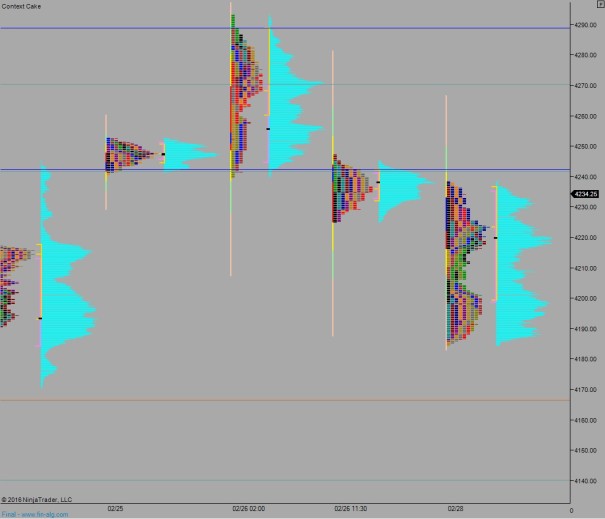

The NASDAQ futures are priced to start the week flat after an overnight session featuring elevated range and volume. Price struggled to hold Friday’s lower quadrant before giving way to selling that poked the micro-composite low volume node [MCLVN] before buyers stepped in. The MCLVN is lined up with the support level buyers defended numerous times last Thursday. Since then buyers spent the morning working price back to flat.

On the economic calendar today we have Pending Home Sales at 10am, 3- and 6-month T-Bill auctions at 11:30am.

Last week was choppy. We came into the week with a big gap up and buyers sustained the gap through Monday. Tuesday was a slow trend lower ahead of a large gap down into Wednesday. An early balanced auction gave way to a strong trend up. Thursday extended upon those gains.

Last Friday price opened gap up and spent the rest of the session on a slow grind lower.

Heading into today my primary expectation is for buyers to work price up through overnight high 4238.50. Look for sellers up at4242.50 and two way trade to ensues above 4200.

Hypo 2 buyers push up through 4242.50 and sustain trade above it setting up a secondary leg to target 4270 before two way trade ensues.

Hypo 3 sellers work lower off the open to test below last Friday low 4225. Sellers accelerate lower from here to target 4200 then overnight low 4184.50. Look for a strong responsive bid at the MCVPOC 4171 and two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: