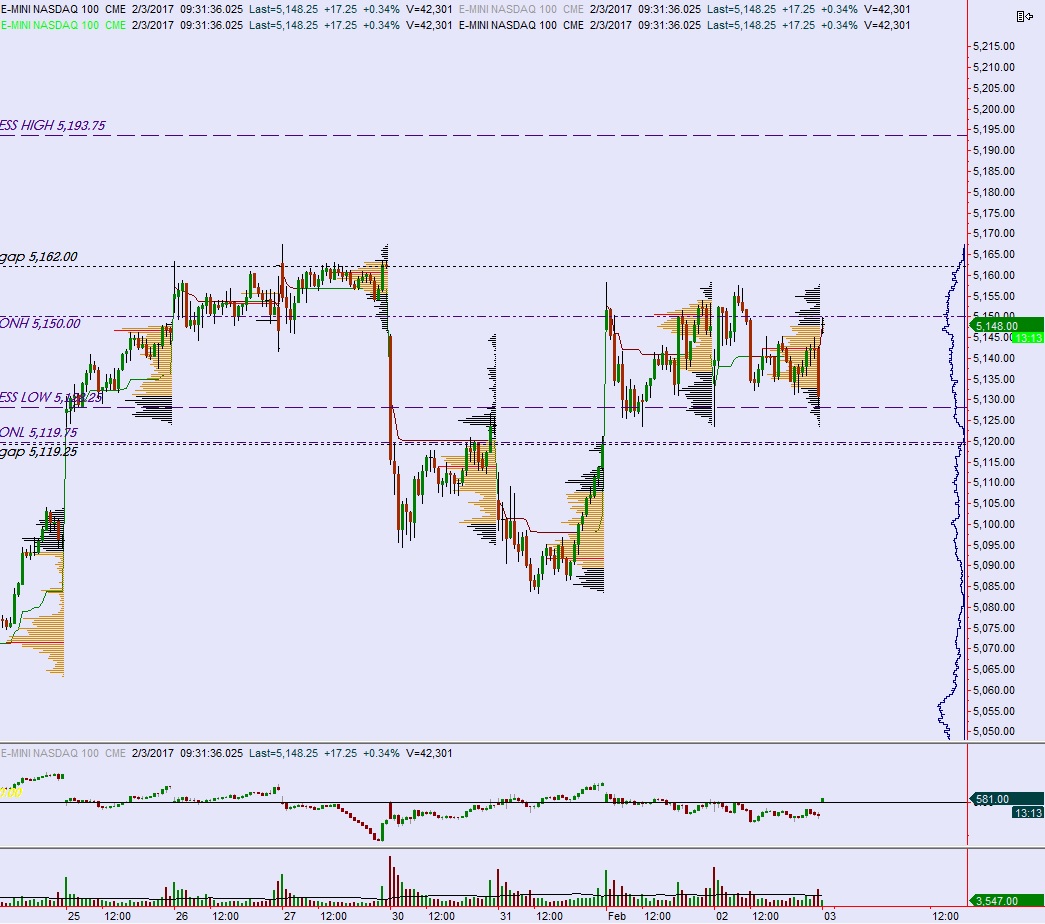

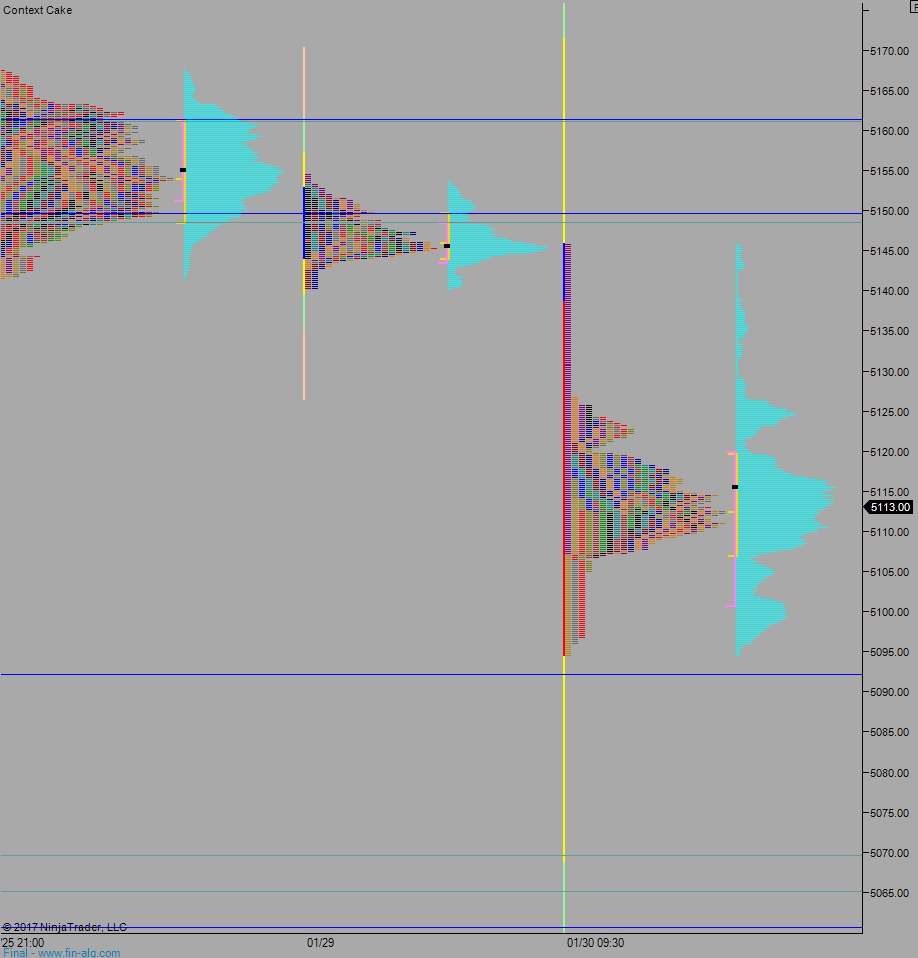

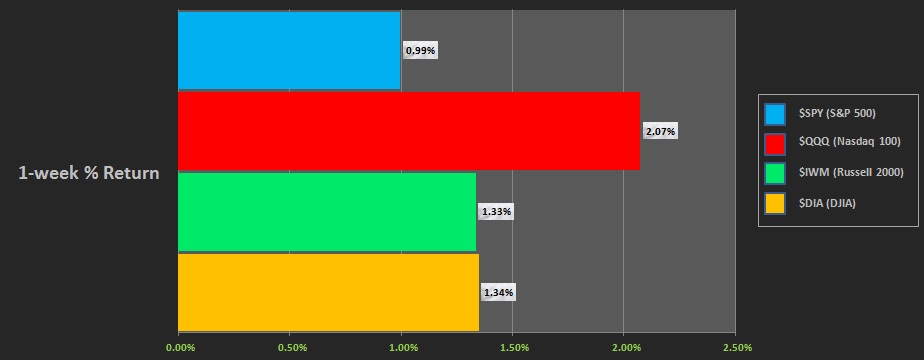

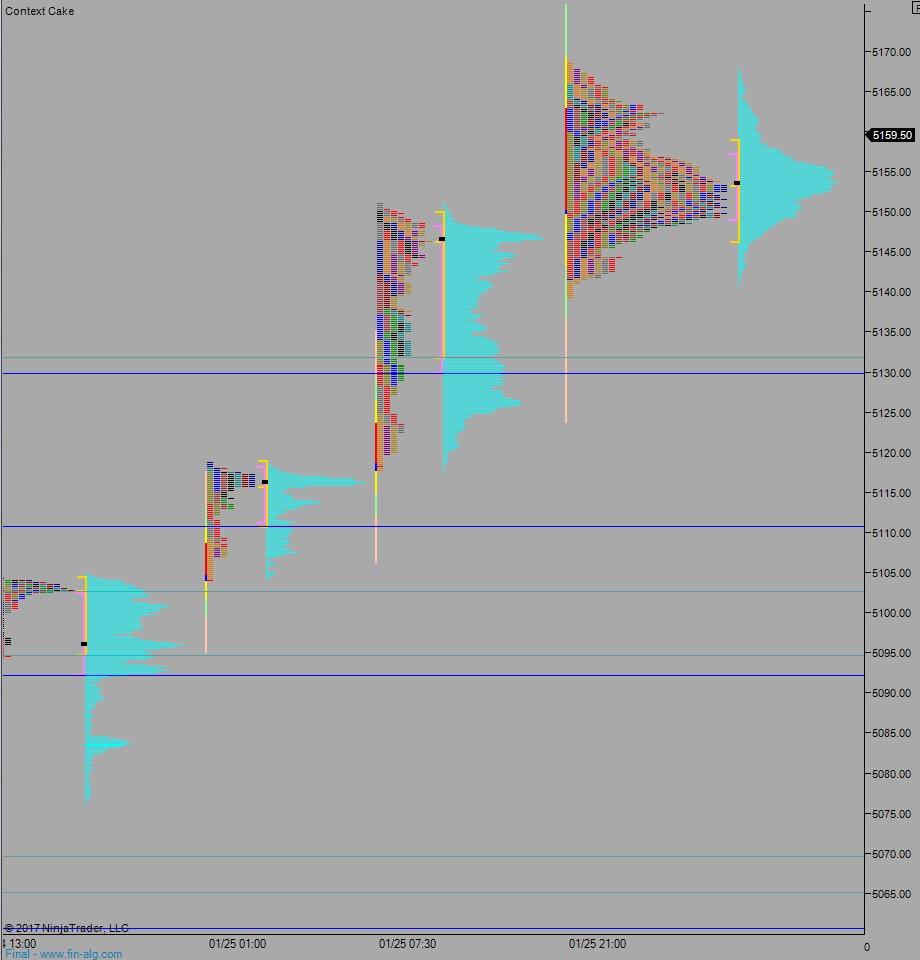

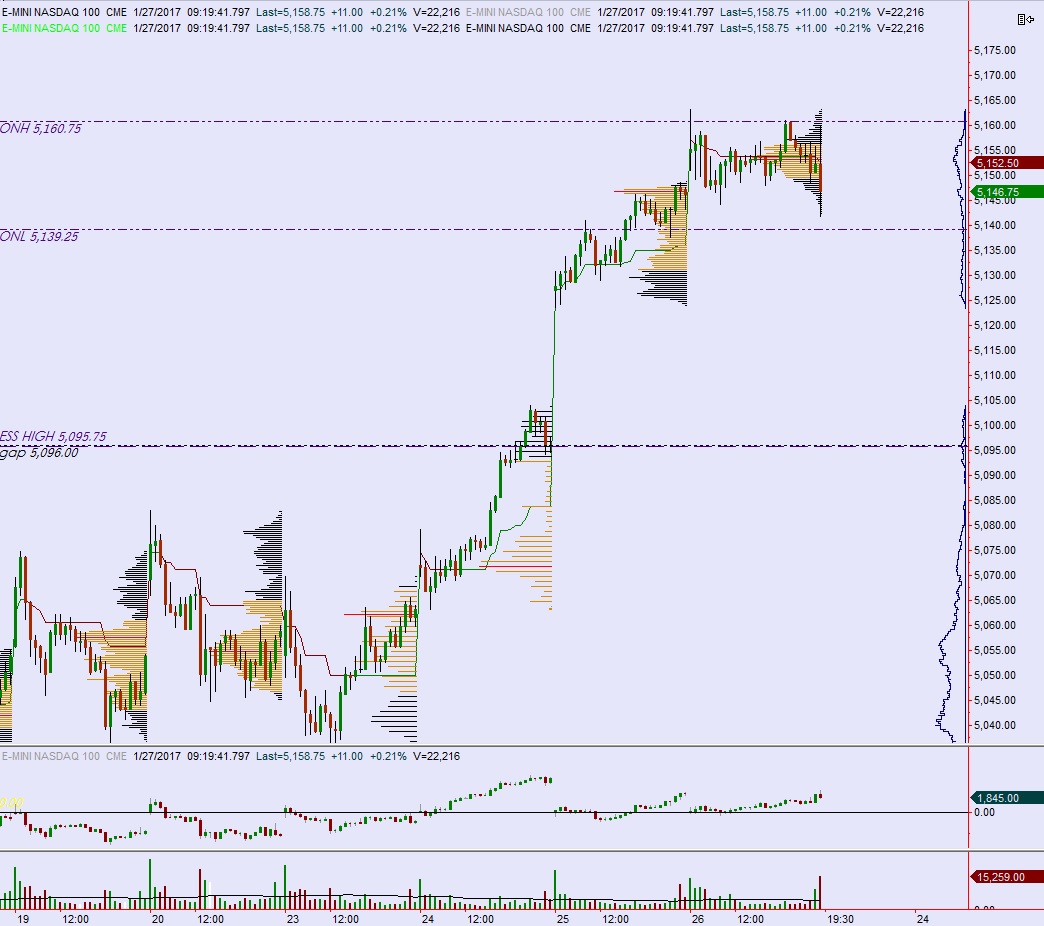

