NASDAQ futures are coming into Friday flat after an overnight session featuring abnormally low range and volume. This is the second time this week Globex has been so quiet it registered as abnormal. Price held yesterday’s range on a balanced trading session. At 8:30am Advance Retail Sales came in well-below expectations.

Also on the economic docket today we have Business Inventories and U. of Michigan Confidence at 10am and the Baker Hughes rig count at 1pm.

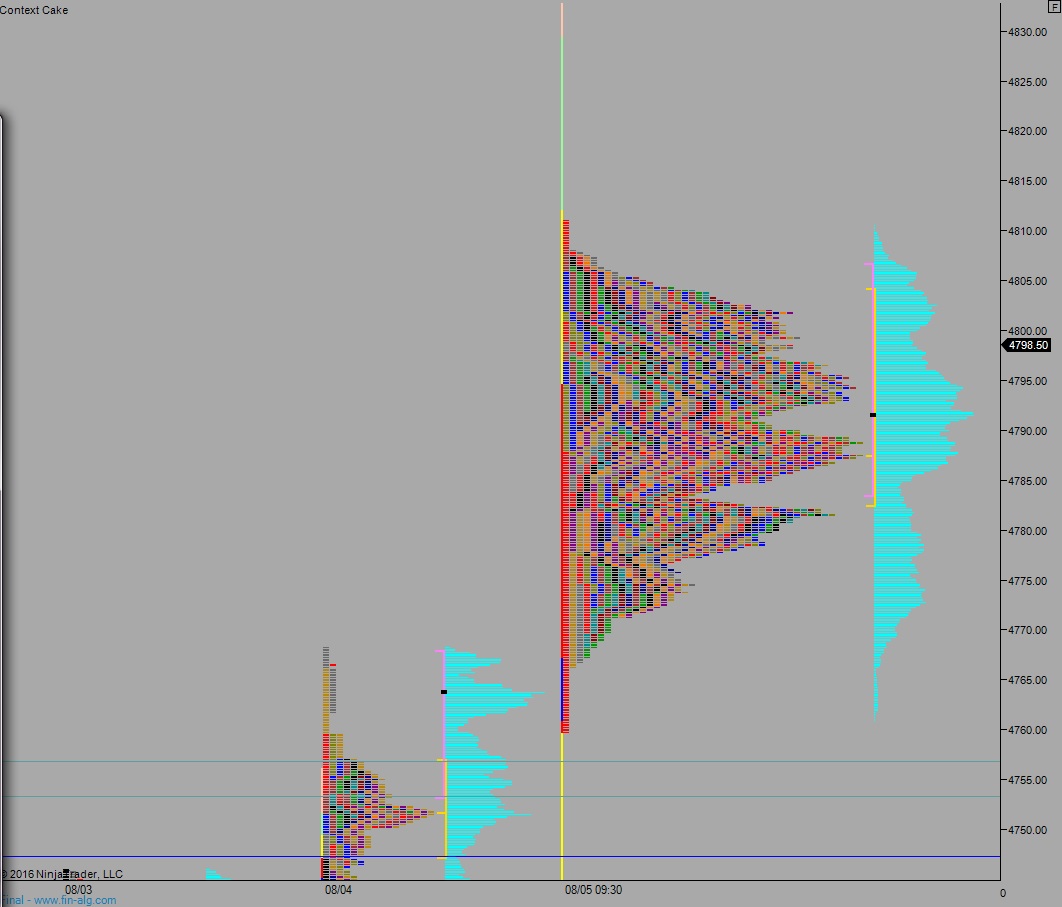

Yesterday we printed a Normal Day, the statistically rare day-type that we also printed on Monday. These tend to occur near inflection points. After opening gap up the market drove to new highs early on and found a sharp responsive seller. The rest of the session traded inside the first hour’s range, earning Thursday the Normal designation.

Heading into today my primary expectation is for sellers to work the market lower, down through overnight low 4796 then continue working lower to target the open gap down at 4781.25 before two way trade ensues.

Hypo 2 buyers push up through overnight high 4805.25 and work price up to 4819 before two way trade ensues.

Hypo 3 strong selling pushes down through 4781.25 and probes the week’s lows, below 4766.25 triggering a liquidation down to 4756.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter