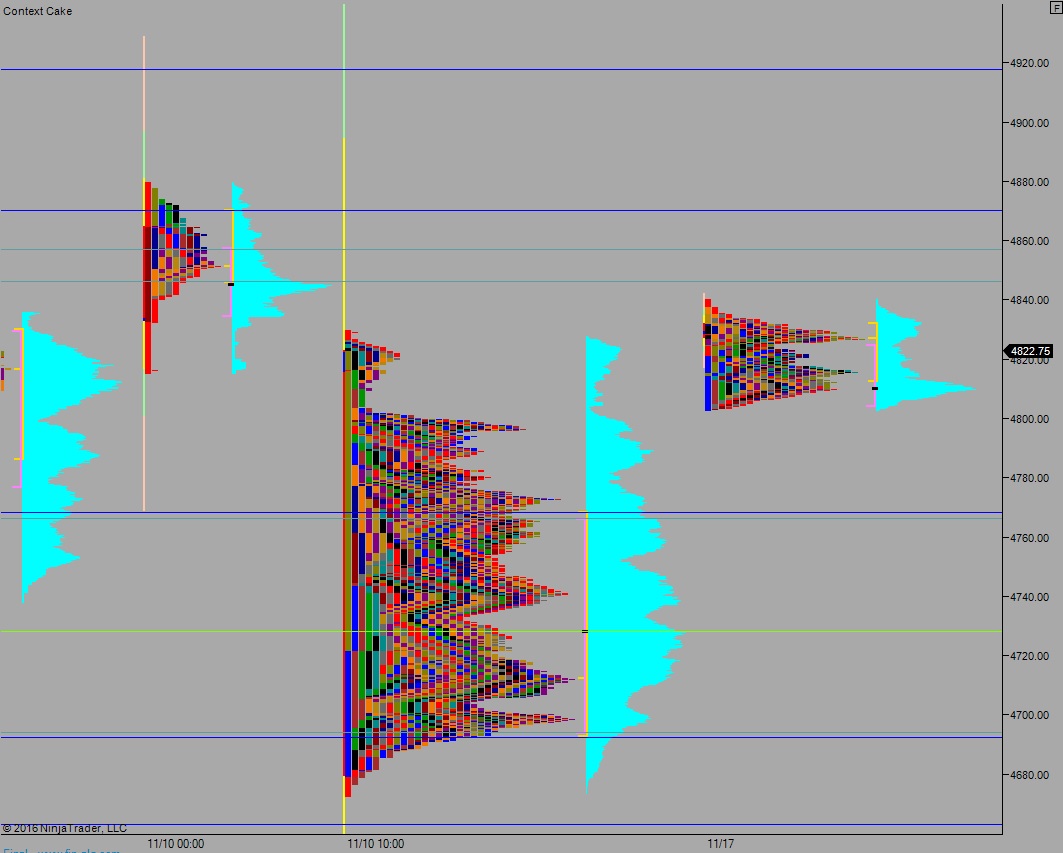

Meanwhile, over at the Dow Jones, sellers could not regain Tuesday’s range. Also the Russell is at its Exodus Strategy Session bracket low–a demarcation line that grades my algo and also draws a proverbial do or die for whether a week ends up being range-bound or something bigger.

If these sort of conversations and observations seem logical to you, and an objective way to assess and engage the markets, it may make sense for you to sign up for Option Addict’s upcoming bootcamp. He’s proficient in these matters and has a knack for presenting them in understandable ways and you can ask him whatever you want.

I sort of just do, ya feel?

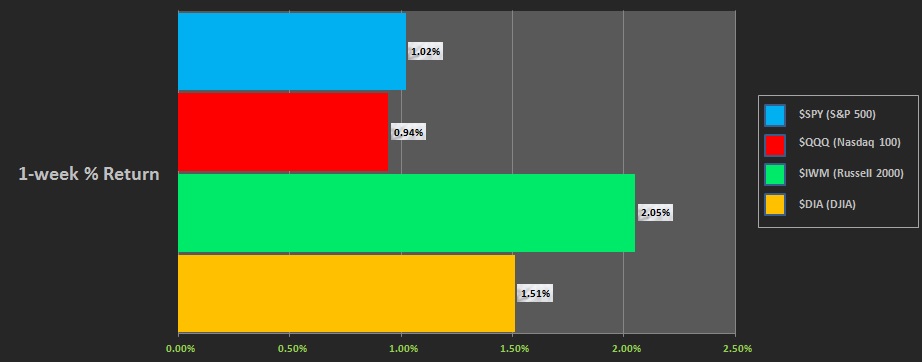

The resilience is coming from the S&P and Dow while our riskier Russell and NASDAQ potentially lead lower.

First of the month action could be fast to the downside. If it does accelerate, look for any Non-farm payroll data to be used to exacerbate the action. Same goes if we rally hard into NFP, look for the Friday morning data to stoke the rally.

If we are flatish heading into the data–then use it to gauge direction into Friday and the weekend and may GOD HAVE MERCY ON YOUR SOUL.

NASDAQ CLOSES OUT WEDNESDAY ON THE LOWS…

Comments »