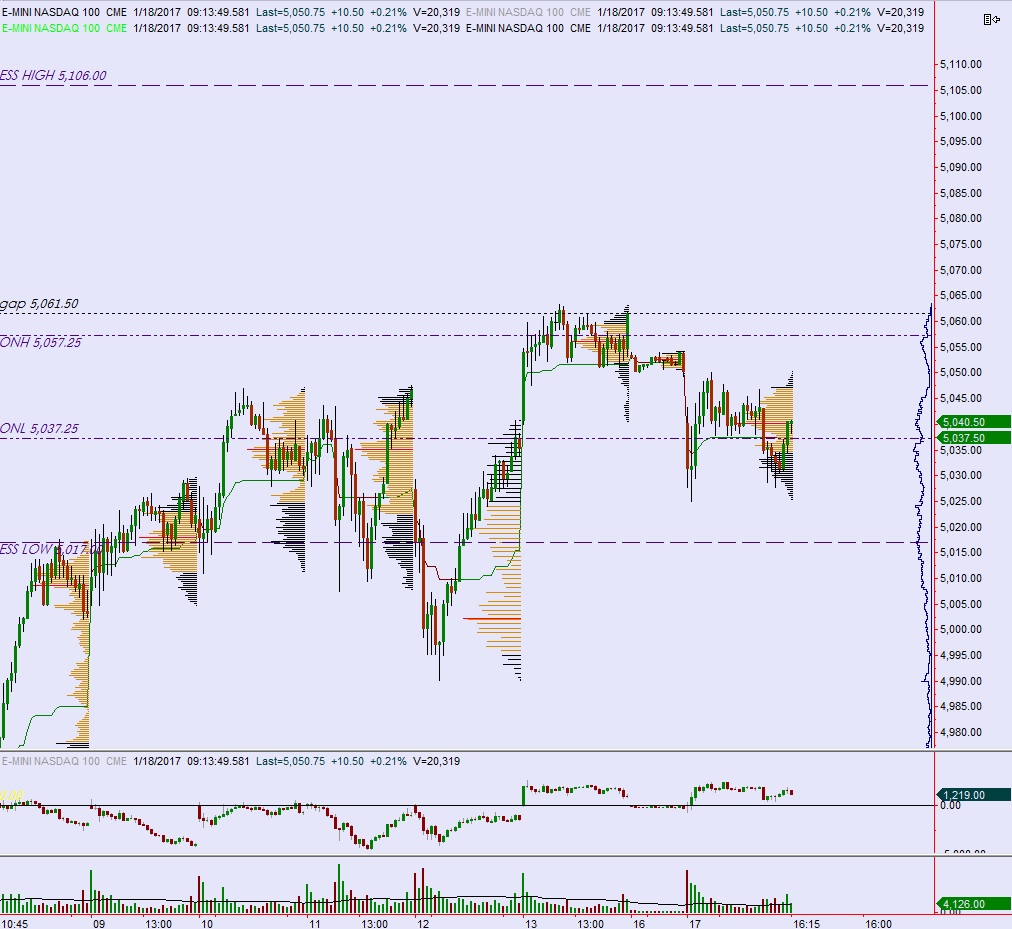

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price worked lower, down through the Thursday low briefly before rallying through the night. At 8:30am Non-farm Payroll data came out mixed.

Also on the economic docket today we have ISM Non-Manufacturing composite and Factory Orders at 10am, followed by the Baker Hughes rig count at 1pm.

