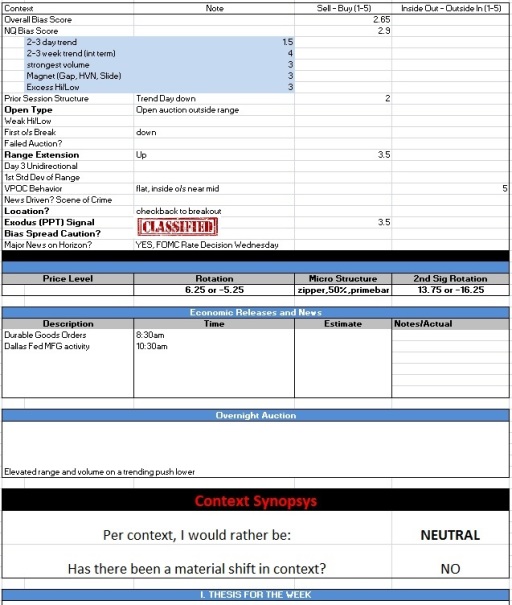

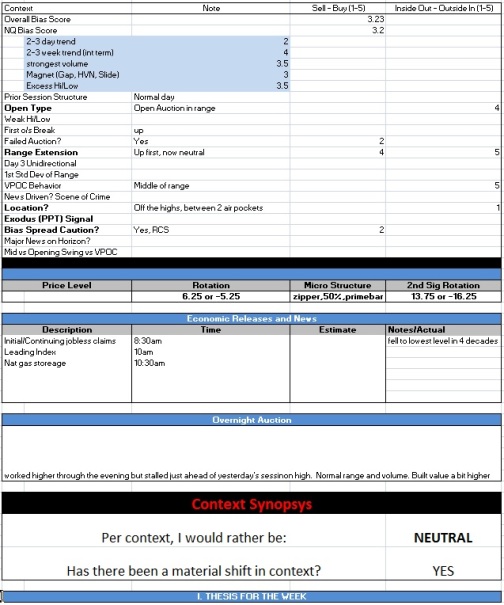

Nasdaq futures are gap up heading into Tuesday after a globex session featuring elevated range on normal volume. Price managed to push up into last Friday’s range slightly and consolidate in the low-end of last week’s range.

Coming up on the economic docket we have Case-Shiller Composite 20 at 9am, Markit Composite PMI at 9:45am, and Consumer Confidence at 10am. Investors are also likely looking forward to tomorrow’s FOMC rate decision tomorrow afternoon.

Yesterday we started the week gap down and soon after the open we found responsive buyers. Price managed to “check back” to the scene of last week’s breakout before finding the buyers who pushed but struggled to reclaim last Friday’s range. We spent the rest of the session slow grinding lower to ultimately go neutral.

Heading into today, my primary expectation is for sellers to push into the overnight inventory to close the gap down to 4523. From there I will look for sellers to continue lower to take out the overnight low 4515 and target the 4500 century mark. Look for buyers to defend here.

Hypo 2 sellers struggle to close the overnight gap and we push up above the overnight high 4549.25 . Look for some churn around 4553 before continuing higher to close last Friday’s gap up at 4563.75.

Hypo 3 is sellers push down through 4500 to close the open gap from 7/13 down at 4487.50.

Comments »