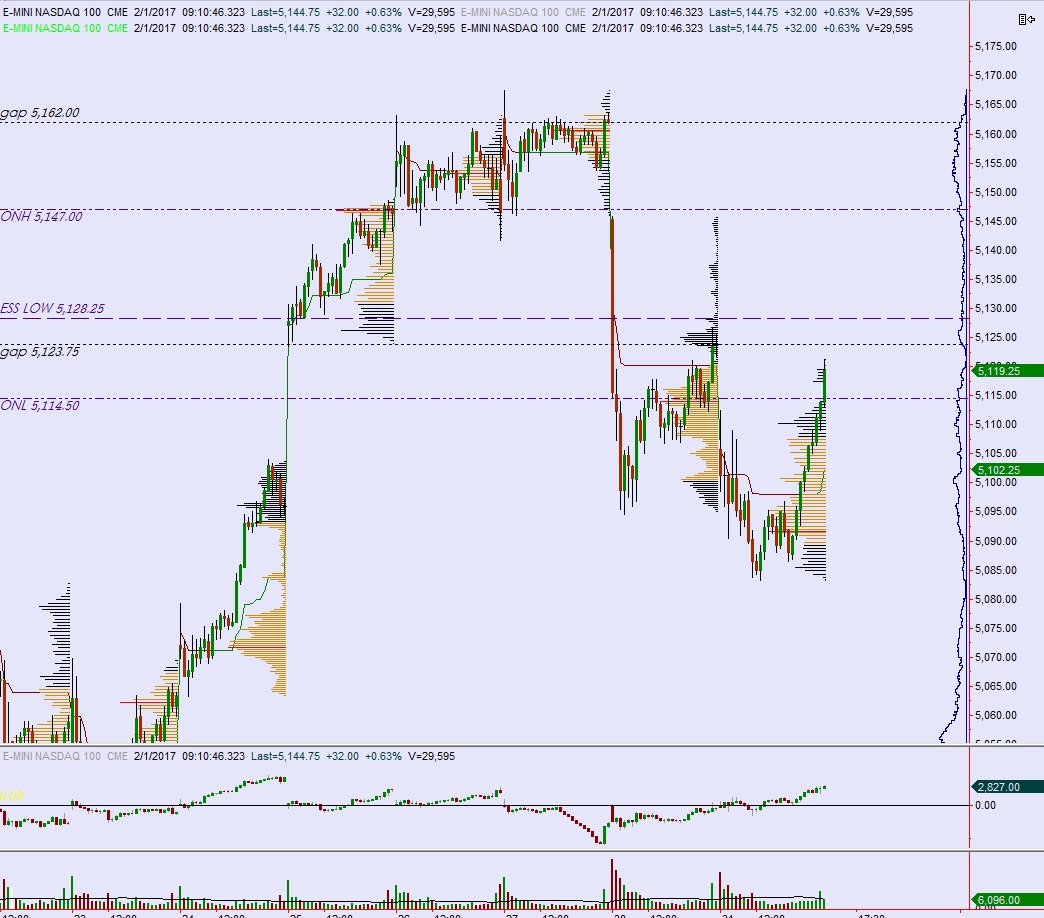

NASDAQ futures are heading into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, pressing up through Monday’s high and sustaining the gains as we approach cash open. Buoying the NASDAQ were strong earnings out of Apple Tuesday evening. At 7am MBA mortgage applications came out worst than last week. At 8:15am ADP employment data was much better than expected—likely also supporting higher prices.

Also on the economic docket today we have both ISM Manufacturing and Construction Spending at 10am, crude oil inventories at 10:30am, and most importantly an FOMC Rate Decision at 2pm.

Facebook is set to report earnings after-market-close and packs enough market cap to move the NASDAQ.

Yesterday we printed a neutral extreme up. The market opened gap down, inside Monday range and sellers were active early on, pressing lower for much of the morning. Buyers then stepped in, and continued working into the market to completely reverse the selling and make a new daily high. Prices spiked near end of day.

Heading into today my primary expectation is for a quick poke up to 5150. Sellers show up here and we tread water until the FOMC rate decision.

Hypo 2 short squeeze up to the weekly gap at 5162 before we base out ahead of FOMC.

Hypo 3 sellers work into overnight inventory and close gap down to 5119.25 then continue lower, down through overnight low 5114.50 before two way trade ensues ahead of FOMC.

Use third reaction post FOMC to determine market direction into the close, and into the end of week.

Levels:

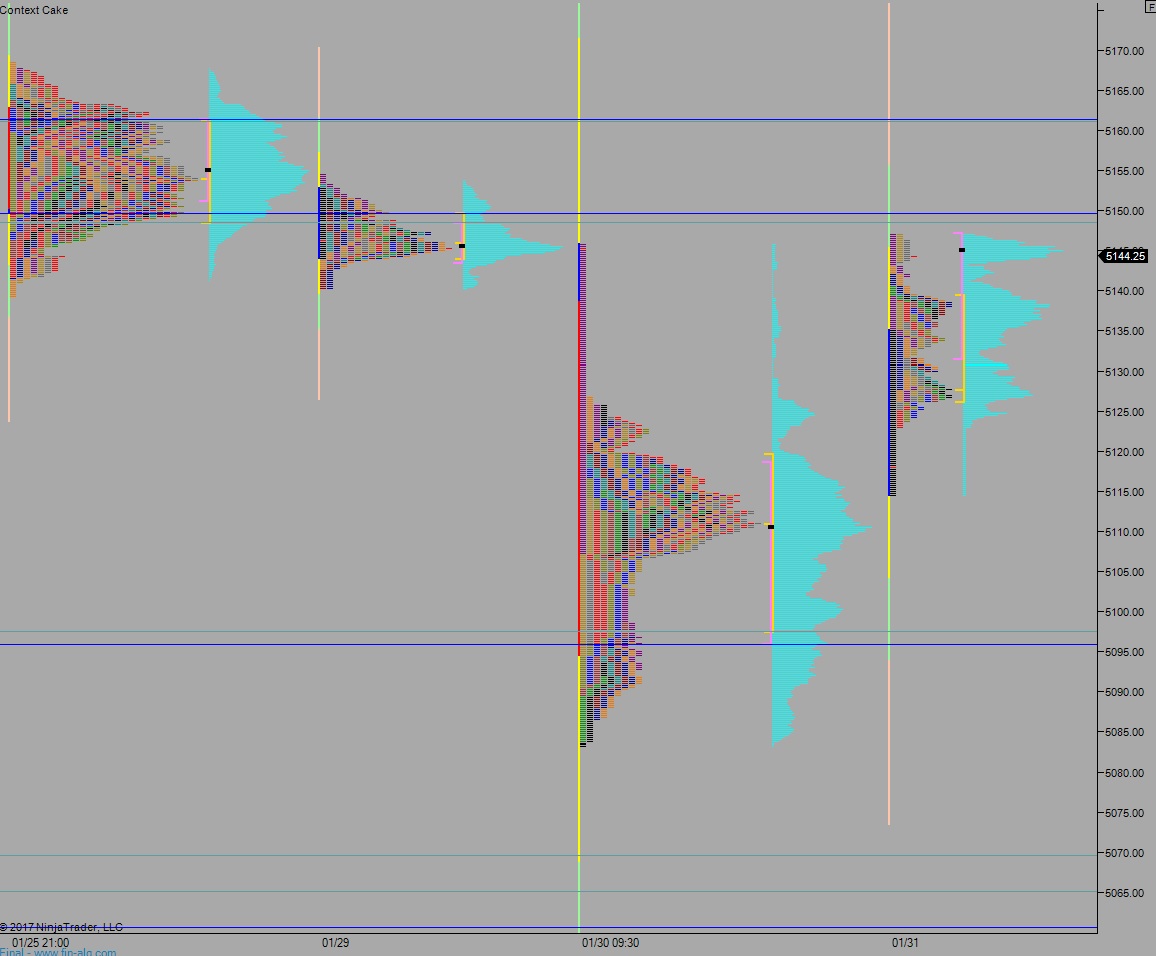

Volume profiles, gaps, and measured moves:

a “poke” hahaha

getting fancy with the hypos