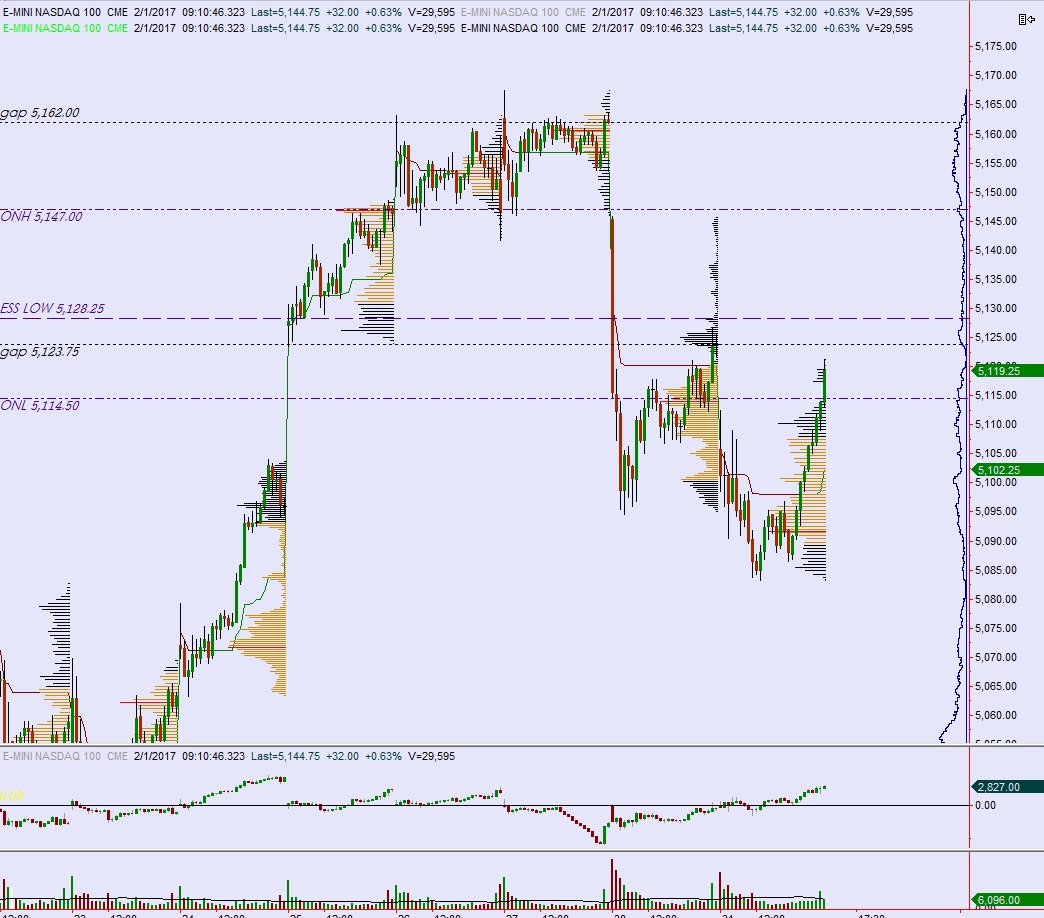

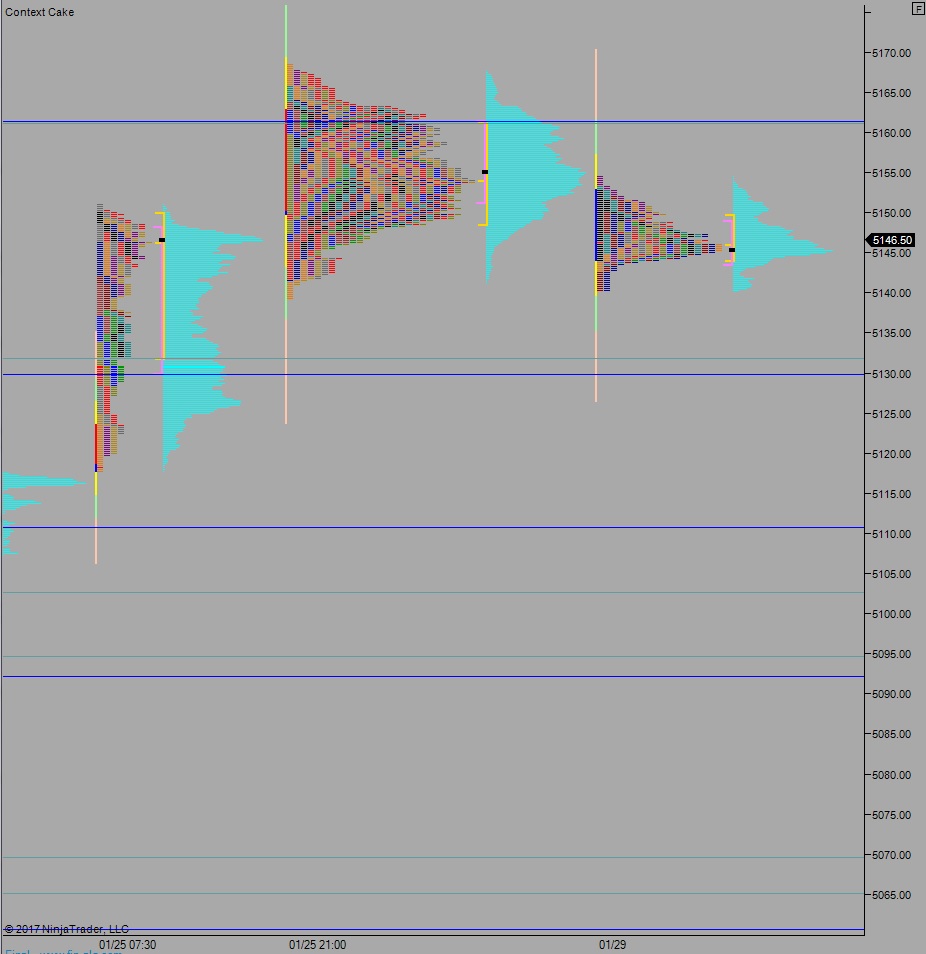

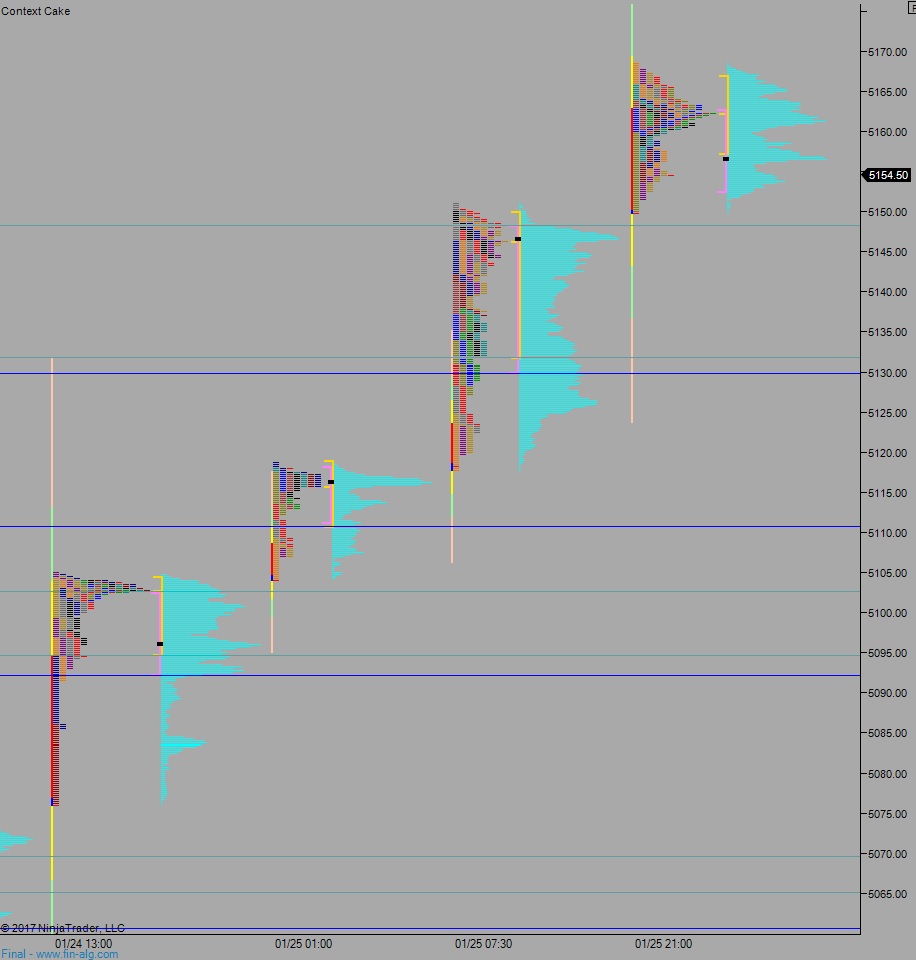

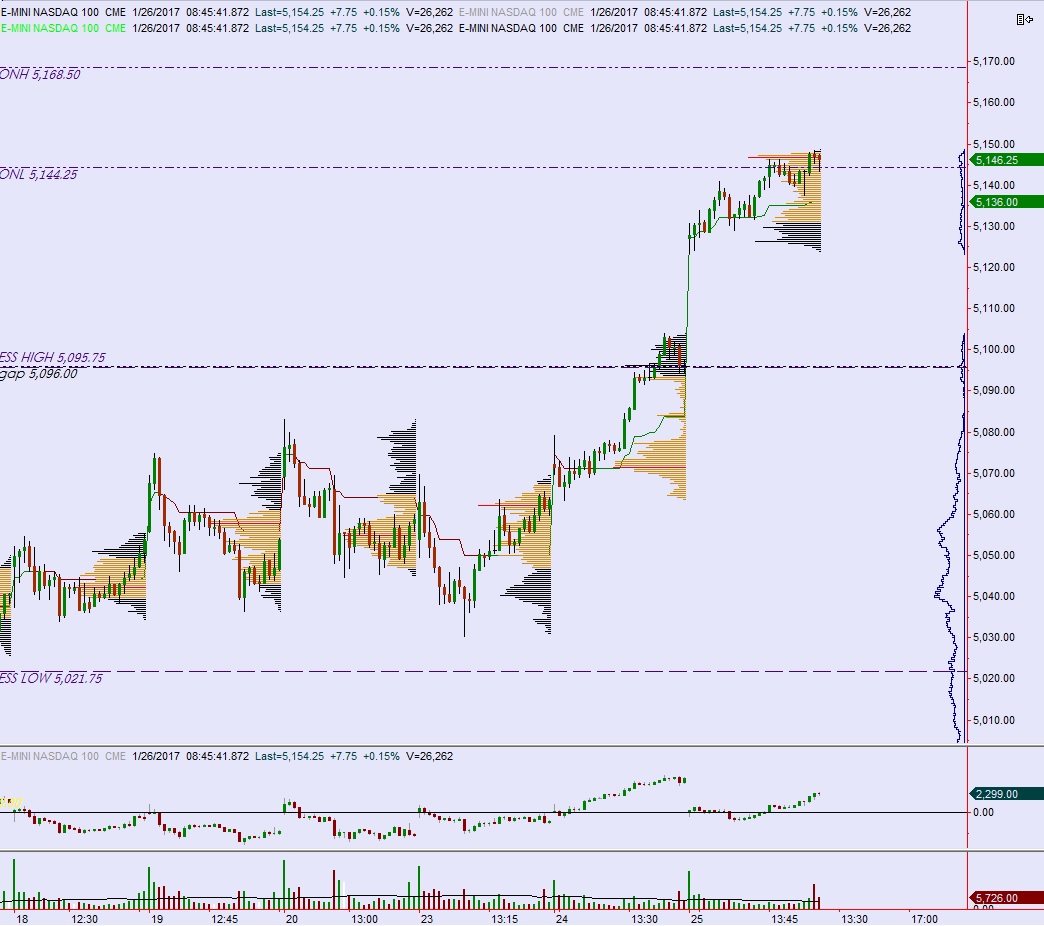

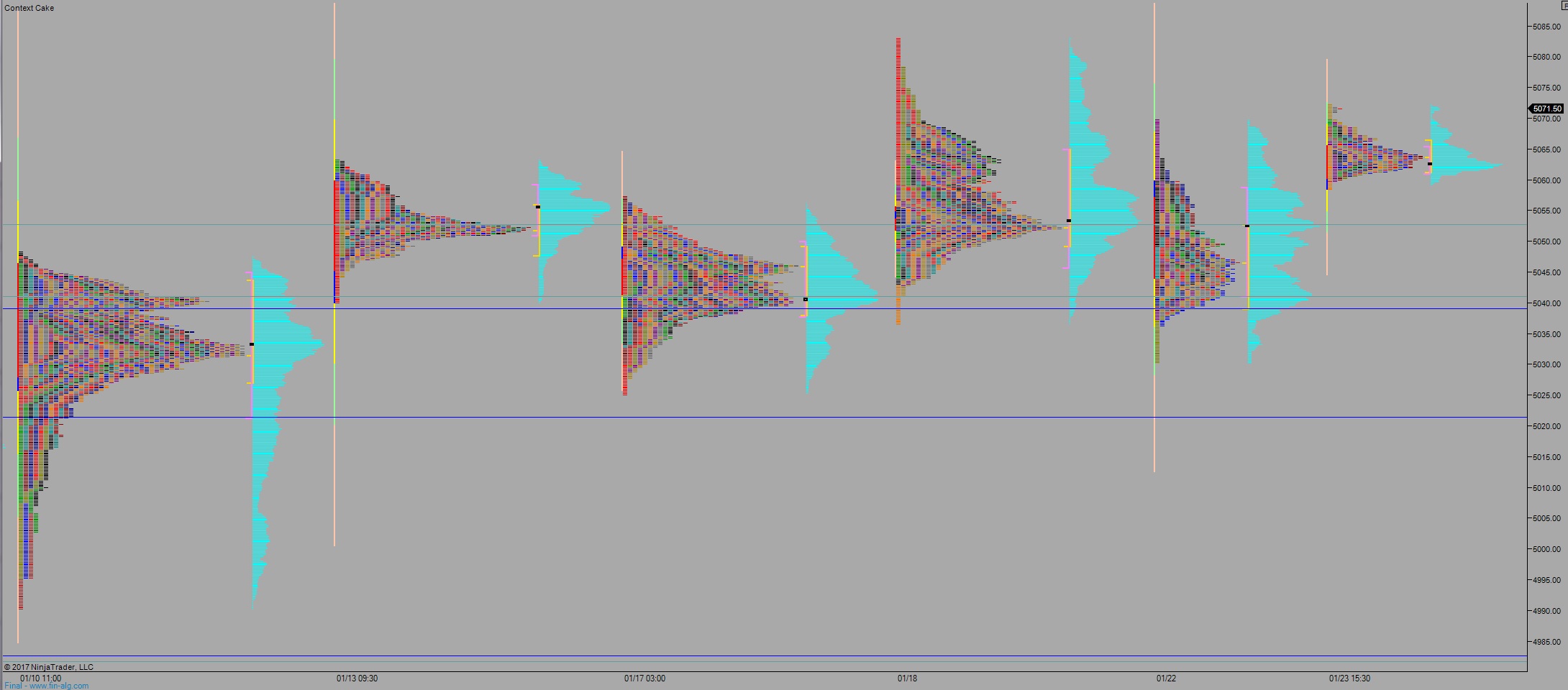

Yesterday we printed a normal variation up. Price opened gap down, could not penetrate the Wednesday low but instead rallied all morning. WE stalled inside of the Wednesday range and balanced out, printing an inside day.

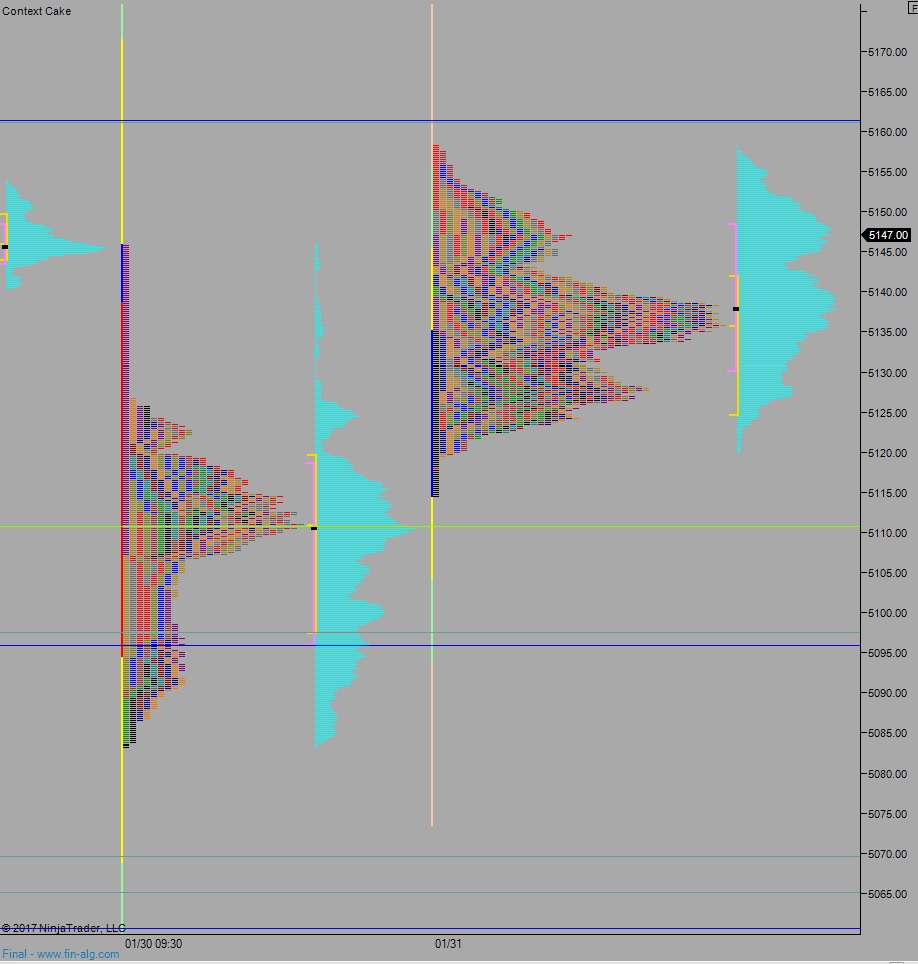

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5130.75. Look for buyers down at 5125 and two way, calm, peaceful trade around 5137 as we head into the weekend.

Hypo 2 squeeze up though overnight high 5150 to target the open gap at 5162 before we balance out.

Hypo 3 strong buyers sustain trade above 5162 staging a rally. Stretch target is 5193.75 then 5200.

Levels:

