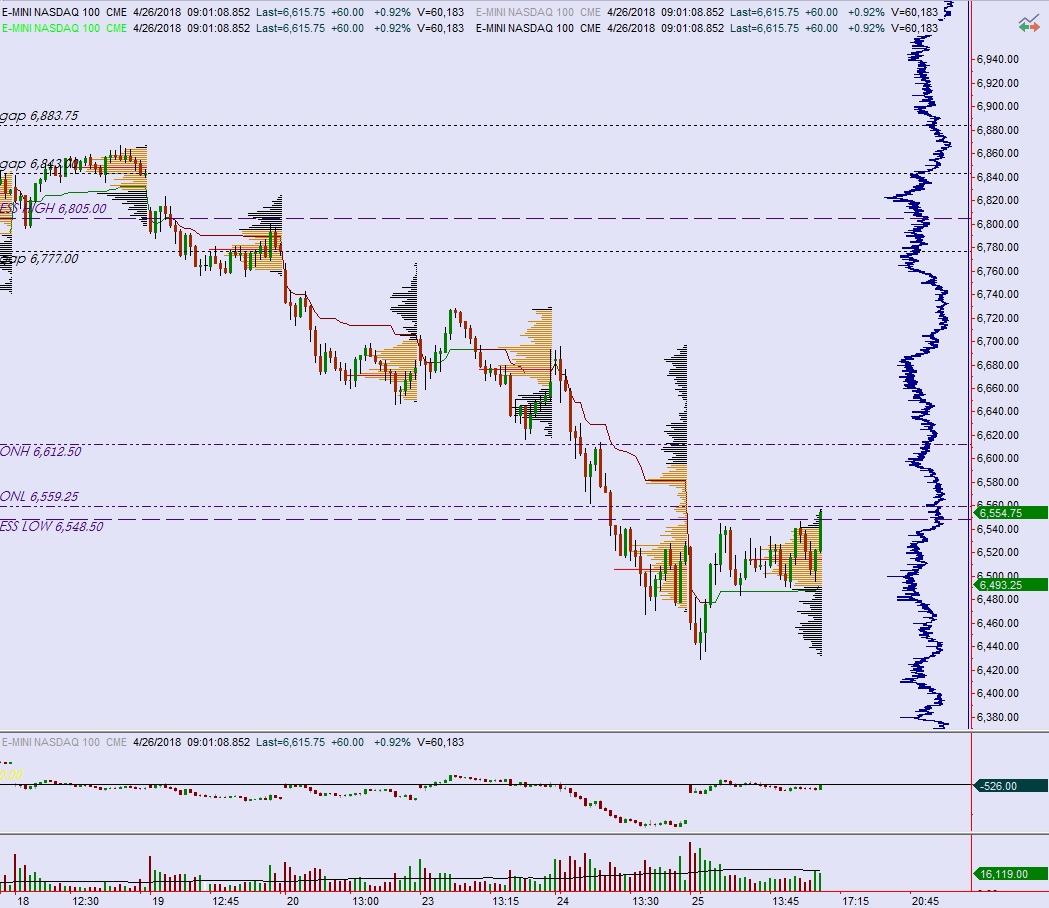

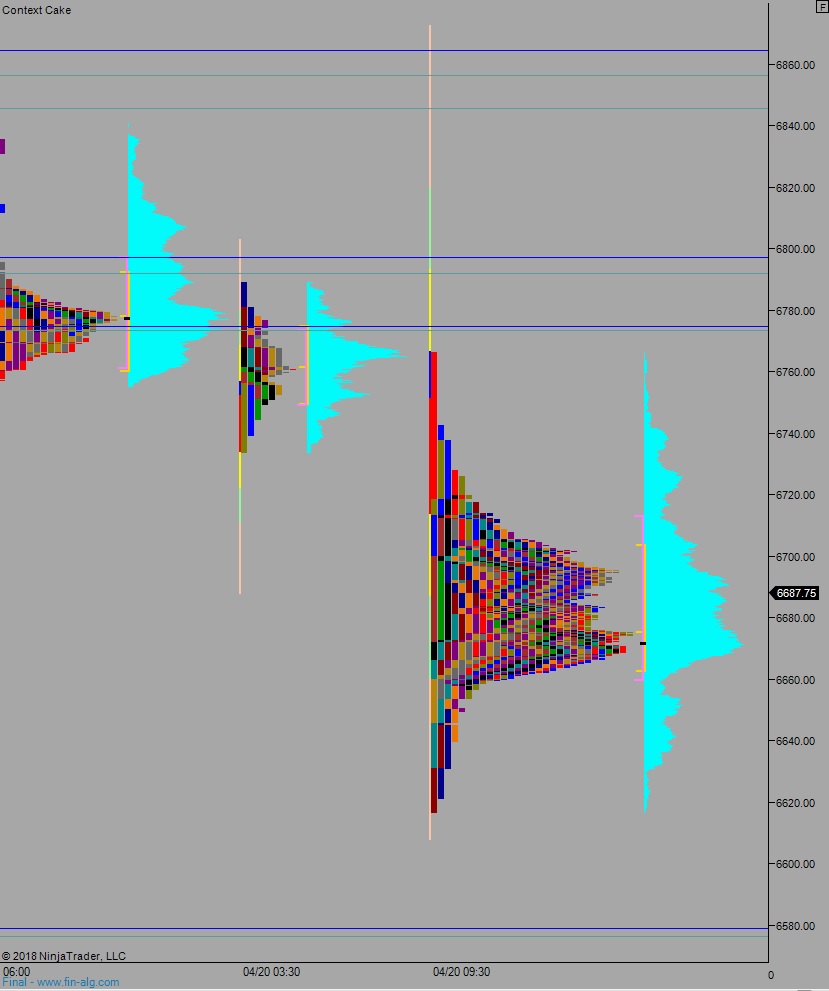

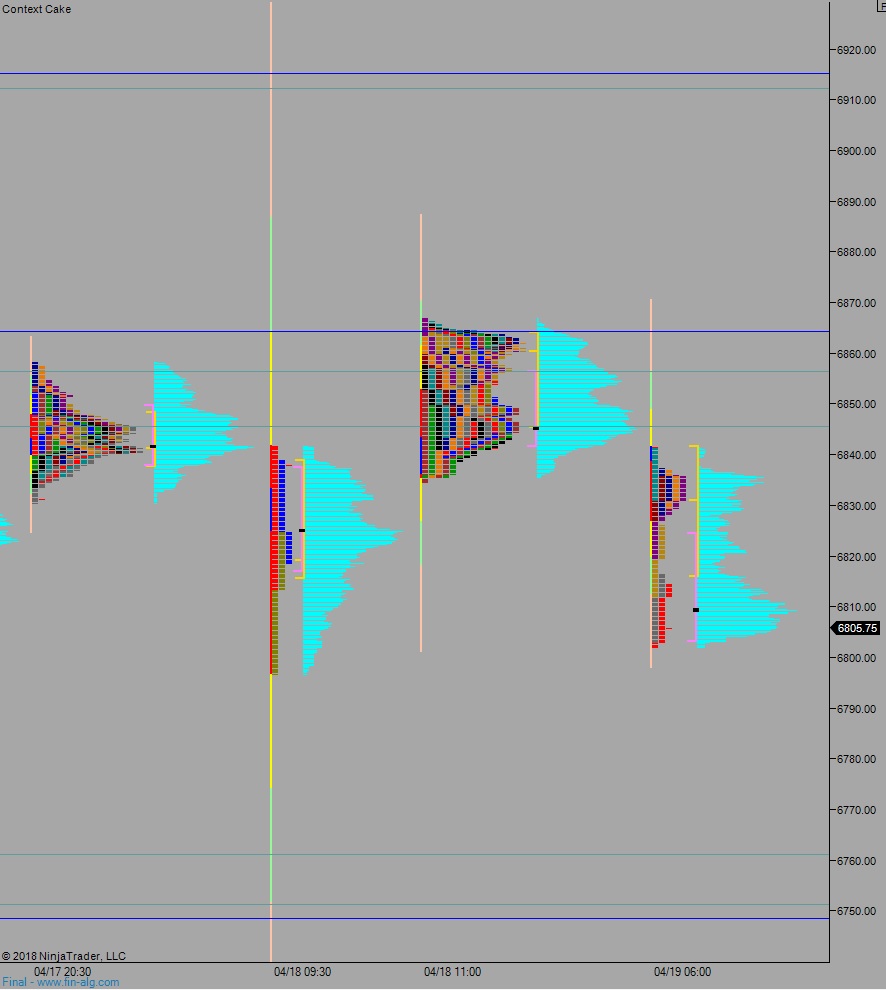

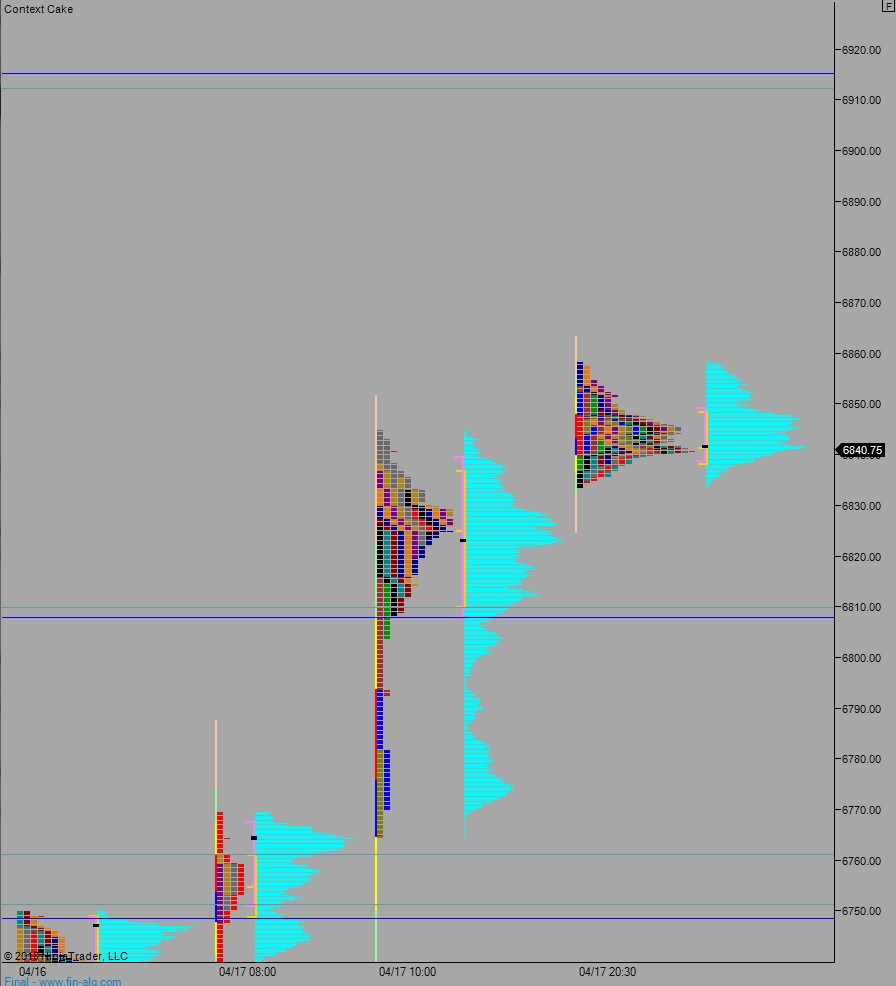

NASDAQ futures are coming into Thursday gap up after an overnight session featuring elevated range and volume. Price was balanced overnight, moving higher initially after Facebook reported earnings, then rallying again after 3am. At 8:30am advance goods trades balance, initial/continuing jobless claims, and durable goods orders all came in better than expected.

At 1pm the US Treasury will auction off $29 billion in 7-year Notes.

Amazon, Microsoft, and Intel are set to report earnings after-market-close.

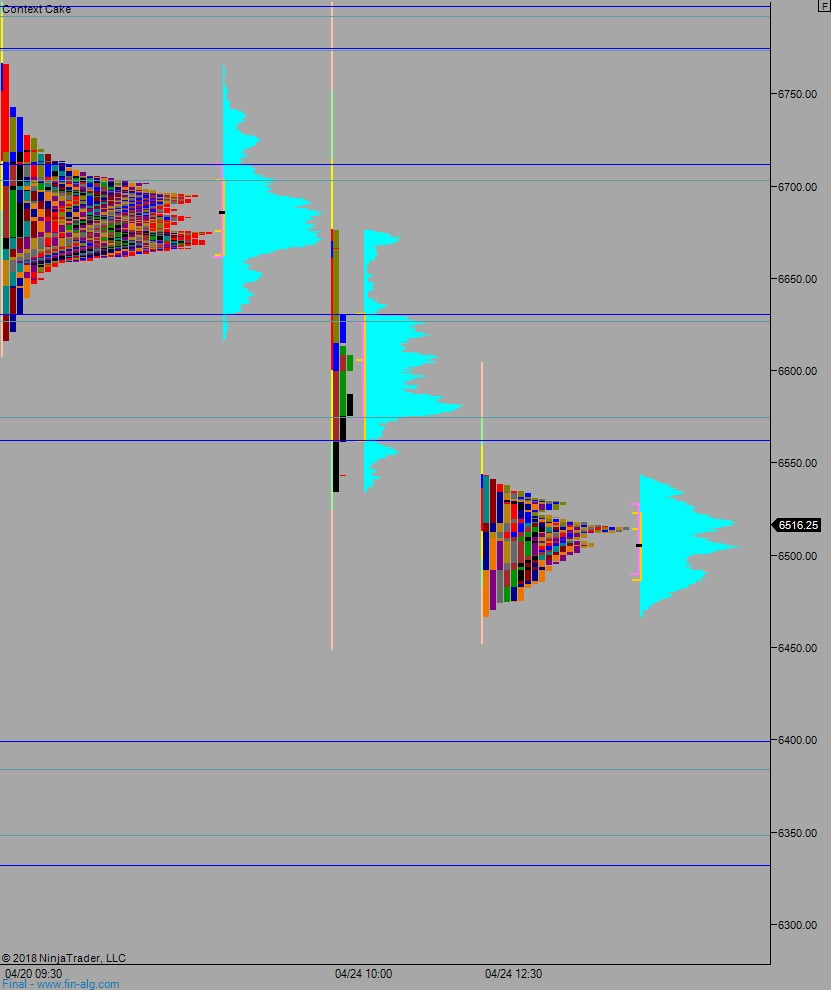

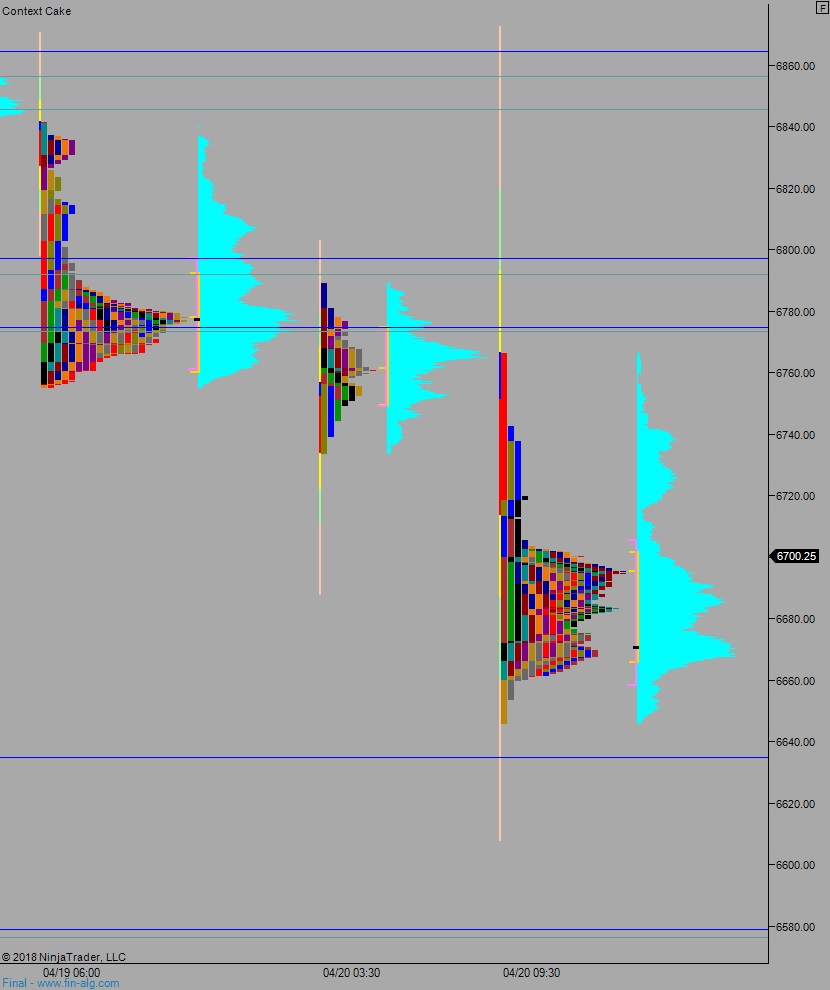

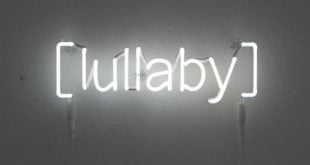

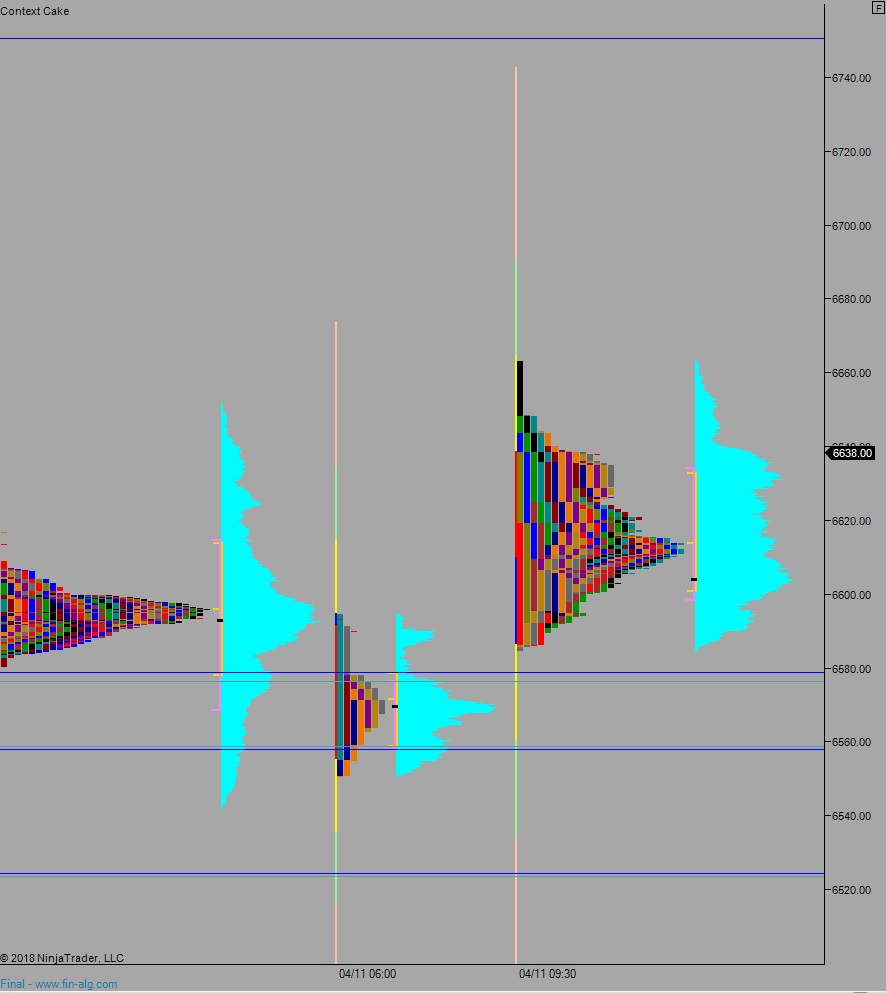

Yesterday we printed a normal variation up. The day began with sellers driving the market to a new weekly low. This discovered a responsive bid early in the day and we spent the rest of the day chopping sideways before ramping higher into the bell.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6554.75. Look for buyers around 6532.25 and two way trade to ensue.

Hypo 2 buyers sustain trade above 6631 setting up a short squeeze up to 6700.

Hypo 3 sellers regain Thursday range, sustaining trade below 6532.25, setting up a move down to 6500.

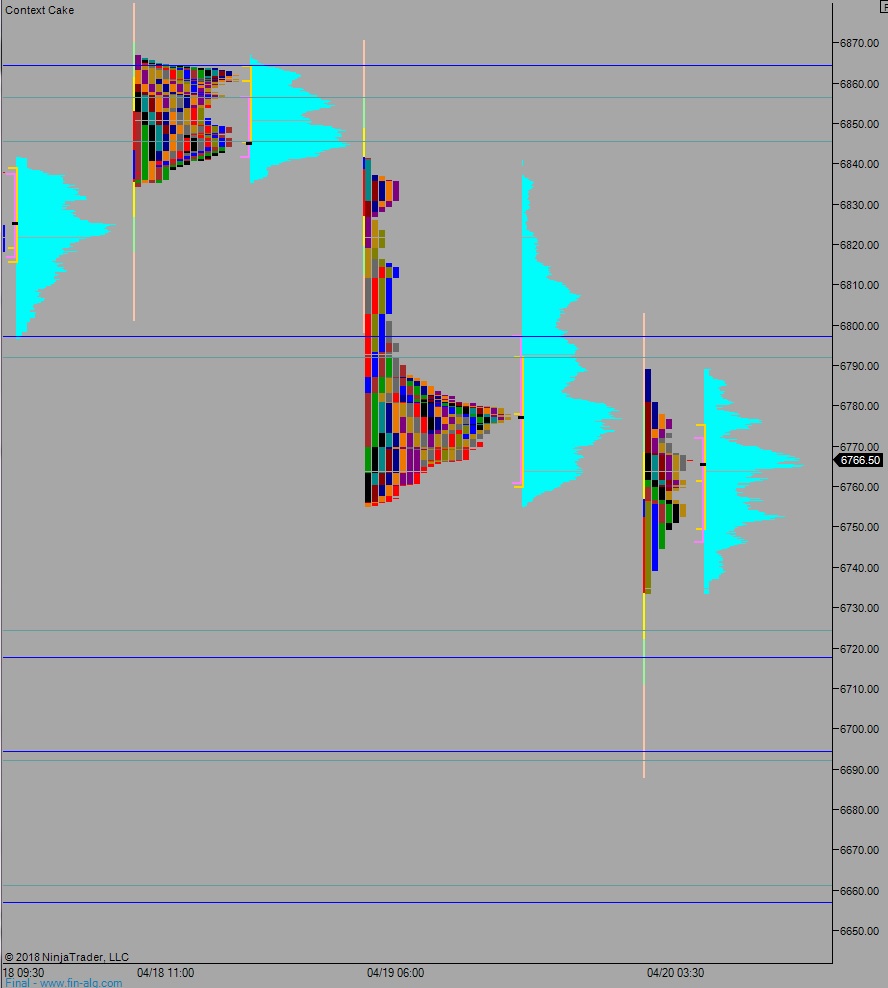

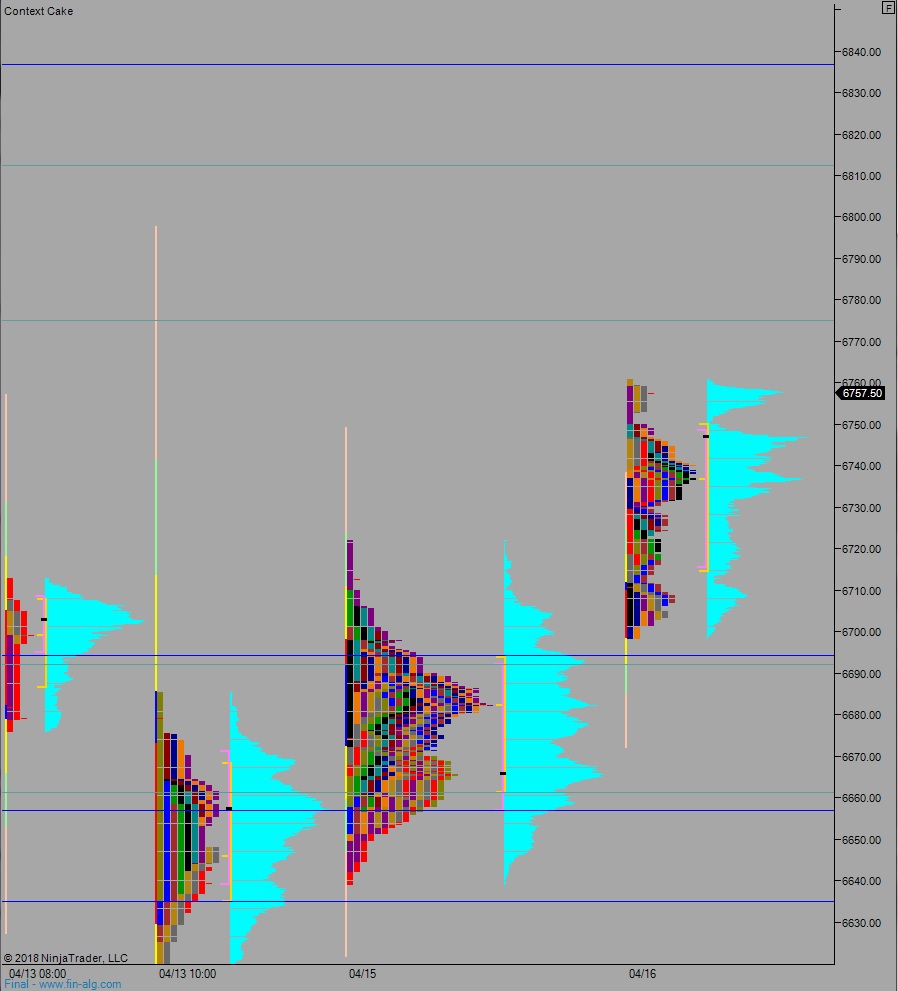

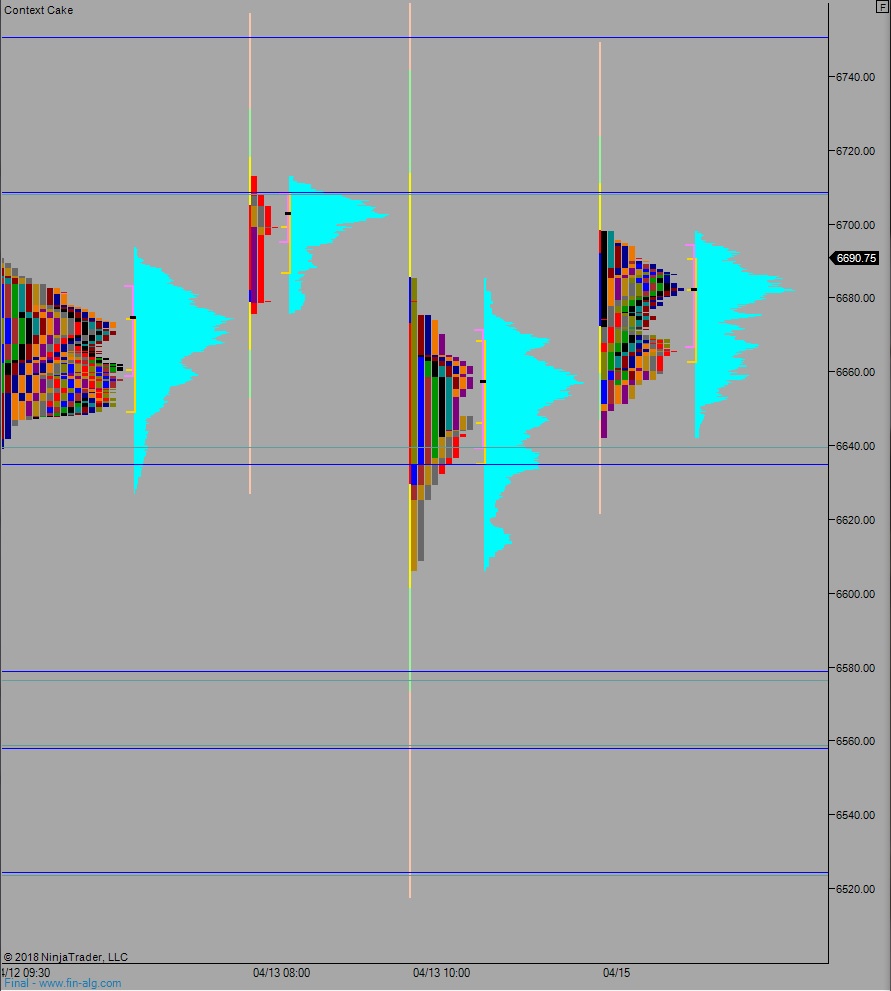

Levels:

Volume profiles, gaps, and measured moves: