On May 14th several BTC users paid transactions fees over $1,000. Let’s dig in on how this is happening.

Here’s a random screenshot taken at 1215PM EST on 05/15/2020 from this website: https://blockchair.com/bitcoin/transactions

Notice the columns in red. Inputs and fees are correlated. BTC users are paying ~$2 per input used in a BTC transaction.

BTC is a shared ledger. Every BTC transaction has a number of inputs and a number of outputs. If you want to spend BTC your inputs are sent as outputs and the fees (currently) are ~$2 per input spent. The more inputs used to spend your BTC the more space your transaction takes on the BTC blockchain and the higher the fee.

Think about it as you have a wallet with three $20 bills. Each $20 bill is an input in your wallet waiting to be spent. If you want to spend those three $20 bills (three inputs) it will cost you ~$2 in BTC fees per bill (input) spent. Let’s say you want to buy an item for $50. You give the cashier three $20 bills (three inputs) and there are two outputs, the $50 you paid and the $10 in change you receive. Using BTC, this would result in ~$6 in fees to spend $50. This is not sustainable.

BTC proponents like to point out when millions of USD are moved on BTC for a transaction fee of $2 but they never mention when someone pays $6 to move $50, or $1,000+ for a single transaction that consolidates a large number of inputs.

This is a very expensive fee to use a very small amount of data on the BTC blockchain.

Why does this happen? Because BTC has a 1MB blocksize. This means BTC can only process ~1MB in data roughly every 10 minutes. The cap creates a fee market where users compete to pay for the privilege of using the 1MB BTC blocksize. This fee market makes BTC expensive to use in majority of cases and completely broken in times of heavy usage.

You’ll hear that BTC is a “Store of Value” and “digital gold”. Many talking heads in BTC claim these fees are good for the network. But look behind the people promoting this narrative. Their companies (or themselves) are financially tied to BTC operating in a limited fashion with high fees. Blockstream, the main company responsible for BTC’s direction the past several years, is based on selling products that take advantage of these expensive BTC fees.

Read the Blockstream whitepaper for yourself: https://blockstream.com/sidechains.pdf

What did Blockstream say when BTC fees last exceeded $100?

Personally, I'm pulling out the champaign that market behaviour is indeed producing activity levels that can pay for security without inflation, and also producing fee paying backlogs needed to stabilize consensus progress as the subsidy declines. - Greg Maxwell, Blockstream CTO

Translation: high fees justify limiting BTC to create a marketplace for Blockstream products.

Here are your Blockstream products:

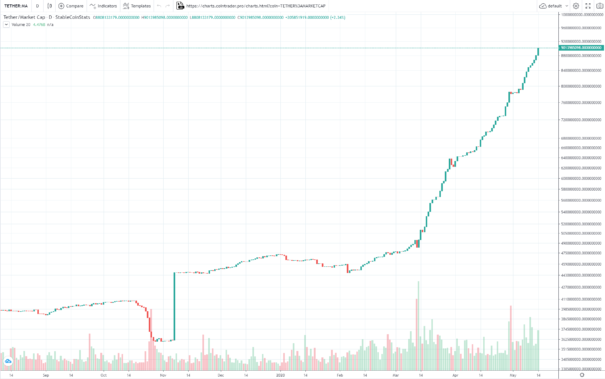

If what I’m saying is true, why does BTC continue to appreciate in price? I don’t know, but I have a hunch it has something to do with this Tether chart.

Don’t trust anyone, including me. Fact check what I’m saying.

Summary: the investment thesis of BTC is that this artificially limited and expensive to use network will be adopted globally because BTC is a Store of Value and/or digital gold. Please ignore that BTC cannot scale without third party products that financially reward those in direct control of BTC development.

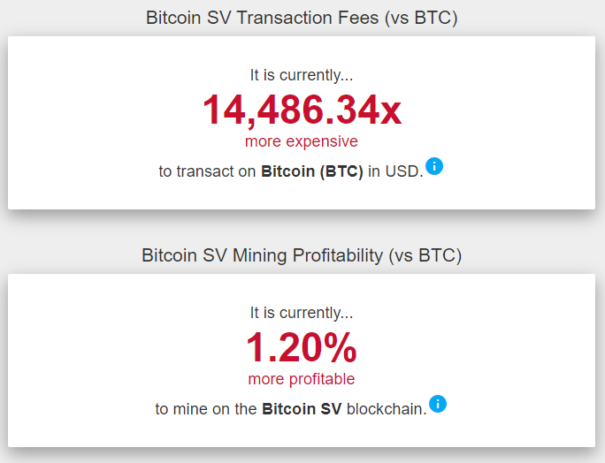

Let’s compare BTC to BSV. First, here’s a comparison of BTC fees vs BSV from coin.dance

BSV fees are generally under 1 cent vs BTC fees of ~$2 per input spent.

But how can BSV operate with such low fees? BSV is scaling to millions of transactions per 10 minutes. The goal is exceed Visa volumes in the near future. At scale anyone can spend BSV, includuing making micropayments on the Internet, for nearly zero fees. At scale BSV will survive off fees as the Bitcon block reward continues to halve every four years. BSV is scaling for the world to use, no third party products needed.

This makes BSV a stable and inexpensive platform for commerce and application development.

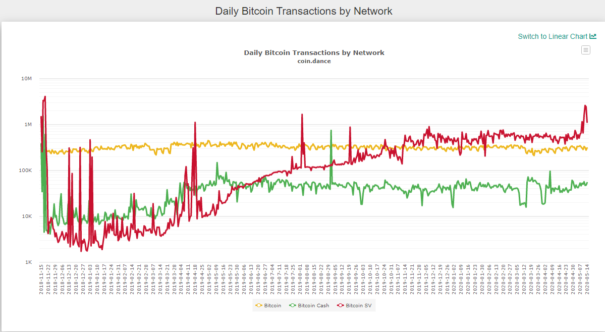

Let’s look at transactions (algorithmic chart). BSV in red. BTC in yellow.

BSV can handle orders of magnitude more transactions than BTC at orders of magnitude lower fees.

Summary: BSV is positioning for high volume and low fees. BTC is positioning for high fees and low volume.

One of these approaches has a future and one does not. Let’s see who wins.

This post first appeared on Coinspeak.io

Comments »