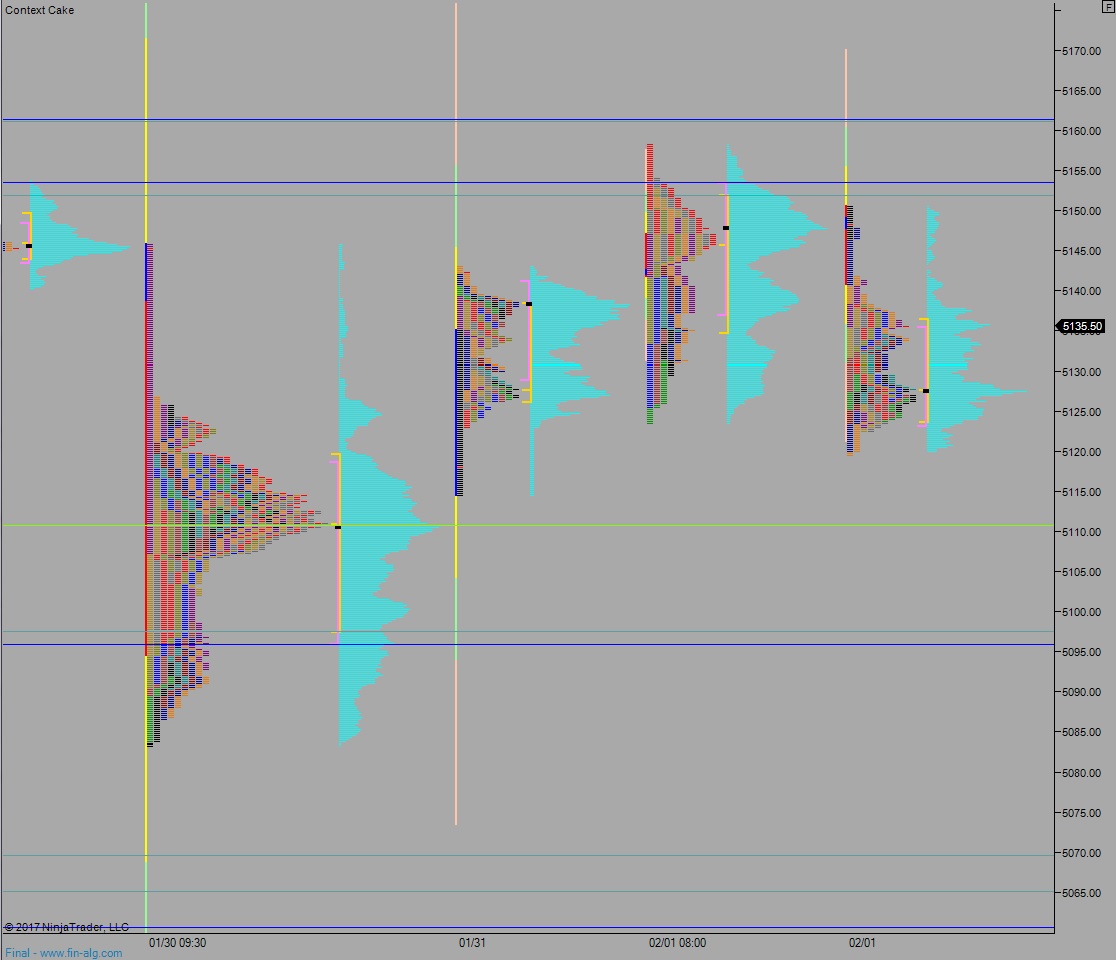

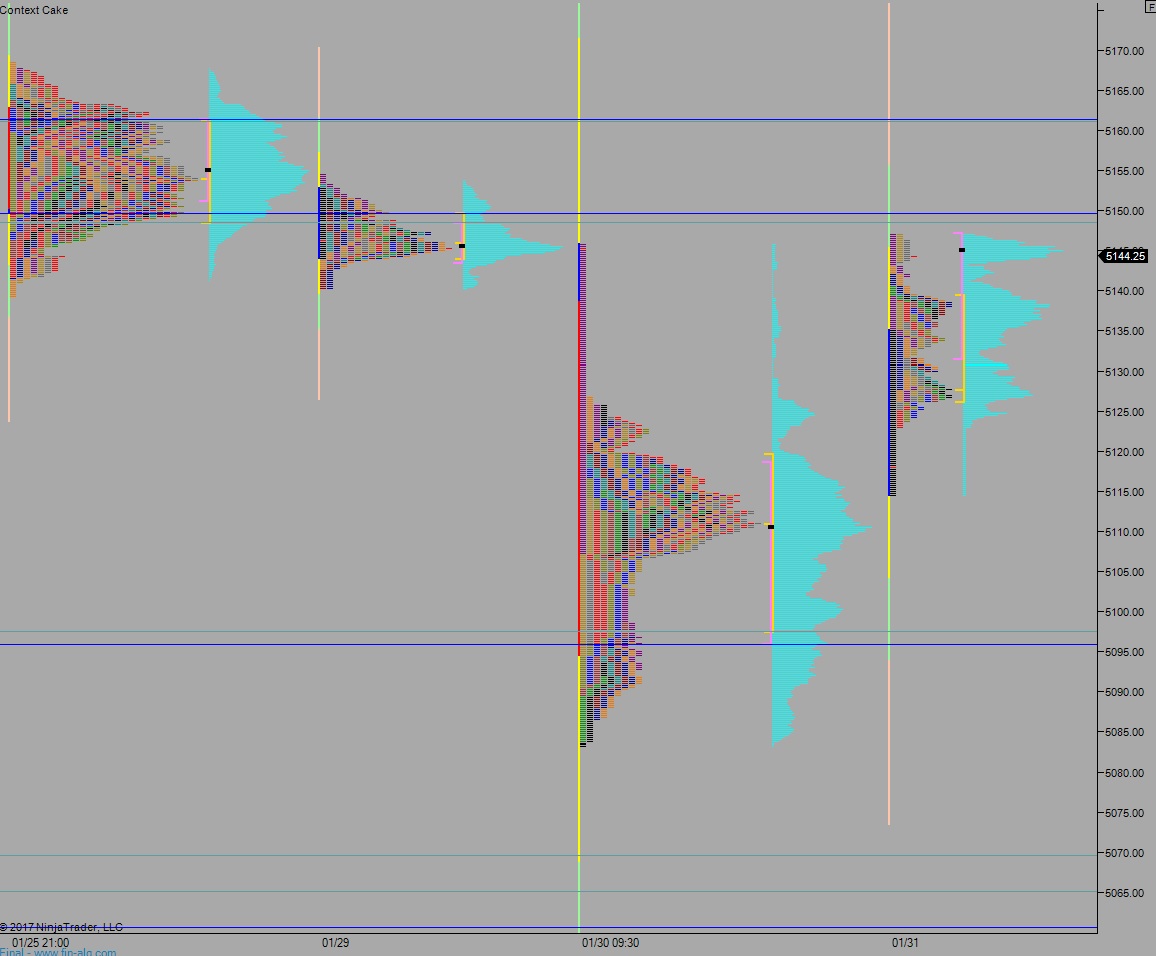

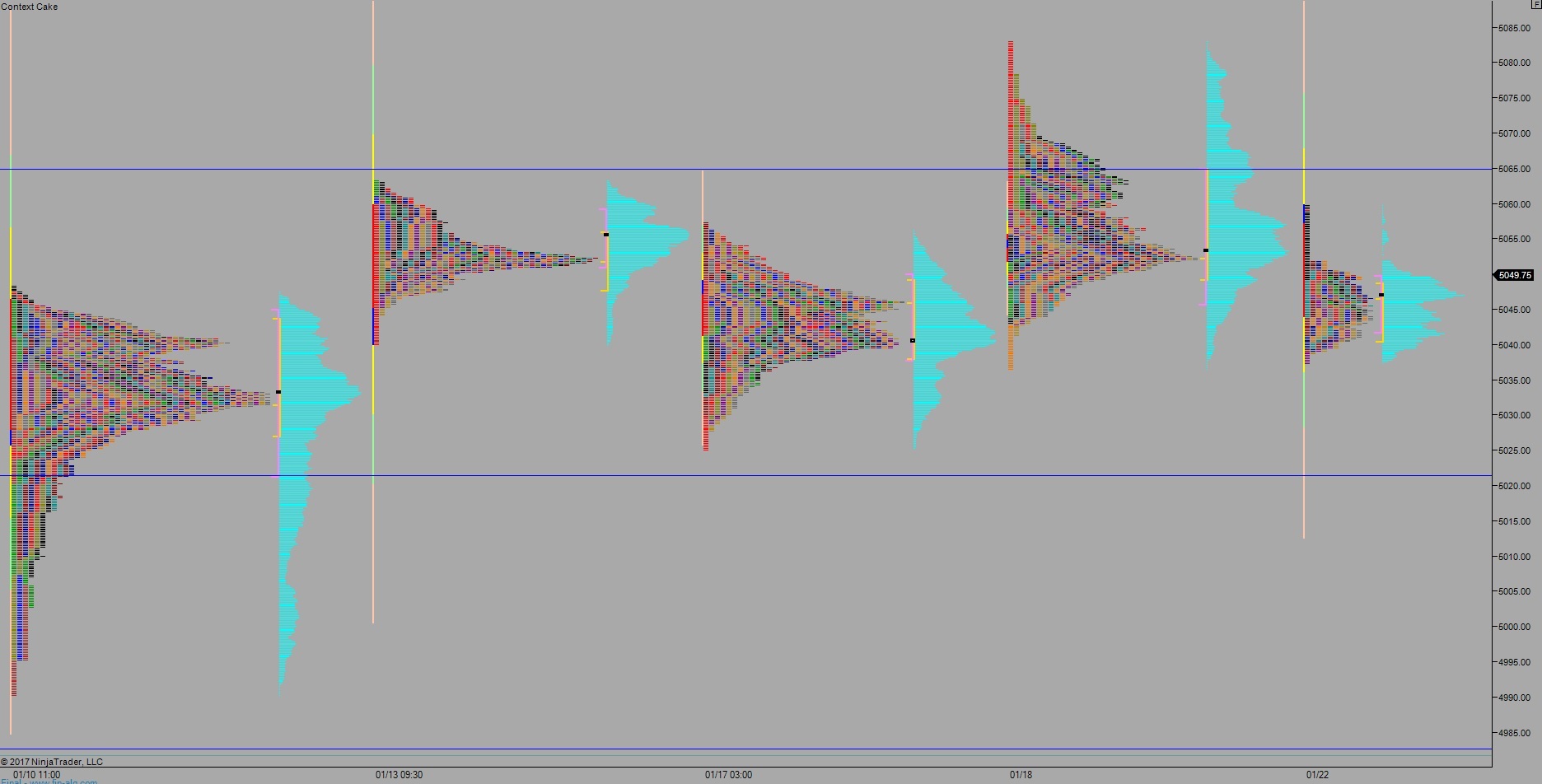

