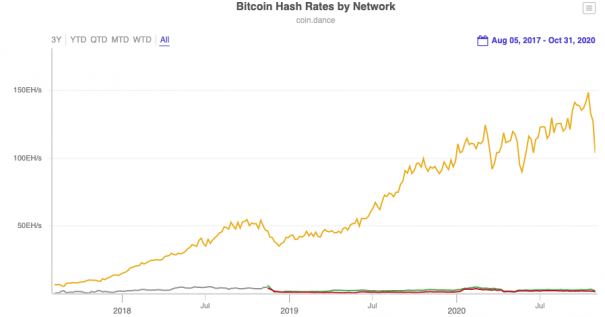

Brief weekend update on BTC. Network Hash has collapsed by 30+% resulting in high fees and very slow transactions. The reason for the hash collapse? Chinese miners who rely on hydro power are no longer receiving plentiful cheap energy as China enters the dry season. The increase in energy cost results in less profitable miners shutting down and a collapse of hash rate. This seasonal adjustment recurs every year although you can see the cycle is more dramatic each time.

If miners turn their machines off because electricity is more expensive this results in less processing power, delayed transactions and higher fees. Examples below:

Play small block games, get small block prizes. https://t.co/YK6MZlPugm

— Coinspeak (@coinspeak_io) October 31, 2020

Fees on BTC (if you want your transaction processed in 20 minutes you’d pay a $8.30 fee with some people are paying over $100):

$13707.12 (1 usd = 7295 sats)

340 sat/B ($8.30) – 20m

324 sat/B ($7.91) – 40m

281 sat/B ($6.86) – 60m

268 sat/B ($6.54) – 4h

111 sat/B ($2.71) – 8h

62 sat/B ($1.51) – 24h

3 sat/B ($0.07) – 3d

1 sat/B ($0.02) – 7dblocks 654899

— Bitcoin fees (@coinyfees) October 31, 2020

BTC vs BSV fees. While BTC fees are over $8 for a 20 minute transaction BSV is running zero confirmation instant transactions for less than a penny.

While this issue on BTC is temporary and relief should come in ~3 days when the network adjusts for the new lower hash rate the problems shows the precarious nature of the BTC network and small blocks. Any increase in transactions or reduction in hash results in a slow and expensive network that is unusable for all but the super rich or super patient.

Shockingly, the BTC team thinks this is what Satoshi intended when he designed Bitcoin.

Never interrupt your enemy when he is making a mistake.

-Napoleon

Finally, here is a rich bit of comedy gold showing how disconnected the BTC crowd is from Bitcoin.

12 years ago, Satoshi Nakamoto dropped a 9-page bomb on the global financial system.

Happy Birthday to the #Bitcoin Whitepaper! pic.twitter.com/KO1ey6vPQI

— Edge (@EdgeWallet) October 31, 2020

If you enjoy the content at iBankCoin, please follow us on TwitterThey’re just reading from the introductory paragraph of the white paper

— Bryan Jacoutot (@BryanJacoutot) October 31, 2020

interesting point you’ve covered here– do you think that extreme hash rate events (up or down) should continue for all major chains? i’m not sure how to read them; they could be

a) part and parcel of having a global mining pool that’s exposed to all sort of disruptions–shifting Chinese electric production in this instance

b) indicative of smaller hash actors attempting to maximize profitability in the short run by switching chains with similar algo (I don’t think that SHA256 miners will flip to Scrypt because of retooling and optimization concerns)

c) trading signals–the last major BTC hash rate decline was in March and was a great time to get long, but not enough data for me to convincingly identify a trend or cause/effect

d) the once and future state–i can’t recall a stable mining pool for any one period (t>1year) in most data i have access to

interested to hear takes on this

btw, great post but a bit of constructive criticism: plz cut this blatant BSV propaganda, by selectively talking about unimportant lawsuits and names you’re really revealing personal bias that’s painting your good work wrong–while it’s not quite at the level of BTC maximalists, it’s getting there–all chains have stupid and unproductive McGuffins (typically the most litigious and loud crowds) there’s no reason to pretend like one side is winning or more righteous this early in the game. IMO, we can make hay with a number of chains without lining up to die on any one moron’s hill–crypto isn’t zero sum…yet

Constructive criticism noted. However, I am taking the position BSV consumes all. It’s BSV or bust. You’re welcome to disagree but I don’t see any objective reason to alter that course. And, with the markets so far off the mark, it’s not easy.