If you managed to make it through last week’s volatility without blowing up, it’s looking like you’ll have a week of respite to decide how you want to position into the heat of summer. Everyone’s favorite Aunt, the honorable Yellen, will head over to Washington this week to field qNa from the House and Senate.

She’s particularly talented at answering yes or no questions with long tales, much to the chagrin of the panelists who each have a small window of time to probe her. It’s an art lads, I highly recommend you tune in for it.

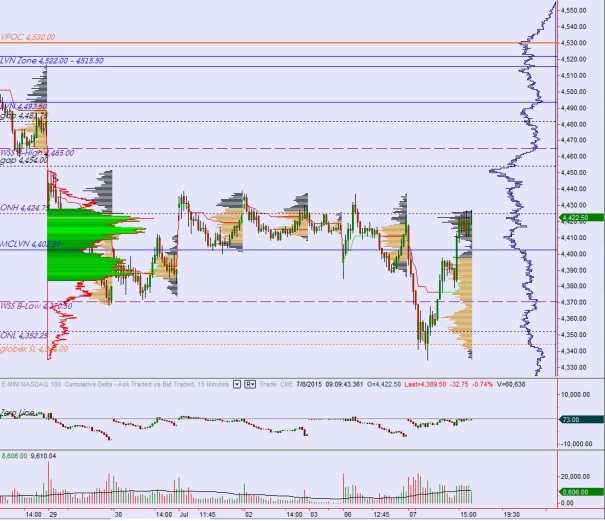

Meanwhile, last week was hellish. If your degeneracy spiked and you opted for can upon can of ale, this week is your chance to right the ship. Switch to white wine, drink it at lunchtime only, and sleep well. America was spit upon during her birthday. Do not think that will go unpunished.

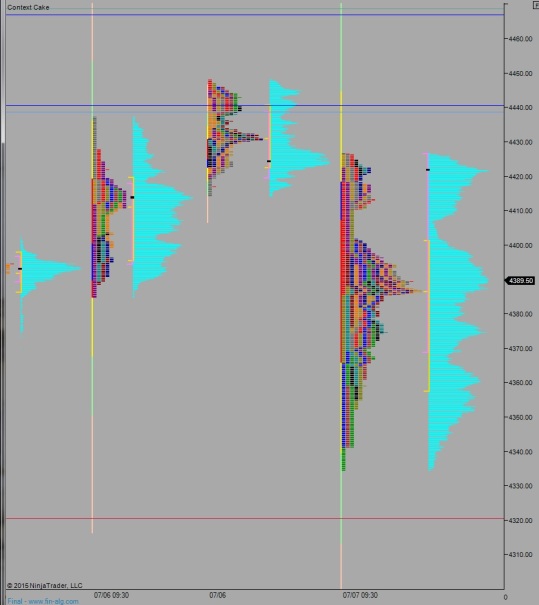

Look for a show of force from US markets this week. Where and how we push higher will tell the story. Exodus members, check out what I mean in more detail inside this week’s strategy session.

Comments »