NASDADQ futures are set to open gap down after an overnight session featuring normal range and volume. Price spent most of Globex trading down, but in a slow and methodical manner. As we head into the open, price is pressing down into the low-end of our multi-day balance.

At 10am we’ll hear a read of the Labor Market Conditions Index Change, and 11:30am both a 3- and 6-month T-Bill will be auctioned, and at 3pm Consumer Credit data is set for release.

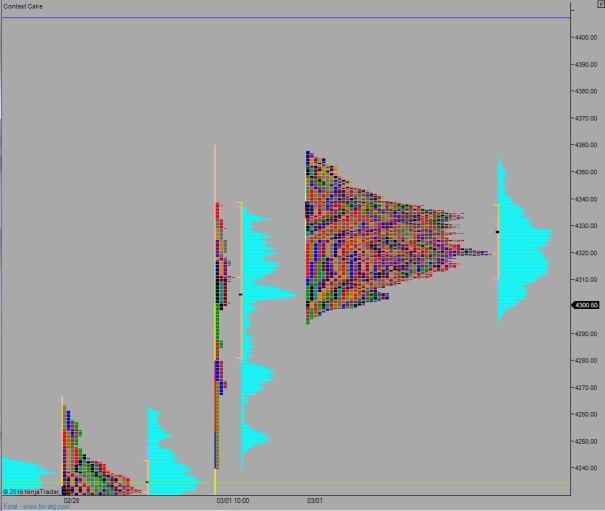

Last week volatility receded significantly, the most we’ve seen all year. There was a big trend day Tuesday then the rest of the week was spent consolidating on the upper quadrant of the move.

Friday printed a normal variation up day, with sellers responding late in the session to close the day flat.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4323. From here look for a move up to 4333 before two way trade ensues.

Hypo 2 seller push off the open, take out overnight low 4296 and trigger a liquidation down to 4279. Look for responsive buyers here and two way trade to ensue, perhaps with a late day gap fill up to 4323.

Hypo 3 sellers accelerate down through the zipper, down through 4279 setting up a full-on liquidation down to 4234.50 before two way trade ensues.

Hypo 4 strong buyers close overnight gap up to 4323 and push and sustain trade up above 4333 setting up a move to test last Friday’s high 4355.

Levels:

Volume profiles, gaps, and measured moves:

Vol curve is way outta wack