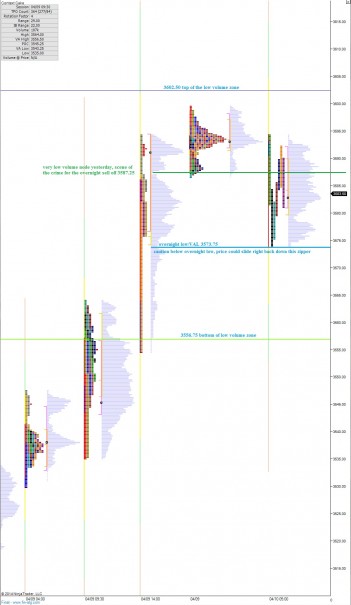

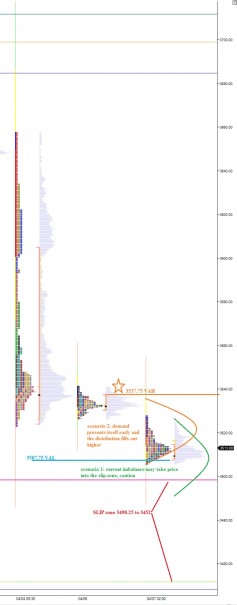

As we enter the thick of earning’s season, it becomes more important than ever to not lose sight of both the big picture and the intricate short term picture which develops before us. Overnight we saw an upward move Sunday evening which gave way to balanced, two-way trade overnight and into the morning. As the USA comes online, we are seeing sellers creep onto the tape.

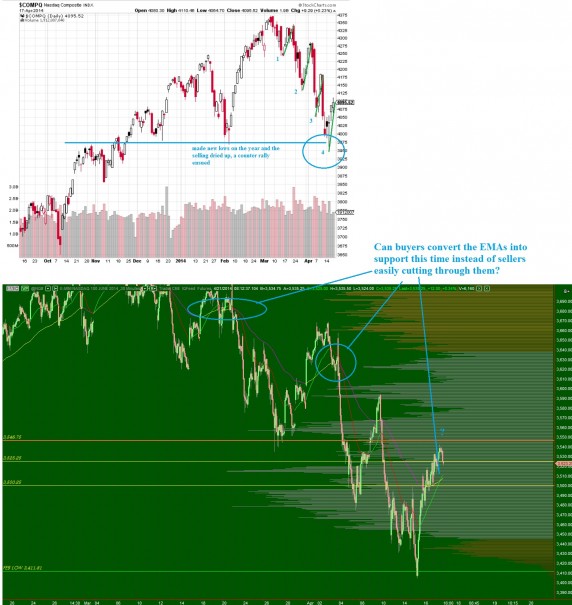

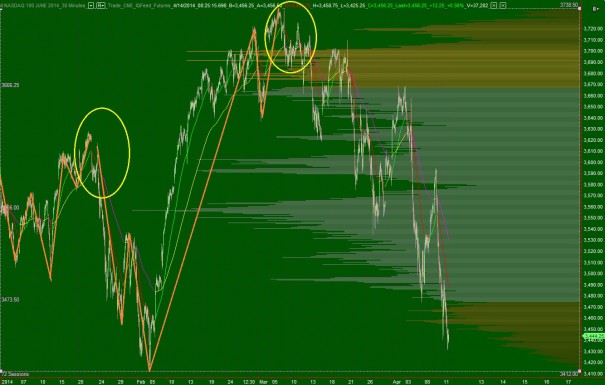

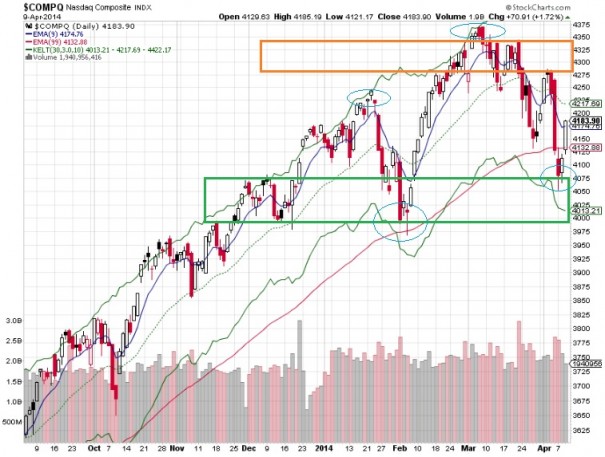

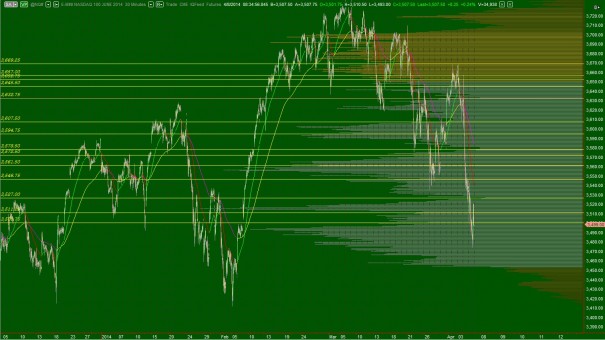

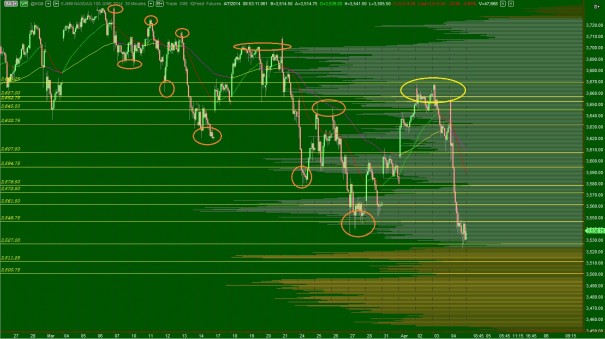

The long term auction is very interesting this week as we can see a notable change taking place. For quite some time, it appeared the long term auction was buyer controlled where it now appears balance has taken hold. Research shows the markets spend more than half their time in balance thus one must expect such an environment to return often. The question is whether buyers can build upon last week’s responsive buying. To me, it is not so important that these recent lows hold, but instead that we see equal force being applied on the market by both buyers and sellers. Here’s the current long term auction:

