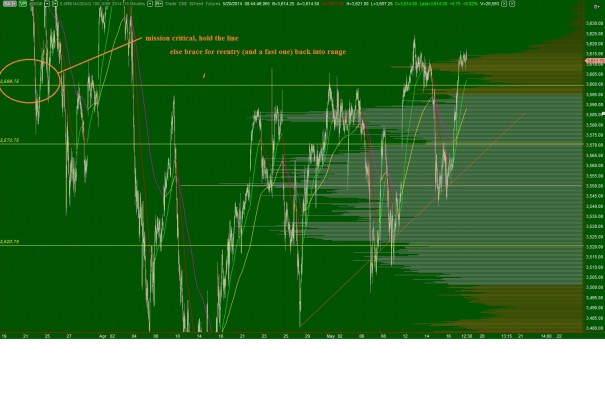

Nasdaq futures are down a touch after a balanced overnight session. The 8:30am Canadian GPD numbers as well as the Consumer data out of the USA was initially met with a selling response. We jave more economic data out at 9:45 and perhaps some Fed speak.

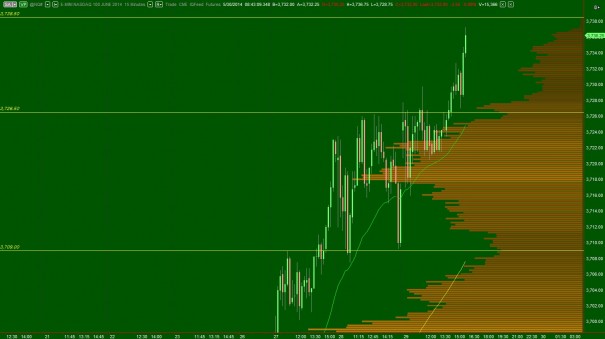

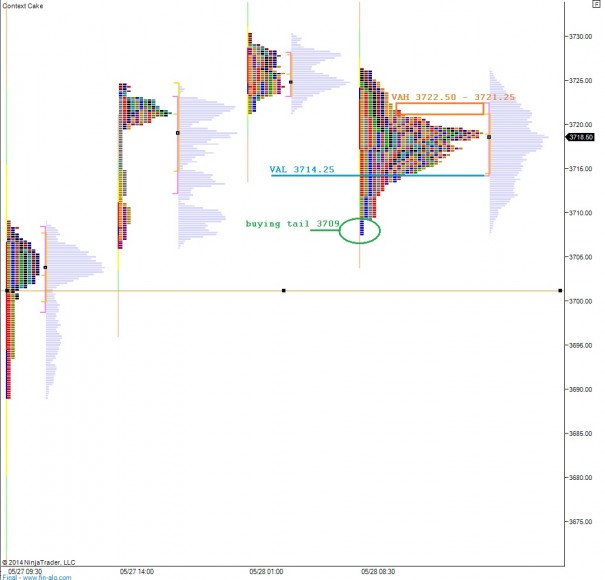

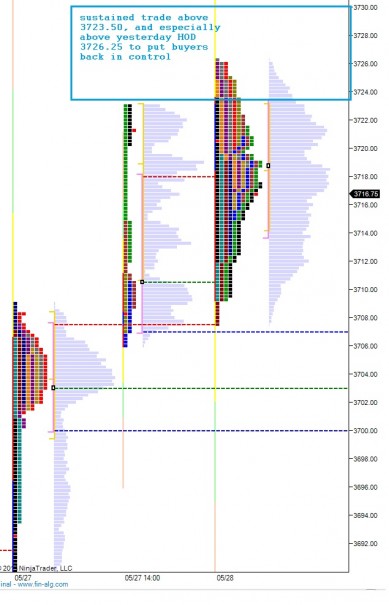

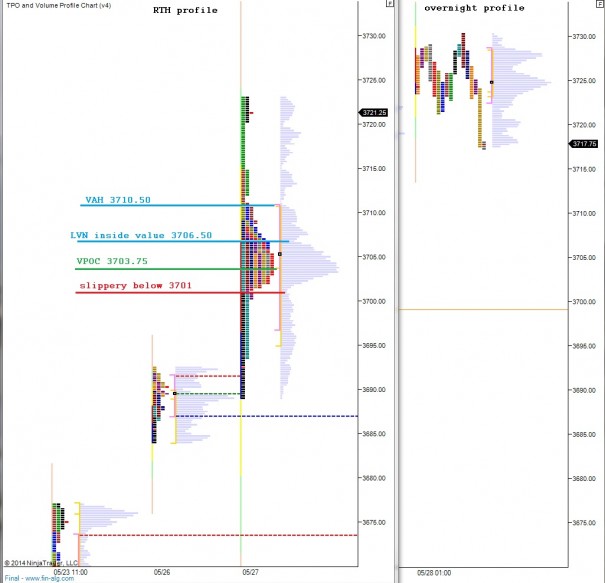

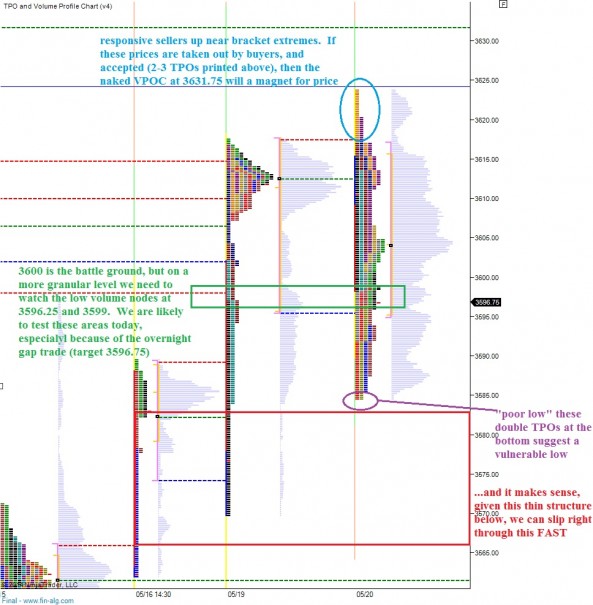

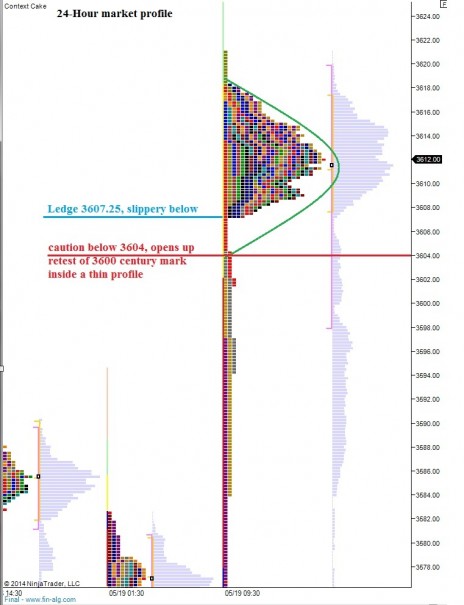

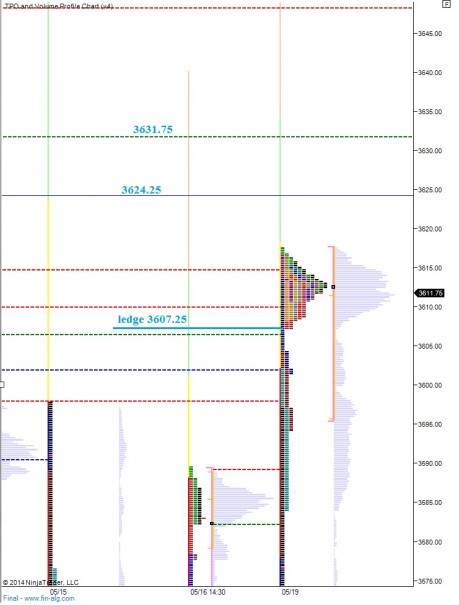

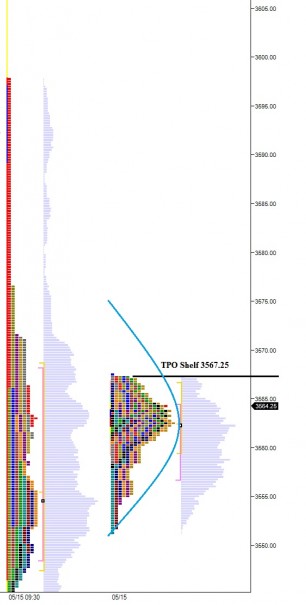

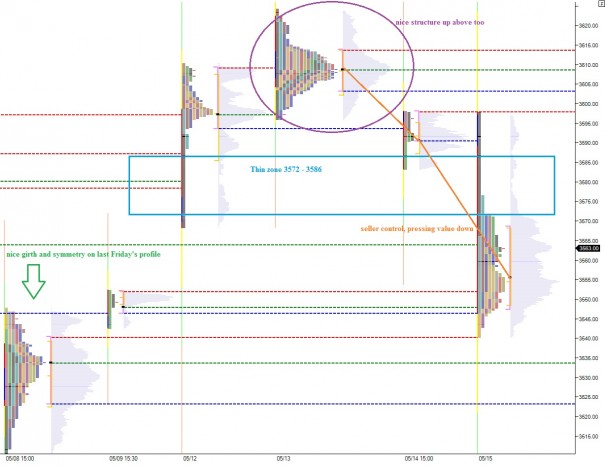

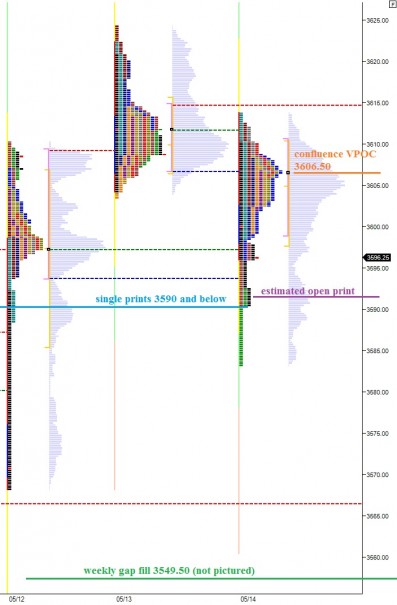

Yesterday the price action was tight after we opened inside Wednesday’s neutral print. The opening type was an open auction inside range which eventually broke higher. The Nasdaq rallied late in the session and into the 15 minute settlement period after cash close. As a result, I had to split off the late auction from the rest of the well-defined profile. This yields a clear picture of the balance and levels of opportunity below current prices. See the following market profile chart:

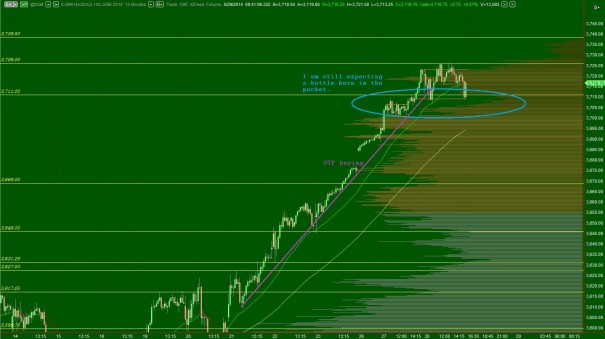

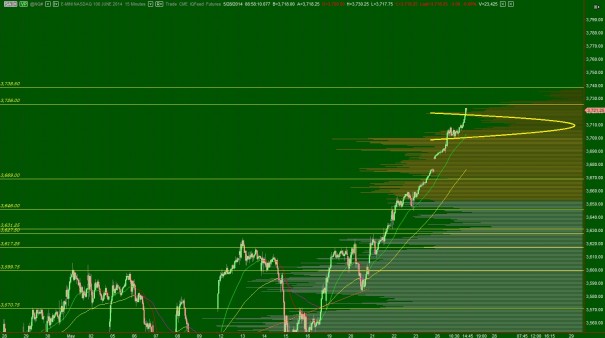

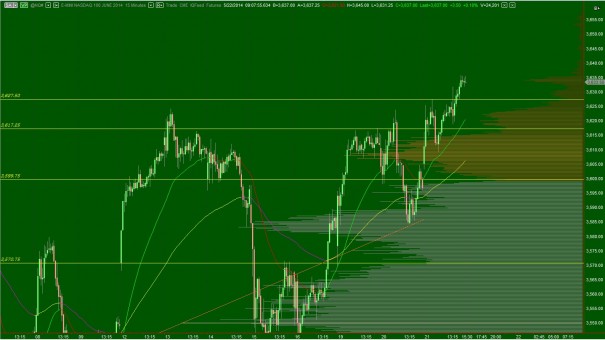

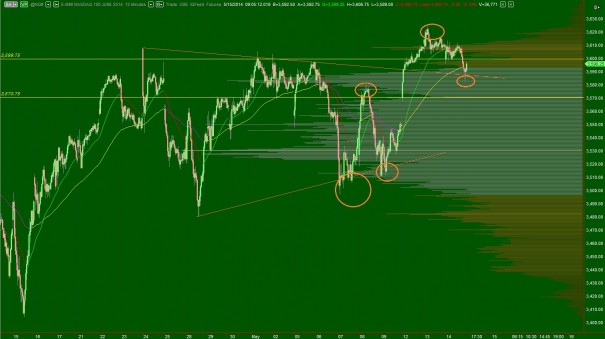

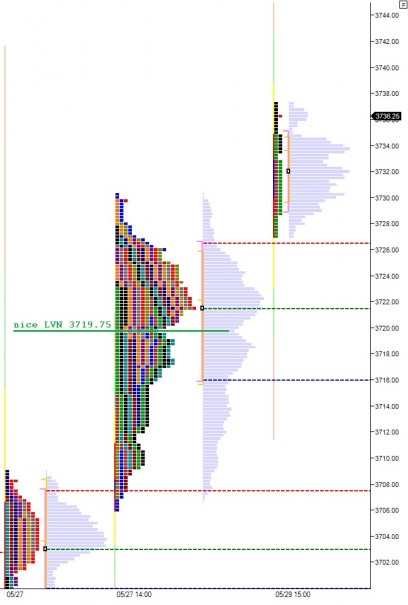

The intermediate term swing is buyer controlled. For a moment yesterday morning it looks as if we may be coming into balance. However we never made a lower low after printing a lower high. Instead the swing continued pressing higher and by the close of trade we were only 2.25 points away from contract highs. I do not draw too many lines on my intermediate term chart when possible because I want to see the volume profile structure. I have noted three key intermediate term levels however: the contract high, a nice low volume node just above yesterday’s congestion, and another nice low volume node inside the volume pocket buyers rejected us out of. See below:

After a strong week and into month end, the context is challenging. Waiting for a clear picture to emerge will save your emotional capital, even if it turns out to be a losing trade.

Comments »