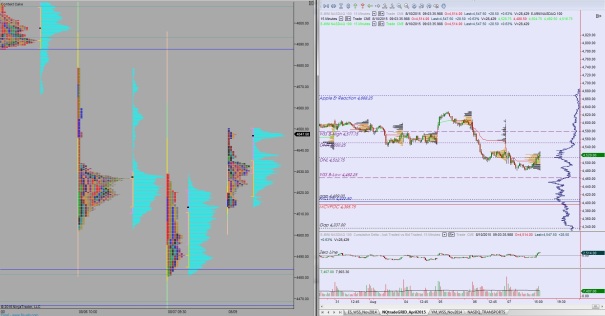

Nasdaq futures printed a slightly abnormal range overnight while steadily pushing higher. Volume metrics are running normally while price is set to open in a slippery zone. As we approach cash open, the market is continuing to explore higher in search of sellers.

Nasdaq futures printed a slightly abnormal range overnight while steadily pushing higher. Volume metrics are running normally while price is set to open in a slippery zone. As we approach cash open, the market is continuing to explore higher in search of sellers.

The economic calendar is quiet for most of the week. Today we shall hear from Fed’s Lockart who is talking both at 9am and 12:25pm—though it may not show much impact on the tape. We also have the Labor Market Conditions Index Change at 10am.

After Wednesday, we spent most of last week pushing lower. Buyers stepped in shortly after we closed the open gap from 7/13 affirming this market’s “no gap left behind” policy. In accordance with this policy, it is my duty to report that two gaps are open below and one above.

Price ramped higher Friday afternoon after spending most of the morning working lower. The afternoon rally was impressive, nearly 40 Nasdaq points, and material enough to switch the short-term intention of the marketplace.

Heading into today, my primary expectation is for sellers to push down into the overnight inventory. The open location is a fast zone, inside single prints left behind last Thursday so I expect there will be big rotations to wrangle with early on. Look for sellers to check down to 4534.75. If they can take this levels then continue lower to target overnight low 4512.75 then a test of Friday’s low 4480.50. Stretch target is 4468.50.

Hypo 2 buyers gap-and-go up, climbing the pole. Look for sellers to defend from 4587.50 to 4593 and price to roll over and head lower.

Hypo 3 buyers sustain price up near 4590 setting up a move to the 4600 century mark.

If you enjoy the content at iBankCoin, please follow us on Twitter