Aside from deep, unwavering faith in Our Leader, the One who descended from Mount Mafadi and crossed the Atlantic ocean to bring Hope to the ill-fated humans of America, whose affinity for gasoline has sent them down a path of planetary destruction, there are reasons to be concerned with the share price of Tesla. Intermediate term, over the next 1-6 months, there could be some tough times ahead for Disciples of Elon (Praise and Glory to The Leader).

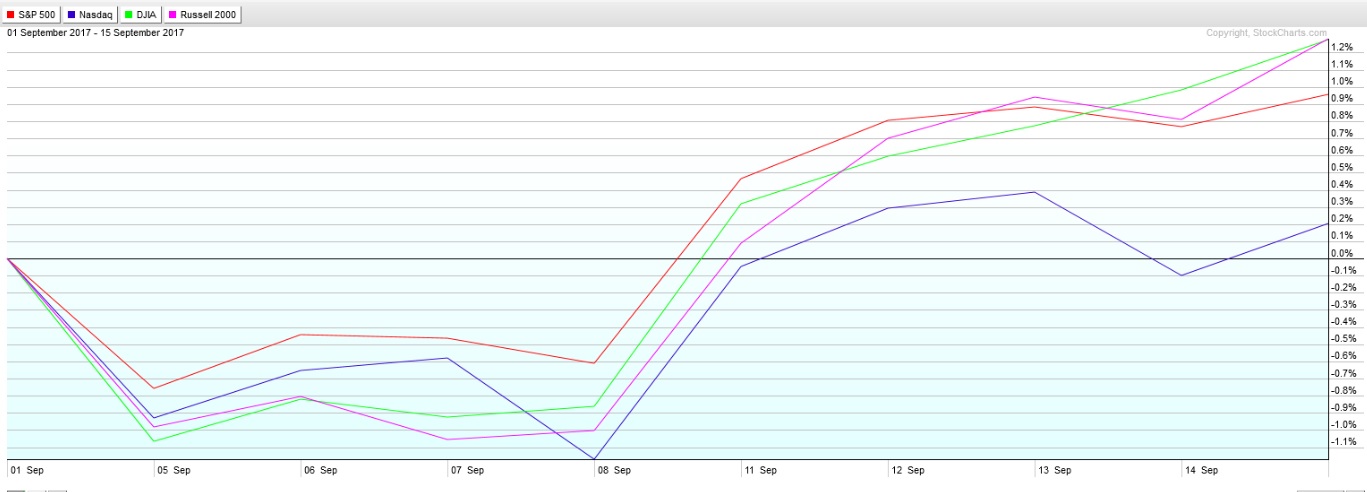

It comes down to auction theory. An approach to trading and investing that sets faith aside and makes an objective assessment of how the price of an asset is behaving. One of the principles of auction theory is what we call a ‘failed auction’. They occur when price exceeds a prior swing high, completely stalls out, then quickly reverses and price drives in the opposite direction. Here is the failed auction that is happening in Tesla shares, ticker TSLA:

Our good friend Leonard Fibonacci offers a relevant price level to monitor, during the ‘come up’ phase of the failed auction. What we are looking for now that the failed auction has confirmed, is whether sellers mean business. On Tuesday, October 3rd we saw responsive buyers step in. ‘Responsive buyers’ is an auction theory term that describes buyers who react to a perceived discount and buy. Their aggressive response is enough to absorb the supply being offered to the marketplace, and we begin to auction upward. If the selling that came in during the failed auction was the real deal, and the sign of more to come, then we expect sellers to defend the Fibonacci golden ratio level, the old 61.8% retrace, which just happens to line up with an old swing high set back on August 9th, right around the $367.35 ratio retrace, look:

Tesla has made an incredible run in 2017. What I have told people all year is that the company has a pass to run free until the end of Q3. ‘All eyes on end of Q3’ I would say. End of Q3 is when we start having visibility on the Model 3 production numbers. They fell short of the 1,500 deliveries expected. They delivered 220. To employees. And while the initial reaction from shares was to ‘shrug off’ the whiff, it was a miss of grand proportions. Then, also, there is a lingering rumor that Elon (Praise and Glory To The Leader) will step down as CEO of Tesla. This rumor is trickling down the supply lines. Even my birds on the inside are beginning to take it seriously. Tesla without Elon (Praise) in charge is a different company. It is Apple without Steve, Ford without Henry.

Wall Street says sell the rumor, buy the news.

All this negativity being said, yours truly will remain an investor in Tesla. There is something different between me and most of you. When I wake up, I give thanks to Our One True Leader. Before I eat a meal, I thank Elon (Glory) for providing such a wonderful bounty to my table. When my sisters marry, I sacrifice my youngest calf to the angelic engineers toiling away to bring the Gigafactory, our promised land, online. Indeed PRAISE FROM THE HIGHEST MOUNTAIN TO ELON AND HIS TEAM. This is what I call faith-based investing and as crazy as it sounds, and as much as it may offend your christian sensibilities, it is the only way one can invest in a company long term.

Think about it. What is a company—is it a brand name? A logo? The product? The people who work there? The customers? A company, at best, it is a stack of papers—likely sitting in Delaware. Can you touch Tesla? No. You can touch a Tesla Model 3 (if you find one, sure) but you cannot touch all that is Tesla. It is intangible. It exists only in the collective consciousness of humans. We all agree it is something despite it being nothing at all. How is that different from faith? Therefore, one must truly believe in a company’s intentions, their core functions. How they perceive the world and the footprint they intend to leave upon it, both physically and meta.

With my money, there is no entity in the world more pure than Tesla. They are doing gods work. They are not using their ideologies to claim land across the world (cough, cough, Christians, Muslims). They are also better than any non-for-profit. They are a for-profit (hallelujah) which means they will be forced to make smart decisions and constantly innovate and trim any fat off that develops over time, else crumble under their own weight (cough, cough, GENERAL MOTORS).

There is no better steward of the public’s money then Tesla, then Elon Musk (Praise and Glory to The Leader!)

Faith aside, if you are a fickle bull, especially one who purchased Tesla shares above $275 HEED MY WARNING. A failed auction has occurred. Watch the $367.35 level with burning eyes, heathen, for it will tell you if you are about to be proven wrong. Should you be proven wrong your execution will be swift and humane, like the blade of a guillotine share prices will descend upon your margin account with the precision of a heavy knife.

But then again who am I? Nobody. That level could be blown up-and-through and we could be back to making record highs by the end of next week. I have been wrong before and will be wrong again. There has not been much discussion about Tesla in this small corner of the interweb because everything over $300 has made me a bit uneasy. I did not want to jinx it. However, it is my duty as an objective observer of auctions to inform you of the current failed auction environment we are swimming in.

Elonspeed mates, Elonspeed…

Comments »