United airlines had to pull four paying customers off an airplane. Was it dumb to let them board in the first place? Probably yes, as was busting a citizen’s jaw till he was leaking, as they say in urban centers.

There are people who think the old man should have just got off the plane. Siding with the aggressors–whether airport police or gate goons–means you are insensitive or worse hateful.

LABELING!

Moving on…

The truth is life gets way harder then your flight plans being screwed over. Some people are right on the edge when they travel. If only there was an institution to blame…

We can agree most people are obsessed with what happened here, right? It makes great viral news because travel stress is relatable. So many things about traveling suck. The lines, the smell, space allotted per human, dirty toilets, belligerent drunks and kids. Relating to the struggle this man faced is so human of you.

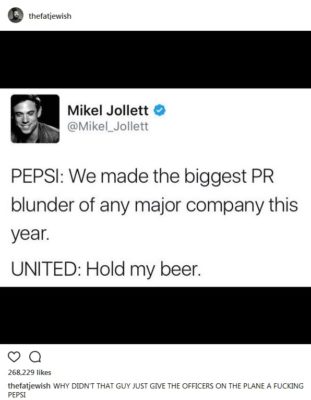

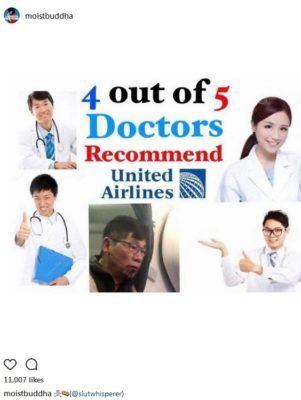

But is what happened bad? It depends on who you ask. Airline jokes are the bread and butter of comedians. Just thumb through your Instagram and BEHOLD, JOKES:

Most of you probably have a group chat, yes? Friends and such, YES YES!? JOKES:

Go to your local comedy club this weekend. You bet your ass there will be United Airline jokes. The reckless behavior demonstrated by everyone on that plane is the type of fodder comedians hope for.

The quick thinkers at Southwest airlines actually tweaked their marketing, cashing in on a huge opportunity to target millennials. MILLENNIALS, mind you, who love traveling more than owning possessions:

They say Cato ran his dead brother’s ashes through a sieve, looking for gold. Perhaps there are some stoics on the branding team at $LUV, making delicious lemonade from their wounded brother’s ashes.

Are airport police going to suddenly increase their violence against flyers, nipping at their heels? Corralling them like sheep? Doubtful. There is/was little harm done to society by the event.

When you sum up the benefits (jokes, distraction from WW3, branding opportunity) and subtract out the consequences (bloodied jaw, bruised ego for the resist crowd) you see quite logically that the event was a success for humanity, overall.

In six months, the cell phone footage of a beta-male being preyed on by a team of alphas will cease to resonate in your mind. There will be something new for you thumb suckers to be outraged about, or you will just be distracted by living your own life—an infinitely more rewarding task.

In the meantime, consider what sort of message you send by insulting and name calling the realists of the world. It makes you the hater, bro.

So lets just leave people to their own mistakes, all of them. Shaka

Comments »