USA indices are up slightly during the globex session, despite notable weakness in the Asian markets. The NASDAQ continues to lag the S&P, The Dow, and the Russell index.

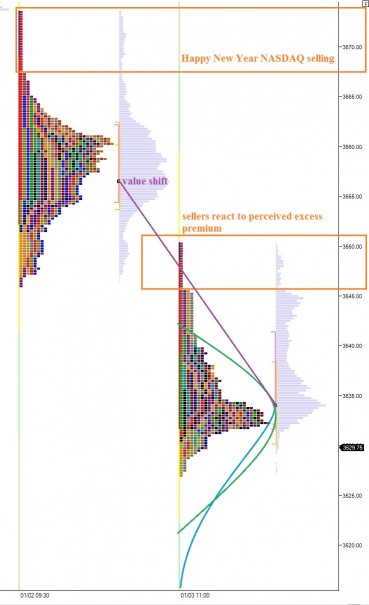

The sell flow which entered the market last week was strongest in the NASDAQ where sellers can clearly be seen reacting to perceived premiums. Their actions in the market were dynamic enough to leave selling wicks on the market profiles and also effective in driving value lower. The 24-hour profile shows this action mostly clearly, with selling wicks clear. I have highlighted these wicks, as well as two scenarios I envision for today’s trade in the /NQ_F, our futures contract for tracking the NASDAQ:

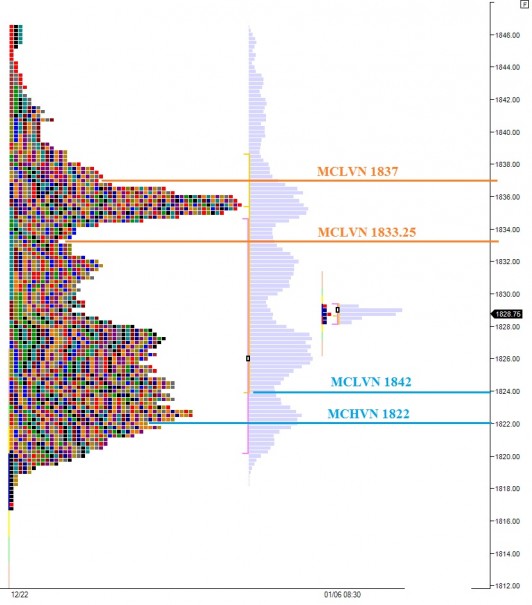

It is important, especially if you are participating in the financials trade, to keep an eye on the intermediate-term balance in the S&P 500. I have highlighted this balance on the following /ES_F chart, our futures contract for tracking the S&P 500. We can monitor the price action near these balance extremes to gauge if other time frame (long time frame) participants are increasing activity in our market. Note: they “should” be more active, as the holiday trading season comes to an end:

If you enjoy the content at iBankCoin, please follow us on Twitter