Bitcoin is facing it’s own Brexit. Here’s what you need to know.

Similar to US Government, Bitcoin has three branches governing it: Developers (Legislative), Miners (Executive) and Users (Judicial).

Legislative power: The Developers create new code (Laws).

Executive power: Miners run the version of Bitcoin that is in the best interest of Miners. They can work with any party of Developers they choose, even if those Developers are not status quo.

Judicial power: Users choose to buy or sell Bitcoin (affecting supply/demand/price) including any versions created in a hard fork.

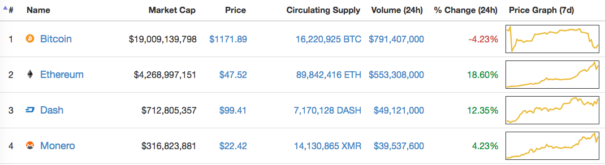

This is important because the three branches of Bitcoin are at war right now. A powerful subset of Miners are threatening to force a hard fork of Bitcoin. Think Apple splitting into two companies: Apple and Orange. Which stock would you buy and which stock would you sell? Now you are thinking like a user of Bitcoin.

The arguments between branches are so ridiculous that Vinny Lingham sold 90% of his Bitcoin and is encouraging other Users to defend Bitcoin by selling now to put pressure on Miners. An example of a well known User exercising proactive Judicial power.

If this subset of Miners cause a contentious hard fork it means consensus could not be reached. A contentious hard fork is like a big fat VETO by the Miners. It’s bad for Bitcoin and confuses the market.

If a hard fork happens the Users (Judicial branch) will settle the matter via price discovery (demand being the ultimate arbitrator, like the Supreme Court). I believe the fork of Bitcoin called Bitcoin Unlimited will die off. The cost will be substantial and there will be no winners, only survivors.

Despite the damage, Bitcoin will bounce back quickly. Bitcoin has been declared dead so many times it’s truly an example of “What is dead may never die.”

I am still long.

Comments »