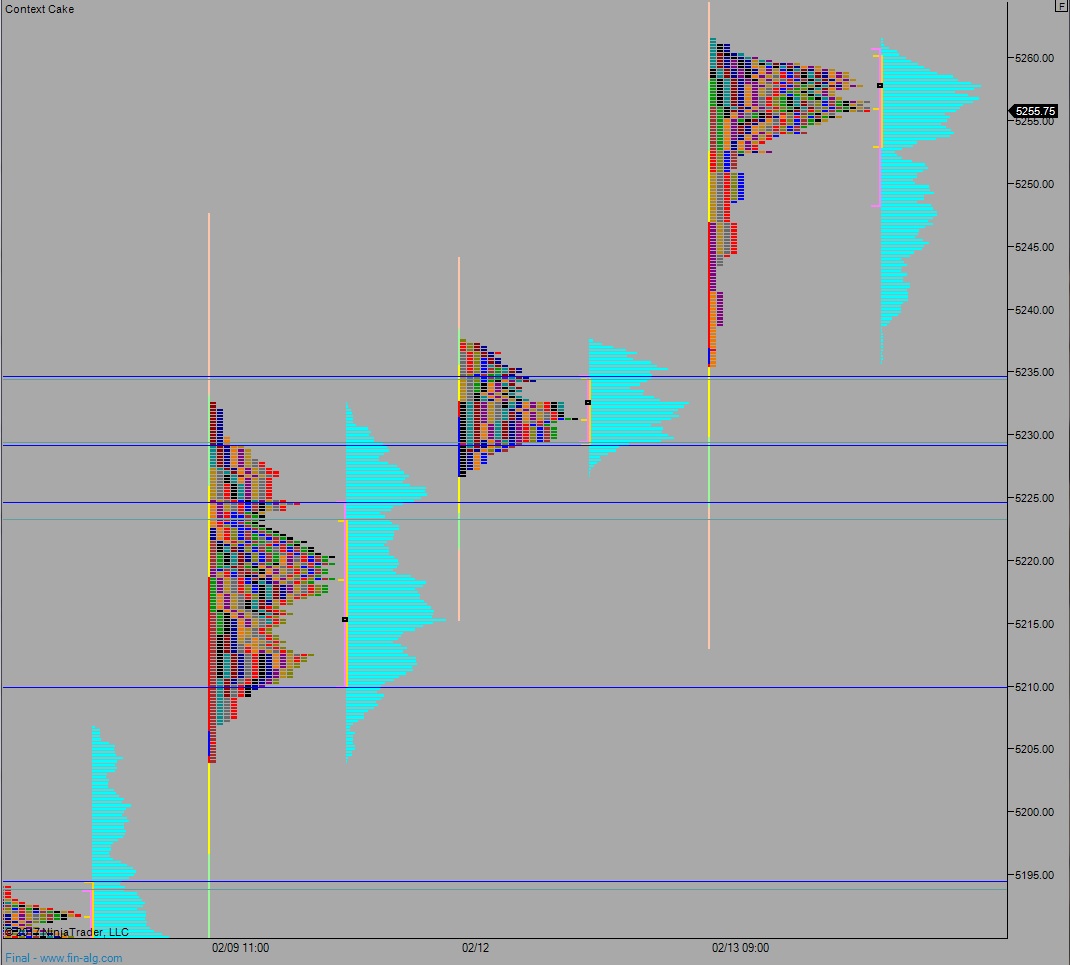

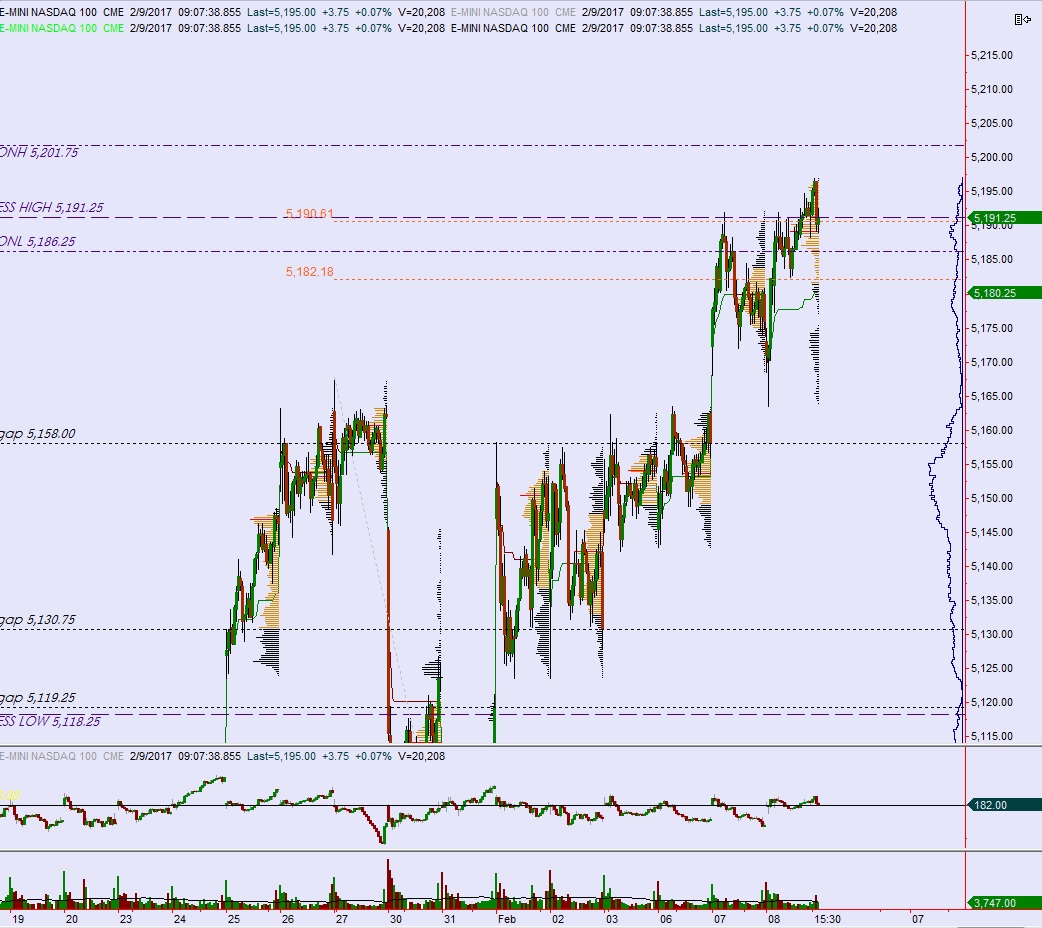

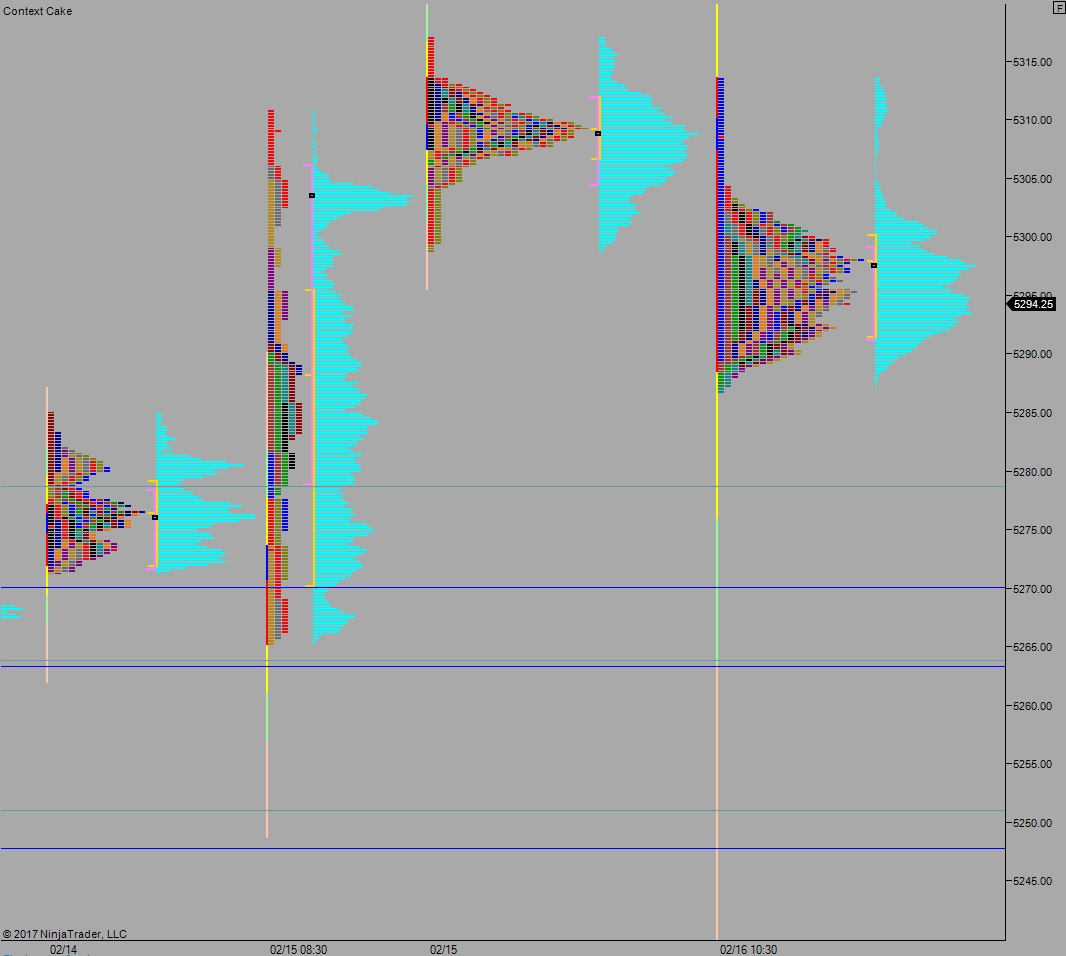

NASDAQ futures are coming into Friday with a slight gap down after an overnight session featuring normal range and volume. Price took out the Thursday low briefly before recovering and settling into two-way trade.

