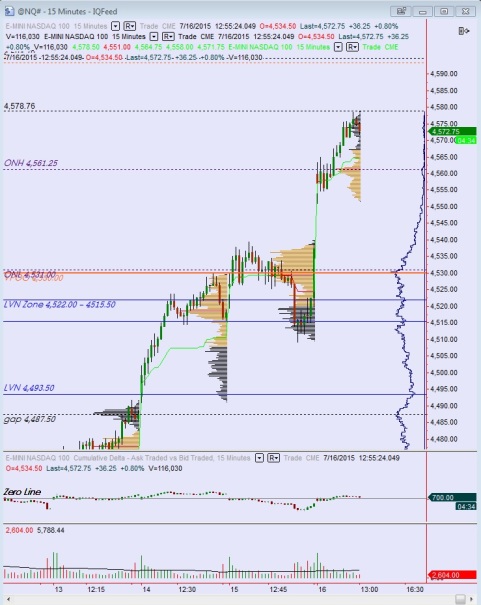

Nasdaq futures are coming into the week higher after a grinder of a session. Price opened gap down yesterday evening but it wasn’t long before buyers started working into the tape. We then spent the rest of the session trading higher, traversing over 80 points worth of range on abnormal volume. The action stalled up just a tick before the 6/17 open gap.

On the economic calendar today, we start quiet, with only a Monthly Budget Statement at 2pm. As the week progresses however, it will become increasingly heavier with economic data points and Fed’s Yellen performing her semi-annual testimonies in Washington.

Last week volatility ratcheted up both during RTH and globex. The choppy action only managed to take price a touch lower on the week after a big up gap and push higher Friday. The only problem contextually with our swing low is the gap left behind at 4337. Recent history has shown that no gap is left behind in our marketplace.

Heading into today, my primary expectation is for choppy, two-way trade. We’re set to open right atop the annual VPOC and typically we see murky trade around these highly trafficked areas. I suspect the action will give way to sellers who test down to Friday’s range high 4426.50. This level was a key resistance for the entire month of July thus far, therefore I am interested to see if buyers can convert it into support. Look for buyers to defend north of 4426.50 and a push higher to target 4466.25. Stretch target is the open gap at 4481.75.

Hypo 2 sellers push down through 4426.50, closing the range gap and setting up a full overnight gap fill down to 4409.

Hypo 3 buyers gap-and-go higher, take out 4466.25 early, sustain trade above it, and then muster up a secondary leg higher to 4481.75 and then the LVN at 4493.50. Look for responsive sellers in this region.

I plan to book a few position trades into this strength today, in particular my QLD long.

Levels:

Comments »