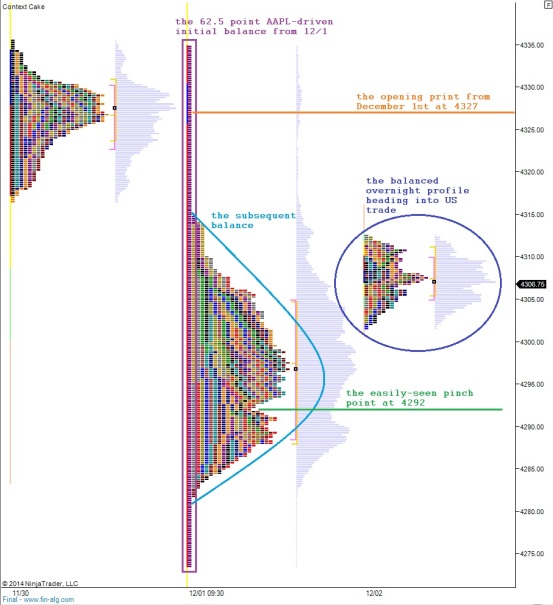

We started the month of December with an ‘event’ of sorts. The first half-hour of trade, also known as the initial balance, was spread far and wide (61.25 points) by an aggressive other time frame participant who predominantly sold the market. We must also give some credit to the buyers who pushed up 7.75 points before the move, the move largely driven by a fast sell in AAPL shares.

In case you are very new to the Nasdaq, Apple Inc. is the largest component of the Nasdaq 100, the underlying index of /NQ_F futures.

However, none of this activity was news driven, which makes it unique. We treat motivated, news driven moves a bit differently from big, participant driven moves.

Participant driven moves must be monitored for continuation. Does the responsive seller become initiative? Is the other-time-frame (OTF) still engaging the market? So far no, and maybe.

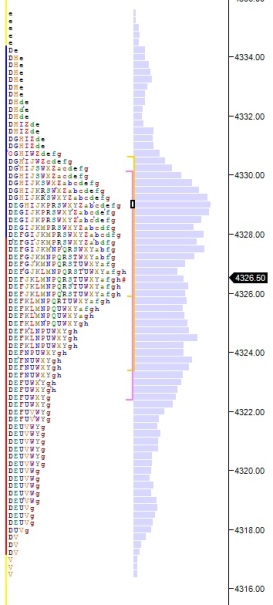

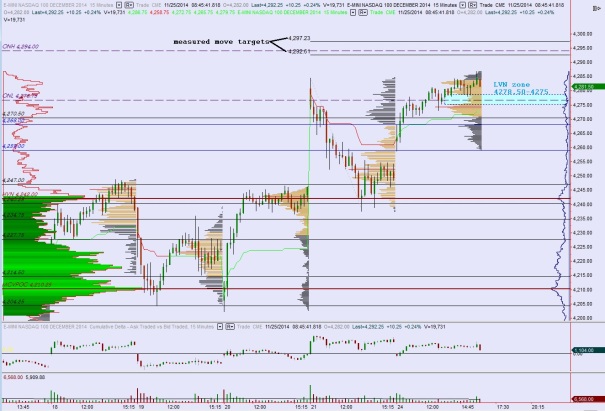

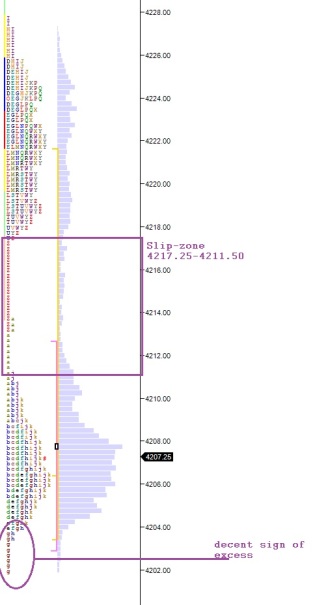

We have traded inside this initial balance since it occurred. And as far as I am concerned, we can shelf the volume profile I normally share which features very granular levels only useful to me and other day traders, and instead put your eyes, the swing traders eyes, on just a few key points.

Listen, we have Fed Beige Book coming out at 2pm today and it is usually not a high impact event. But before then ISM Non-Manufacturing Index is set for release. This number surveys all sorts of odd industries like services, construction, mining, agriculture, forestry, and fishing and hunting. It may be of interest during the great commodity liquidation of 4th quarter 2014. Keep an eye on the price action around 10am eastern.

In the meantime, amid all that noise, keep these context levels close to your itchy trigger finger during today’s session:

Comments »