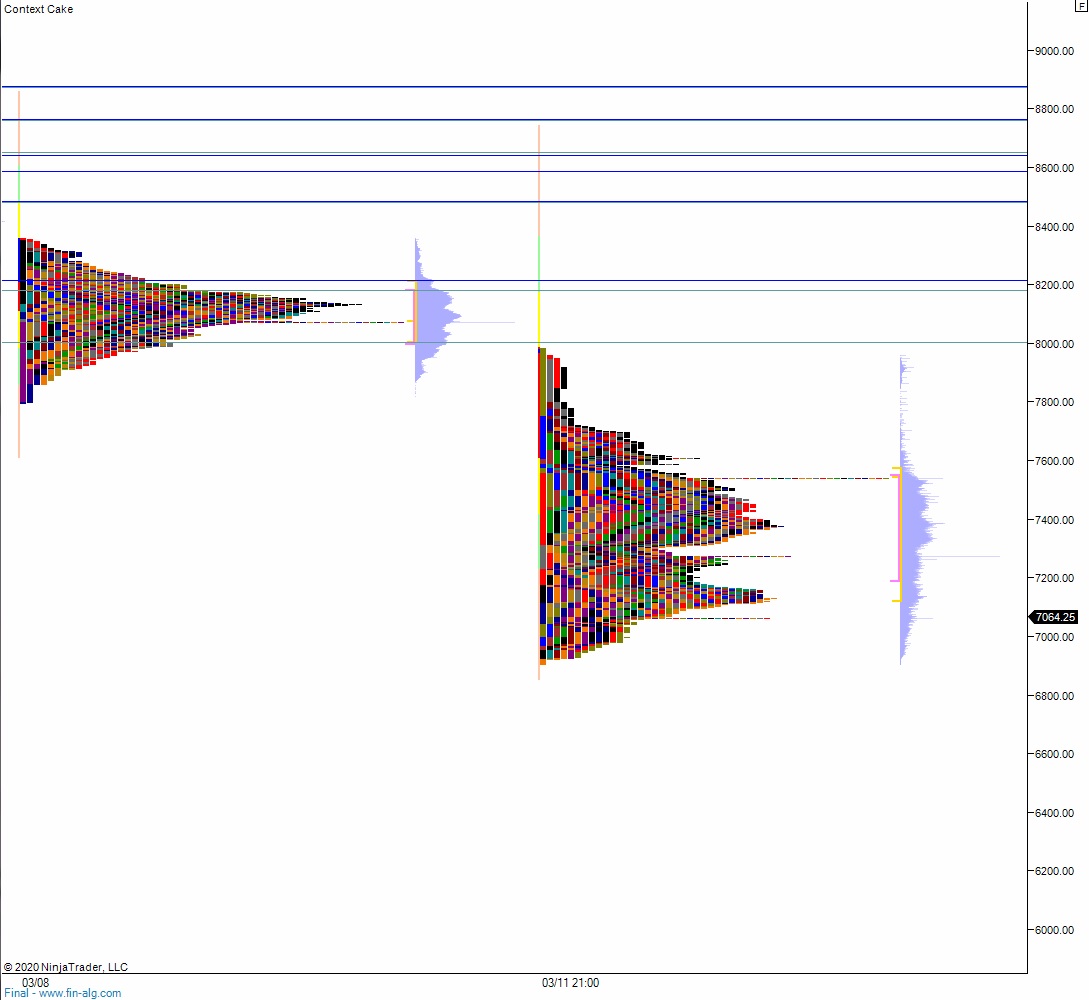

NASDAQ futures locked limit down around 1:20am New York after an overnight session featuring elevated volume on extreme range. Liquidity is low in the globex markets. The overnight session was balanced for about two hours, then around 6:30pm it began to rotate lower, methodically moving down near the lower quadrant of Tuesday’s range before finding a bid. Said bidders spiked price back up to the Tuesday midpoint. Sellers were here and we spent the rest of the session moving lower until locking limit down near the high-end of Tuesday’s bottom quadrant.

On the economic calendar today we have crude oil inventories at 10:30am.

Yesterday we printed a normal variation up. The day began with a gap up and two way auction. Sellers eventually worked into the tape, closing the overnight low but unable to take out Monday’s low. Instead buyers stepped in and began working price higher, tagging the Monday naked VPOC along the way and nearly taking out the Monday high. Instead a massive amount of volume was transacted on the daily high, putting a distinct VPOC on the day’s profile before price rotated back to the midpoint. Buyers defended the midpoint and we spent the rest of the day chopping above the mid, eventually closing in the upper quad of range.

Heading into today my primary expectation is for some kind of gap down when the circuit breaker lets loose. Sellers move to take out Tuesday low 6906 but are unable to do so. Instead buyers come in and work a gap fill higher, trading up to 7383.75 then up through overnight high 7398.75. This sets up a move to 7500. Look for sellers up at 7600 and two way trade to ensue.

Hypo 2 stronger buyers trade up to the composite VPOC at 7700 before two way trade ensues.

Hypo 3 sellers press down through Tuesday low 6906 setting up a liquidation. Targets are the century marks 6800 and 6700.

Levels:

Volume profiles, gaps and measured moves: