What feels good about this week is, well everything.

I have learned to take the good with the bad and treat them all the same. I refined what makes me feel good. It is not financial gain. It is physical pain, but that is irrelevant to my professional life. What makes me feel good professionally is doing the right work.

Research, plan, execute.

This was an important week, but I woke up late Monday. The Sunday football had me all fired up. Bill Belichick is someone I admire, and seeing him take another set of athletes to the Superbowl gives me hope that I will have a long trading career if I do my job.

But the real fun was seeing the birds trounce those primitive norse men.

Through it all I forgot to set my alarm.

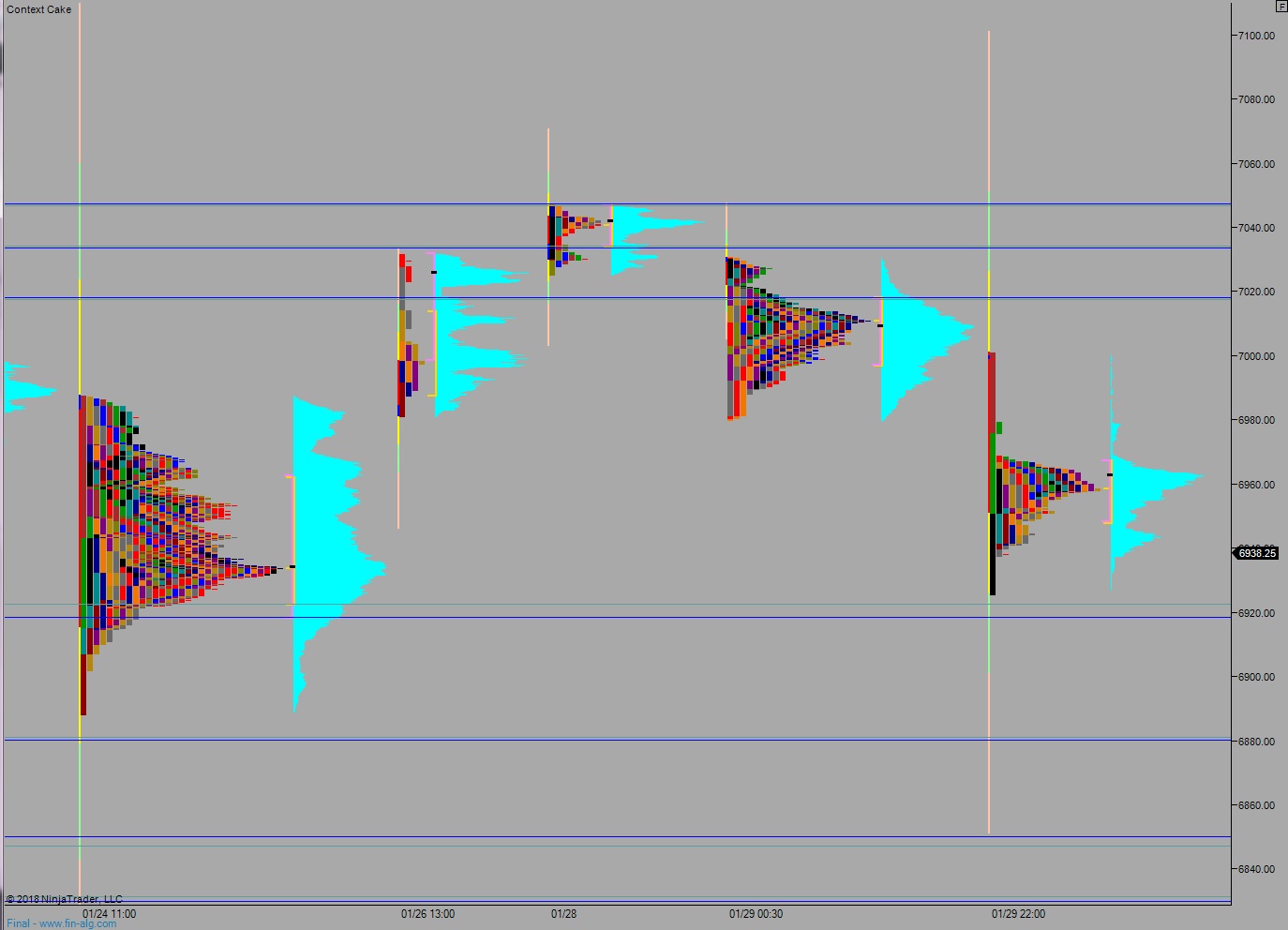

So I woke up late Monday. Missing the opportunity to write a NASDAQ trading plan before opening bell threw me completely out of whack. Suddenly everything else I needed to do this week started swirling around in my head. It was overwhelming.

Just then I took a mental break. I sat down in the office. Turned off all the monitors. Left the phone in the kitchen and folded a standard eight and a half by eleven piece of paper in half four times. This yields the only size to-do list one can effectively tackle.

And I wrote down everything I need to do this week. I took Monday off from trading. I did not force myself to sit down and use my gut, or instinct, or whatever to go swing some trades around.

That was something I used to do. It lost me lots of time and money.

I sat down and wrote a to-do list. Then I starting knocking out the most enjoyable tasks. The low-hanging fruit.

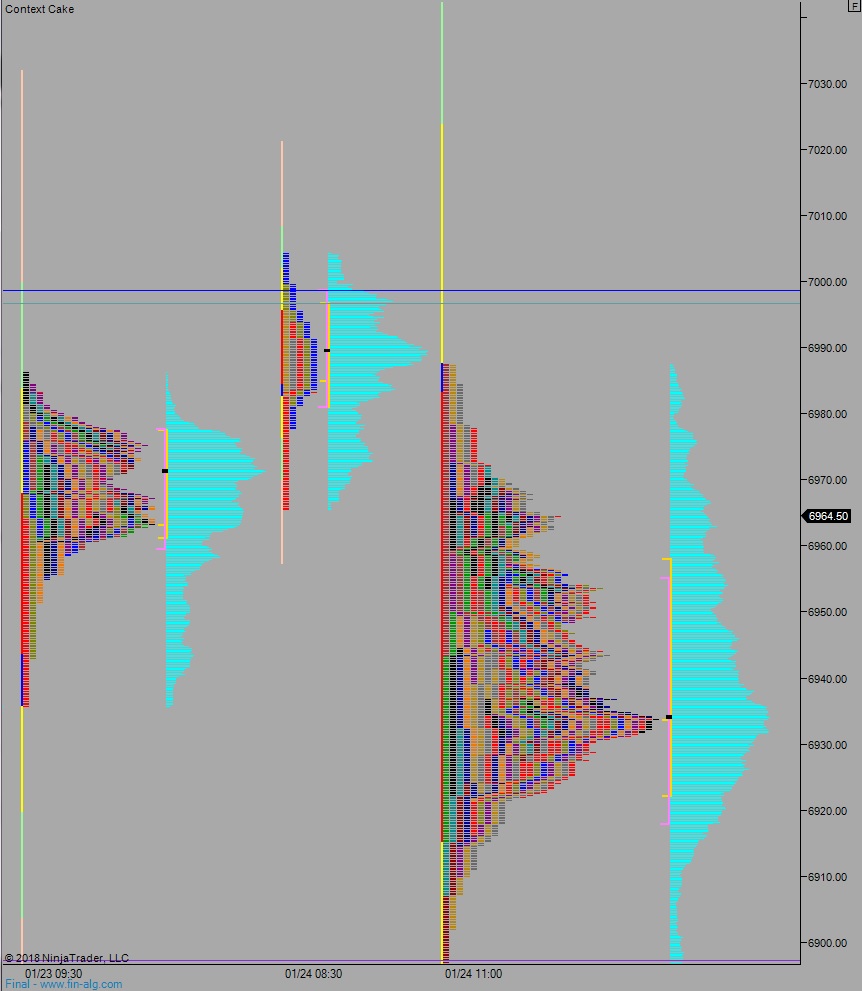

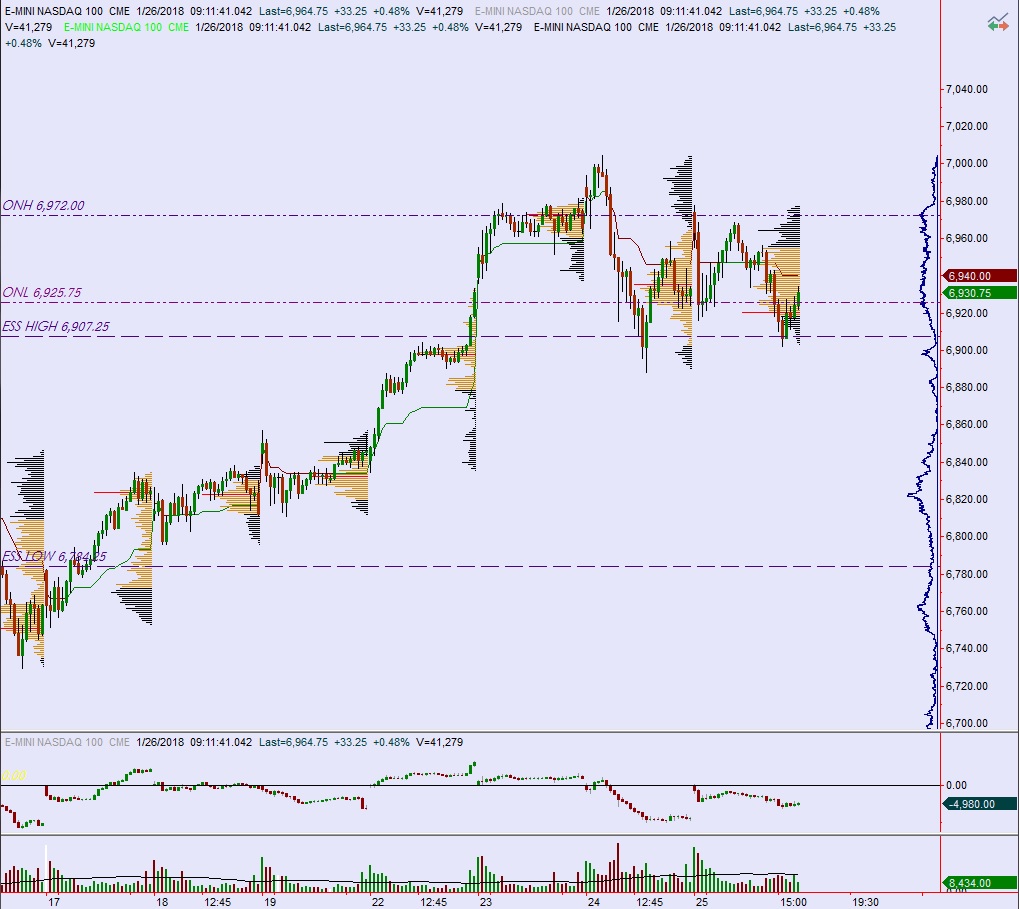

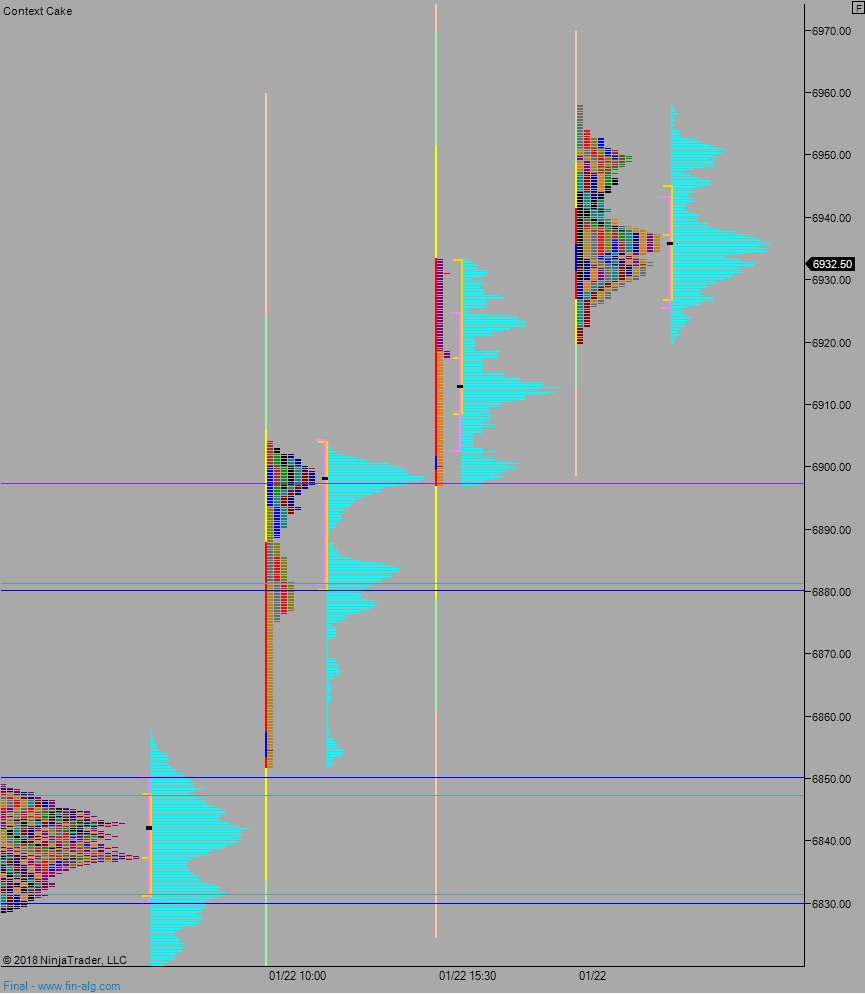

On Tuesday I traded. I cleaned up the overnight high before lunch and went back to work on the to-do list:

Tuesday night I had an awesome Meetup downtown and made some real connections with people who I think will become better observers and traders.

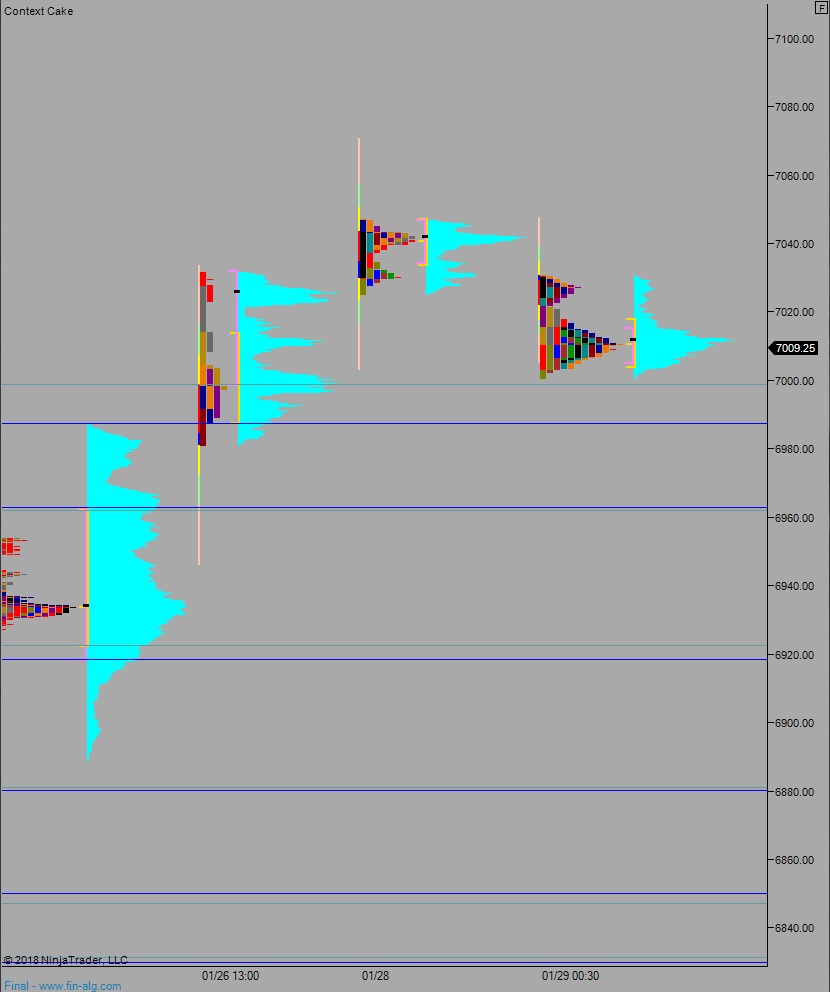

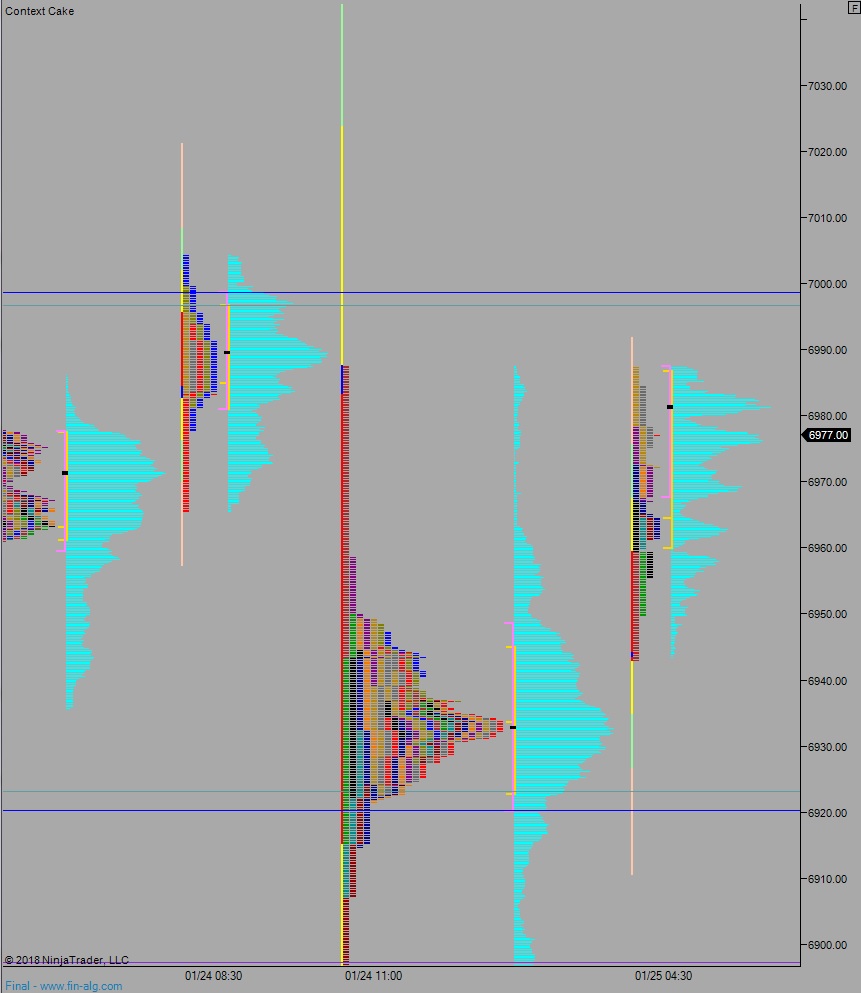

Wednesday I nailed the trade up through overnight high THEN pivoted and rode a fast rip lower and went back to work on my to-do list:

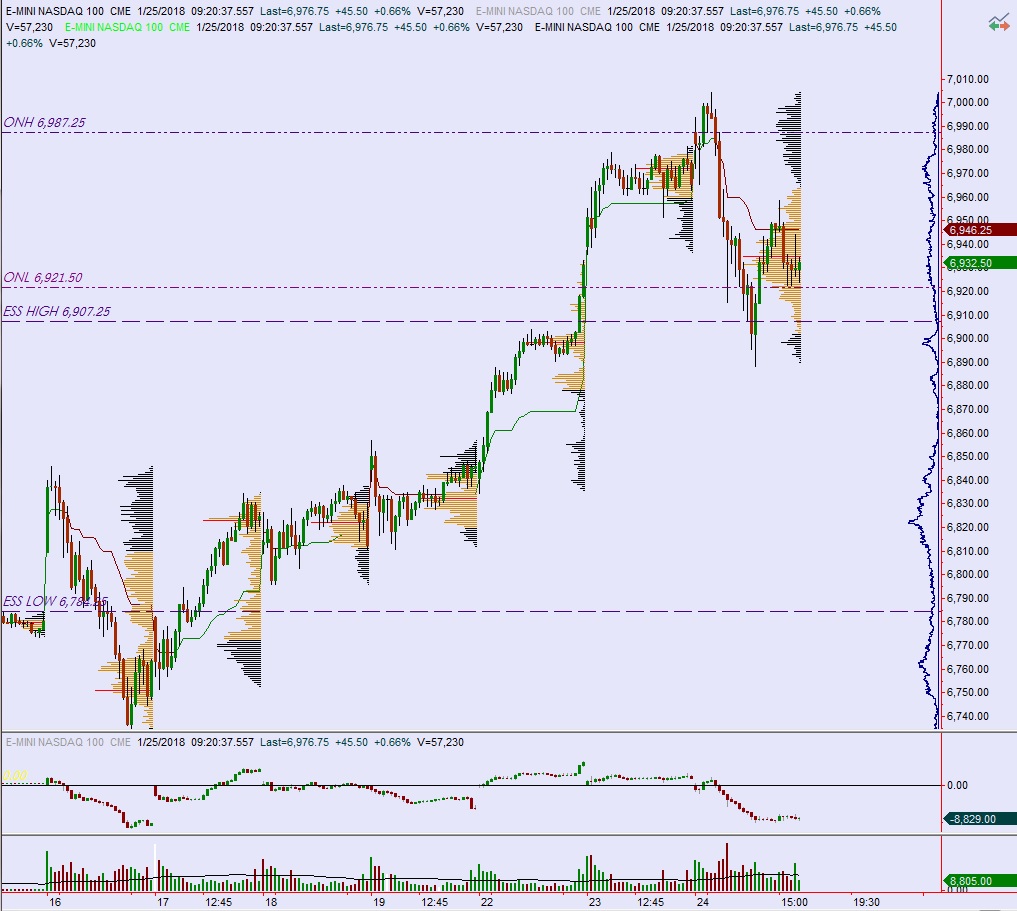

Thursday I nailed the gap trade fast and magnificently and then worked on my to-do list:

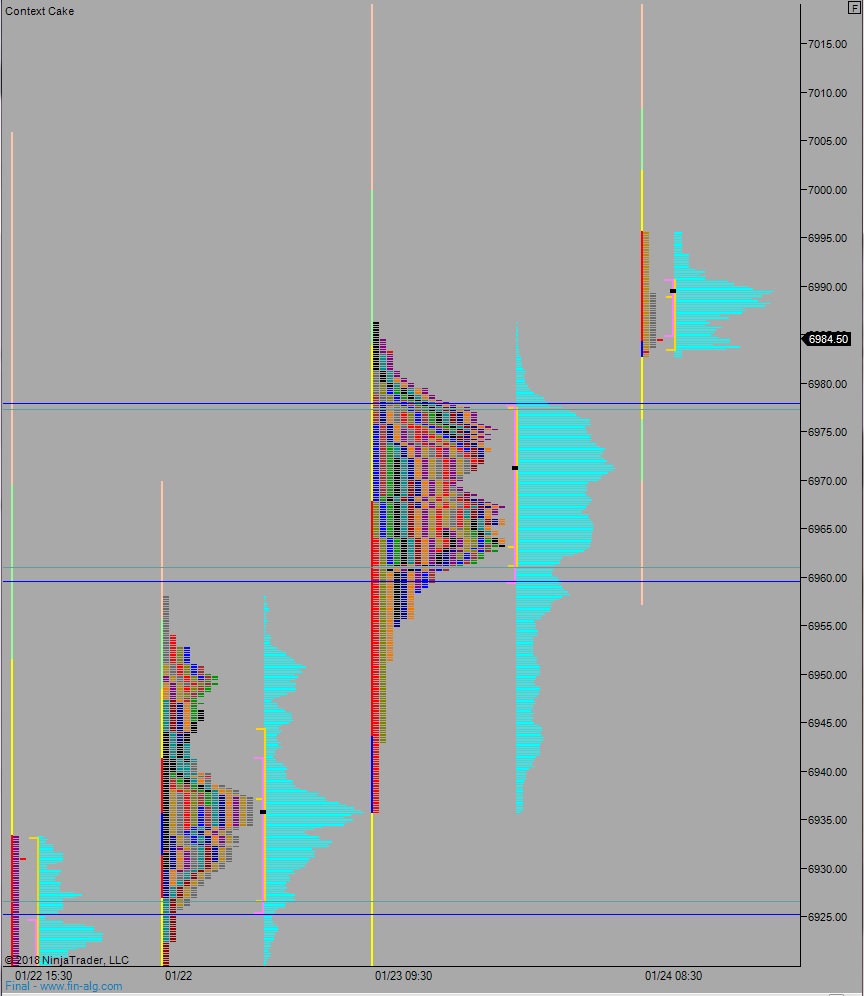

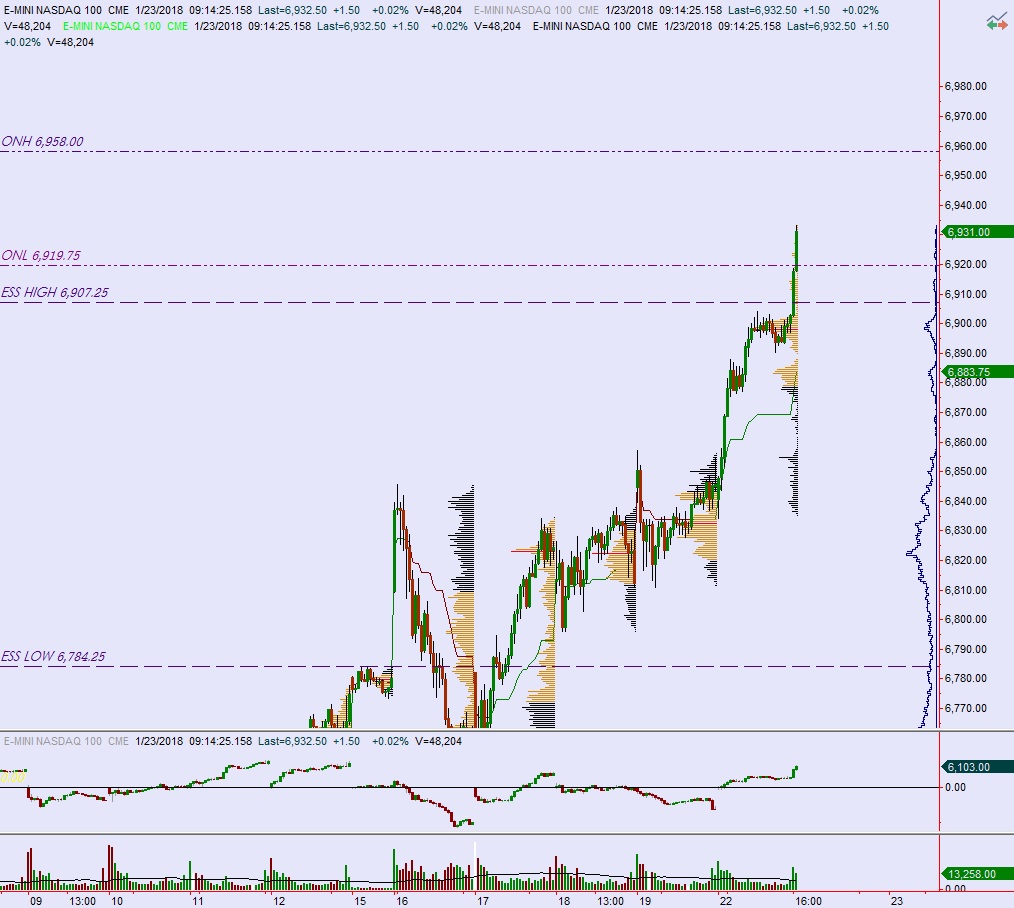

Friday, today, I pivoted to hypo 2 and slowly rode the trend higher:

And now it is time to return to my to-do list. There are a few items left and I scratched a few new items in the corners. I may not even complete the whole list this week. But the process of stopping—of sitting down and writing all the seemingly overwhelming tasks on paper, with pencil, on an eight and a half by eleven piece of paper folded in half four times—saved my entire week. And I am happy that I stuck to an old habit that helps to clarify my thoughts and take proper action.

I am grateful I took a stop.

I like to think a week like this would make coach Belichick proud. Not that that matters.

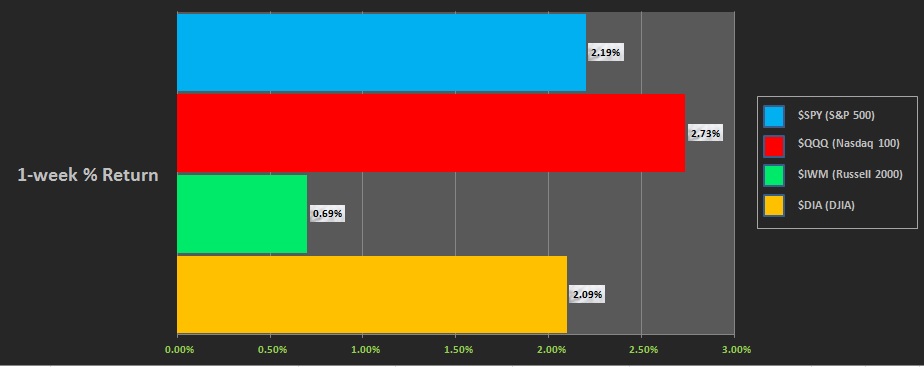

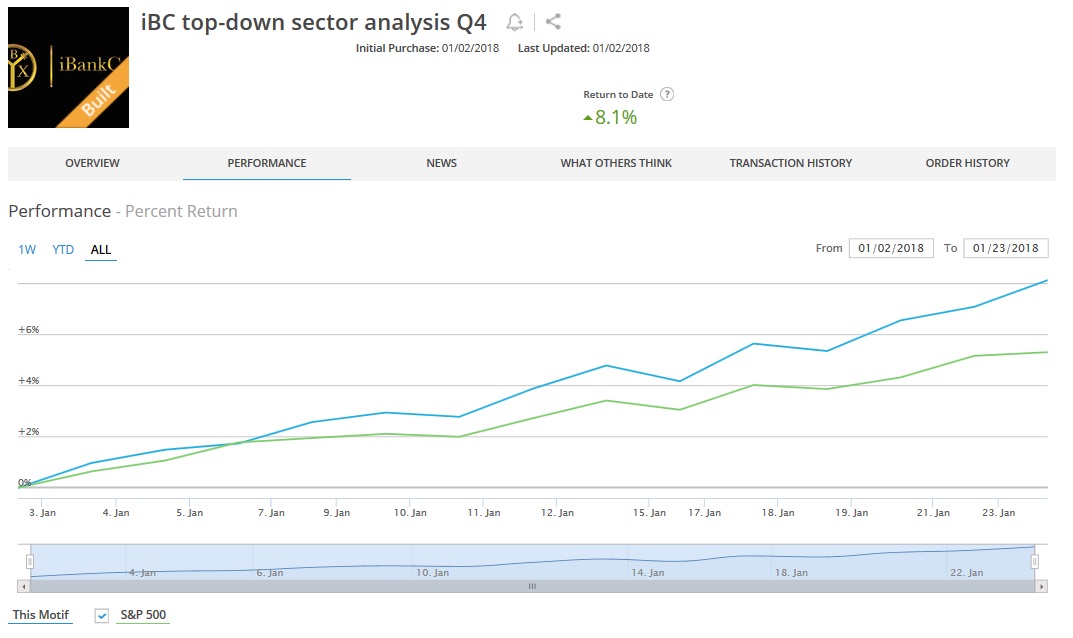

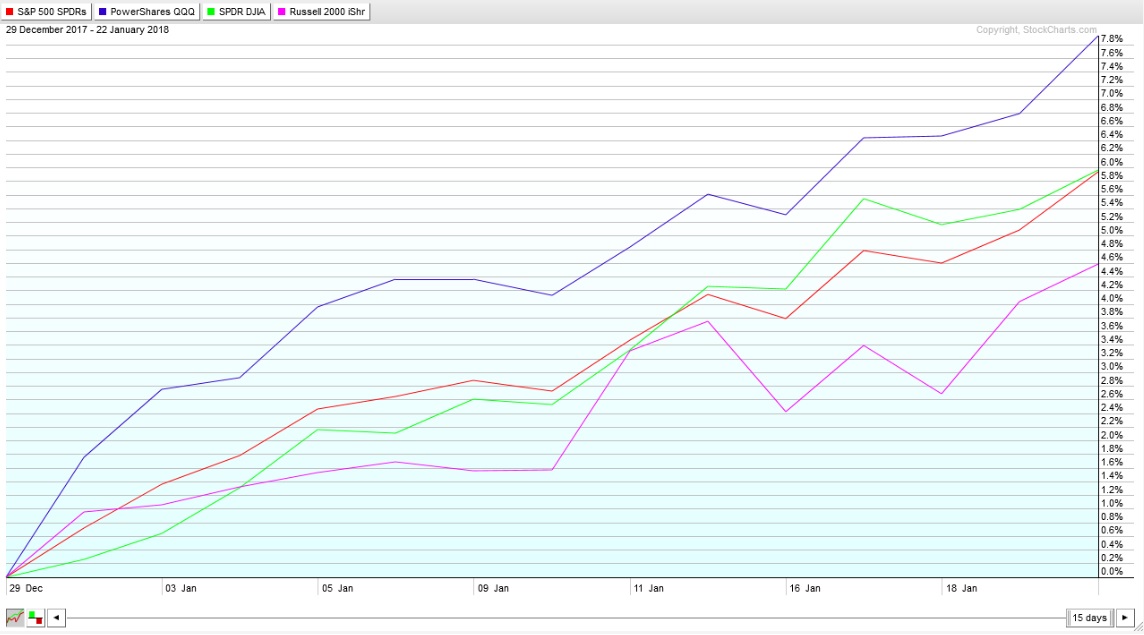

Meanwhile my quantitative portfolios are all at record highs and outperforming the S&P 500. These truly are good times. So much winning is occurring.

I know the inevitable snap back is just around the corner, like a hard northern wind just after passing beyond a building. Don’t let it blow you over. Keep you feet on the ground and stay balanced.

Have a great weekend everyone. I am grateful for the connections I make here. It means a lot to me that you guys share my work, and hopefully it finds someone who needs help with their approach. Everyone takes a different path to consistency and sometimes it helps to emulate some of the traits they see in others. Eventually, with experience they can begin creating their own recipe. They become less of a cook and more of a chef. But we can always go back to being a cook again if someone is more experienced and a worthy mentor. And I hope people read my work and realize that it takes patience.

Raul Santos, January 26th, 2018

Comments »