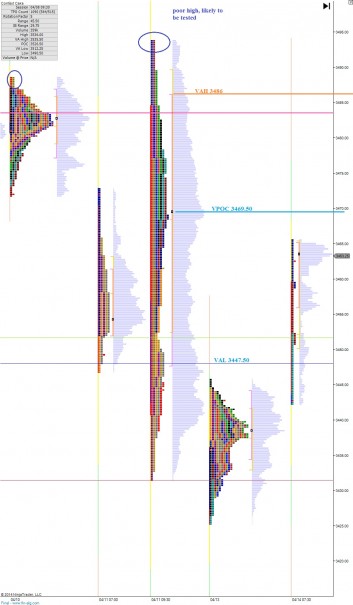

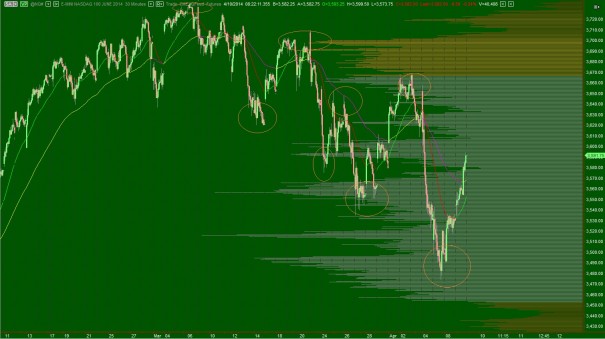

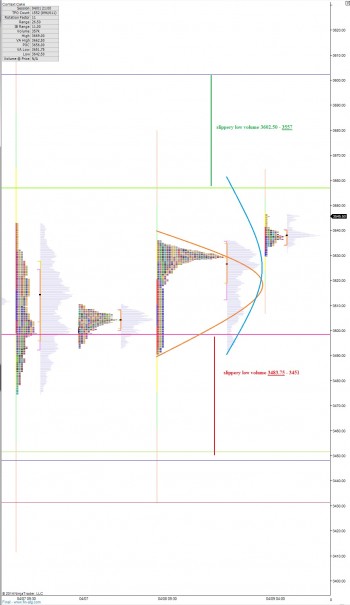

On the intermediate timeframe, we can see volume totally dried up when we made new annual lows last week. Speculators often look for explosive, high volume type action to confirm a swing high or low when really the exact opposite occurs at these levels. What happens movement in the direction of the trend stops bringing new participation in. In this case, sellers were not motivated to act by the new lows. Instead we saw a buy response which was equally as strong as the selling move down. Thus began an intermediate term swing higher:

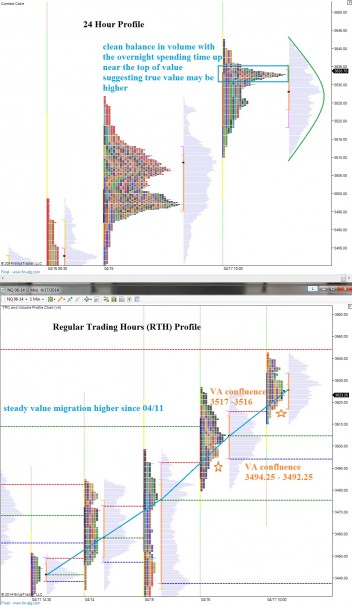

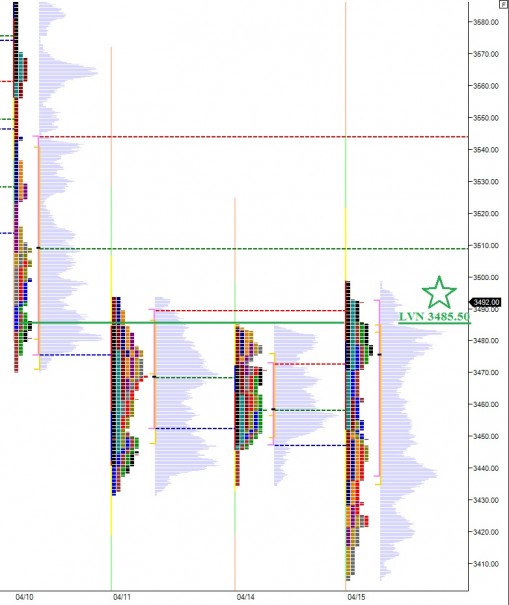

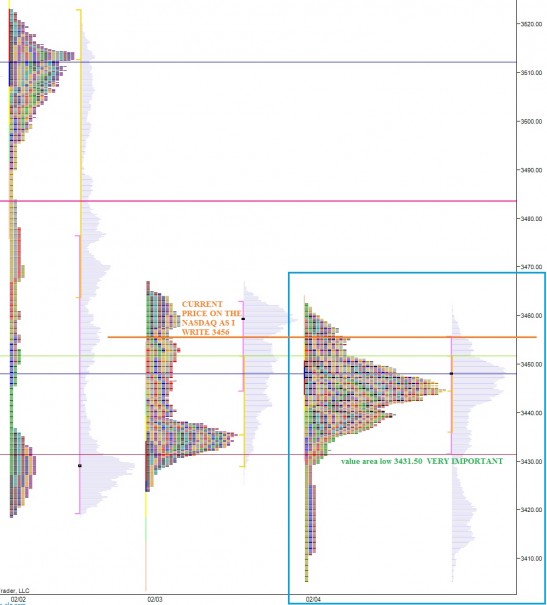

I am using my EMAs as well as the very low volume node just a tick above the very round 3500 price level as my intermediate term pivot this week.

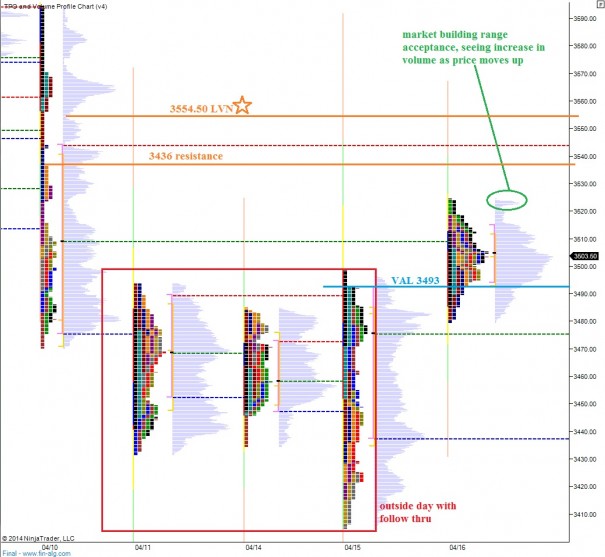

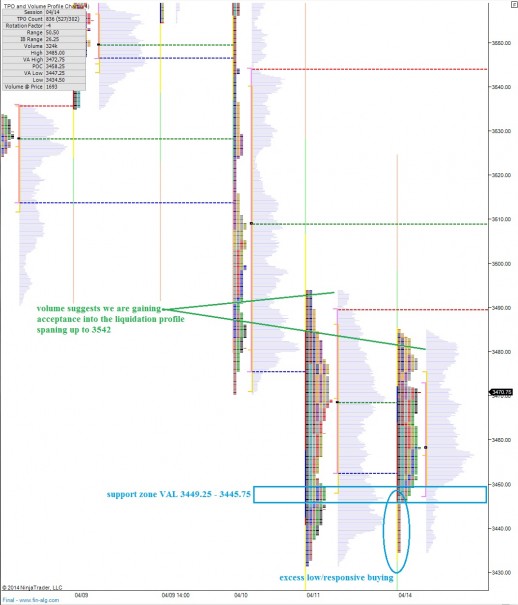

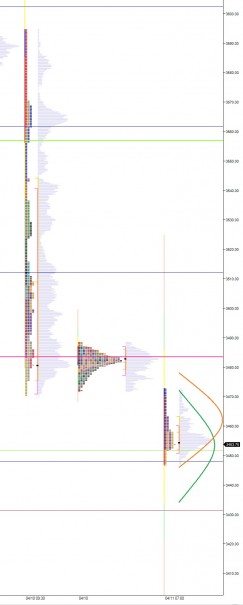

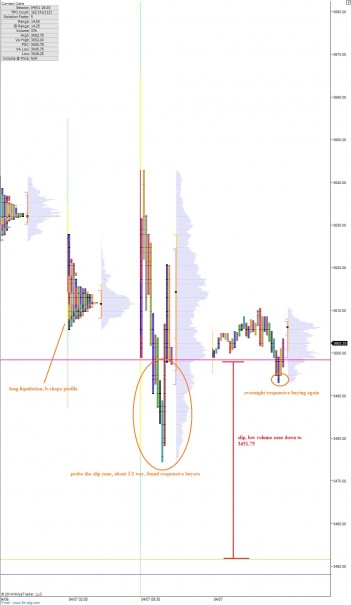

The short term shows buyer control. Value is migrating higher without much overlap and the profiles are showing healthy auction activity on both sides. Whether this clean auction continues through an important week of earnings will be telling for the weeks to come. See below:

Comments »