NASDAQ futures are coming into Wednesday down 10 points after an overnight session featuring normal range and volume. Price managed to extend upon yesterday’s trend during Globex and push deep into 01/07 range before setting into two way trade along the upper quadrant of yesterday. At 8:15am ADP Employment data came in better-than-expected. The initial reaction is selling.

Also on the economic calendar today we have Crude Oil inventories at 10:30am and Fed Beige book at 2pm.

Yesterday we printed a trend up, or conviction buying day. After opening gap up, initiative buyers stepped in big time and rotated the market higher. Their accumulation was sustained throughout the entire session and the market closed on session high.

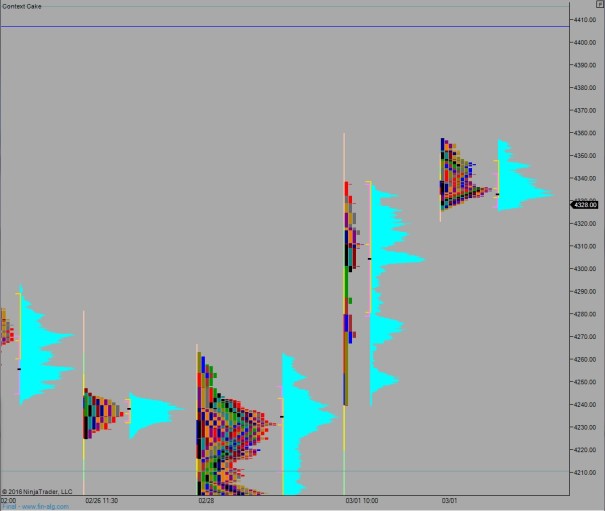

Heading into today my primary expectation is for buyers to press into the overnight inventory and close the gap up to 4337.50. Look for responsive sellers up at 4347.50 and then a move to take out overnight low 4325.50 before two way trade ensues.

Hypo 2 buyers close gap up to 4337.50 then sustain trade above 4347.50 setting up a move to target overnight high 4357.75. Stretch targets to the upside are 4398.75 then 4406.50.

Hypo 3 sellers push down through overnight low 4325.50 and continue lower to test the 4300 century mark before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter