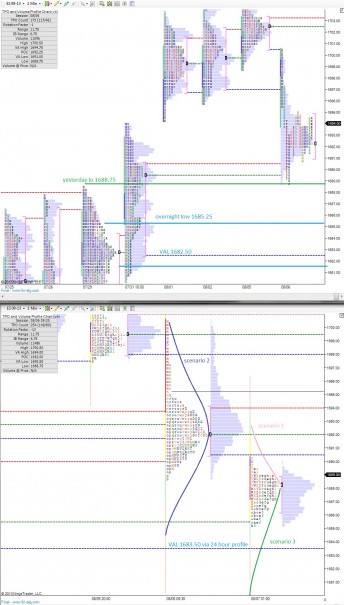

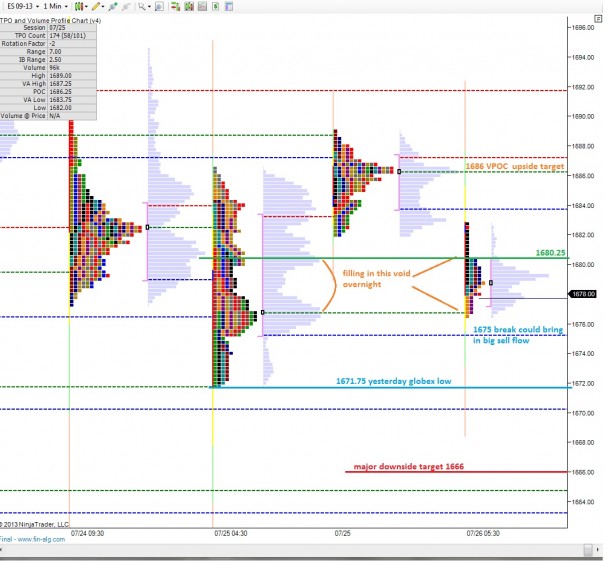

We’re seeing some follow through in the overnight hours of Tuesday’s weak trade. The sell orders began rolling in again during the Asian session and stabilized into a chop along the lows during the European session.

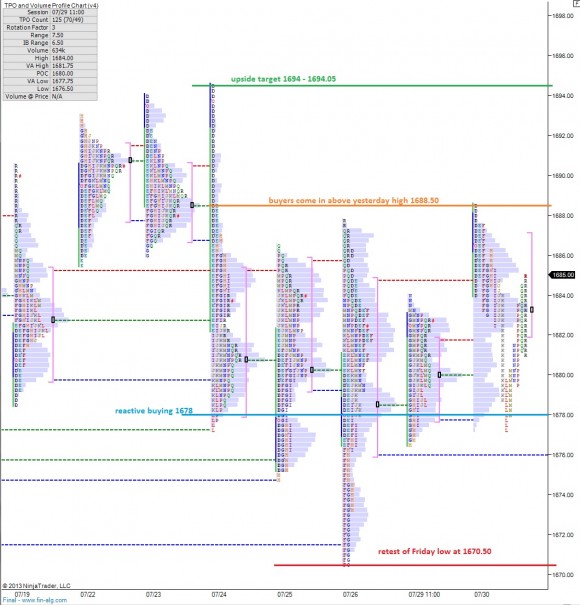

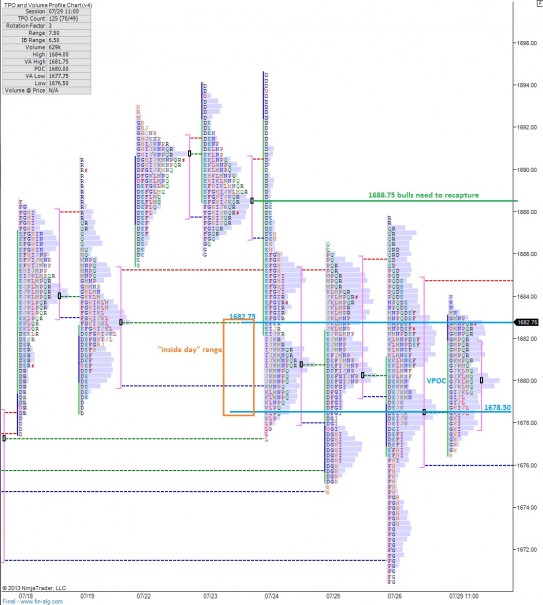

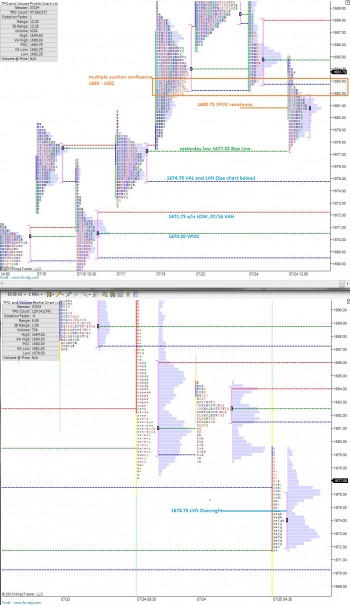

Yesterday’s cash session (RTH) shows characteristics of long liquidation, or risk off, with a long selling tail followed by the market balancing out. The auction that took place was healthy, albeit downward, putting in a good looking low at 1688.75. This level will be in play early on.

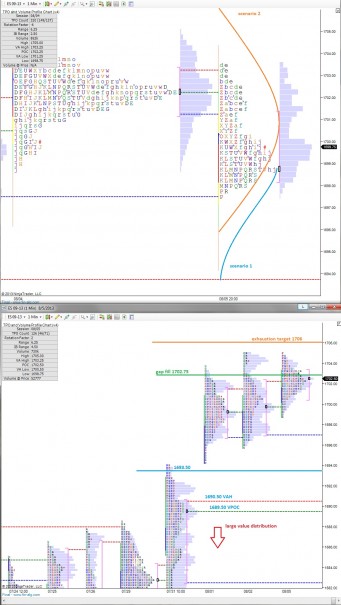

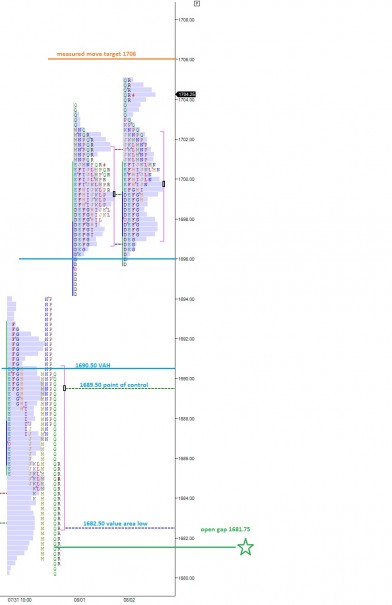

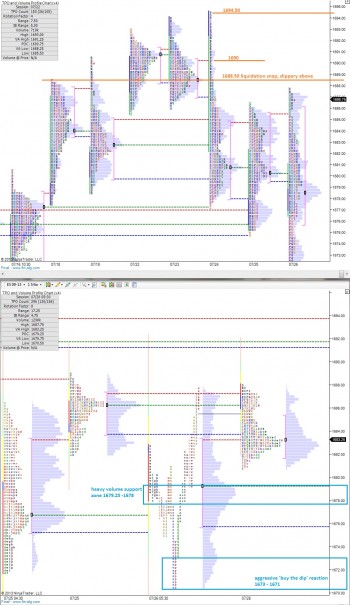

At risk to the buyers is a rotation down through the large balance area we built prior to launching to new highs. There’s potential downside support at 1683.50 then 1682.50.

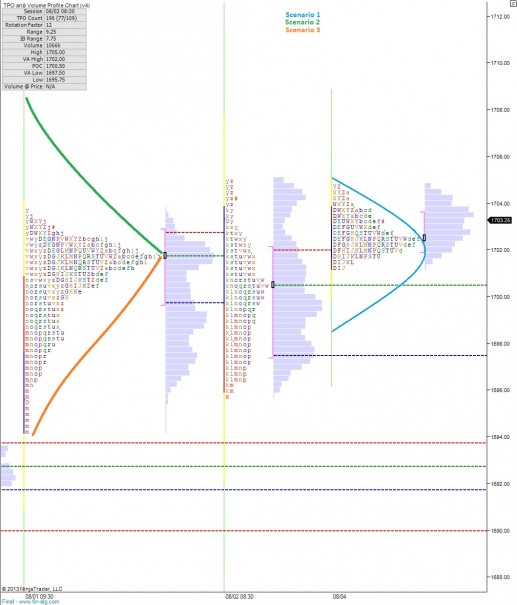

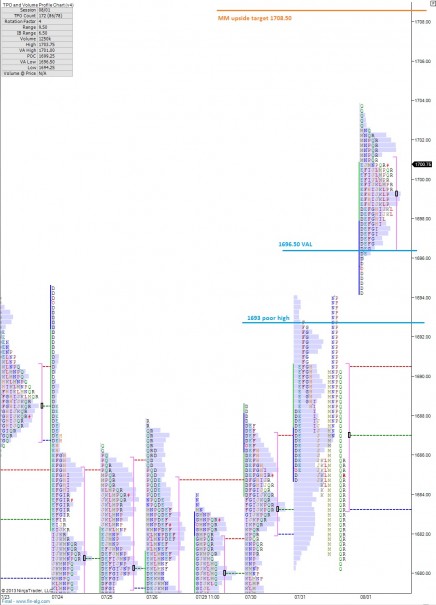

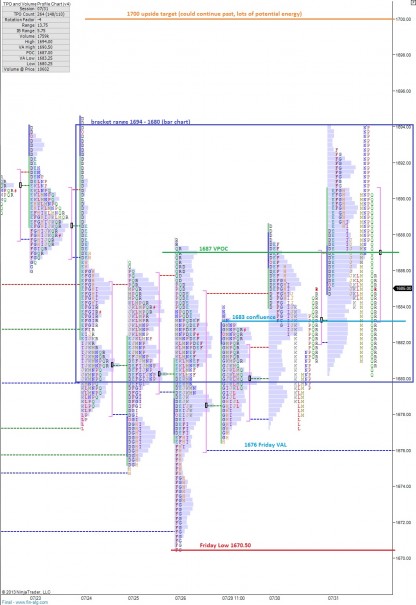

I’ve highlighted some upside observations of resistance in the following market profile charts:

Comments »