NASDAQ futures are coming into the first Friday of the month lower because it’s May. The globex session featured normal range and selling as the downward price action has been orderly. Price managed to push to a new swing low after 8:30am when Non-Farm payroll data came in much worse than expected.

See also: Huge Payrolls Miss: Non-farm Payrolls Come in at 160k, Well Below Estimate of 207k

The only other economic events scheduled for today are the Baker Hughes rig count at 1pm and Consumer Credit at 3pm.

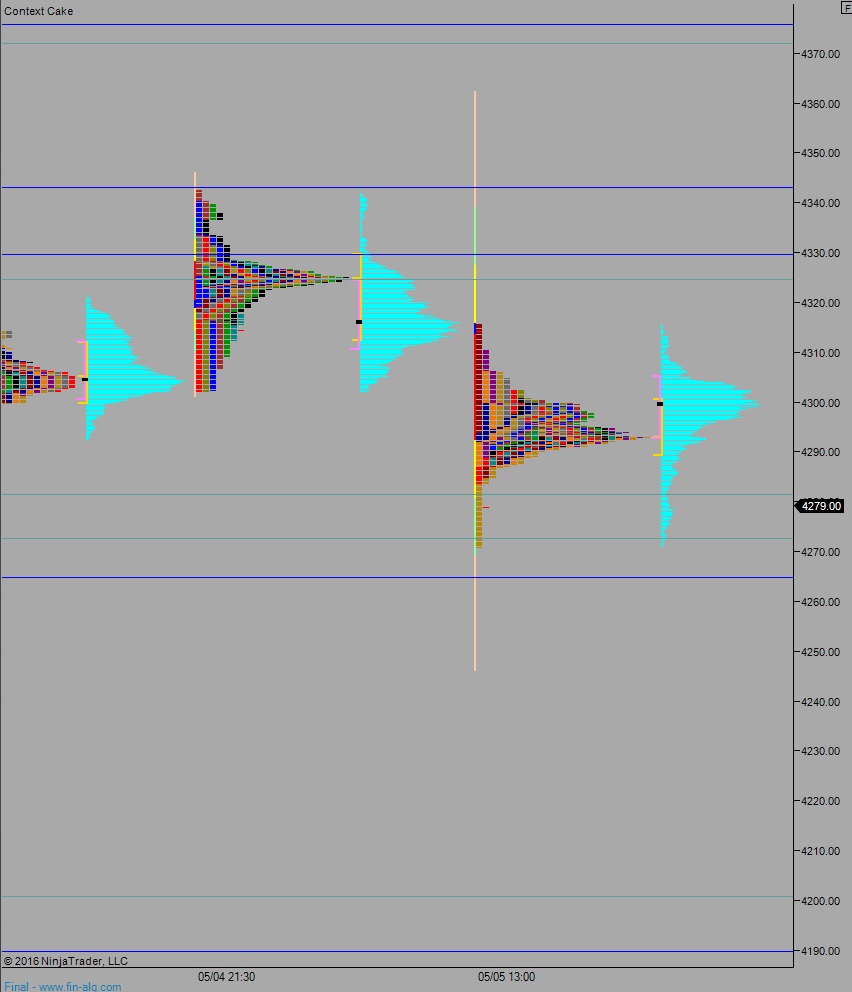

Yesterday we printed a neutral extreme down. A choppy open gave way to buyers pushing higher. Their try was quickly thwarted, and sellers managed to push down through the entire daily range and extend lower. We ended the session chopping below the key 4300 level. The selling has been methodical so far, with volatility hardly inching higher.

Sticking below 4300 is what bears need to bust this balance loose. Tick tick, let's go $NQ_F

— Raul (@IndexModel) May 5, 2016

Heading into today my primary expectation is for a hard move lower off the open, fast, that quickly stalls out around 4265. Look for responsive buyers to then start working price back up to 4300 where we chop heading into the weekend.

Hypo 2 buyers press into the overnight inventory and work back up to 4300 gap. From here they set their sights on overnight high 4302.75. Buyers rally price through the close, up to 4324.50 before two way trade ensues.

Hypo 3 full on liquidation. Sellers sustain price below 4265 setting up a liquidation down to 4200.

Levels:

Volume profiles, gaps, and measured moves:

Hey Raul sometimes you mention ‘return to the scene of the crime’ , are there days where this is more applicable than others with big morning news?

I always say that in reference to news driven moves, returning to ‘check back’ to where the initial motivated move occurred, to see if they were serious or not.

it can be any news any time, it just needs to be unexpected (i.e. not in-line with prior estimates if economic, but even more if it’s a breaking, unexpected, non-scheduled event)