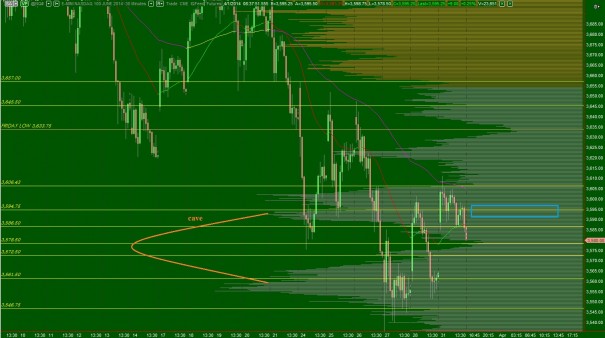

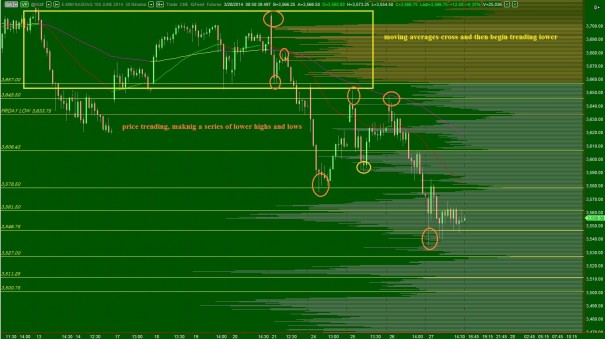

The NASDAQ futures drifted higher over night on low volume ahead of the jobs report at 8:30am. The initial reaction to the jobs report was a move higher. The report itself was mediocre-to-decent news thus an initial positive reaction is good, but not of the strongest conviction. The strongest conviction would be a positive reaction to a bad employment report. The strength was quickly faded by a strong bit of sell flow. It looks like the opening may be interesting today.

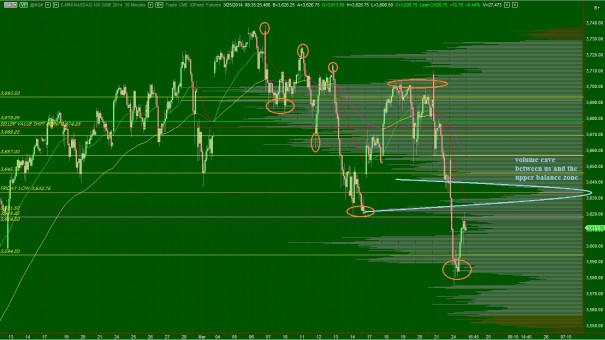

The long term time auction is buyer controlled. This can be seen as a series of higher highs and lows on the a daily chart of the NASDAQ composite. If sellers can succeed over the next few days at printing a lower high verses March, we will likely see the long term auction transition into a balanced state.

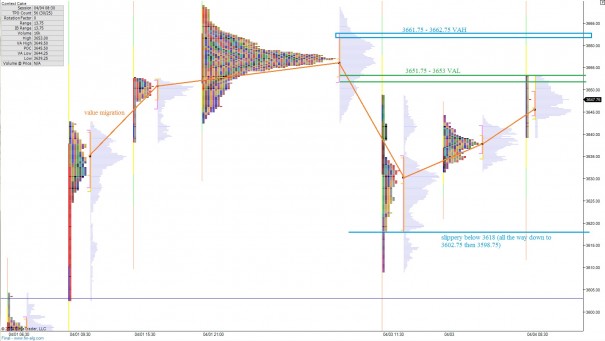

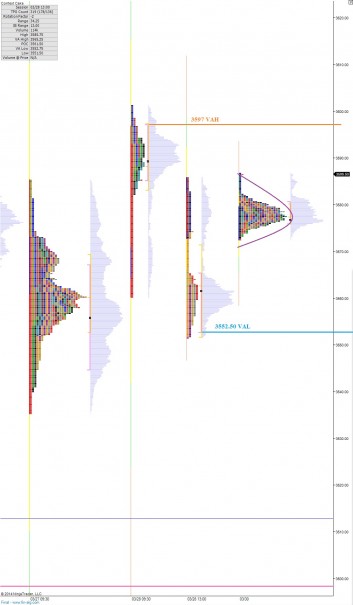

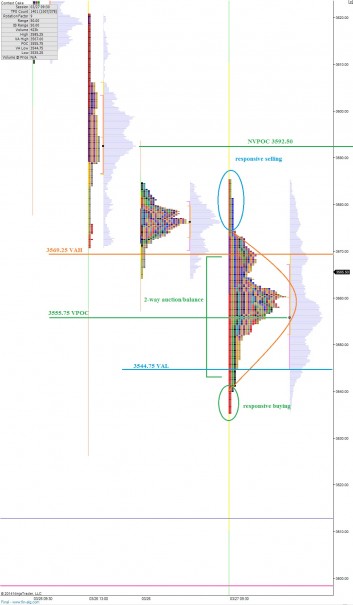

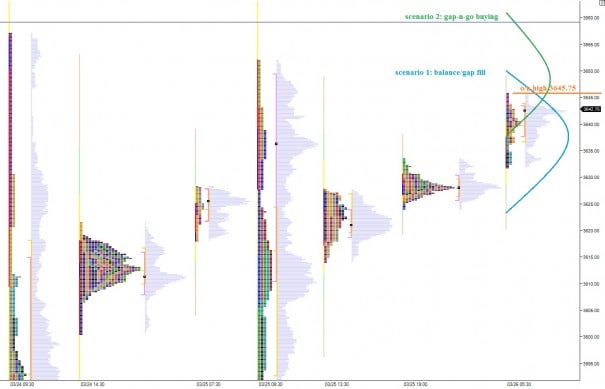

The intermediate term auction is in balance. Overhead supply came into effect yesterday morning and the resulting trading day was a press lower. The action probed prices back to the midpoint of this intermediate term balance where my expectation was to find buying. I will be watching the price action around 3632.75 for an early directional bias on the day. I have highlighted this level and a few other observations on the following volume profile chart:

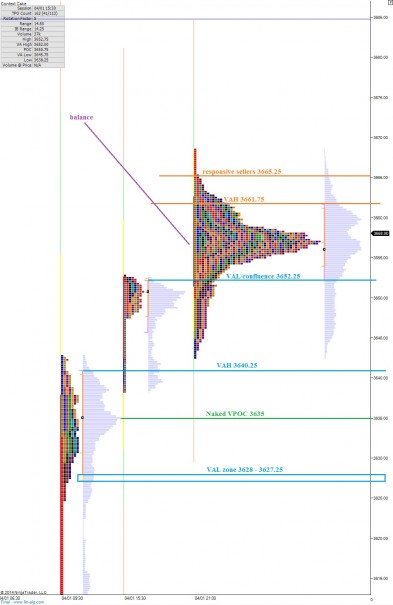

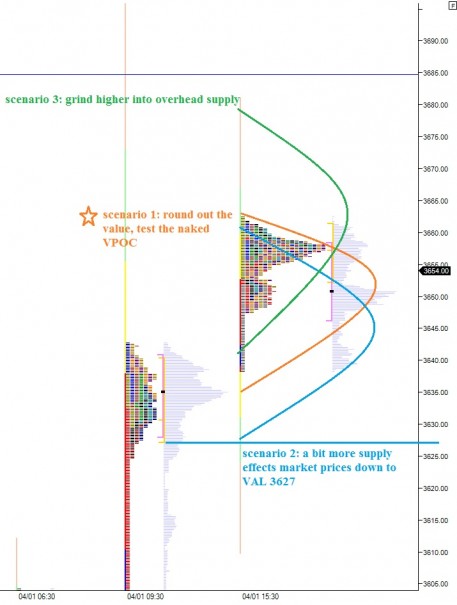

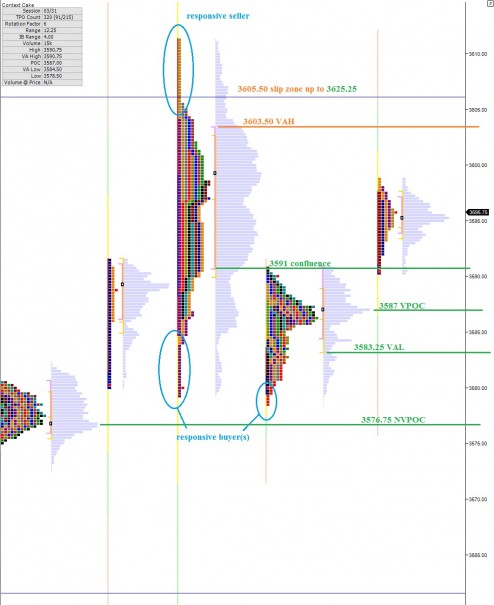

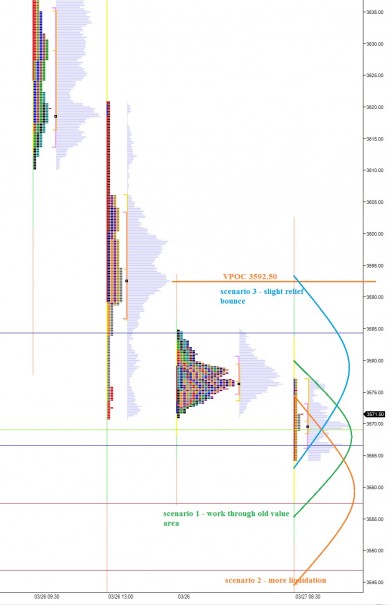

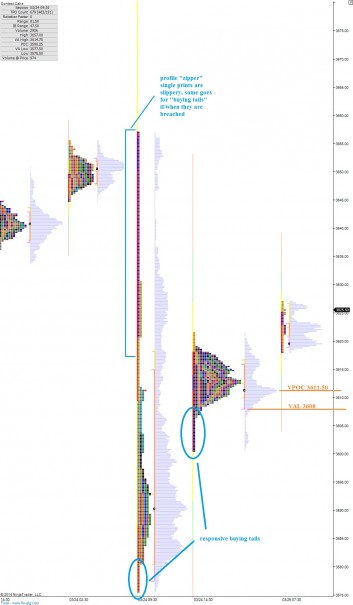

The short term auction is very indecisive but I would call it a semblance of balance. Value is roaming somewhat aimlessly. We have a strong developed profile overhead which price rejected away from yesterday and since then we have been inching back upward toward the reference zone. I have highlighted this key upside profile as well as a few other observations on the following market profile chart:

Comments »