The Wall Street Journal is following up on yesterday’s BuzzFeed report [BuzzFeed Link – Click Here] about Twitter’s confirmed plan to cease funding their stupid ‘Buy’ button program. The ads were intended to turn Twitter into a virtual mall or something.

Wait. Isn’t that Amazon?

I imagine you can walk into Twitter HQ any given day, up in the extremely expensive hills of San Fransisco, and find no less than 5 bearded children sitting around a glass conference table scheming up dumb business ideas.

And since none of them get any traction, someone there has the job of putting said bearded heads on a chopping block every quarter. It’s all very bleak.

Anyhow, here is the entire WSJ article, courtesy of Googling the headline to shimmy around the paywall:

Twitter Inc. on Wednesday confirmed it is curtailing an advertisement effort that encouraged people to purchase products from merchants without leaving the social-media service.

In September 2014, Twitter began testing ads with a button that select U.S. merchants sell their wares directly on Twitter. The hope was these ads could transform Twitter into something of a virtual shopping mall and drive new advertising revenue. They opened up the ad to U.S. merchants of all sizes the following year.

A Twitter spokesman said the company will no longer devote resources to supporting the development of the ads for the foreseeable future. Instead, the company has reallocated resources in favor of a different kind of retail-related ad product that it said has gained more traction with its retail partners.

BuzzFeed News earlier reported that Twitter would end product development on the “buy button” ads and shift its commerce team into other divisions within the company.

The Twitter spokesman said the commerce team will shift its efforts to focus on customer service and commerce-related ads, which have shown greater success for retailers. These ads, called dynamic product ads, show users images of products that they had previously viewed on the advertiser’s website but for whatever reason had decided not to purchase. If a user clicks on the ad, it takes them back to the specific product page on the retailer’s site.

RELATED

Twitter Tweaks Will Make 140-Character Limit Roomier (May 24) [RAUL NOTE: THEY ALSO ANNOUNCE NEW FEATURES THEN DON’T ACTIVATE THEM]

Twitter Looks to Video to Increase Advertising Sales (May 1)

Twitter Posts Disappointing Revenue and Forecast (Apr. 26)

Social commerce burst onto the scene in recent years as platforms such as Twitter, Facebook Inc. and Pinterest Inc. all started testing “buy buttons” on their respective services. But it appears consumers aren’t yet ready to open their wallets while checking their social feeds.

Facebook, which has tested buy buttons, has in recent years poured greater resources into dynamic product ads instead. Chief Operating Officer Sheryl Sandberg noted in an earnings call with analysts last July that the company’s e-commerce objective is to connect its users with marketers rather than selling retailers’ wares directly on the service.

News of Twitter’s commerce-ad shift came on the same day that CEO Jack Dorsey sought to reassure frustrated shareholders that the social media service is headed in the right direction.

Mr. Dorsey, speaking along with other executives at the company’s annual shareholder meeting in San Francisco, answered investor queries that ranged from his plans to revive the company’s stalled user growth to what all those high-paid engineers are actually doing.

In introductory remarks, Mr. Dorsey emphasized the company’s top priorities and its progress over the past year. He pointed to the announcement on Tuesday that Twitter was tweaking its format to not count media attachments and usernames sent in reply tweets against its signature 140-character limit in an attempt to make the product easier to use.

The 40 some shareholders who showed up at the Yerba Buena Center for the Arts in downtown San Francisco were polite during the question-and-answer session with executives. But some shareholders, such as one who identified himself as Keith Miller from North Carolina, shared what the view looked like from the investor seats: “The stock price is stuck in the mud,“ he said. ”…Within the company the ’geekdom’ is very happy and is very positive, but out here in the marketplace everybody else is saying it’s too hard to use.”

Mr. Miller described the company’s sluggish user growth and advertising revenue per use as both “not very impressive.”

Mr. Dorsey acknowledged the product’s weaknesses and asked Mr. Miller for more time. “We know that there are areas of the product that people don’t understand,” he said. ”They don’t understand how it works and it’s inhibiting a lot of usage. We’re focused on the one thing that we can control, which is building an experience that people want to use and experience every single day. It’s going to take time.”

During the meeting, the shareholders officially approved the appointment of PepsiCo Vice Chairman and CFO Hugh Johnston, and also re-elected Mr. Dorsey, to the board. The shareholders also approved Mr. Dorsey’s plan to donate about 6.8 million of his Twitter shares, representing about one third of his total Twitter shares, to the employee equity pool.

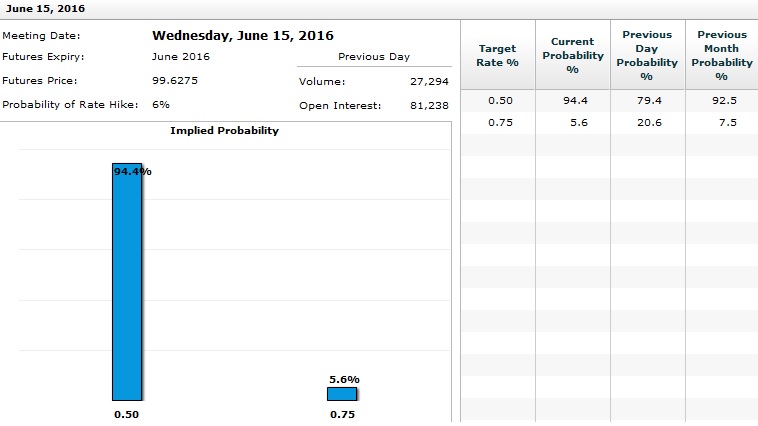

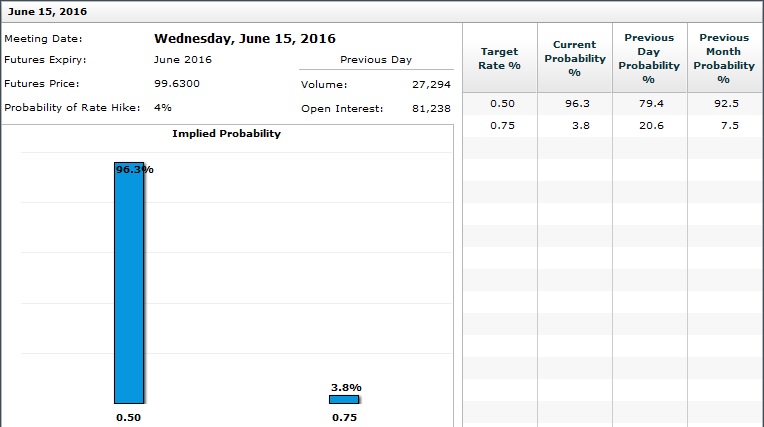

Twitter shares [ticker – TWTR] are hovering near all-time lows:

Comments »