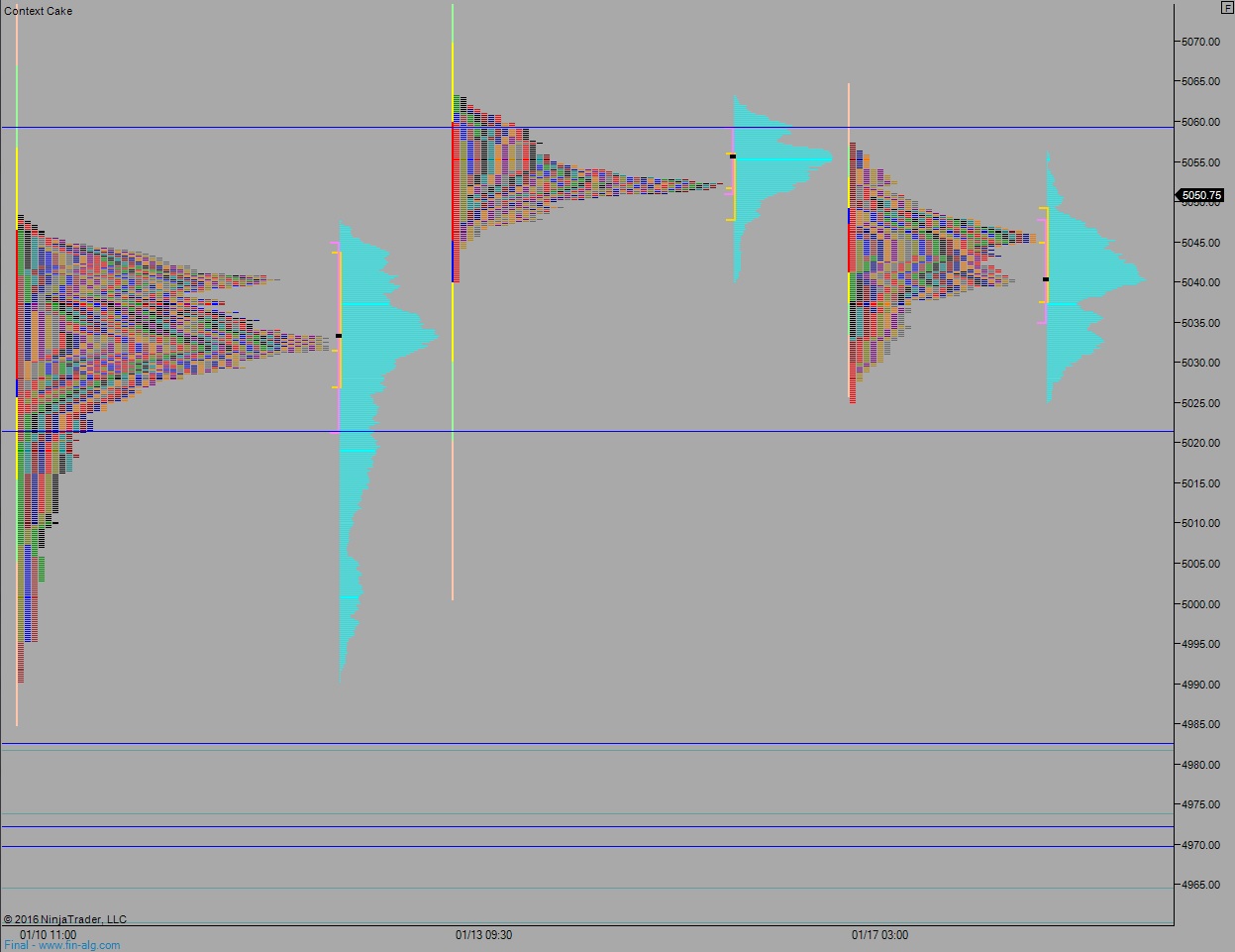

Volume profiles, gaps, and measured moves: