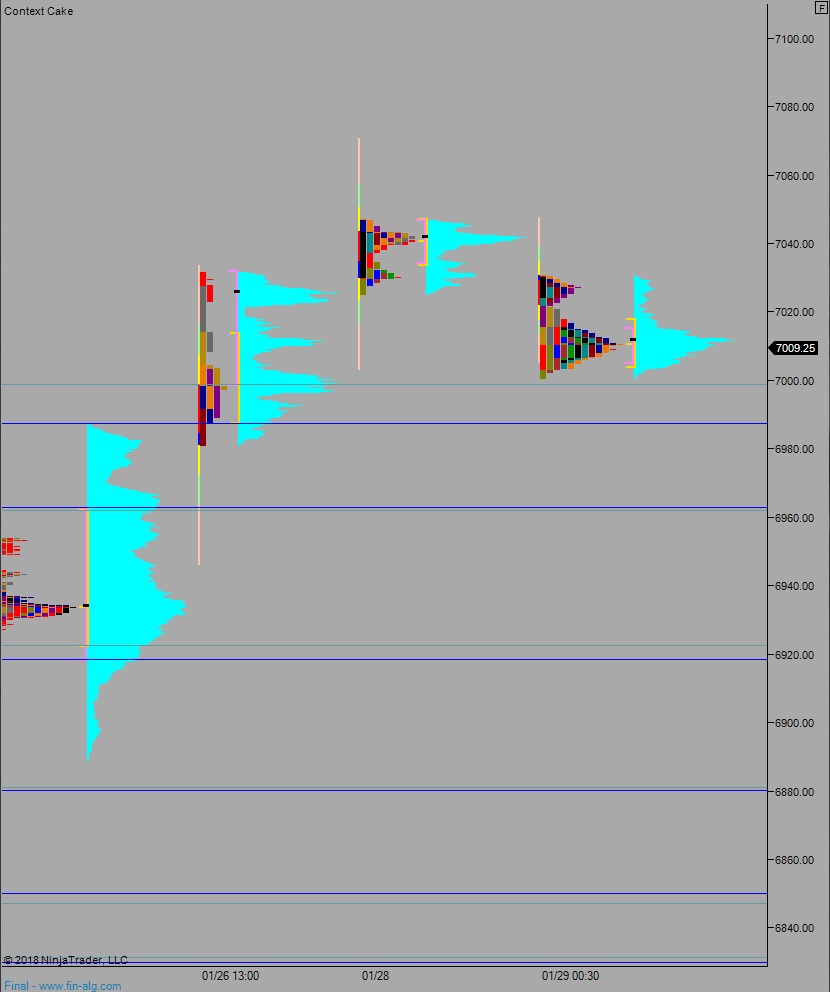

NASDAQ futures are coming into the week gap down after an overnight session featuring elevated range and volume. Price worked up to a new record high before fading back down to 7000. At 8:30am personal consumption expenditure data came out in-line with expectations.

Also on the economic agenda today we have Dallas Fed manufacturing activity at 10am, then a 3- and 6-month T-bill auction at 11:30am.

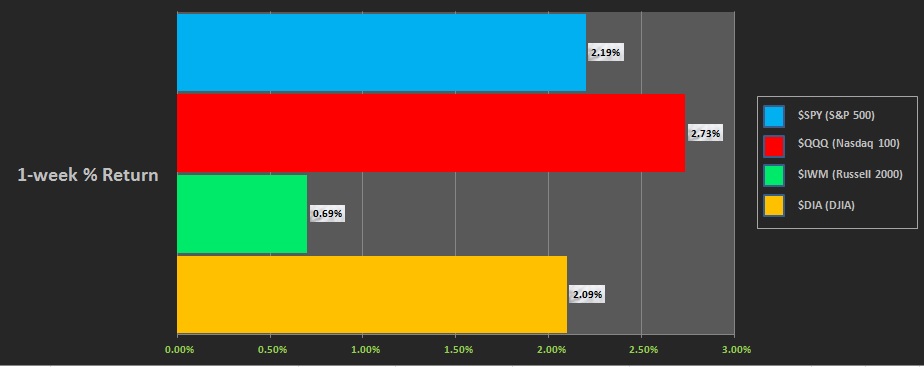

Last week the broad indices were volatile Monday, trading higher, consolidated from Tuesday-to-Thursday, then rallied into the weekend. Here is the last week performance of each major index:

On Friday the NASDAQ printed a double distribution trend day. The day began with a gap higher. Sellers stalled during an early attempt lower and we took out Thursday high. Then after flagging along the highs a trend took hold, higher into the weekend.

Heading into today my primary expectation is for sellers to work down to 6987.75 before two way trade ensues south of 7021.

Hypo 2 buyers work into the overnight inventory and close the gap up to 7029.75. From here they continue higher, up through overnight high 7047.25 before two way trade ensues.

Hypo 3 stronger sellers work down to 6962.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: