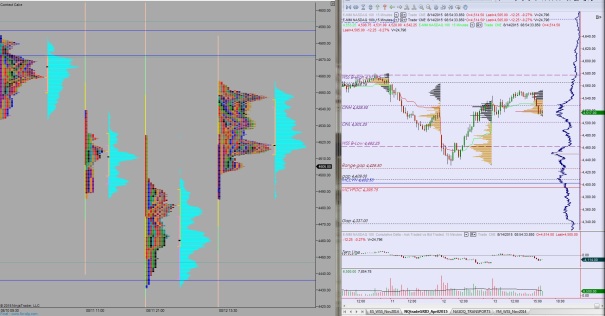

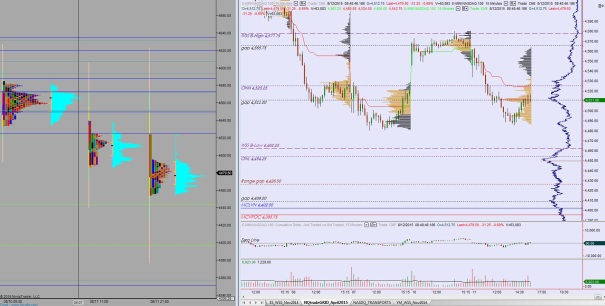

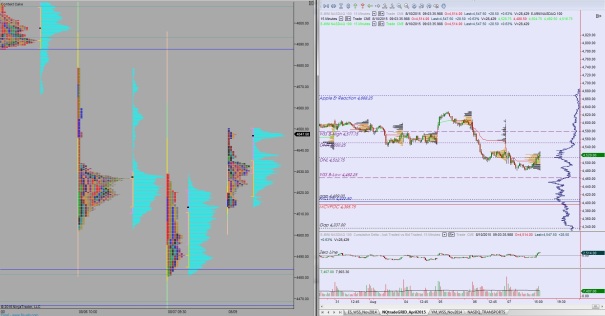

Friday summer grind is not conducive to pressing shorts. Yesterday and today exemplify the conditions you want to avoid shoring like the plague. Just.chill. Literally, your money is better risked at the horse track. Better yet, buy yourself a nice pair of sneakers—they’ll give you more mileage.

By 11am I was off the grind and pursuing other economic endeavors. Overall my book is cashed up. I have long term faith in Elon and the team over at Tesla. Gas is back over $3 bucks here in the D. That didn’t take long. It should serve as a reminder to all SUV buyers that their freedom is always at risk and electric cars charged by the power plant in the sky free you from the caprices of refineries.

Aside from TSLA, I am bidding my time in SCCO and TWTR fully aware that either could make a move against me any minute. Also, I need solar exposure. I sold SUNE at thirty deus man! I need to space alien back into the space, but how?

Slowly, and with the help of Exodus of course.

Going into the weekend I feel neutral. We worked the short side for two productive weeks, that’s enough for me. However, if come Sunday the models insist I continue twisting my knife into this market, I shall.

They’re talking 90+ degree weather this weekend in Detroit. Straight Out of Compton is playing in the movie theaters, and massive block parties are set to take over the industrial centers of our cities. What do you know about that? Conditions are ripe for debauchery, crime, and rambunctiousness. You have to keep your wits about you in these conditions. Stay sharp.

Comments »