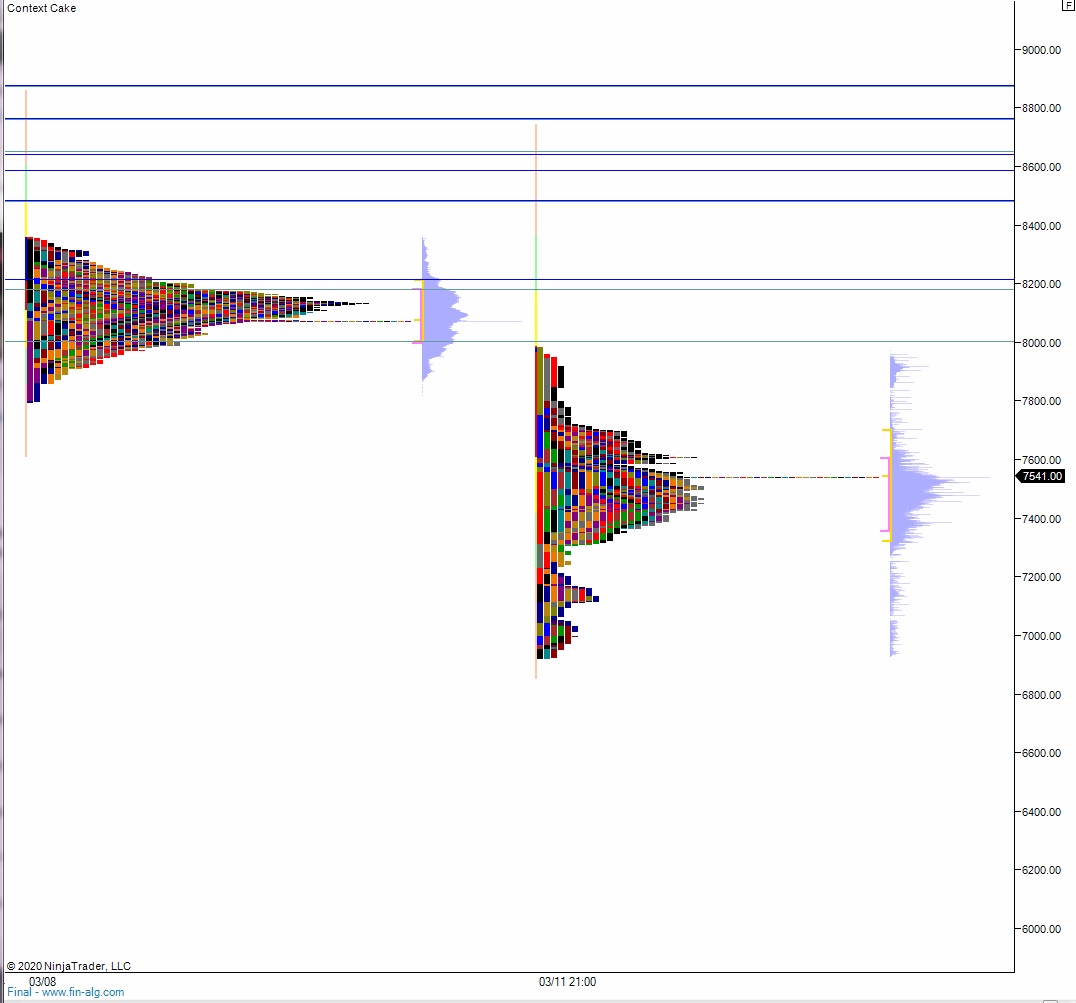

NASDAQ futures are coming into Monday down a quick -360 after an overnight session featuring normal volume (markets were halted about 20 minutes into trading) on extreme range. Sunday markets began with a gap down and push lower that was briefly reversed following an unprecedented stimulus action from the Federal Reserve, who surprise lowered interest rates to zero percent and did $700 billion worth of QE. Buying on that news was quickly reversed, and by 6:20pm New York futures hit the circuit breaker and were halted. Heading into cash open, the price was halted a bit below the Friday midpoint.

On the economic calendar today we have 13- and 26-week T-bill auctions at 11:30am followed by Long-term TIC flows at 4pm.

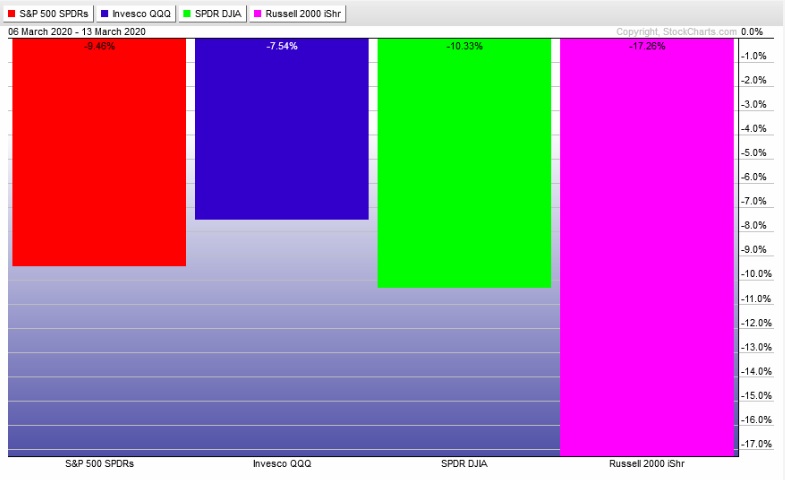

Last week began with futures limit down. After strong selling to begin Monday we had a responsive bid come in and work price strongly higher. This low held through Wednesday across the board before another strong limit down move happened Thursday night. Price was choppy until late Friday when we saw a surge higher into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a limit up gap. After a two way open sellers stepped in and nearly filled the gap but could not before buyers stepped in. We traded back up through the midpoint and chopped all around it before a late-day rally saw price return to Wednesday’s low and reclaim it. We ended near session high.

Heading into today my primary expectation is for a two-way open before buyers work into the overnight inventory work price to the composite VPOC 7700. We pause here before continuing higher, to close the overnight gap 7901. Look for sellers up at 8000 and two way trade to ensue.

Hypo 2 sellers work down through overnight low 7556 setting up a move to tag 7000 before two way trade ensues.

Hypo 3 full on liquidation, hitting circuit breakers along the way, targeting 6900.

Levels:

Volume profiles, gaps and measured moves: