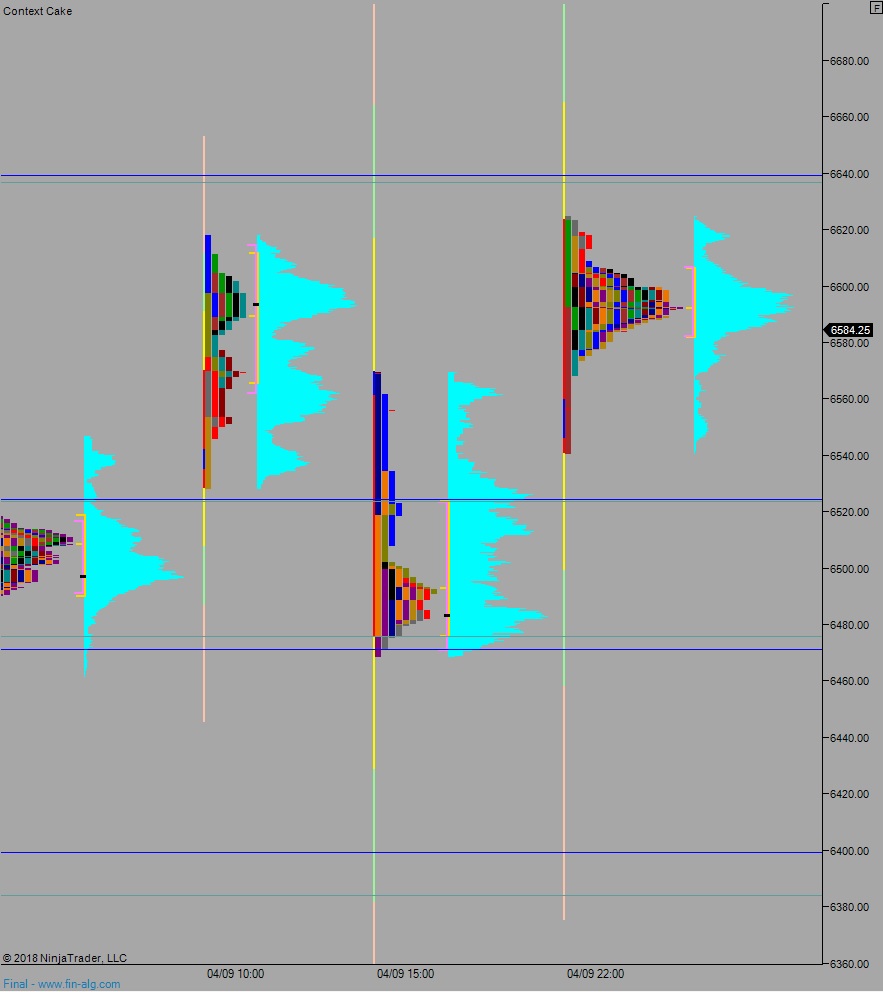

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, twice up through the Monday RTH high while coming into balance. As we approach cash open, price is hovering above the Monday midpoint.

The economic calendar is light today—a 4-week T-bill auction at 11:30am and a 3-year Note auction at 1pm.

Yesterday we printed a neutral extreme down. It looks like the only reason it was able to earn the extreme designation is because it went neutral (RE down after being RE up already) so late in the day.

Heading into today my primary expectation is for a gap-and-go higher. Look for buyers to step in ahead of 6561.75 and work up through overnight high 6624.75. Seller up at 6639.75 and two way trade ensues.

Hypo 2 sellers work into overnight inventory, down to 6624.75 before two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 6496.75 then take out overnight low 6471.75 setting up a move to close the Friday gap down at 6451.50. This could trigger a liquidation down to 6400 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: