DOUCHE bank is going to collapse, Italy is going to stuff all of EU’s debt into it’s boot then flush it into the Mediterranean and GDPR is the canary in the coal mine that Big Data social media companies are grossly overvalued.

The Fed has put a bid under the market for 10 years. Maybe they will do it another 10 years. But today….today Crypto strikes back with gains while markets plummet. Fiat, government backed currencies are getting closer to a showdown with decentralized HARD money backed by math. So far it’s been an landslide win for Crypto.

Markets are cyclical. Every 40+ years a new asset class is birthed. Like any birth it’s messy and loud and you want to throw up. In the juvenile stage there are times when you want to shake the baby.

But for those assets that survive there is a chance at reshaping markets and even our day to day lives.

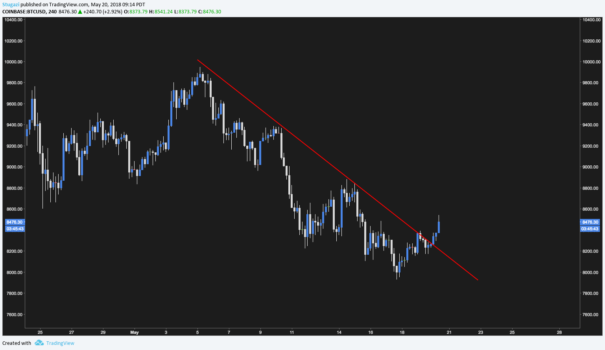

The past week Crypto suffered a dramatic correction. The correction may not be over. I am looking at charts daily to consider selling a rally. But this post is not about short term movements. This is big picture stuff….

When Fly posted about his losses in Crypto and how he’s abandoned the space I thought “perfect”. This is what is needed. We need the latecomers who got fleeced to completely abandon Crypto. That’s when smart money steps in and the new ramp begins. Tweets like this are a good sign.

There are Manias (tulips), Bubbles (beanie babies) and S-Curves (Internet). Crypto is an example of all three. At times Crypto is Manic. Remember our $1,000 daily candles? That’s insane. A rocket ship form $1k to $20k Bitcoin in 2017 definitely qualifies as a Bubble. But……if you ZOOM OUT, you start to see an S Curve. That S Curve is what you buy and the price you pay is riding out the volatility.

I detest the HODL mentality. I want to punch people in the face when I hear that word. But in the grand scheme playing Warren Buffett and holding hard money for 6+ months hasn’t failed yet.

— Stephan Livera (@stephanlivera) May 24, 2018

Sell your altcoins. The market is nearing purge mode where alts will be punished severely.

Buy the S Curve. Sell the Bubbles.

Comments »