Greetings from the inside the machine!

I have spent the better part of Sunday calibrating the cogs and greasing the wheels inside the Exodus Strategy Session index model to ensure it deploys an accurate message.

After the scores were tallied and married to the learning algorithms of Exodus, the results are in:

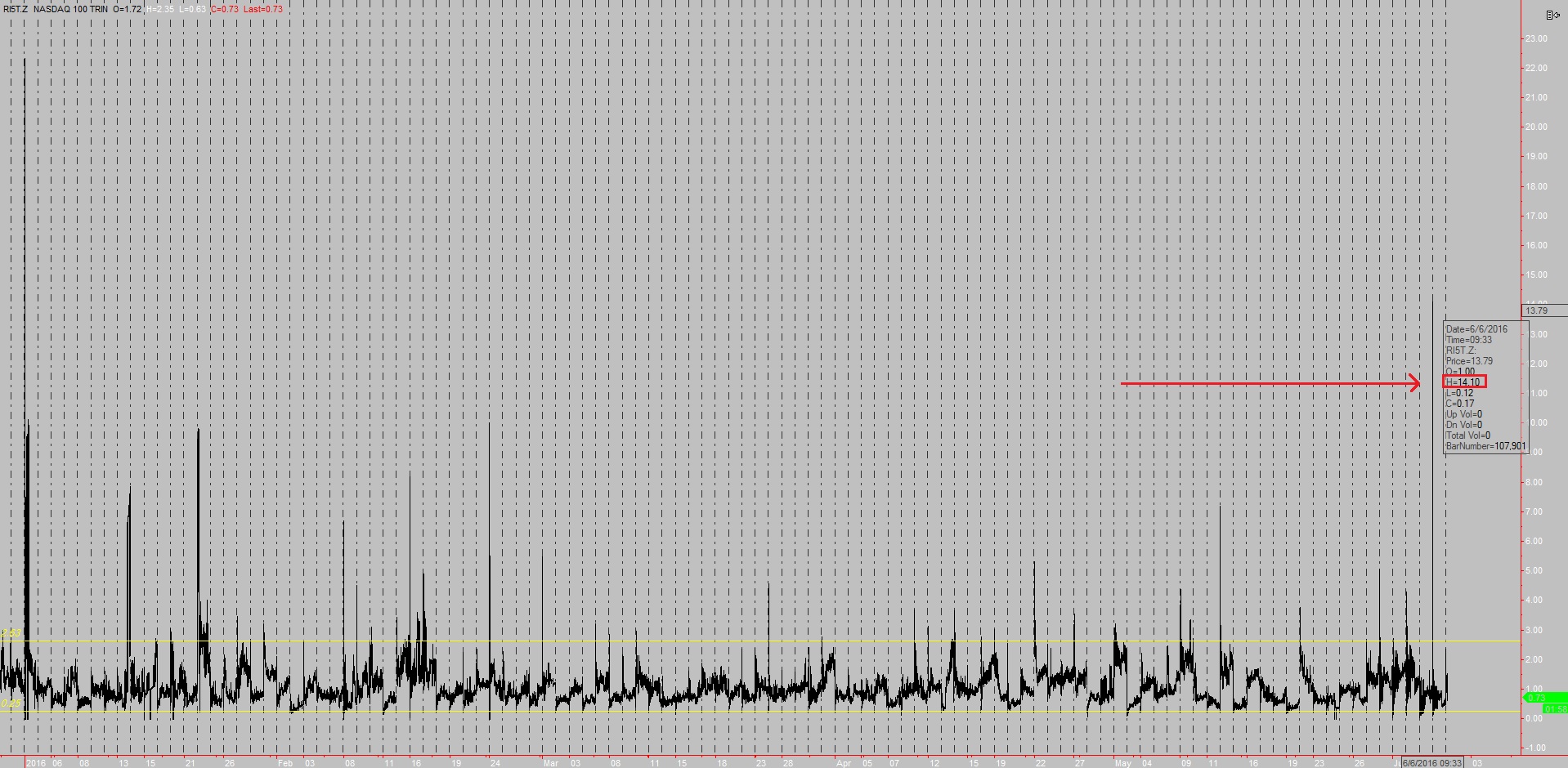

Next week we drift, like a slow summer wind.

I know many of your were ‘treated’ to tree-bending winds, torrential rains, and biblical skies that made you seriously consider boarding the ark, but the robots are like, “not just yet, Mr. Robinson.”

The gritty details of how I expect this week to pan out are written in the Exodus Strategy Session, a weekly report published inside Exodus every Sunday about this time. You executive types, with your cocaine addictions and bastard children, may enjoy a quick read of the summary which takes every bit of data and coagulates it into two-to-three succinct sentences.

You are a busy person, and your pal Raul is going to take care of you.

In summary, lab results are in, and they are calling for more balance and drift on the top-side of the marketplace. Trade accordingly.

Distinguished members of Exodus, it is with humility and a child-like desire to learn that I present the 93rd Edition of Exodus Strategy Session. It is live now, go check it out!

Comments »