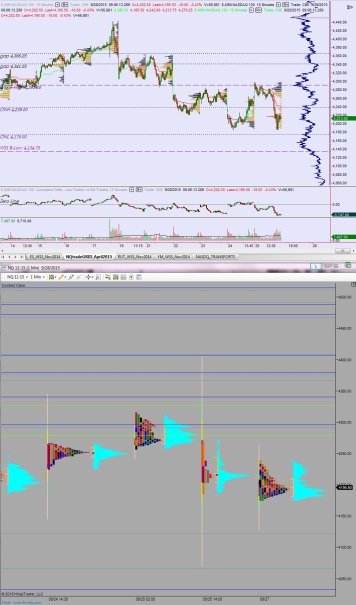

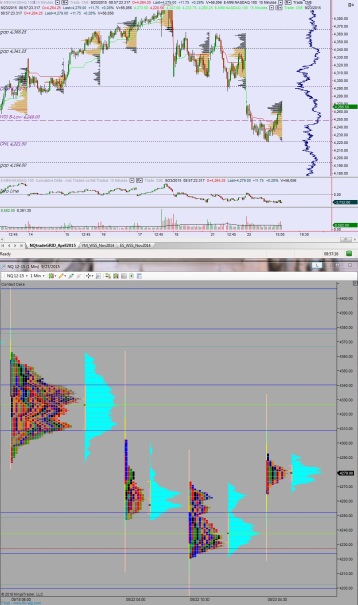

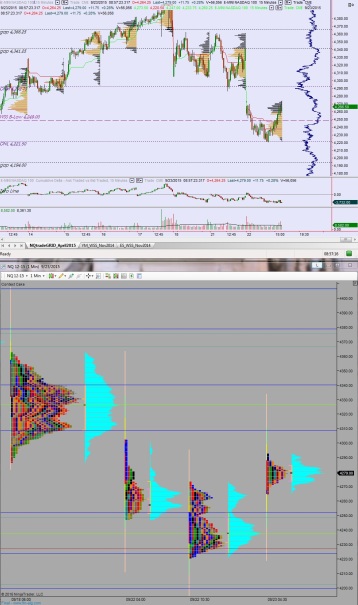

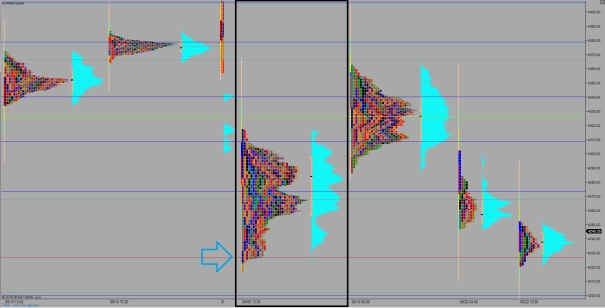

NASDAQ futures are starting the week out with a gap down. Price is down nearly 30 points which is right around pro gap territory. The overnight session featured extreme range on elevated volume during the choppy session. Globex trade started with selling and quickly exceeded Friday’s low before buyers stepped in and rallied price back up to the mid. From there we spent the early morning working back down through the range to make new lows. We have a weak/double low at 4175. At 8:30am Personal Consumption Expenditure data came out in line/slightly better than expectation and the initial reaction was buying.

The only other item on today’s economic calendar is Pending Home Sales at 10am. As the week progresses keep in mind Friday’s Nonfarm payroll data.

Last week price worked lower. There were two pro gaps down and Friday a pro gap up that was faded, along with all of Thursday’s range. Volume on the sell side was stronger than we have recently seen. However there was a slight bounce [at least in the NASDAQ] as we wrapped up the week.

Heading into today, my primary expectation is for seller to work into the overnight inventory and close the weekend gap up to 4213. From there I will look for buyers to continue higher to take out overnight high 4239. Look for buyers to stall out soon after exceeding overnight high and two way trade to ensue.

Hypo 2 buyers cannot fill overnight gap and instead sellers step back in ahead of it. Look for sellers to target the weak overnight low at 4175 then to continue lower to target 4122.25.

Hypo 3 strong buyers, push up through overnight high 4239 and pole climb up to 4265, Then some churn, before targeting 4279.

Levels:

Comments »