The economic calendar is light as we wrap up the week. At 10am Leading Indicators data is out, and at 1pm the Baker Hughes rig count. There are no other economic events.

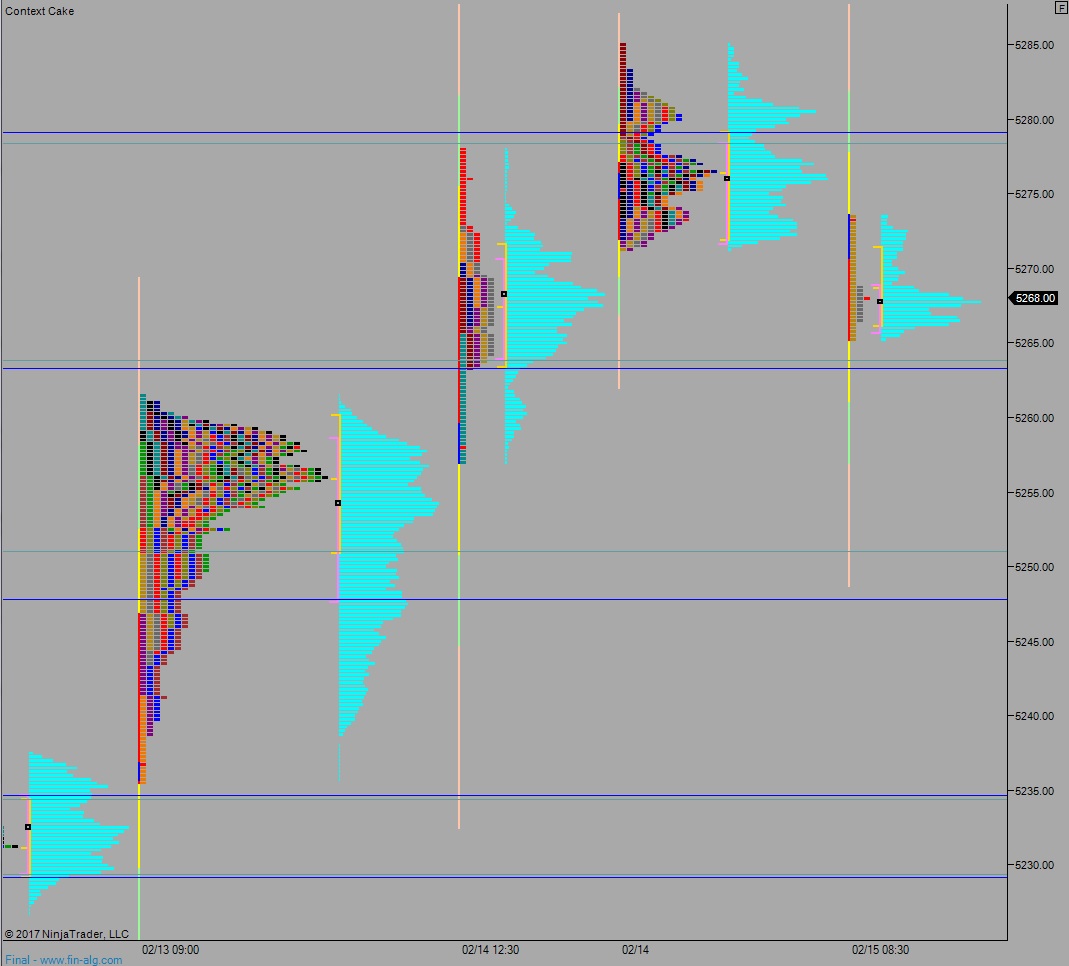

Yesterday we printed a normal variation down. After an early spike took prices to new highs, sellers made two hard rotations lower before we marked time for the rest of the session.

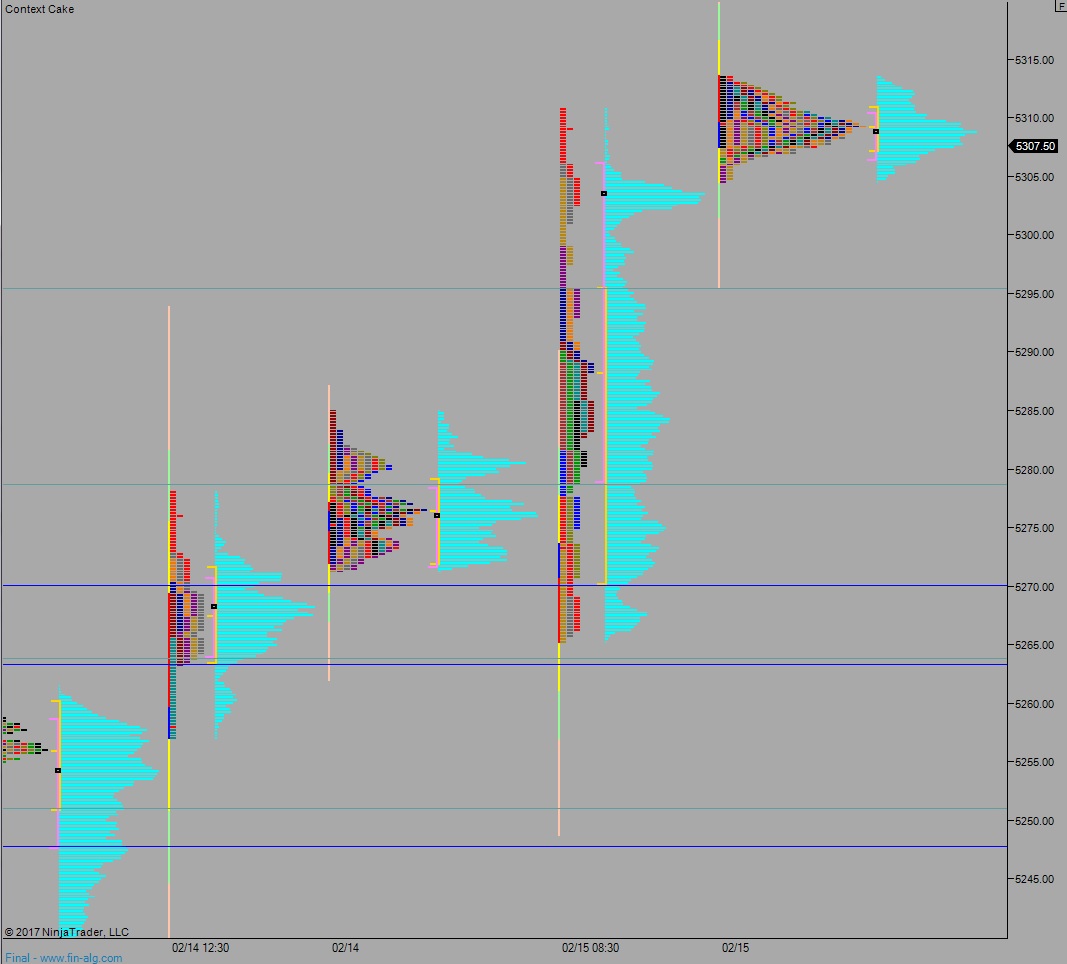

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5301. From here we take out overnight high 5303.25. Look for sellers up at 5308.75 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 5286.75 and continue lower, down to 5278.75 before two way trade ensues.

Hypo 3 strong sellers press down to 5270 before two way trade ensues.

Levels:

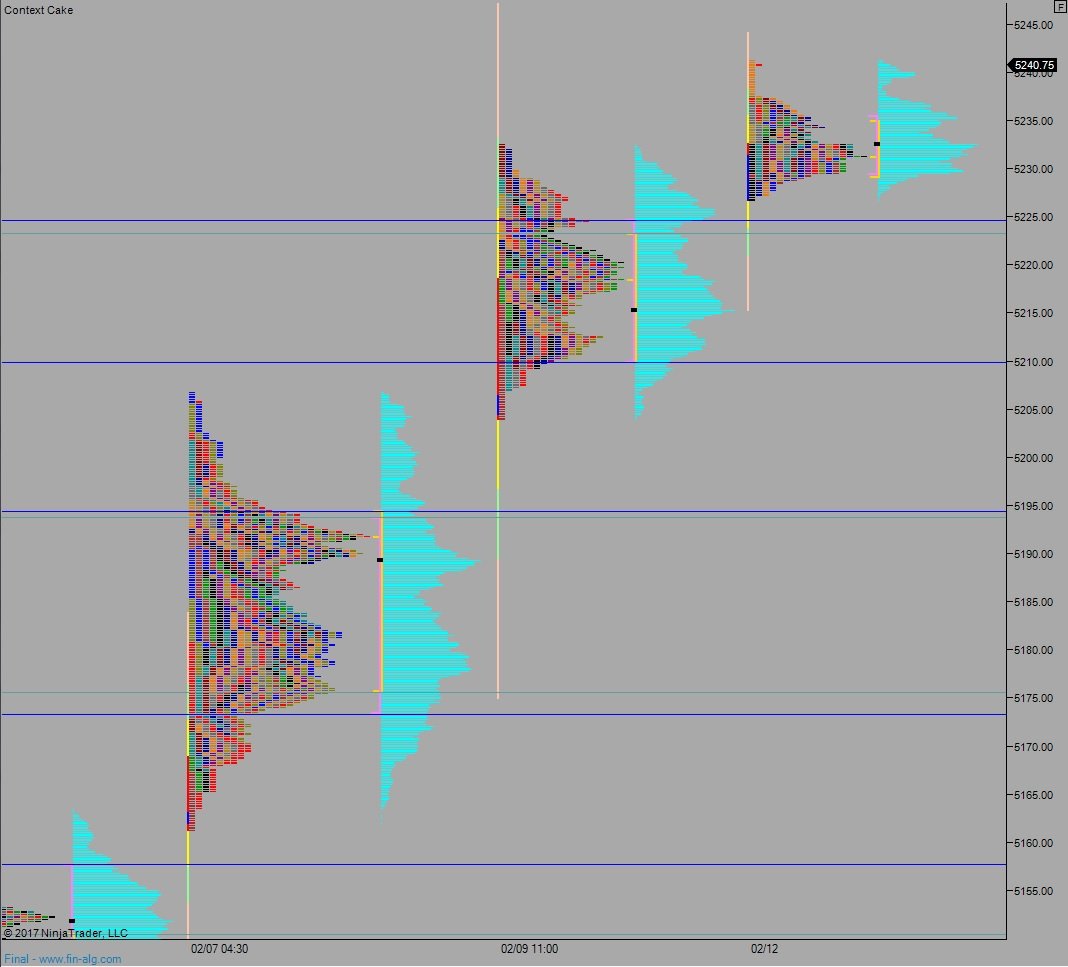

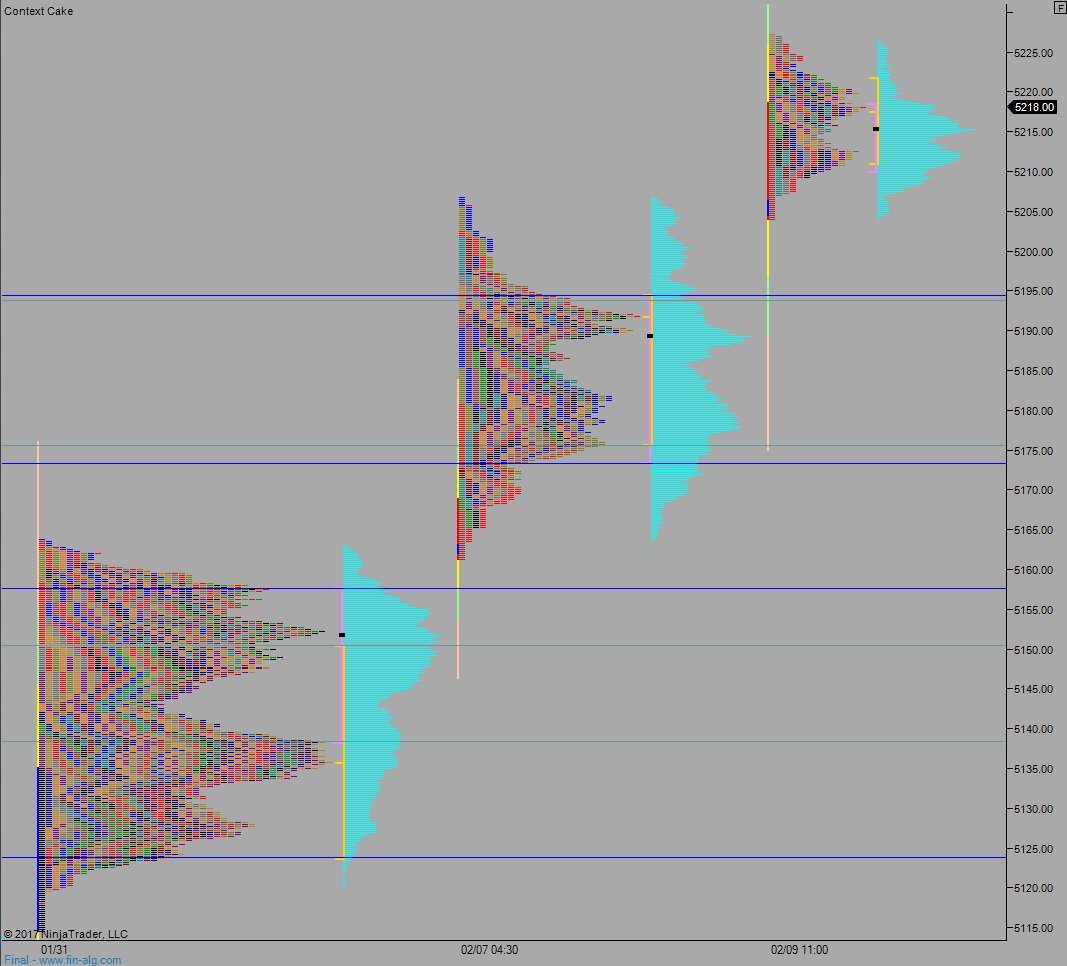

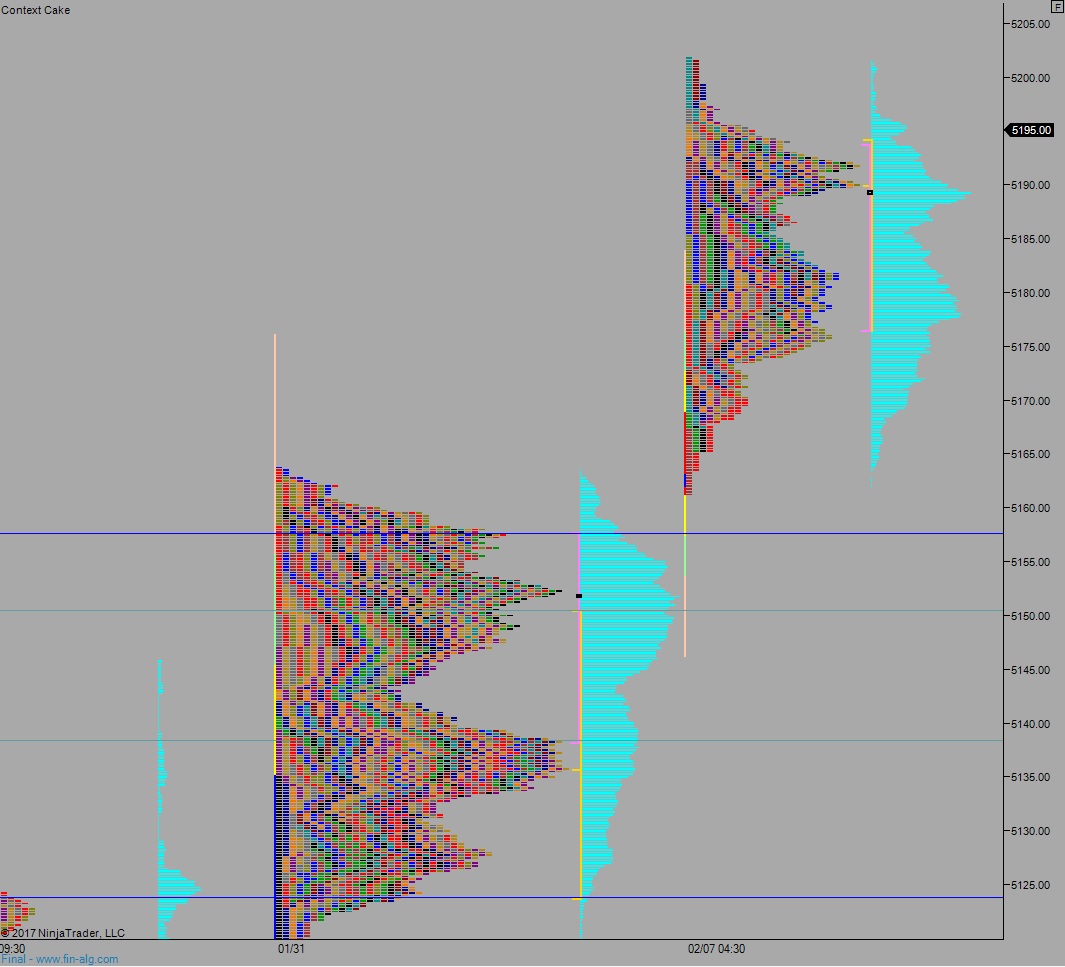

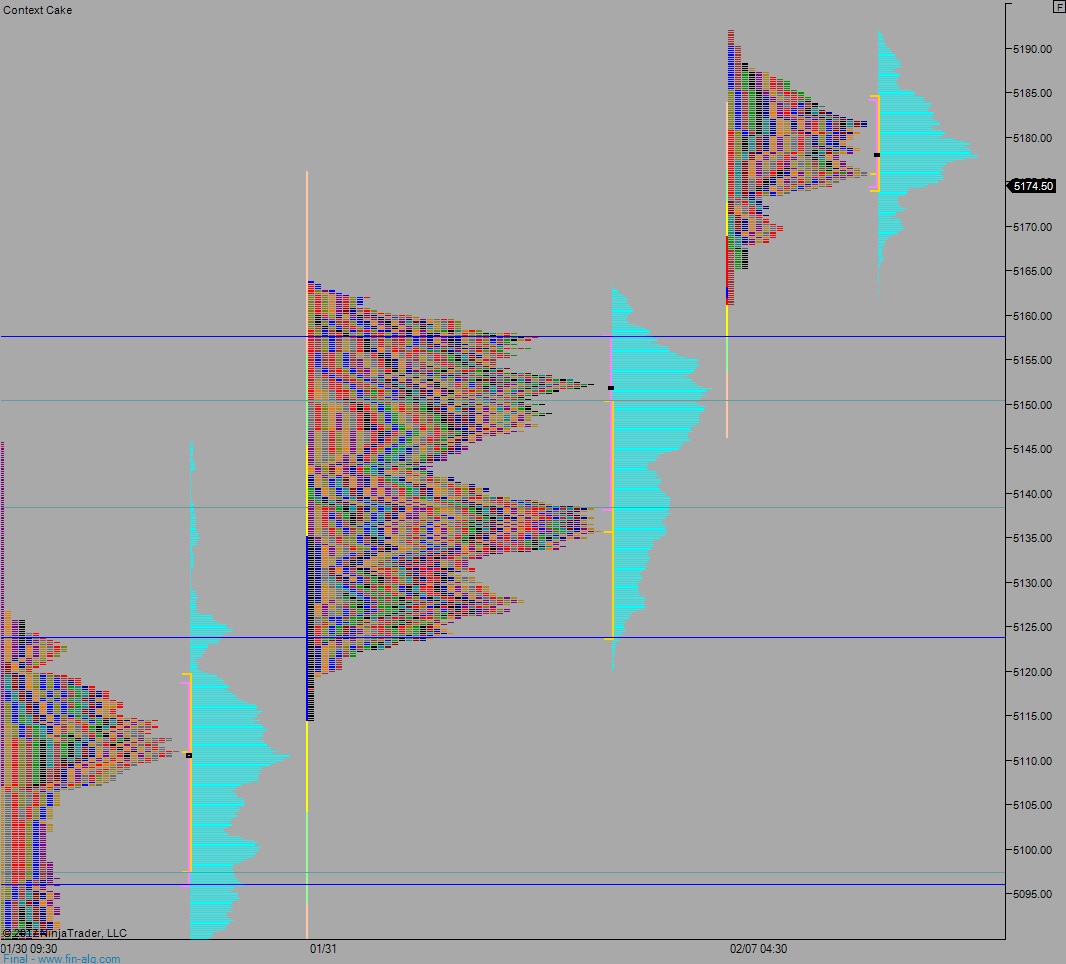

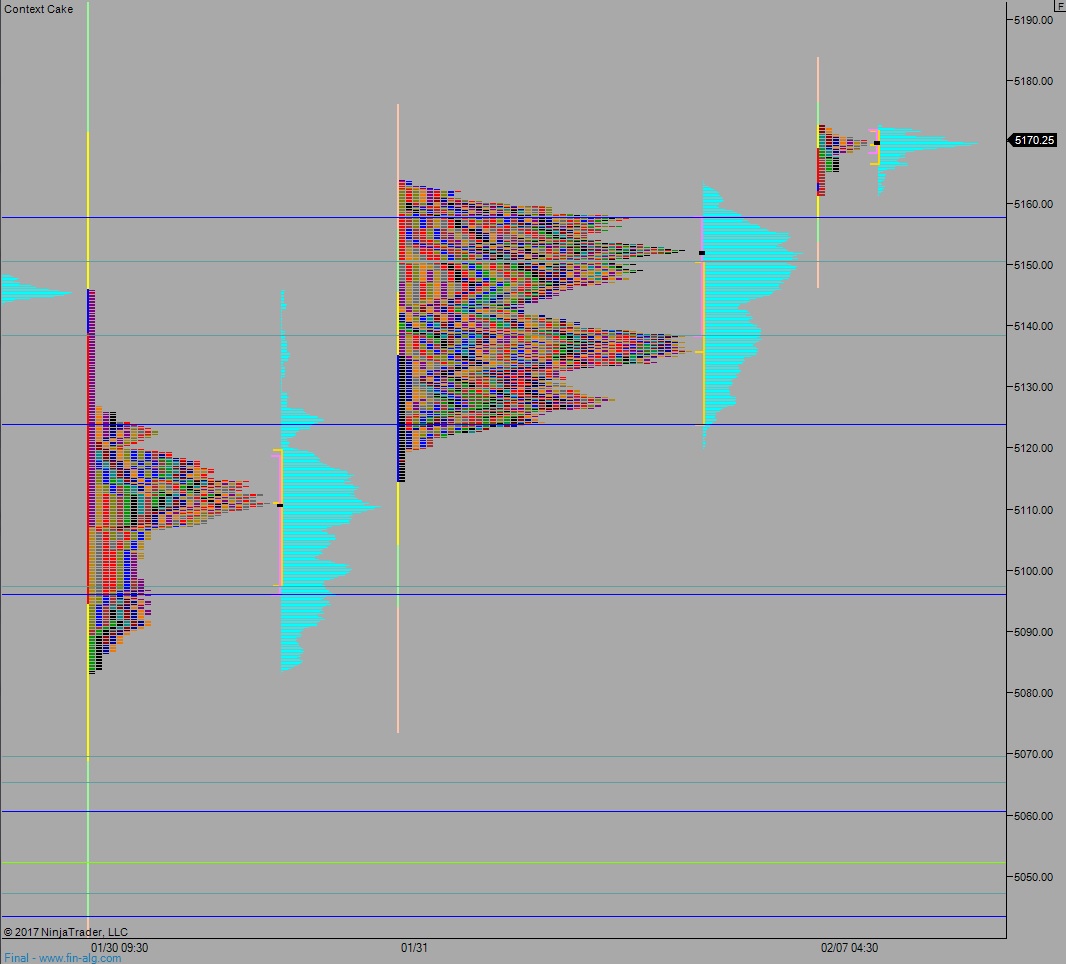

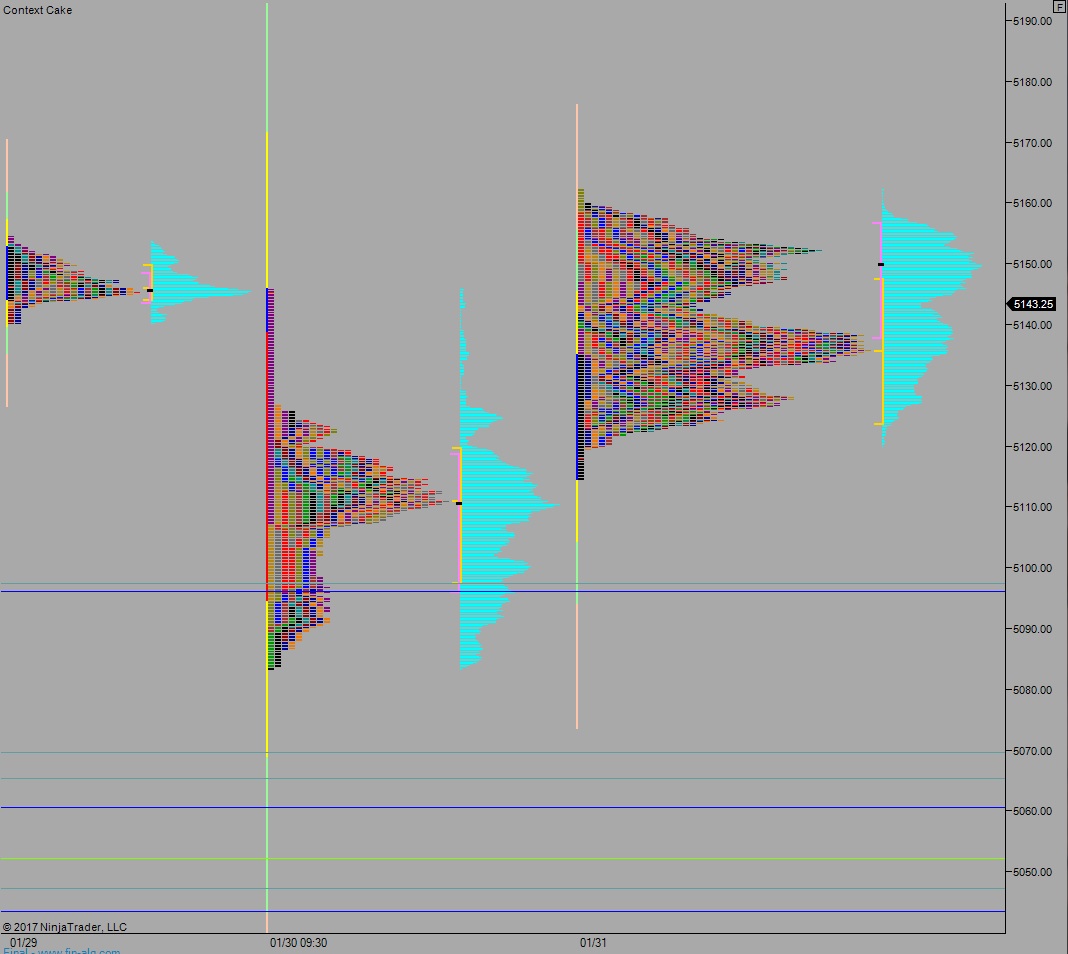

Volume profiles, gaps, and measured moves:

*REVISION: This post originally stated that the Snapchat IPO was today, February 17th. It has since been updated.

Comments »